Table of Contents

Introduction

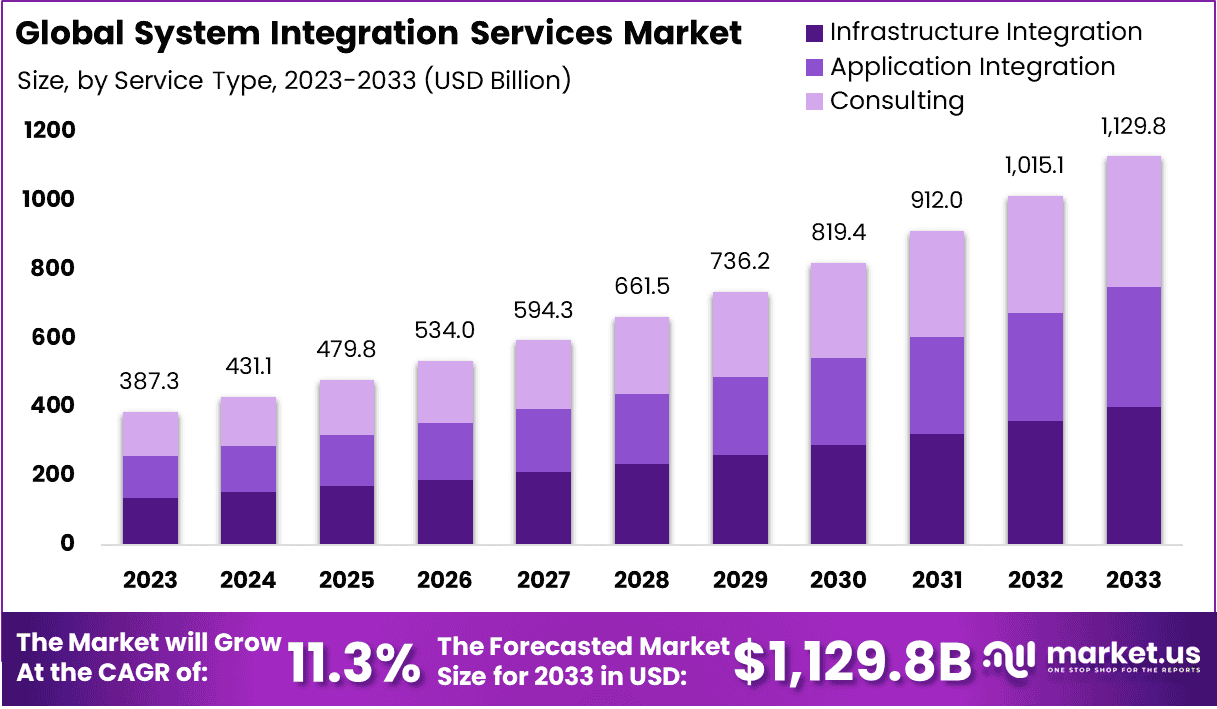

According to Market.us, the Global System Integration Services Market size is projected to expand from USD 431.1 million in 2024 to USD 1,129.8 Billion by 2033. The market is projected to surge at 11.3% CAGR through 2033. In 2023, North America maintained a leading position in the system integration services market, securing over 35.6% of the global market share. This dominance is reflective of the region’s advanced technological infrastructure and the proactive adoption of integration services across various industries.

System integration services involve the coordination and unification of various IT systems, software, and hardware components into a cohesive, functioning whole. These services are essential for organizations aiming to enhance operational efficiency, reduce costs, and improve data flow across different systems. System integrators provide expert knowledge and skills to connect disparate system components, ensuring they work together seamlessly.

The market for system integration services is experiencing significant growth due to the increasing complexity of IT infrastructures and the need for interconnected systems in business operations. Enterprises are investing in system integration to streamline their IT processes and ensure more effective data management and access.

The demand is also driven by the ongoing digital transformation initiatives across industries, the adoption of cloud computing, and the integration of Internet of Things (IoT) technologies. As businesses continue to recognize the importance of having an integrated IT environment, the market is seeing a surge in opportunities for system integrators to offer tailored solutions that address specific industry needs and challenges. This trend is expected to continue as more organizations prioritize digital cohesion and operational efficiency.

The demand for system integration services is on the rise, driven primarily by the ongoing digital transformation across various sectors. Businesses are increasingly relying on sophisticated IT systems that need to interact seamlessly to optimize performance and support new functionalities. This necessity is especially pronounced in industries where real-time data processing and interconnectivity between devices are critical, such as manufacturing, healthcare, and financial services.

