Table of Contents

- Introduction

- Editor’s Choice

- Digital Remittance Market Overview

- Global Digital Remittance Volume Statistics

- World’s Top Digital Remittance Recipient Nations Statistics

- Transaction Value of Digital Remittances

- Number of Digital Remittance Users and Penetration Rate

- Average Transaction Value Per User

- Share of Digitally Initiated Remittances Across the World

- Digital Remittance Transaction Value Across Various Nations Statistics

- Digital Remittance Growth and Transaction Values by Region Statistics

- Digital Remittance Adoption Trends and Statistics

- Use of Digital Financial Technology During the COVID-19 Pandemic

- Key Challenges in Digital Remittance Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Digital Remittance Statistics: Digital remittance, facilitated through online platforms and mobile apps, involves the electronic transfer of funds across borders.

It offers individuals the convenience of sending money internationally to family, friends, or businesses in different countries.

With its speed and lower costs compared to traditional methods, digital remittance has become increasingly popular among migrants and expatriates.

Providers comply with regulatory requirements and employ measures like identity verification to ensure security.

Users can fund transactions through various payment gateway options, and recipients may receive funds directly into their bank accounts or through cash pickup locations.

Overall, digital remittance has transformed international money transfers. Providing a fast, affordable, and convenient solution for individuals with global financial needs.

Editor’s Choice

- The global digital remittance market revenue reached USD 22.1 billion in 2023.

- Among the competitive landscape, Azimo Limited leads the market with a significant share of 19%.

- The global digital remittance market is regionally segmented, with North America leading the way with a 32.0% market share.

- By 2023, the total remittance volume had reached USD 750 billion. With digital remittances at USD 387 billion and non-digital volume at USD 363 billion.

- By 2028, the transaction value of digital remittances is projected to be USD 181.6 billion.

- The United States leads the market with a digital remittance transaction value of USD 29,920 million.

- A study in France and Poland found that 62% to 67% of individuals used digital devices for international P2P remittances. Compared to 61% in the United States, where physical payments like cash and cheques remain common.

Digital Remittance Market Overview

Global Digital Remittance Market Size Statistics

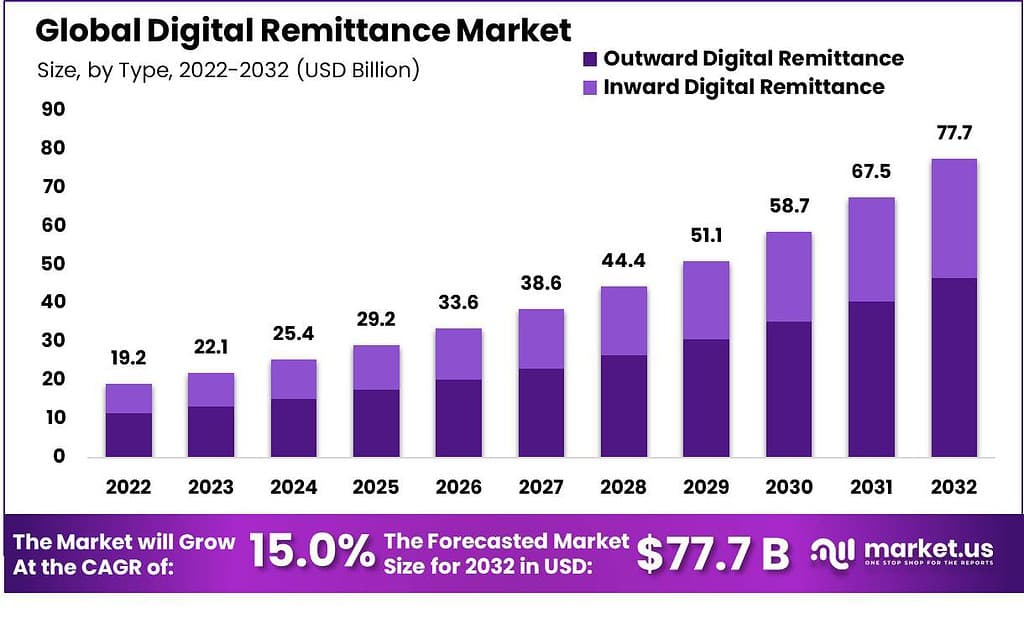

- The global digital remittance market has experienced significant growth over the past decade at a CAGR of 15.0%.

