Table of Contents

Introduction

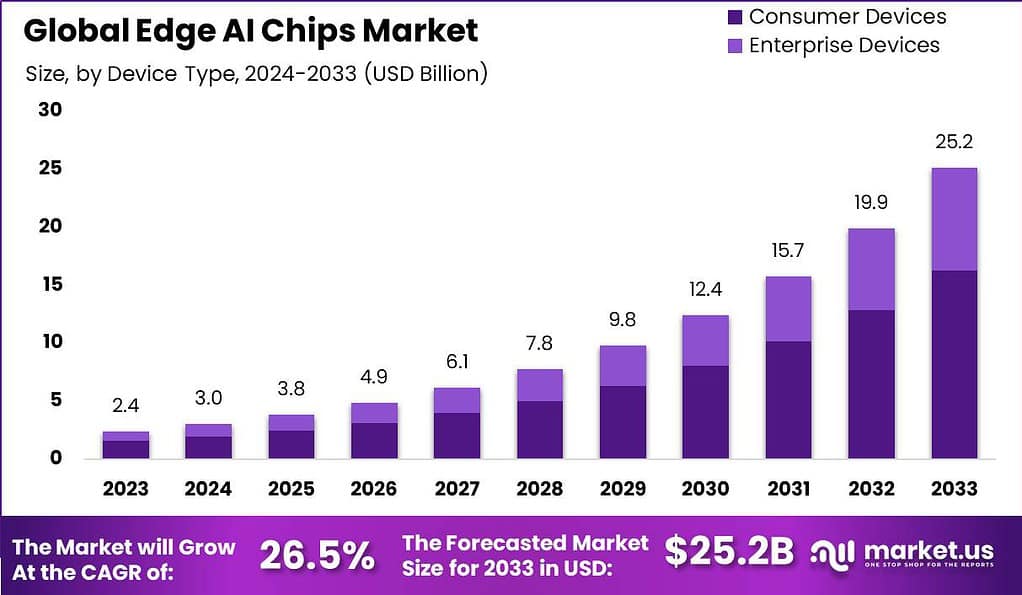

According to Market.us, The Edge AI Chips Market is poised for substantial growth, projected to reach USD 25.2 billion by 2033, expanding at a robust CAGR of 26.5% throughout the forecast period from 2024 to 2033. Edge AI chips, also known as AI processors or AI accelerators, are specialized hardware components designed to execute artificial intelligence computations directly on edge devices. This capability enables devices like smartphones, IoT gadgets, and autonomous vehicles to perform AI tasks swiftly and in real-time, without relying heavily on cloud-based processing.

The Edge AI Chips Market is experiencing significant growth, driven by the increasing demand for faster processing and real-time decision-making in devices at the edge of networks. These chips are designed to process data locally, reducing latency and enhancing the efficiency of applications like autonomous vehicles, smart home devices, and industrial automation. The rapid expansion of IoT devices and advancements in machine learning algorithms further fuel this market’s growth.

However, the market faces challenges, such as the high cost of development and the complexity of integrating AI capabilities into small, energy-efficient chips. Additionally, there are concerns about data security and privacy, as edge devices often process sensitive information. Opportunities in this market are abundant, particularly in developing areas such as healthcare for remote monitoring and diagnostics, and in smart cities for traffic management and public safety. The ongoing innovation in semiconductor technologies also presents opportunities for market players to develop more powerful and energy-efficient edge AI chips, catering to the evolving needs of various industries.

To learn more about this report – request a sample report PDF

Key Takeaways

- The Edge AI Chips Market is projected to reach USD 25.2 billion by 2033, growing at a CAGR of 26.5% over the forecast period. In 2023, the market was valued at USD 2.4 billion.

- In 2023, the CPU segment dominated the market, capturing more than a 36.7% share of the Edge AI Chips market.

- The consumer device segment also held a significant position in 2023, accounting for more than a 64.5% share of the market.

- Additionally, the inference segment led the market in 2023, with a share exceeding 56.5%.

- Geographically, North America was the leading region in the Edge AI Chips market in 2023, holding more than a 42.3% share, with revenues amounting to USD 1.01 billion.

Edge AI Chips Statistics

- The Edge AI Market is projected to reach approximately USD 143.6 billion by 2033, up from USD 19.1 billion in 2023, reflecting a compound annual growth rate (CAGR) of 25.9% over the forecast period from 2024 to 2033.

- The Edge AI Hardware Market is anticipated to be valued at around USD 43 billion by 2033, rising from USD 8 billion in 2023, with a CAGR of 19.2% during the forecast period from 2024 to 2033.

- The Global AI Chip Market is expected to achieve a valuation of approximately USD 341 billion by 2033, growing from USD 23.0 billion in 2023, with a CAGR of 31.2% over the forecast period from 2024 to 2033.

- As of 2020, around 750 million Edge AI chips have been sold, generating roughly USD 2.6 billion in revenue. This growth trajectory indicates that Edge AI chips are increasingly being integrated into a variety of consumer IoT devices, including advanced smartphones, smart speakers, wearables, tablets, and smart video doorbells.

- This USD 2.6 billion revenue figure significantly surpasses the 300 million edge AI chips Deloitte forecasted to sell in 2017.

- Edge intelligence devices are predicted to process 18.2 zettabytes of data per minute by 2025.

- By 2024, the sales of edge AI chips are expected to exceed 1.5 billion units, potentially surpassing this number by a significant margin.

