Table of Contents

- Introduction

- Editor’s Choice

- Laboratory Information Management System Market Overview

- History of Laboratory Information Management Systems

- Components of Laboratory Information Management Systems

- Technical Requirements of Laboratory Information Management Systems

- Factors Considered While Selecting Laboratory Information Management Systems Software

- Regulations for Laboratory Information Management Systems

Introduction

According to Laboratory Information Management System Statistics, A Laboratory Information Management System (LIMS) is a software solution that optimizes laboratory operations and data management across various industries.

It tracks samples from collection to disposal, organizes laboratory data securely, and automates workflows, reducing errors and enhancing productivity with laboratory informatics.

LIMS integrates with laboratory instruments to streamline data exchange and improve accuracy. It enforces quality assurance measures and regulatory compliance, generating customizable reports and analytical insights for decision-making.

LIMS ensures sample traceability, facilitates collaboration, and supports regulatory requirements, making it indispensable for efficient and compliant laboratory operations.

Editor’s Choice

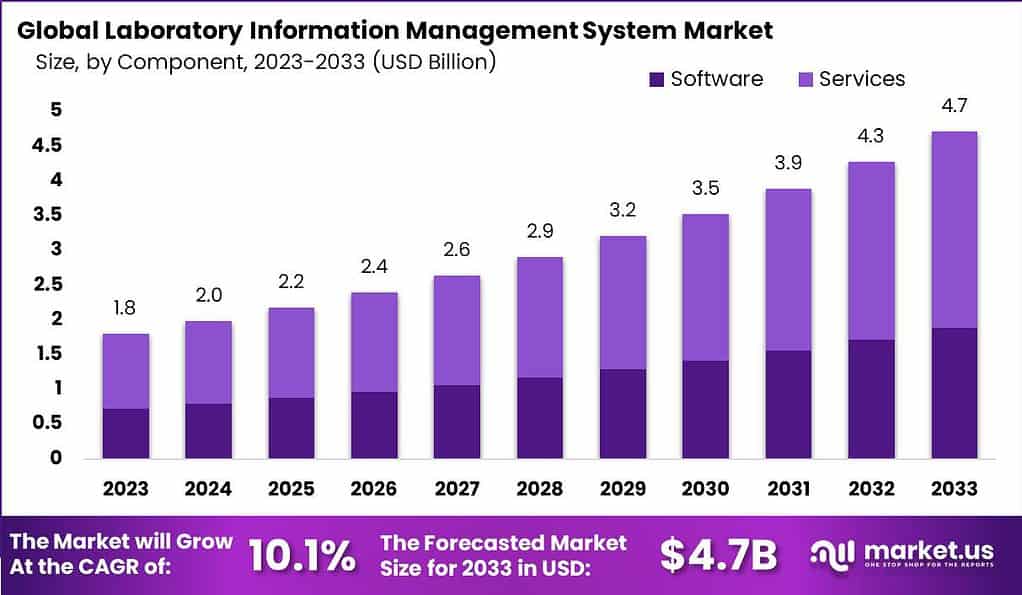

- In 2023, the global Laboratory Information Management System (LIMS) market revenue was recorded at USD 1.8 billion.

- By 2033, the market is forecasted to reach USD 4.7 billion, with software revenue at USD 1.89 billion and services revenue at USD 2.81 billion.

- Thermo Fisher Scientific leads the market with a 14% share.

- The global Laboratory Information Management System (LIMS) market is geographically segmented, with North America commanding the largest share at 47.0%.

- In 1982, the first Laboratory Information Management Systems (LIMS) debuted, using centralized minicomputers for automated reporting.

- When selecting a Laboratory Information Management System (LIMS), several key factors are crucial for effective decision-making. Vendor reputation and brand awareness are paramount, with 67.79% of decision-makers considering these aspects vital.

- When selecting Laboratory Information Management System (LIMS) software, various factors play significant roles in the decision-making process. The primary consideration is the specific requirements of the laboratory, which account for 49% of the decision criteria.