- In 2022, the market revenue was valued at USD 19.2 billion. This figure rose to USD 22.1 billion in 2023 and is projected to continue its upward trajectory.

- By 2024, the market is expected to reach USD 25.4 billion, with further increases anticipated in subsequent years.

- The market revenue is forecasted to climb to USD 29.2 billion in 2025 and USD 33.6 billion in 2026.

- This growth trend is expected to persist, with the market reaching USD 38.6 billion in 2027 and USD 44.4 billion in 2028.

- By 2029, the market is projected to hit USD 51.1 billion, and by 2030. It is expected to reach USD 58.7 billion.

- The market is anticipated to continue expanding, with a projected revenue of USD 67.5 billion in 2031 and USD 77.7 billion by 2032.

- This robust growth can be attributed to the increasing adoption of digital remittance solutions. Advancements in financial technology, and the rising demand for convenient and secure money transfer services globally.

(Source: market.us)

Global Digital Remittance Market Size – By Type Statistics

- The global digital remittance market has demonstrated substantial growth. With a detailed breakdown by type revealing distinct trends in outward and inward digital remittance revenues.

- In 2022, the total market revenue was USD 19.2 billion, with outward digital remittance contributing USD 11.5 billion and inward digital remittance contributing USD 7.7 billion.

- This trend continued in 2023 when total market revenue rose to USD 22.1 billion. With outward remittance at USD 13.3 billion and inward remittance at USD 8.8 billion.

- The market is projected to expand further, reaching USD 25.4 billion in 2024 (USD 15.2 billion outward, USD 10.2 billion inward) and USD 29.2 billion in 2025 (USD 17.5 billion outward, USD 11.7 billion inward).

- By 2026, the market is expected to achieve USD 33.6 billion in total revenue. With USD 20.2 billion from outward remittances and USD 13.4 billion from inward remittances.

- This growth trajectory continues, with projections for 2027 at USD 38.6 billion (USD 23.2 billion outward, USD 15.4 billion inward) and 2028 at USD 44.4 billion (USD 26.6 billion outward, USD 17.8 billion inward).

- By 2029, the market is anticipated to reach USD 51.1 billion. With outward remittance revenue of USD 30.7 billion and inward revenue of USD 20.4 billion.

- The upward trend is expected to persist, with 2030 projections at USD 58.7 billion (USD 35.2 billion outward, USD 23.5 billion inward), 2031 at USD 67.5 billion (USD 40.5 billion outward, USD 27.0 billion inward), and 2032 at USD 77.7 billion (USD 46.6 billion outward, USD 31.1 billion inward).

- This consistent growth underscores the increasing reliance on digital remittance services for both sending and receiving funds globally.

(Source: market.us)

Competitive Landscape of Global Digital Remittance Market Statistics

- The digital remittance market is characterized by the presence of several key players, each holding varying shares of the market.

- Azimo Limited leads the market with a significant share of 19%. Followed by InstaReM Pvt. Ltd. with a 17% market share.

- Digital Wallet Corporation holds 13% of the market, while TransferGo Ltd. accounts for 10%.

- Both MoneyGram and TransferWise Ltd. each capture 8% of the market.

- PayPal Holdings, Inc. has a 7% market share, and Western Union Holdings, Inc. holds 6%.

- Ria Financial Services Ltd. contributes 5% to the market.

- The remaining 8% of the market is distributed among other key players.

- This distribution highlights the competitive landscape of the digital remittance industry. With a mix of established companies and emerging players driving market dynamics.

(Source: market.us)

Regional Analysis of the Global Digital Remittance Market Statistics

- The global digital remittance market is regionally segmented, with North America leading the way with a 32.0% market share.

- Europe follows closely with 26.3%, while the Asia-Pacific (APAC) region holds a substantial 28.9% share.

- South America accounts for 9.1% of the market, and the Middle East and Africa (MEA) region represents 3.7%.

- This regional distribution highlights the prominence of North America and APAC in the digital remittance landscape. Reflecting robust adoption rates and technological advancements in these regions.

- Europe also shows significant market activity, while South America and MEA. Though smaller in share, continues to present growth opportunities in the digital remittance sector.