- This projection translates to an annual unit sales growth rate of at least 20%, which is more than double the longer-term forecast of a 9% CAGR for the overall semiconductor industry.

- In March 2021, Microsoft launched Azure Percept, a new platform dedicated to edge AI and machine learning.

- Edge AI is projected to reduce cloud traffic by up to 99% by 2025.

- An Omdia report indicates that edge AI processor revenue will increase from USD 31 billion in 2022 to USD 60 billion in 2028.

Emerging Trends

- Increased Adoption in Consumer Electronics: The demand for edge AI chips in consumer electronics, especially smartphones, is rapidly increasing. This is due to the enhanced capabilities these chips provide in processing AI tasks directly on devices, thereby improving performance and efficiency.

- Growth in IoT Devices: There is a significant surge in the deployment of edge AI chips within IoT devices. This trend is driven by the need for real-time data processing and decision-making at the device level, without relying on cloud connectivity.

- Advancements in Chip Technology: New developments in semiconductor technology are allowing for more powerful and energy-efficient edge AI chips. These advancements are crucial as they enable broader applications across various industries including automotive and industrial automation.

- Integration with 5G Technology: The rollout of 5G networks is enhancing the capabilities of edge AI by reducing latency and increasing the speed and reliability of data transmission. This integration is pivotal for applications requiring real-time analytics and processing.

- Focus on Sustainability: There is a growing emphasis on designing edge AI chips that are not only powerful but also energy-efficient. This shift is in response to the increasing environmental concerns and the need for sustainable technology solutions across industries.

Top Use Cases for Edge AI Chips

- Smartphones and Wearables: Edge AI chips are heavily utilized in smartphones and wearables to perform on-device processing for features like facial recognition, augmented reality, and real-time language translation, enhancing user experience without the need for continuous cloud connectivity.

- Automotive Applications: In the automotive sector, edge AI chips are used for advanced driver-assistance systems (ADAS) to process information in real-time, which is crucial for safety features such as object detection and collision avoidance.

- Industrial Automation: These chips are also transforming industrial automation by facilitating the real-time analysis and response to operational data, which enhances efficiency and reduces downtime through predictive maintenance and anomaly detection.

- Healthcare Devices: In healthcare, edge AI chips help in monitoring and diagnostic devices by processing complex datasets locally to provide immediate insights, which is essential for patient monitoring and emergency response.

- Smart Home Technology: Edge AI chips enable smart home devices like security cameras and voice assistants to process data on the device, improving responsiveness and privacy by reducing the amount of data sent to the cloud.

Major Challenges

- Market Saturation: Some segments, like the smartphone market, are nearing saturation with existing AI architectures integrated into many chipsets, which could limit new market entries or expansions.

- High Development Costs: The advanced technology required for Edge AI chips involves significant research and development costs, including the costs associated with advanced semiconductor packaging and fabrication technologies.

- Technological Complexity: The complexity of developing Edge AI solutions that are efficient, reliable, and capable of running sophisticated AI algorithms at the edge poses a considerable challenge.

- Regulatory and Security Concerns: As Edge AI chips process data locally, they must comply with various regional data protection regulations, adding complexity to their deployment across different markets.

- Supply Chain Issues: Disruptions in the global supply chain can impact the production and delivery of Edge AI chips, affecting overall market growth and stability.

Market Opportunities for Edge AI Chips

- 5G Technology Deployment: The rollout of 5G networks offers high-speed, low-latency communications that can enhance the capabilities of Edge AI applications, particularly in real-time data processing and analytics.

- Growth in IoT and Smart Devices: Increasing adoption of IoT and smart devices across various sectors, including automotive, healthcare, and consumer electronics, drives demand for Edge AI chips to process data at the source efficiently.

- Advancements in AI and Machine Learning: Continuous improvements in AI and machine learning algorithms enhance the capabilities of Edge AI chips, making them more attractive for new applications such as autonomous vehicles and smart manufacturing.

- Energy Efficiency Needs: As energy efficiency becomes more crucial, Edge AI chips that minimize data transmission to the cloud and reduce power consumption offer significant benefits and market opportunities.

- Diverse Application Areas: Edge AI chips have a broad range of applications, from video surveillance and security to advanced driver-assistance systems (ADAS), providing multiple pathways for market expansion .

Recent Developments

- April 2024: Intel launched its next-generation Xeon processors with integrated AI accelerators, designed to enhance AI performance in edge computing environments.

- March 2023: Google unveiled the Coral Dev Board Micro, a compact development board for edge AI applications, featuring Google’s Edge TPU for accelerating machine learning tasks at the edge.

- February 2024: Qualcomm introduced the Snapdragon X75 5G modem, featuring advanced AI capabilities for edge devices, enhancing connectivity and AI processing at the edge.

- October 2023: Samsung launched the Exynos 2200 chip, featuring an integrated AI engine designed to improve AI processing capabilities in smartphones and edge devices.

Conclusion

The Edge AI chips market is positioned at the intersection of several powerful technological trends, including the growth of IoT, the rollout of 5G, and advances in machine learning. While the market faces challenges such as technological complexity and supply chain vulnerabilities, the expanding applications and the shift towards more localized, real-time processing present significant growth opportunities. As these technologies continue to evolve, the demand for Edge AI chips is expected to increase, especially in applications requiring high-speed processing at the edge of networks. The market’s potential is underscored by the integration of Edge AI into diverse industries, driving innovation and efficiency across sectors.