Table of Contents

Introduction

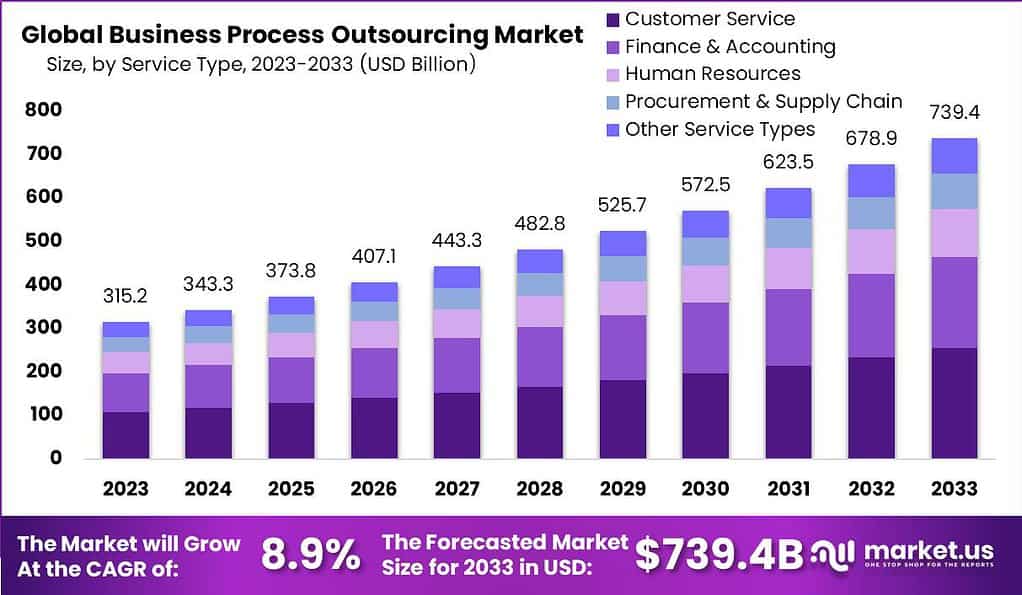

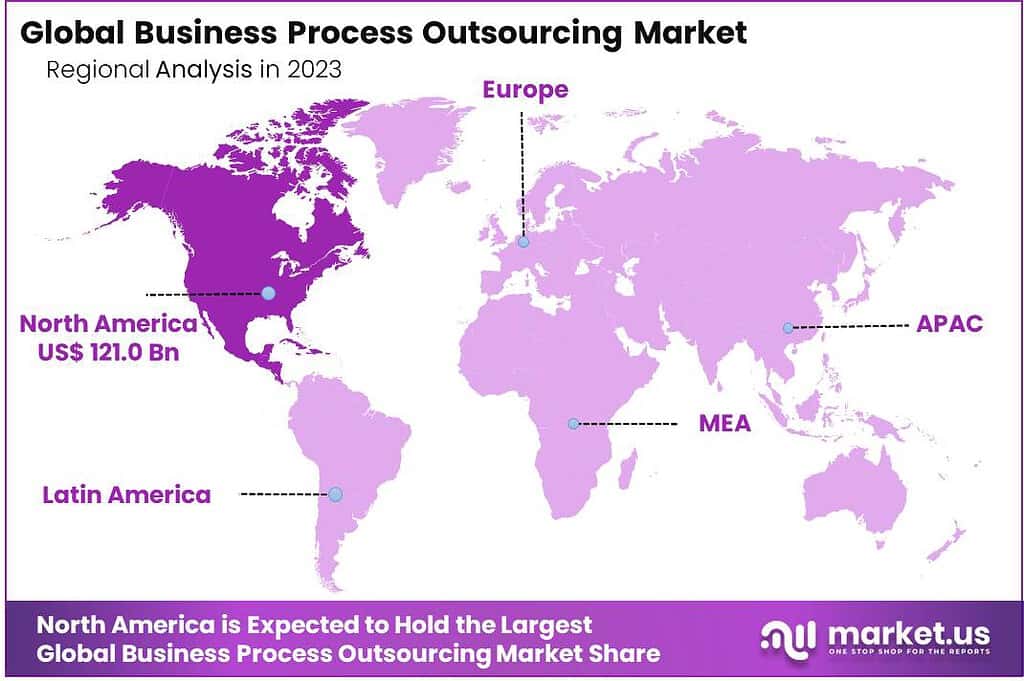

The Global Business Process Outsourcing (BPO) Market is poised for substantial growth, projected to expand from USD 315.2 billion in 2023 to an estimated USD 739.4 billion by 2033. This growth represents a robust Compound Annual Growth Rate (CAGR) of 8.9% over the forecast period from 2024 to 2033. As of 2023, North America has established a commanding presence within the market, securing a significant 38.4% market share, which corresponds to revenues of approximately USD 121 billion. This regional dominance underscores North America’s integral role in shaping the dynamics of the global BPO landscape, driven by advanced technological infrastructure, stringent data compliance regulations, and the presence of major market players.

The Business Process Outsourcing (BPO) industry involves delegating various business-related operations to third-party vendors. This model is extensively utilized by organizations to manage tasks such as customer support, human resources, finance, and accounting services, among others. The key drivers for adopting BPO services include cost reduction, focus on core business activities, and access to technological advancements without substantial investments.

Regarding the Business Process Outsourcing Market, it has witnessed significant growth and transformation, particularly influenced by technological advancements like cloud computing and artificial intelligence. The global market is expanding due to the increasing demand for cost efficiency and improved service delivery across various sectors. This growth is further propelled by industries such as healthcare, retail, and telecommunications, which are increasingly relying on outsourcing to optimize their processes and focus more on their core business functions.

The demand in the BPO market is primarily driven by the need for companies to reduce operational costs and increase efficiency. As businesses globally strive to stay competitive, outsourcing non-core activities allows them to benefit from reduced overheads and enhanced focus on strategic growth areas.