(Source: market.us)

Global Digital Remittance Volume Statistics

- The global remittance volume has shown a steady increase over the past decade. With a significant shift towards digital remittance services.

- In 2014, the total remittance volume was USD 598 billion, of which USD 538 billion was non-digital, and USD 60 billion was digital.

- By 2015, the total volume had slightly decreased to USD 582 billion. But digital remittances had nearly doubled to USD 104 billion, while non-digital volume had dropped to USD 478 billion.

- The trend continued in 2016, with total remittances at USD 573 billion, digital volume increasing to USD 145 billion, and non-digital volume decreasing to USD 428 billion.

- In 2017, the total remittance volume rose to USD 613 billion, with digital remittances growing to USD 183 billion and non-digital volume remaining relatively stable at USD 430 billion.

- The following year, 2018, the total volume reached USD 642 billion. With digital remittances at USD 225 billion and non-digital volume at USD 417 billion.

More Insights

- By 2019, the total volume had increased to USD 670 billion. With digital remittances at USD 247 billion and non-digital volume at USD 423 billion.

- The year 2020 marked further growth, with the total remittance volume reaching USD 694 billion, digital remittances at USD 277 billion, and non-digital volume at USD 417 billion.

- In 2021, the total volume increased to USD 714 billion. With digital remittances at USD 314 billion and non-digital volume at USD 400 billion.

- The upward trend continued in 2022, with total remittances at USD 733 billion, digital volume at USD 360 billion, and non-digital volume declining to USD 373 billion.

- By 2023, the total remittance volume had reached USD 750 billion, With digital remittances at USD 387 billion and non-digital volume at USD 363 billion. This data highlights the growing preference for digital remittance solutions over traditional methods.

(Source: World Bank)

World’s Top Digital Remittance Recipient Nations Statistics

- In 2020, the top ten remittance-receiving nations experienced varying degrees of change compared to 2019. Reflecting diverse economic impacts and migration patterns.

- India remained the largest recipient with USD 83.1 billion in remittances. Experiencing a slight decrease of 0.2% from the previous year.

- China received USD 59.5 billion, marking a significant decline of 13%.

- Mexico saw a robust increase of 9.9%, receiving USD 42.9 billion.

- The Philippines received USD 34.9 billion, a slight decrease of 0.7%.

- Egypt experienced a substantial increase of 10.5%, with remittances totaling USD 29.6 billion.

- Pakistan recorded a notable rise of 17.4%, reaching USD 26.1 billion.

- France saw a decline of 8.8%, with USD 24.5 billion in remittances.

- Bangladesh reported an impressive 18.4% increase, receiving USD 21.8 billion.

- Germany experienced a 2% decline, with remittances totaling USD 17.9 billion.

- Nigeria faced the most significant decrease among the top recipients, with remittances dropping by 27.7% to USD 17.2 billion.

- These variations highlight the complex dynamics of global remittance flows during the year. Influenced by factors such as economic conditions and the COVID-19 pandemic.

(Source: Statista)

Transaction Value of Digital Remittances

- The transaction value of digital remittances has shown a consistent upward trend over the past decade, indicating the growing adoption of digital remittance services.

- In 2018, the transaction value stood at USD 68.88 billion.

- This figure increased significantly to USD 83.73 billion in 2019 and further to USD 95.29 billion in 2020.

- The upward trajectory continued in 2021, with the transaction value reaching USD 114.7 billion.

- By 2022, this value had risen to USD 121.3 billion, and in 2023, it reached USD 137.5 billion.

- Projections for the coming years indicate sustained growth, with the transaction value expected to hit USD 150.8 billion in 2024, USD 161.4 billion in 2025, and USD 168.9 billion in 2026.

- By 2027, the transaction value is anticipated to reach USD 176.5 billion, and by 2028, it is projected to be USD 181.6 billion.

- This continuous increase reflects the expanding reliance on digital remittance platforms for international money transfers.

(Source: Statista)

Change in Transaction Value

- The digital remittance market has experienced varying rates of transaction value change over the past decade, reflecting fluctuating growth dynamics.

- In 2018, the transaction value change was notably high at 23.30%. Followed by a slight decrease to 21.56% in 2019.

- The growth rate further slowed to 13.80% in 2020, likely influenced by global economic conditions. In 2021, the market rebounded with a 20.38% increase in transaction value.

