Table of Contents

Introduction

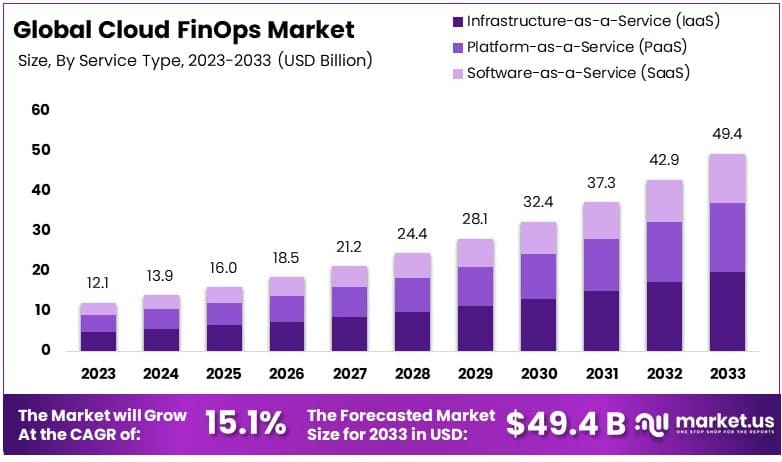

According to Market.us, The Global Cloud FinOps Market size is expected to be worth around USD 49.4 Billion by 2033, from USD 12.1 Billion in 2023, growing at a CAGR of 15.1% during the forecast period from 2024 to 2033.

Cloud Financial Operations also known as Cloud FinOps, is an evolving business practice designed to help companies manage and optimize their cloud spending efficiently. As organizations increasingly shift to cloud-based infrastructures, the need for a structured approach to financial management becomes crucial. The Cloud FinOps market encompasses a range of tools, services, and strategies that enable businesses to align their cloud investments with business goals effectively, ensuring that every dollar spent is justified through tangible business outcomes.

The demand for Cloud FinOps is driven by the growing complexity of cloud environments and the escalating costs associated with cloud services. Businesses are seeking ways to gain better visibility and control over their cloud expenditures to avoid wastage and ensure cost-effectiveness. This demand is further bolstered by the increasing adoption of multi-cloud and hybrid cloud strategies, which add layers of financial complexity that traditional financial management tools are ill-equipped to handle.

The Cloud FinOps market is experiencing robust growth, reflecting the critical need for these services across various industries. The market’s expansion is fueled by the broader shift towards digital transformation, where companies leverage cloud technologies to innovate and enhance operational efficiencies. As cloud deployments become more intricate and critical to business operations, the role of FinOps becomes increasingly central, supporting sustained growth in this sector.

Opportunities within the Cloud FinOps market are vast and varied as there is a growing need for sophisticated analytics tools that can provide deeper insights into cloud spending patterns and help forecast future expenditures. As companies expand globally, the demand for scalable solutions that can manage costs across different regions and cloud providers is increasing. Training and consultancy services also present significant opportunities, helping organizations to implement FinOps practices effectively and cultivate a culture of cost accountability and optimization.

Key Takeaways

- The Cloud FinOps Market had a value of USD 12.1 billion in 2023 and is projected to rise to USD 49.4 billion by 2033, growing at a CAGR of 15.1%.

- Solutions made up 67% of the component segment in 2023, dominating due to a rising need for tools that manage and optimize costs.

- Infrastructure-as-a-Service (IaaS) accounted for 40% of the service type segment in 2023, leading because of its scalable and flexible nature in cloud operations.

- The public deployment model was the most prevalent in 2023, holding a 45% share, favored for its cost efficiency and broad enterprise adoption.

- Large enterprises were the primary contributors to the enterprise size segment in 2023, holding a 65% share, indicative of their substantial investments in cloud management.

- With advanced cloud infrastructure and high adoption rates, North America led the regional markets in 2023, capturing 40% of the market share.

Cloud FinOps Statistics

- TheCloud Computing Market is projected to reach a value of approximately USD 2,974.6 Billion by 2033, up from USD 629.5 Billion in 2023, expanding at a Compound Annual Growth Rate (CAGR) of 16.8% over the forecast period from 2024 to 2033.