Laboratory Information Management System Market Overview

Global Laboratory Information Management System Market Size

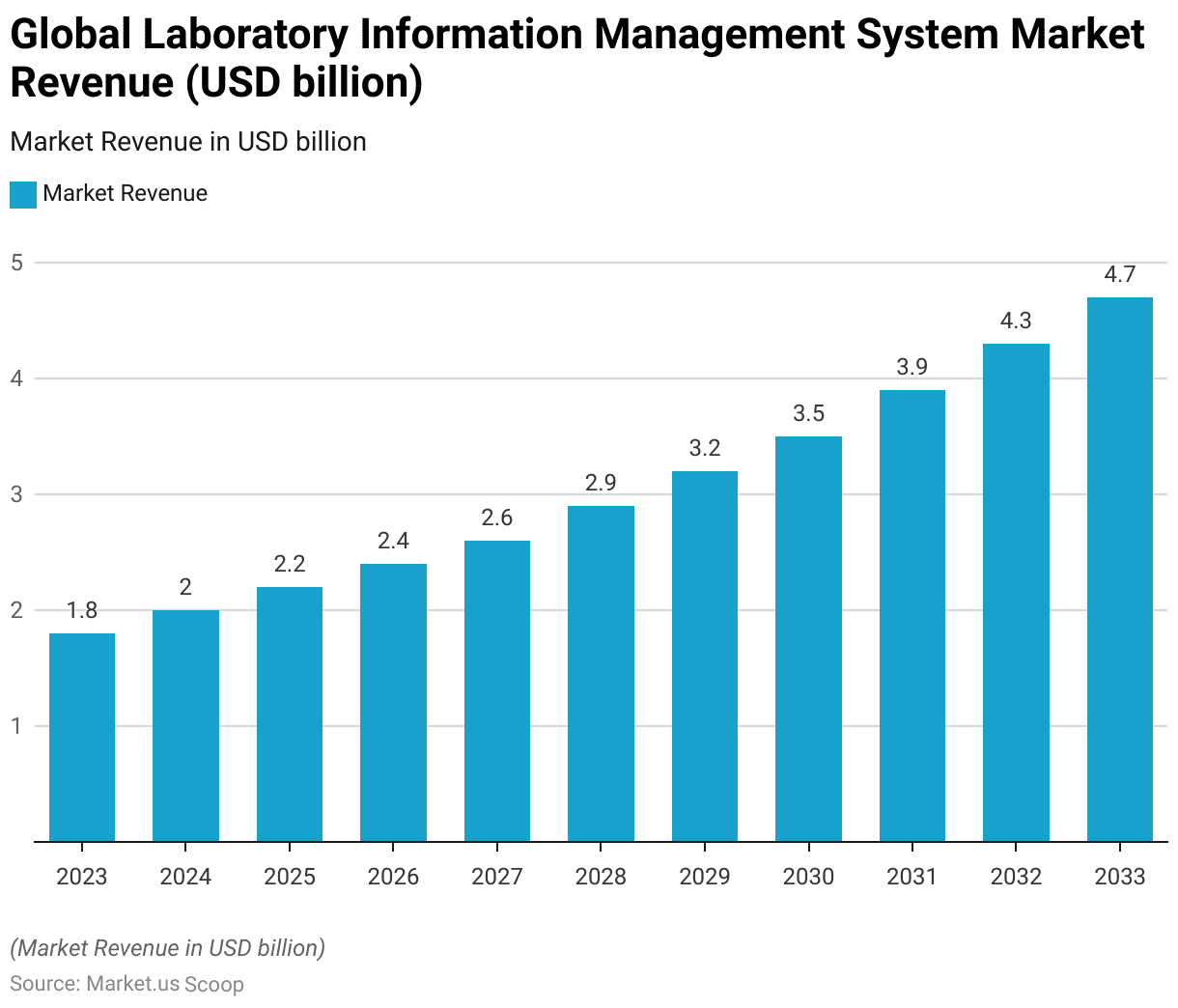

- The global Laboratory Information Management System (LIMS) market has demonstrated a steady growth trajectory over the years at a CAGR of 10.1%.

- In 2023, the market revenue was recorded at USD 1.8 billion.

- The market is forecasted to expand to USD 3.9 billion in 2031, USD 4.3 billion in 2032, and USD 4.7 billion by 2033.