The opportunities in the system integration services market are expansive. As organizations look to adopt emerging technologies such as artificial intelligence, machine learning, and blockchain, the need for integration services that can seamlessly merge these technologies with existing systems becomes crucial. This integration ensures that businesses can harness the full potential of their technological investments.

Moreover, the growing emphasis on cybersecurity and data protection regulations compels companies to seek integration solutions that not only enhance functionality but also ensure compliance and security across all system levels. This evolving landscape presents significant growth prospects for providers of system integration services, who are poised to offer innovative and compliant solutions tailored to the complex needs of modern enterprises.

System Integration Services Statistics

- The global system integration services market is poised for substantial growth, projected to expand from USD 387.3 billion in 2023 to approximately USD 1,129.8 billion by 2033. This represents a robust compound annual growth rate (CAGR) of 11.3% over the ten-year forecast period from 2024 to 2033. This expansion is indicative of the increasing complexity of technological environments and the critical need for integrated systems across various industries.

- In 2023, the infrastructure integration segment emerged as a major contributor to the market, securing a dominant share of 35.4%. This segment’s significant portion underscores the escalating demand for cohesive infrastructural solutions that can seamlessly connect hardware, software, and services within corporate environments.

- Furthermore, the Banking, Financial Services, and Insurance (BFSI) sector significantly dominated the application landscape of system integration services, holding a 54.7% market share in 2023. This dominance highlights the BFSI sector’s imperative requirement for integrated systems to ensure efficient operations, compliance with stringent regulations, and enhanced customer service capabilities.

- Geographically, North America maintained a leading position in the global market, accounting for a substantial 35.6% of the market share in 2023. The region’s dominance can be attributed to advanced technological adoption, a strong presence of key industry players, and significant investments in research and development activities related to system integration services.

- The system integration services industry is witnessing substantial growth, currently valued at over $500 billion and is projected to reach $1 trillion by 2030. This remarkable expansion is primarily driven by the escalating demand for integrated solutions that enhance operational efficiency and improve data accessibility across organizations. Notably, the enterprise integration sector is experiencing an annual growth rate of 30 to 40%.

- According to insights from Partner Fleet, a significant 84% of businesses recognize integrations as “very important” or a “key requirement” for their customers, underscoring the pivotal role that integration plays in customer satisfaction and retention. Furthermore, 90% of B2B buyers state that a vendor’s ability to integrate seamlessly with existing technology is a crucial factor influencing their purchasing decisions.

- The complexity within the integration landscape is also increasing as 50% of enterprise companies report having more than 50 integrations. This trend towards intricate integration environments highlights how businesses evolve and scale. Moreover, companies with five integrations demonstrate their valuation of integrated solutions by being willing to pay 20% more for the same core product, showcasing the perceived added value from such integrated solutions.

Emerging Trends

- IoT Integration: The Internet of Things (IoT) continues to be a significant driver in system integration, enhancing efficiency and enabling new revenue streams through smart, interconnected devices.

- AI-Driven Integration: Artificial intelligence is transforming system integration, automating complex processes and optimizing system efficiency, thereby reducing human error and operational costs.

- Cloud-Based Integration Solutions: There’s an increased adoption of cloud-based platforms for better scalability and flexibility, allowing businesses to respond more dynamically to market changes.

- Edge Computing: This trend focuses on processing data near the source of data generation, reducing latency and bandwidth use, and enhancing the performance of applications across networks.

- Cybersecurity Measures: As system integration involves handling vast amounts of data, integrating robust cybersecurity measures is crucial to protect against increasing cyber threats.

Top Use Cases

- Enhanced Data Analytics: Integrating various data sources allows for comprehensive analytics, enabling better decision-making and strategic planning across business functions.

- Improved Customer Experiences: By integrating systems, businesses can offer seamless customer experiences, bridging the gap between various service touchpoints to deliver consistent and personalized service.

- Operational Efficiency: System integration helps in automating routine tasks and streamlining operations, thereby reducing costs and improving overall business efficiency.

- Regulatory Compliance: Integrated systems ensure that businesses can better comply with regulations by maintaining data integrity and securing data flows across platforms.

- Innovation and Product Development: Integration enables faster and more efficient product development cycles by fostering better collaboration between teams and technologies.