The opportunities within the BPO market are vast, especially in emerging technologies such as robotic process automation (RPA) and digital communication channels. These innovations enable BPO providers to offer more sophisticated, value-added services that go beyond traditional cost-saving measures, thereby helping clients to achieve business innovation and transformation.

Key Takeaway

- The Global Business Process Outsourcing (BPO) Market is poised for substantial growth over the next decade. As of 2023, the market valuation stands at approximately USD 315.2 billion. With a projected Compound Annual Growth Rate (CAGR) of 8.9%, the market is expected to escalate to around USD 739.4 billion by 2033.

- North America continues to lead the BPO sector, securing a significant portion of the market. In 2023, this region accounted for more than 38.4% of the global market, translating to an impressive USD 121 billion in revenue. This dominant position underscores North America’s critical role in the global BPO landscape.

- The Service Type segment has also shown robust performance within the BPO industry. In 2023, it claimed a significant market share of over 34.5%. This segment’s substantial share is indicative of the diverse range of services that businesses outsource to optimize operational efficiencies and reduce costs.

- Large Enterprises are the primary benefactors of BPO services, maintaining a dominant market presence. In 2023, this segment captured more than 67.0% of the market share, reflecting the strategic reliance of large corporations on outsourcing services to streamline operations and enhance service delivery.

- Within the industry verticals, IT & Telecommunications lead the way in adopting BPO services. In 2023, this segment held more than 36.1% of the market share, driven by the sector’s need to manage large volumes of data and maintain extensive communication networks efficiently.

Business Process Outsourcing (BPO) Statistics

- The average base wage for a U.S. call center worker today is $17.00 per hour; this represents a 40% increase since pre-pandemic levels.

- Productive hour pricing bids from BPOs in the U.S. have escalated to the $35-$45+ range in 2022, maintaining this level into 2023.

- Pre-pandemic hourly bids averaged $27-$29 in the U.S., compared to when BPOs could afford wages of $12-$13 per hour for call center employees.