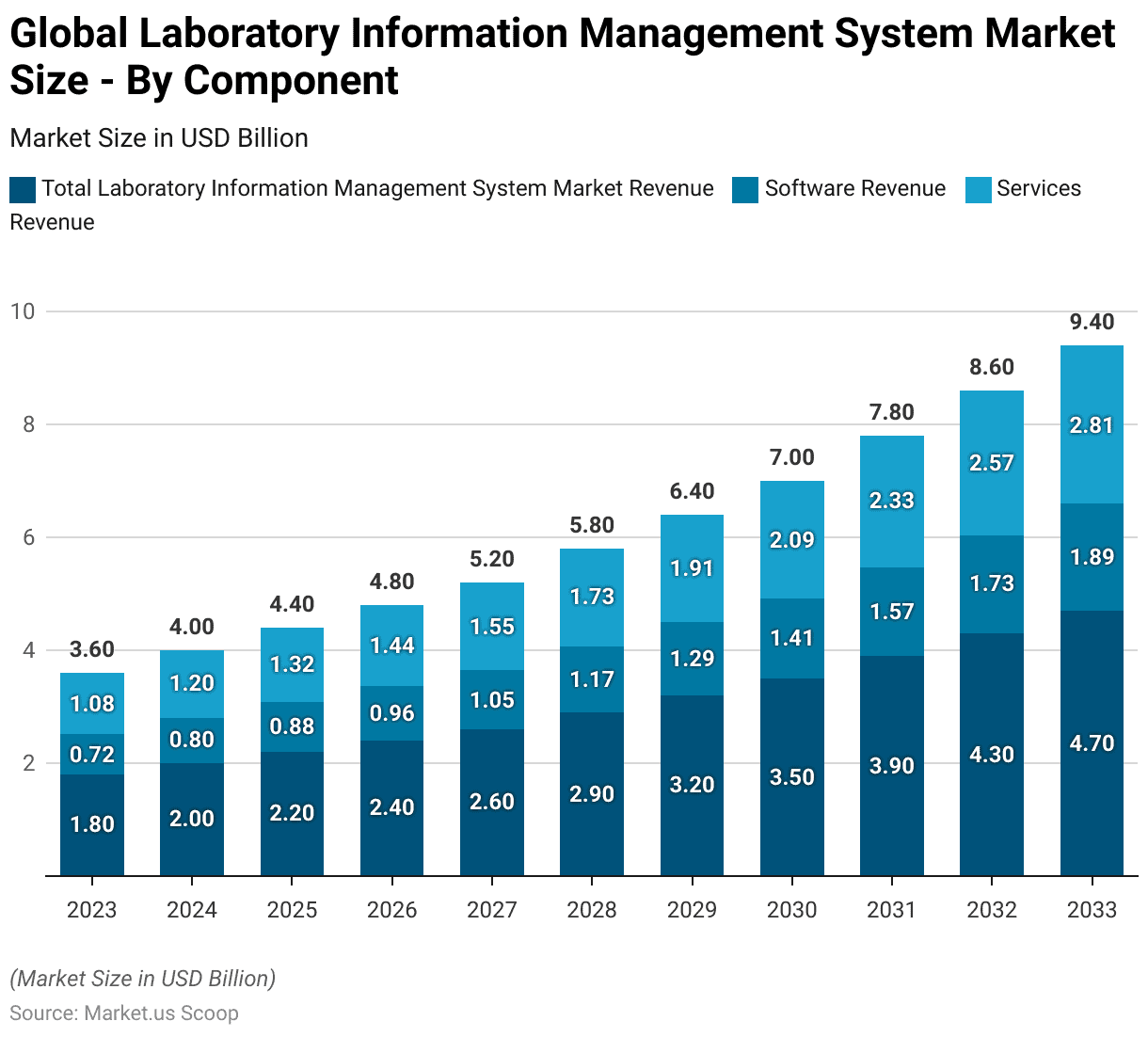

Global Laboratory Information Management System Market Size – By Component

- The global Laboratory Information Management System (LIMS) market is segmented by component, encompassing both software and services.

- In 2023, the total market revenue was USD 1.8 billion, with software revenue accounting for USD 0.72 billion and services revenue at USD 1.08 billion.

- By 2033, the market is forecasted to reach USD 4.7 billion, with software revenue at USD 1.89 billion and services revenue at USD 2.81 billion.