- A significant 60% of professionals express that their cloud expenses are higher than necessary.

- Remarkably, only 13% of companies have allocated 75% of their cloud costs, with the remaining 87% uncertain about the distribution and justification of these costs.

- 73% of respondents indicate that cloud expenses are a major concern for the board or C-suite.

- By 2025, cloud technologies are anticipated to constitute 65% of all enterprise application spending.

- 89% of surveyed professionals perceive FinOps as the solution to managing the complexities of cloud costs.

- According to a PwC survey, more than half of enterprises struggle to see a return on investment (ROI) from cloud expenditures.

- For many organizations, cloud cost management is a critical component of their FinOps program, with 30% of respondents in 2022 and nearly 33% in 2023 facing challenges in engaging engineers and optimizing cloud costs.

- Only 13% of participants report having a mature FinOps program.

- A minor 7.5% of cloud FinOps practitioners are at the “pre-crawl” level, indicating a nascent stage of understanding and implementation.

- 37.1% of respondents are still navigating FinOps at the “crawl” stage, trying to grasp its fundamentals.

- 42.8% are at the “walk” stage, having established their practice but not yet perfected it.

- 12.6% have reached the “run” stage, where cloud FinOps is integrated into daily operations and organizational culture.

- A significant 45% of executives and DevOps professionals view FinOps as a necessary challenge, with varying perspectives ranging from a necessary evil (7%), merely a suggested framework (10%), largely ineffectual (13%), to theoretically simple but practically difficult (15%).

- 82% of organizations now possess a formal FinOps team, with 44% of these teams established within the past year. Additionally, 16% are considering the formation of such a team.

- An overwhelming 96% acknowledge the critical importance of FinOps to their cloud strategy.

- 67% of organizations have transitioned over 60% of their workload to the cloud.

- 78% of organizations opt for either a hybrid or multi-cloud strategy.

- 82% of organizations reportedly waste at least 10% of their cloud spend.

- 63% of organizations allocate more than 7% of their cloud budget towards FinOps activities.

- 34% of organizations are at the initial stages of adopting FinOps.

- The IT/Technology sector leads in FinOps engagement with a substantial 38% participation rate.

- 86% of Senior Vice Presidents (SVPs) and 80% of Vice Presidents (VPs) play active roles in their organization’s FinOps activities

Emerging Trends

- Framework Evolution: The FinOps Framework continues to evolve to address newer challenges like cloud sustainability and integration with other IT management areas. This adaptation ensures FinOps practices keep pace with changing technology and business needs.

- AI and ML Integration: AI and machine learning are becoming integral to FinOps, influencing cost management strategies due to their significant impact on cloud bills. This trend highlights the need for specific strategies to manage AI/ML-related costs.

- Focus on Sustainability: There is a growing trend to align cloud FinOps with sustainability efforts. This includes tracking and optimizing cloud usage to meet new regulatory requirements and achieve sustainability goals, reflecting a broader responsibility beyond cost management.

- Increased Automation: Automation in FinOps is increasing, particularly for routine tasks like data collection and analysis. However, strategic decisions still require human intervention, blending automated processes with expert oversight.

- Expansion of FinOps Teams: There’s a trend towards expanding dedicated FinOps teams within organizations. This shift comes as businesses recognize the need for specialized skills in cloud finance management to handle increasingly complex cloud environments.

Top Use Cases

- Cost Optimization: Utilizing detailed insights from FinOps tools to optimize spending across cloud services, especially in high-cost areas like compute and storage.

- Budget Management: Implementing robust forecasting and budget management practices to prevent overspending and align expenditures with organizational goals.

- Resource Allocation: Enhancing visibility into resource usage to ensure efficient allocation, helping organizations avoid wasted investments and improve operational efficiency.

- Regulatory Compliance: Assisting organizations in meeting compliance requirements, especially in regulated industries where financial management and reporting are crucial.

- Strategic Business Alignment: Aligning cloud spending with business outcomes, ensuring that investments in cloud services directly support business objectives and drive value.

Major Challenges

- Visibility and Control: As cloud deployments scale, organizations face challenges in maintaining visibility and control over cloud spend, leading to inefficiencies and budget overruns. Effective cloud cost management platforms are essential for providing real-time insights and detailed reporting.