- The impact sourcing market boasts 350,000 workers worldwide, with Africa employing 17% and Asia-Pacific 58%.

- The Philippines is a key hub for voice and non-voice BPO services, contributing over 10% to the country’s GDP.

- BPO services contribute over 7% to India’s GDP and employ over 1 million people.

- The healthcare BPO market is poised to surpass ~$500 billion by 2027.

- The global finance and accounting outsourcing market size is projected to reach ~$44.6 billion by 2027.

- The global legal process outsourcing market was valued at USD 19.0 Bn in 2024, with a forecast to reach USD 132.6 Bn in 2033, growing at a CAGR of 24.1%.

- Global spending on outsourcing was estimated at $731 billion in 2023, with 92% of G2000 companies engaging in IT outsourcing.

- 9% of the Philippines’ GDP is derived from business process outsourcing.

- 37% of small businesses outsource at least one business process.

- Each year, over one million new employees join the services outsourcing industry in China.

- 57% of businesses outsource to enhance productivity.

- 59% of companies outsource specific tasks to reduce costs and concentrate on core operations.

- Annually, U.S. businesses outsource approximately 300,000 jobs overseas.

- Major sectors fueling BPO growth include financial services, IT, and telecommunications. IT services constitute about 37% of all outsourced operations, while accounting and digital marketing account for 37% and 34%, respectively.

- 52% of small companies regularly utilize a firm or an agency for outsourcing, while 45% use freelancers and 45% consultants.

- The United States is anticipated to generate the most significant revenue of $129.70 billion in 2023 in the global outsourcing market.

- IBM stands as the largest outsourcing company globally, employing 383,800 individuals.

- The primary objective for outsourcing, as indicated by 70% of organizations, is cost reduction.

- Deloitte’s global outsourcing survey highlights the three main reasons for outsourcing: Cost reduction (84%), Standardization of processes (82%), and Development of capabilities (70%).

Leading countries for outsourcing services

| Top countries for outsourcing | Most outsourced services |

| India | IT and software development |

| Philippines | Customer service, back office |

| United States | Tech support, IT-related services |

| Ukraine | IT outsourcing |

| Poland | IT and software development |

| Brazil | IT outsourcing |

| South Africa | Contact center, IT outsourcing |

| Malaysia | IT and software development |

North America BPO market size

In 2023, North America held a dominant market position in the Business Process Outsourcing (BPO) sector, capturing more than a 38.4% share and generating approximately USD 121 billion in revenue. This leadership can be attributed to several structural and economic factors unique to the region. First, North America, particularly the United States, houses a significant number of Fortune 500 companies that actively seek to optimize operational efficiencies and reduce costs through outsourcing. This has led to a mature market for BPO services spanning finance, HR, customer service, and IT.

Additionally, the region’s advanced technological infrastructure and emphasis on innovation drive demand for BPO services that incorporate digital transformation solutions. North American enterprises are increasingly adopting artificial intelligence, machine learning, and automation to enhance their BPO activities, setting trends that the rest of the world often follows.

Moreover, the regulatory environment in North America generally supports outsourcing practices, coupled with strong intellectual property protection regimes, making it an attractive destination for companies looking to outsource critical business functions while maintaining compliance with standards.

Emerging Trends

- Adoption of Big Data and Analytics: Many BPO providers are increasingly leveraging big data and analytics to enhance operational efficiency and uncover new opportunities by extracting actionable insights from large datasets.

- Integration of Blockchain Technology: Blockchain is gaining traction within the BPO sector for its ability to offer enhanced transparency, security, and efficiency in processes such as transaction handling and data management.

- Expansion of Cloud Computing: Cloud technology continues to be integral for BPO services, facilitating more scalable and flexible solutions that can adapt to changing business needs.

- Increased Use of Robotic Process Automation (RPA): RPA is being widely adopted for automating repetitive tasks, thereby reducing costs and improving service delivery efficiency.