Laboratory Information Management System Market Size – By End-user

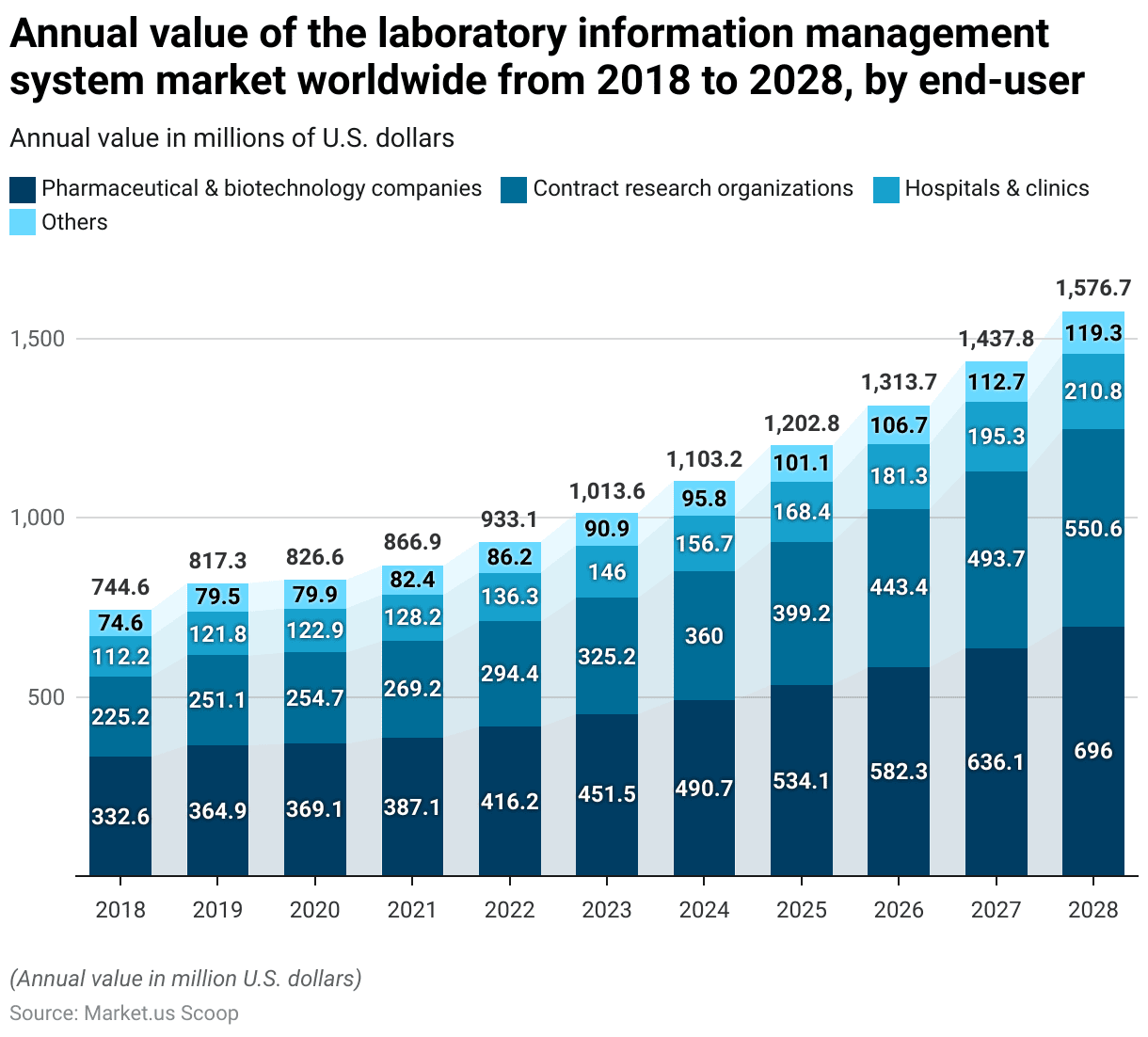

- The annual value of the global Laboratory Information Management System (LIMS) market, segmented by the end user, has shown a consistent upward trend from 2018 to 2028.

- In 2018, pharmaceutical and biotechnology companies led the market with a value of USD 332.6 million, followed by contract research organizations (CROs) at USD 225.2 million, hospitals and clinics at USD 112.2 million, and other end users at USD 74.6 million.

- In 2023, pharmaceutical and biotechnology companies accounted for USD 451.5 million, CROs for USD 325.2 million, hospitals and clinics for USD 146 million, and others for USD 90.9 million.

- In 2028, pharmaceutical and biotechnology companies are projected to reach USD 696 million, CROs USD 550.6 million, hospitals and clinics USD 210.8 million, and other end users USD 119.3 million.