- However, 2022 saw a significant drop in growth rate to 5.77%.

- The year 2023 marked a resurgence, with the transaction value change rising to 13.34%.

- Projections for the following years indicate a more moderated growth rate, with 2024 expected to see a 9.69% increase, followed by 7.01% in 2025.

- The growth rate is anticipated to continue declining gradually, reaching 4.65% in 2026 and 4.51% in 2027.

- By 2028, the transaction value change is projected to further decrease to 2.86%.

- These trends highlight the market’s initial rapid expansion, subsequent stabilization, and a gradual slowdown in growth as the market matures.

(Source: Statista)

Number of Digital Remittance Users and Penetration Rate

- The number of digital remittance users has been steadily increasing, accompanied by a gradual rise in the penetration rate.

- In 2018, there were 6.37 million digital remittance users, representing a penetration rate of 0.09%. This number grew to 7.72 million users in 2019, with a penetration rate of 0.10%.

- The trend continued in 2020, with 9.30 million users and a penetration rate of 0.13%.

- By 2021, the number of users had reached 11.02 million, with a penetration rate of 0.15%. In 2022, the user base expanded to 12.73 million, and the penetration rate increased to 0.17%. The growth trajectory persisted in 2023, with 14.33 million users and a penetration rate of 0.19%.

- Projections for the coming years suggest continued growth, with the number of users expected to reach 15.75 million in 2024 and a penetration rate of 0.21%. By 2025, the user base is anticipated to be 16.96 million with a penetration rate of 0.22%, and in 2026, it is projected to grow to 17.88 million users with a penetration rate of 0.23%.

- The number of digital remittance users is expected to reach 18.46 million in 2027, with a penetration rate of 0.24%. By 2028, it is forecasted to increase to 18.74 million users slightly, maintaining a penetration rate of 0.24%.

- This steady increase in users and penetration rate reflects the expanding adoption of digital remittance services globally.

(Source: Statista)

Average Transaction Value Per User

- The average transaction value per user in the digital remittance market has exhibited slight fluctuations over the past decade.

- In 2018, the average transaction value per user was USD 10.81, which saw a marginal increase to USD 10.84 in 2019.

- However, in 2020, there was a decrease to USD 10.24.

- The value slightly rebounded in 2021 to USD 10.41 but then dropped to USD 9.53 in 2022.

- In 2023, the average transaction value per user showed a minor increase to USD 9.60.

- Projections for the future indicate a relatively stable trend, with the average transaction value per user expected to be USD 9.58 in 2024, USD 9.52 in 2025, and USD 9.45 in 2026.

- By 2027, a slight increase to USD 9.56 is anticipated, with a further increase to USD 9.69 expected in 2028.

- These variations reflect changing user behaviors and transaction patterns within the digital remittance market.

(Source: Statista)

The share of digitally initiated remittances has been steadily increasing worldwide, reflecting a significant shift from traditional methods.

2018-2019

- In Q1 2018, traditionally initiated remittances dominated the market at 90.06%, while digitally initiated remittances accounted for only 6.81%, and digital end-to-end transactions were at 3.13%.

- By Q4 2018, the share of digitally initiated remittances had risen to 8.67%, with digital end-to-end transactions slightly increasing to 3.47%.

- This upward trend continued through 2019, with Q1 seeing 8.70% digitally initiated and 3.76% digital end-to-end, and Q4 reporting 10.03% and 4.13%, respectively.

(Source: Statista)

2020-2021

- The trend became more pronounced in 2020, as the share of digitally initiated remittances grew to 10.70% in Q1 and 12.46% by Q4, with digital end-to-end transactions reaching 4.25% and 5.74%, respectively.

- By Q1 2021, digitally initiated remittances were at 12.81%, and digital end-to-end transactions were at 5.65%.

- A notable surge occurred by Q4 2021, where traditionally initiated remittances dropped significantly to 67.94%, while digitally initiated remittances rose to 20.48% and digital end-to-end transactions to 11.58%.

(Source: Statista)

2022-2023

- This trend continued into 2022, with Q1 seeing traditionally initiated remittances at 66.41%, digitally initiated at 21.06%, and digital end-to-end transactions at 12.53%.

- By Q4 2022, traditionally initiated remittances had decreased further to 53.08%, while digitally initiated remittances increased to 25.58%, and digital end-to-end transactions to 18.53%.