- Growth in AI and Machine Learning: AI and machine learning are being employed not just for automating simple tasks but also for providing more complex analysis and decision-making support.

Top use cases

- Information Technology: Outsourcing IT services such as software development, maintenance, and cybersecurity tasks is prevalent due to the cost efficiencies and access to specialized skills it offers.

- Customer Service: Many companies outsource customer service functions to enhance service quality and availability across different time zones.

- Accounting and Finance: Outsourcing these functions helps companies manage their financial operations more efficiently without the need to maintain large in-house teams.

- Human Resources: Recruitment process outsourcing and talent management are key areas where companies seek external expertise to streamline their HR operations.

- Legal Services: Outsourcing legal services provides access to global expertise and helps manage costs associated with legal operations, such as document review and compliance activities.

Major Challenges

- Staffing Challenges: The BPO sector faces significant staffing challenges, including the need for higher wages to attract and retain talent, as competition with other industries intensifies. Companies are striving to create a “best-place-to-work” culture by investing in employee engagement and amenities.

- Cost Containment Pressures: With rising operational costs, especially in the U.S., companies are experiencing pressure to keep outsourcing costs low while still demanding high-quality services. This has led to increased scrutiny on the pricing models of nearshore and offshore BPOs.

- Recessionary Fears: Economic downturns and recession fears are causing fluctuations in demand. While some companies see reduced volumes that affect staffing needs, others might experience spikes in demand, particularly because recessions can drive greater outsourcing to manage costs.

- Geographic Diversification: As saturation in established markets like the Philippines grows, there is a push towards diversifying outsourcing to unsaturated markets. This shift is driven by the need to de-risk and find new talent pools capable of delivering scalable and high-quality services.

- Social Impact and Sustainability Concerns: More organizations are adopting social impact outsourcing, employing individuals from disadvantaged backgrounds to improve lives and community conditions. However, integrating these practices while maintaining service quality poses a unique challenge.

Top Opportunities

- Emergence of Digital and Cloud Technologies: The integration of big data and cloud solutions offers BPOs new ways to enhance operational efficiency and service delivery, making data-driven decision-making more accessible and effective.

- Expansion in Emerging Markets: As businesses seek cost advantages and skilled labor, emerging markets continue to provide new opportunities for expansion, supported by the global trend of digital transformation and the adoption of advanced technologies.

- Blockchain Integration: The adoption of blockchain technology in BPO operations promises enhanced security, transparency, and efficiency, particularly in managing transactions and data across decentralized networks.

- IoT Advancements: The Internet of Things (IoT) offers potential for BPOs to access and analyze large amounts of data from diverse sources, which can be leveraged to improve service offerings and operational efficiencies.

- XCaaS Technologies: Cross-platform as a Service (XCaaS) solutions are setting new standards in communication and process management, helping BPOs deliver a seamless customer experience by integrating various communication tools and platforms.

Recent Developments

- In November 2023, TTEC Holdings, Inc., a prominent provider of customer experience business process outsourcing (BPO) services, inaugurated a new customer experience delivery center in Cape Town, South Africa. This facility is designed to cater to a variety of industries including manufacturing, automotive, healthcare, and telecommunications. The center boasts capacity for several hundred employees, indicating a significant investment in the region’s economic and employment landscape.

- Earlier in June 2023, Go4Customer, another BPO services provider, enhanced its offerings by integrating Conversational AI technology. This advanced tool uses machine learning algorithms and natural language processing to facilitate human-like conversations with consumers. This technological enhancement aims to streamline interactions and improve customer service efficiency.

Conclusion

In conclusion, the Business Process Outsourcing (BPO) market is poised for robust growth, underpinned by the continuous drive for operational efficiency and cost-effectiveness across various industries. The integration of advanced technologies such as artificial intelligence and machine learning is transforming the landscape of BPO services, enabling providers to offer more sophisticated and value-added services. This evolution is expected to open up new opportunities for growth and innovation within the sector, making it an increasingly vital component of modern business strategies.