- Managing Complexity in Multi-Cloud Environments: Multi-cloud strategies introduce complexities in financial management across different providers, often resulting in inefficiencies and higher operational costs.

- Cost Predictability: The pay-as-you-go model of cloud services often results in unpredictable costs, with unexpected spikes that can severely impact budgets. This calls for advanced forecasting tools and financial strategies to manage these costs effectively.

- Integration of Finance and Engineering Efforts: There is often a significant gap between finance and engineering teams in understanding and managing cloud costs. This misalignment can impede the effective implementation of FinOps strategies.

- Resource Optimization and Waste Reduction: Many organizations struggle with over-provisioning and underutilizing cloud resources, leading to wasted expenditures. Regular resource optimization practices and rightsizing are necessary to address this issue.

Top Opportunities

- Enhanced Cost Efficiency: Implementing FinOps can lead to significant reductions in cloud spending by aligning costs directly with business value and optimizing resource usage.

- Improved Financial and Operational Governance: By integrating financial management with IT operations, companies can achieve more granular governance over cloud expenditures, enhancing accountability and control.

- Strategic Resource Allocation: FinOps facilitates better strategic decision-making regarding resource allocation, ensuring that investments are aligned with business priorities and operational needs.

- Advanced Forecasting and Budget Management: Utilizing sophisticated forecasting methods and budget management tools can help predict and manage cloud spend more accurately, preventing budget overruns and enabling more predictable financial planning.

- Cultural Shift Towards Cost Transparency: Adopting FinOps encourages a culture of cost transparency and collaboration across departments, leading to more informed decision-making and improved financial outcomes.

Recent Developments

- IBM’s Acquisition of Apptio (June 2023): IBM acquired Apptio Inc. for $4.6 billion, significantly enhancing its cloud financial management capabilities. This acquisition allows IBM to integrate Apptio’s offerings, such as ApptioOne and Cloudability, with its own IT automation software and AI platform, Watsonx. This move is expected to help businesses manage and optimize their cloud spend and technology investments more effectively across hybrid and multi-cloud environments.

- Apptio’s Multi-Cloud FinOps Innovations (June 2023): Apptio launched new capabilities for its Cloudability product family, aimed at reducing the complexity of managing multi-cloud environments. These innovations include advanced cloud spend planning, optimization, and automation, along with Kubernetes integration. This is part of Apptio’s ongoing efforts to support FinOps practitioners in better managing cloud financials across diverse cloud platforms.

- Apptio’s Integration with Oracle Cloud Infrastructure (September 2023): Apptio announced the completion of its integration with Oracle Cloud Infrastructure (OCI), enhancing its multi-cloud FinOps capabilities. This integration allows FinOps practitioners to access OCI usage and cost data directly within Apptio’s Cloudability platform, providing a more unified approach to cloud financial management across different cloud providers.

- SoftwareOne Expands Cloud Transformation Services (2023): SoftwareOne has been recognized as a major player in worldwide cloud professional services. The company continues to leverage its partnerships with hyperscalers like AWS and Microsoft to assist clients in cloud transformation, aiming to optimize IT investments and reduce cloud costs. This expansion in services underlines SoftwareOne’s commitment to supporting digital transformation and cloud FinOps initiatives.

Conclusion

In conclusion, the Cloud FinOps market typically emphasizes the critical role of FinOps in enabling organizations to optimize cloud spending and enhance financial accountability. As more businesses adopt cloud services, the demand for FinOps solutions that provide visibility, cost management, and operational efficiency is growing. Key drivers include the need for better budget management, increased cloud investments, and the shift towards complex, multi-cloud environments.

Moreover, the integration of sustainability practices with Cloud FinOps is emerging as a significant trend. As organizations become more conscious of their environmental impact, there is a growing initiative to align cloud cost management with sustainability efforts. This approach is not only about cost reduction but also involves optimizing cloud usage to meet sustainability targets, which is increasingly supported by regulatory frameworks and corporate responsibility goals. The market is expected to expand as companies seek to align their cloud investments with business outcomes, driving innovation in FinOps practices and tools to manage and optimize cloud costs effectively.