Competitive Landscape of Global Laboratory Information Management System Market

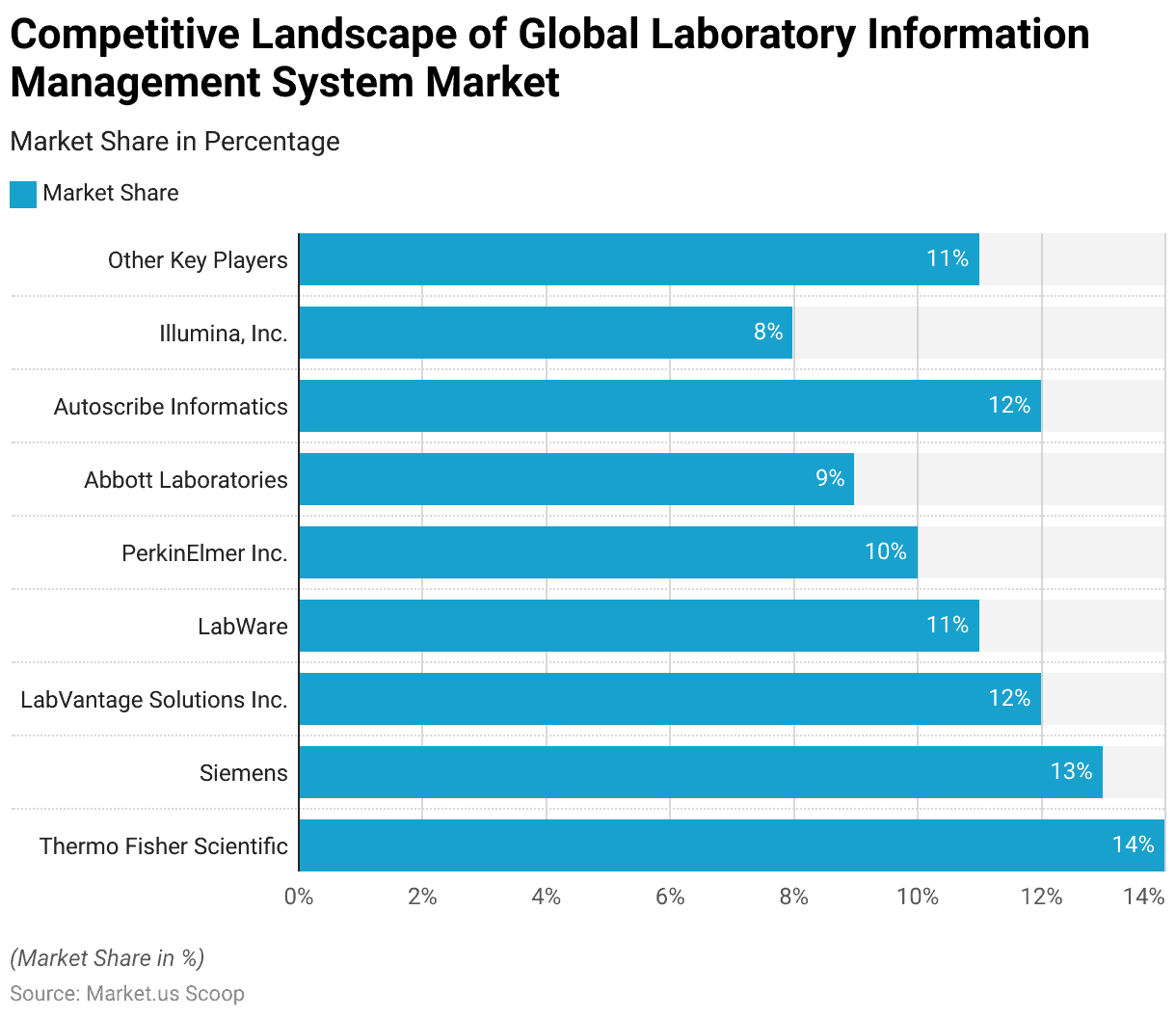

- Several key players dominate the global Laboratory Information Management System (LIMS) market, each holding a significant market share.

- Thermo Fisher Scientific leads the market with a 14% share, followed closely by Siemens, which holds a 13% share.

- LabVantage Solutions Inc. and Autoscribe Informatics each command a 12% share of the market, reflecting their strong presence and competitive offerings.

- LabWare accounts for 11% of the market, demonstrating its robust position among industry leaders.

- PerkinElmer Inc. captures 10% of the market share, while Abbott Laboratories holds a 9% share, highlighting their substantial contributions to the LIMS landscape. Illumina, Inc. has an 8% share, underscoring its influence in the sector.

- The remaining 11% of the market is distributed among other key players, indicating a diverse and competitive environment within the LIMS market.