- The most recent data from Q1 2023 shows traditionally initiated remittances at 52.62%, digitally initiated at 28.81%, and digital end-to-end transactions maintaining at 18.53%.

- By Q3 2023, these figures were at 52.89% for traditionally initiated, 28.95% for digitally initiated, and 18.10% for digital end-to-end transactions, highlighting a sustained shift towards digital remittance methods.

(Source: Statista)

Digital Remittance Transaction Value Across Various Nations Statistics

- Several key countries significantly influence the digital remittance market, each contributing substantial transaction values.

- The United States leads the market with a digital remittance transaction value of USD 29,920 million.

- Saudi Arabia follows with USD 14,730 million, indicating a strong adoption of digital remittance services in the region.

- Switzerland and China also have high transaction values, with USD 10,850 million and USD 10,560 million, respectively.

- Germany contributes USD 9,246 million to the market, while France accounts for USD 5,109 million.

- Russia and the Netherlands have notable transaction values of USD 4,453 million and USD 4,120 million, respectively.

- The United Kingdom and Italy round out the list with transaction values of USD 3,677 million and USD 3,018 million, respectively.

- These figures highlight the diverse geographic distribution and significant market activities in the digital remittance sector across these countries.

(Source: Statista)

Digital Remittance Growth and Transaction Values by Region Statistics

- The adoption of digital remittance services has varied across different regions, with notable growth rates and transaction values.

- In the East Asia and Pacific region, digital remittance transactions grew by 2.6 percent, reaching a total value of USD 147 billion.

- South Asia experienced a higher growth rate of 6.1 percent, resulting in USD 139 billion in transaction value.

- Latin America and the Caribbean saw the most significant growth, with a 7.4 percent increase to USD 96 billion.

- Europe and Central Asia also showed robust growth of about 6 percent, achieving USD 65 billion in transactions.

- The Middle East and North Africa region grew by 2.6 percent, totaling USD 59 billion in digital remittance transactions.

- In contrast, Sub-Saharan Africa experienced a slight decline of 0.5 percent, with transaction values decreasing to USD 48 billion.

- These regional variations highlight the diverse landscape of digital remittance adoption and growth across the globe.

(Source: Visa Economic Empowerment Institute)

Digital Remittance Adoption Trends and Statistics

- A study in France and Poland found that 62% to 67% of individuals used digital devices for international P2P remittances, compared to 61% in the United States, where physical payments like cash and cheques remain common.

- According to the Visa study and ECB analysis, digital P2P payments in the Eurozone more than tripled from 2019 to 2022.

- The pandemic spurred this growth, increasing mobile app usage for P2P payments from 3% to 10% by number and from 4% to 11% by value.

- In Poland, 56% of people who previously used only physical methods for foreign P2P transfers are likely to switch to digital.

- Poland, mainly a remittance recipient, has over 21 million digital banking users, with 16.5 million using mobile apps.

- In France, a country that sends more remittances, 40% of those who had not used digital methods before are likely to start using them.

- According to recent research released by VisaV, just over half of respondents are inclined to transmit funds digitally. Based on a survey encompassing more than 14,000 individuals across ten nations, the findings reveal that 53% opt for digital channels, while 34% prefer physical bank or money transfer branches.

- Additionally, 12% resort to mailing cash, checks, or money orders, with another 11% depending on friends or acquaintances to carry money when traveling.

(Source: Visa)

Use of Digital Financial Technology During the COVID-19 Pandemic

- In 2021, the COVID-19 pandemic significantly influenced the increased use of digital financial technology across various economies, with distinct differences observed between emerging markets and developing economies versus advanced economies.

- In emerging markets and developing economies, 65% of the population reported an increased use of digital smart payments and remittances, compared to 50% in advanced economies.

- The adoption of digital banks was also higher in emerging markets, with 24% of the population reporting increased use, while in advanced economies, this figure was 18%.

- Similarly, digital savings or deposits saw a higher uptake in emerging markets at 22%, compared to 12% in advanced economies.

- Digital lending followed the same pattern, with 14% of the population in emerging markets and developing economies reporting increased use versus 12% in advanced economies.

- These figures illustrate the accelerated adoption of digital financial technologies driven by the pandemic, particularly in emerging and developing economies.