Major Challenges

- Legacy Systems and Technology: Many organizations still rely on outdated infrastructure and aging technology, which can complicate integrating with newer systems. This often results in increased complexity and costs associated with upgrading or replacing these legacy systems.

- Complexity of Integration: The need to integrate disparate systems, each with their own interfaces and technologies, adds significant complexity. Ensuring data consistency and security across these systems is a continuous challenge.

- High Costs: System integration often involves substantial financial outlays for development, deployment, and ongoing maintenance. Managing these costs while ensuring effective integration is a critical challenge.

- Talent Shortage: There is a noticeable shortage of skilled professionals who are adept at managing and executing system integration projects. This talent gap can delay projects and increase reliance on external consultants.

- Security Concerns: As systems become more interconnected, the potential for security vulnerabilities increases. Ensuring that integrated systems are secure against breaches and comply with data protection regulations is a significant challenge.

Top Opportunities

- Digital Transformation: As companies continue to invest in digital transformation, there is a significant opportunity for system integrators to assist in upgrading legacy systems to modern platforms that support digital operations.

- Growth of IoT and AI: The proliferation of technologies like the Internet of Things (IoT) and artificial intelligence (AI) requires new integration solutions to ensure these technologies work harmoniously with existing systems. This presents a substantial opportunity for system integrators.

- Cloud Computing: The shift towards cloud-based solutions offers vast opportunities for system integrators to help organizations migrate their operations to the cloud efficiently and securely.

- Managed Services: There is a growing trend of businesses outsourcing their integration needs to managed service providers. This trend allows organizations to leverage specialized expertise without the need for extensive in-house capabilities.

- Compliance and Governance: As regulatory requirements continue to evolve, organizations increasingly need sophisticated integration solutions that can ensure compliance. System integrators can capitalize on this need by offering tailored services that address specific regulatory challenges.

Recent Developments

- Acquisition: In November 2023, Accenture completed its acquisition of ALBERT, a provider of AI-driven big data solutions. This acquisition aims to bolster its system integration services with enhanced capabilities in data analytics.

- New Product Launch: In Q1 2024, Cognizant launched new cloud-based solutions designed to improve IT infrastructure integration and automation, focusing on industries like healthcare and finance

- Acquisition: Capgemini has seen an uptick in performance after the 2023 acquisition of Quantmetry, a consulting firm specializing in AI and data science. This acquisition strengthens Capgemini’s system integration services, especially in sectors requiring advanced analytics and AI-driven solutions.

- Expansion: In May 2023, Infosys announced an expansion of its system integration services by opening new delivery centers in Germany and Ireland. This move is aimed at increasing its onshore presence and enhancing cloud and AI integration solutions for European clients.

- New Partnership: In January 2024, Cisco announced a collaboration with NetApp to enhance its FlexPod XCS hybrid cloud service, integrating automation and data services into system integration platforms for the retail and BFSI sectors.

Conclusion

In conclusion, the vital role of system integration services in today’s business landscape cannot be overstated. As organizations navigate the complexities of modern IT infrastructures, the demand for these services is poised to grow significantly. System integration not only enhances operational efficiency but also plays a crucial role in enabling data consistency and seamless communication across various technology platforms.

With the digital transformation of industries accelerating, businesses are increasingly dependent on system integrators to leverage new technologies effectively. The market for system integration services is expanding, reflecting the broader shift towards more connected, efficient, and technologically cohesive business environments. This trend underscores the importance of strategic system integration in achieving competitive advantage and long-term success in the digital age.

Explore ongoing Technology Domain coverage by Market.us.

- The Global Smart E-Drive Market is projected to reach USD 34.1 billion by 2033, expanding at a CAGR of 32.8% from 2024 to 2033, with Asia Pacific leading the segment with a 45% market share.

- The Global Smart Highway Market is anticipated to grow to USD 261.3 billion by 2033 from USD 49.5 billion, progressing at a CAGR of 18.1%, with North America capturing a 41.3% share.

- Projected to ascend at a CAGR of 19.3%, the Global Smart Government Market is expected to surge from USD 35.7 billion to USD 208.5 billion by 2033.

- The Global AI in Edtech Market is forecast to escalate from USD 3.65 billion to USD 92.09 billion by 2033, achieving a CAGR of 38.1%.

- Finally, the Global Retail POS Market is poised to reach USD 73.3 billion by 2033, growing at a steady CAGR of 10.5%.