Regional Analysis of Global Laboratory Information Management System Market

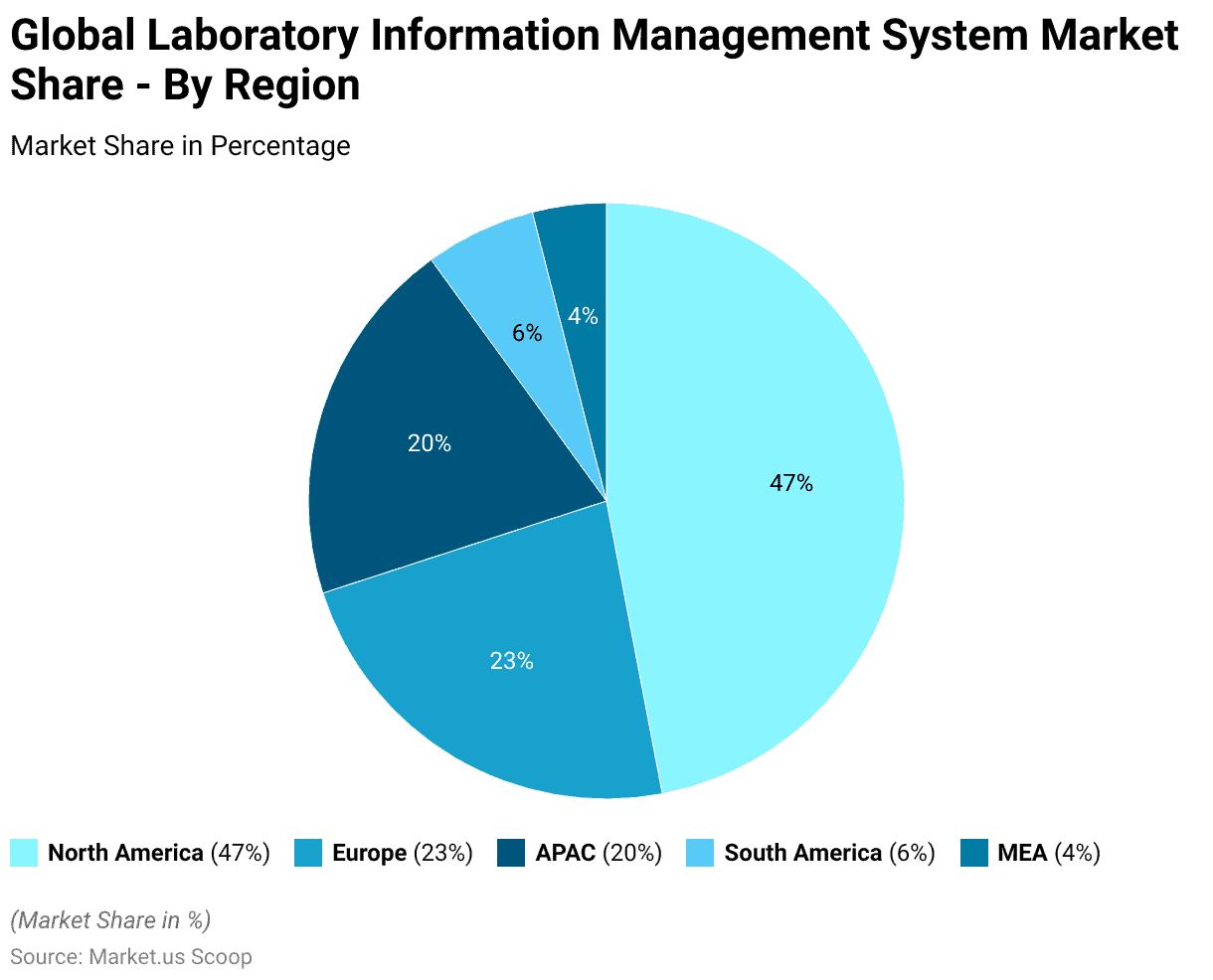

- The global Laboratory Information Management System (LIMS) market is geographically segmented, with North America commanding the largest share at 47.0%. This dominance is attributed to the region’s advanced technological infrastructure and significant investment in healthcare IT.

- Europe follows with a 23.0% market share, driven by stringent regulatory requirements and a growing emphasis on laboratory automation.

- The Asia-Pacific (APAC) region accounts for 20.0% of the market, reflecting rapid industrialization, increased research activities, and expanding healthcare infrastructure.

- South America holds a 6.0% share, with growth propelled by rising healthcare expenditure and the adoption of advanced laboratory systems.

- The Middle East and Africa (MEA) region, although holding the smallest share at 4.0%, is experiencing gradual growth due to improving healthcare facilities and increasing awareness of laboratory management systems.

History of Laboratory Information Management Systems

- Before the late 1970s, managing laboratory samples and analyses was labor-intensive and error-prone, prompting efforts to streamline processes. Initially, individual labs developed custom solutions, while some pursued commercial options using specialized systems.

- In 1982, the first Laboratory Information Management Systems (LIMS) debuted, using centralized minicomputers for automated reporting. Interest grew, leading figures like Gerst Gibbon to advocate through LIMS-focused conferences.

- By 1988, second-generation LIMS with relational databases emerged, expanding into specialized applications alongside International LIMS Conferences.

- The 1990s saw a third generation of LIMS leveraging client/server architecture for improved data processing.

- By 1995, these systems enabled network-wide data processing, with web-enabled LIMS introduced the following year, extending operations beyond labs.

- From 1996 to 2002, LIMS evolved further, adding features like wireless networking, georeferencing, XML standards, and internet purchasing.

- As of 2012, LIMS development continued, integrating clinical functionalities, electronic laboratory notebooks (ELNs), and transitioning to the software as a service (SaaS) model.

Components of Laboratory Information Management Systems

- The software segment, which accounts for a substantial portion of the market, includes applications for sample tracking, instrument integration, and data analysis.

- Recent advancements have seen software evolve from simple SaaS to more advanced PaaS and community networks, providing greater flexibility and scalability for laboratories.

- Services, which dominated the market with over 58% of global revenue in 2023, encompass implementation, integration, maintenance, and validation.

Technical Requirements of Laboratory Information Management Systems

- The technical requirements of Laboratory Information Management Systems (LIMS) are multifaceted, ensuring the efficient management of laboratory data, compliance, and operational workflows.

- Key components include robust software that integrates seamlessly with various laboratory instruments, supporting data import and export to streamline sample processing and analysis.

- The software must also be highly configurable, allowing labs to customize workflows and business processes without extensive coding.

- Moreover, compliance with regulatory standards such as ISO 17025, GLP, and 21 CFR Part 11 is critical, necessitating features like electronic signatures and audit trails to maintain data integrity and security.

- Modern LIMS also prioritize user-friendly interfaces and mobile accessibility to facilitate ease of use and remote access. The need for scalability is paramount as laboratories grow, requiring systems that can handle increasing data volumes and user demands.