(Source: Cambridge Center for Alternative Finance (CCAF), World Bank, and World Economic Forum)

Key Challenges in Digital Remittance Statistics

- According to the World Bank, 65% of adults in developing nations lack access to essential financial services, making it challenging for them to save money, build credit, pay bills, and engage in the financial system.

- A recent survey by the International Association of Money Transfer Networks (IAMTN) and the United Nations Capital Development Fund (UNCDF) revealed that 91 percent of over 75 remittance service providers (RSPs) from more than 30 countries have noticed changes in remittance volumes, with the majority (69 percent) reporting a sudden decrease.

- This decline corresponds with recent World Bank estimates, predicting that global remittance flows will decrease by approximately 20 percent in 2020, from US$554 billion in 2019 to US$445 billion this year.

(Source: World Bank, United Nations)

Recent Developments

Acquisitions:

- RippleNet’s Expansion: RippleNet expanded its network by connecting Malaysian mobile finance firm Mobile Money with Bangladeshi mobile financial services provider bKash, which has 45 million customers.

- This integration aims to improve the efficiency and cost-effectiveness of cross-border payments using Ripple’s distributed ledger technology.

New Product Launches:

- Valora by Celo: Valora, a mobile peer-to-peer payments and remittance app built on the Celo blockchain project, gained traction with 53,000 monthly active users in over 100 countries.

- In 2023, it received a $20 million Series A funding led by Andreessen Horowitz (a16z), aimed at increasing cryptocurrency adoption among smartphone users.

Funding:

- Investment in Digital Wallets and Platforms: Digital remittance platforms continue to attract significant investments.

- For instance, PayPal Holdings and MoneyGram have been pivotal in driving digital remittance growth through technological advancements and user-friendly services.

Market Growth:

- Market Expansion: The growth is driven by increasing migration, technological advancements, and the need for efficient, cost-effective remittance solutions.

- Segment Growth: The inward digital remittance segment is expected to register the highest growth rate due to the increasing adoption of mobile payment technology among migrants. Real-time banking technology is also being widely adopted to facilitate immediate payment services.

Innovation in Technology:

- Blockchain and Real-Time Banking: The adoption of blockchain technology and real-time banking solutions is revolutionizing the remittance industry by enhancing transparency, reducing transaction costs, and ensuring faster settlements.

- Companies like Ripple and platforms like Valora are leading these innovations.

Regional Insights:

- North America and Asia-Pacific: North America, particularly the U.S., remains a significant market for digital remittance due to its large immigrant population and advanced financial infrastructure.

- The Asia-Pacific region is anticipated to be the fastest-growing market, driven by the high volume of remittances and increasing adoption of digital payment solutions in countries like China and India.

Conclusion

Digital Remittance Statistics – The digital remittance market has grown significantly, driven by advancements in financial technology and the rising adoption of digital services.

Key players like Azimo Limited and InstaReM Pvt. Ltd. have notable market shares. Regional analysis shows North America and Asia-Pacific as prominent markets, with emerging economies adopting digital financial technologies rapidly, especially during the COVID-19 pandemic.

Despite a projected decline in global remittance volumes in 2020, the market outlook remains positive, with expected growth in transaction values and user base.

This evolution highlights the importance of digital solutions in enhancing financial inclusion and economic resilience globally.

FAQs

Digital remittance refers to the electronic transfer of money by people living in foreign countries to their home countries using digital platforms and financial technologies.

Digital remittance typically involves transferring funds through online platforms or mobile apps. Users can send money by linking their bank accounts, credit cards, or digital wallets to the remittance service, which then facilitates the transfer to the recipient’s bank account or mobile wallet.

Digital remittance offers several benefits, including convenience, speed, lower transaction costs, and enhanced security. It allows users to transfer money instantly from the comfort of their homes and often provides better exchange rates compared to traditional methods.

Some key players in the digital remittance market include Azimo Limited, InstaReM Pvt. Ltd., Digital Wallet Corporation, TransferGo Ltd., MoneyGram, TransferWise Ltd., PayPal Holdings, Inc., Western Union Holdings, Inc., and Ria Financial Services Ltd.

The COVID-19 pandemic accelerated the adoption of digital financial technologies, including digital remittance. Many users turned to digital platforms for money transfers due to restrictions on physical movement and the need for contactless transactions.