Factors Considered While Selecting Laboratory Information Management Systems Software

Aspects That Describe the Best Decision-Making in Terms of LIMS Selection

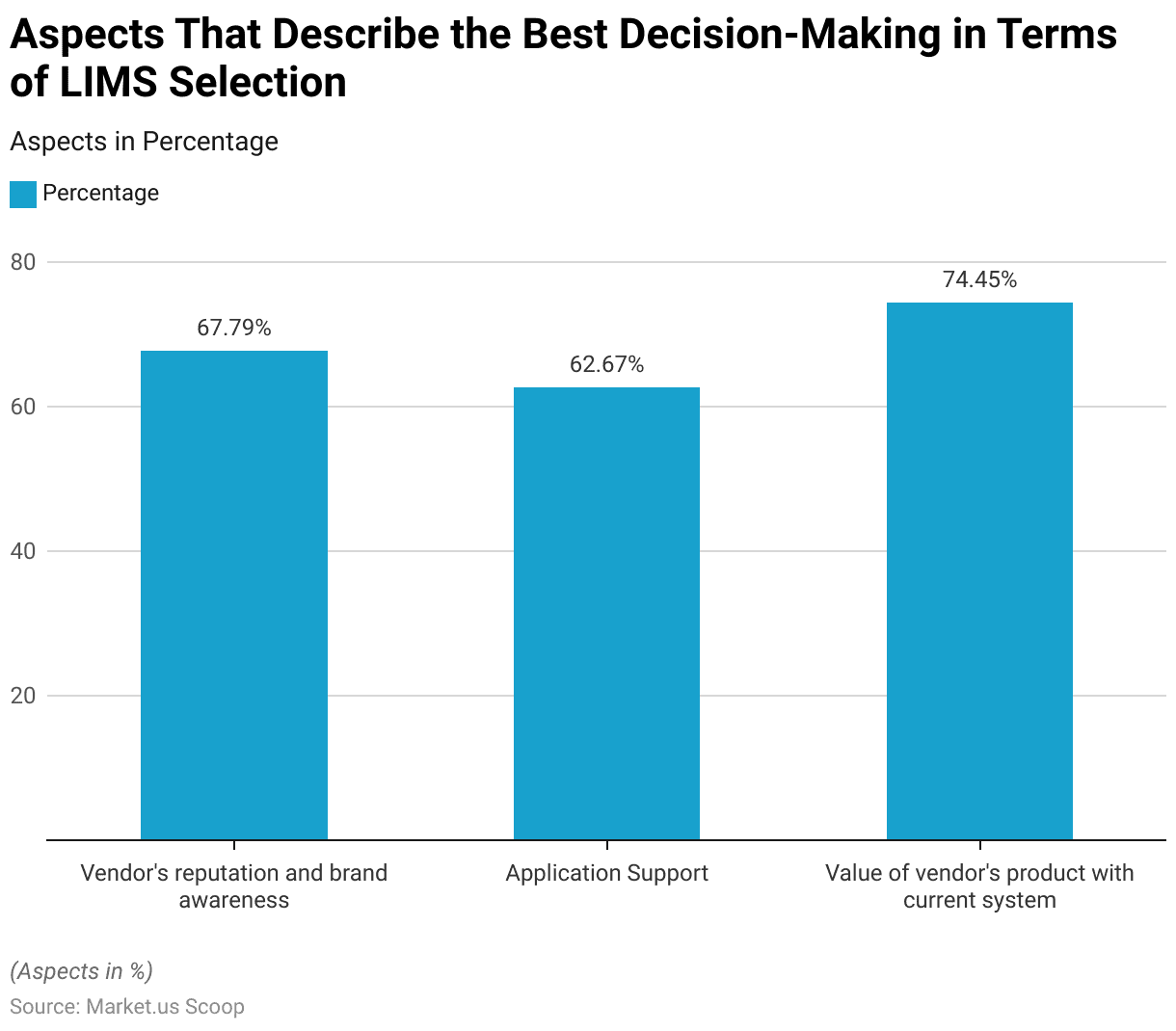

- When selecting a Laboratory Information Management System (LIMS), several key factors are crucial for effective decision-making.

- Vendor reputation and brand awareness are paramount, with 67.79% of decision-makers considering these aspects vital.

- Application support is another significant factor, valued by 62.67% of respondents.

- The most critical factor, with a value of 74.45%, is the compatibility and value of the vendor’s product with the current system.

Points Considered While Selecting LIMS Software

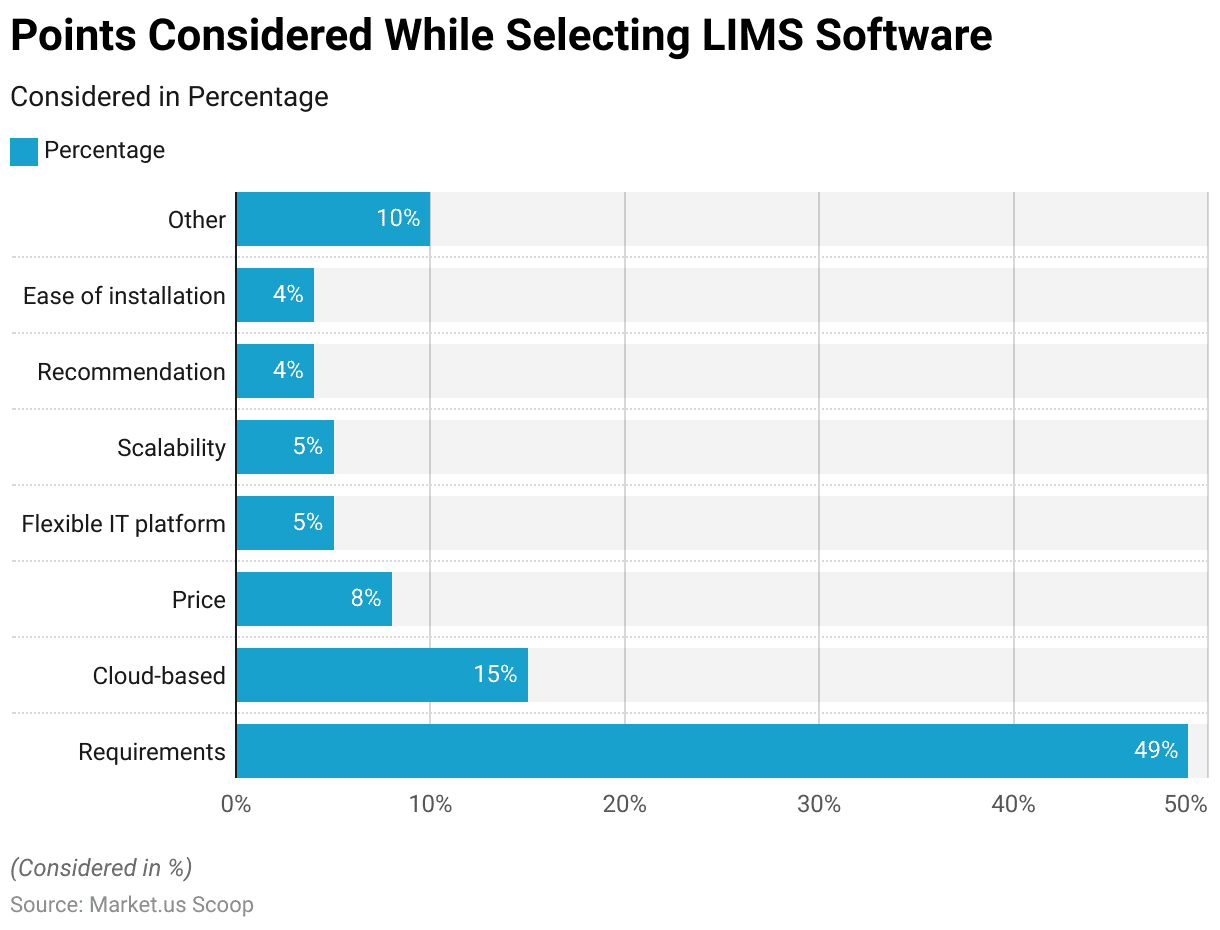

- The primary consideration is the specific requirements of the laboratory, which account for 49% of the decision criteria. This highlights the importance of ensuring the software meets the lab’s unique needs and workflows.

- Cloud-based solutions are also a notable factor, valued by 15% of decision-makers, reflecting the growing trend towards leveraging cloud technology for its scalability and accessibility benefits.

- Price is a consideration for 8% of respondents, indicating that cost-effectiveness is important but not the overriding concern.

- A flexible IT platform is critical for 5% of users, emphasizing the need for software that can adapt to evolving technological landscapes and integrate with various systems.

- Scalability, also at 5%, underscores the necessity for a system that can grow with the laboratory’s needs.

- Recommendations and ease of installation are each valued by 4% of decision-makers, highlighting the influence of peer reviews and the need for straightforward deployment processes.

- Other factors, making up 10%, include various additional considerations that might be specific to individual laboratories’ circumstances.

Regulations for Laboratory Information Management Systems

- In the United States, the Clinical Laboratory Improvement Amendments (CLIA) of 1988 set federal standards for all facilities that test human specimens, emphasizing the need for accurate, reliable, and timely test results.

- Globally, the International Health Regulations (IHR 2005), coordinated by the World Health Organization (WHO), encourage member states to develop robust laboratory quality management systems.

- Modern LIMS platforms offer features such as electronic signatures, complete audit trails, and real-time data exchange with electronic health records (EHRs), ensuring that laboratories meet stringent standards such as 21 CFR Part 11, GMP, and ISO 17025.