Table of Contents

Introduction

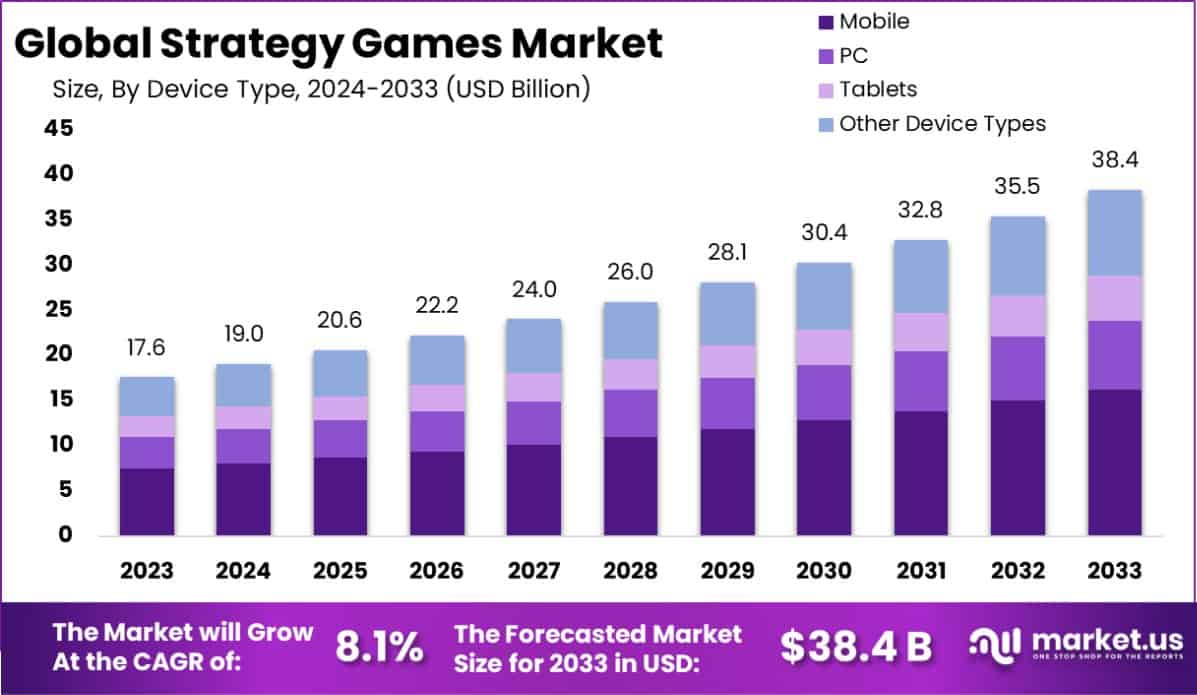

According to Market.us, The Global Strategy Games Market is projected to increase from USD 17.6 billion in 2023 to USD 38.4 billion by 2033. This growth represents an annual rate of 8.1% from 2024 to 2033. In 2023, Asia-Pacific is the largest market for strategy games, holding a 40.1% market share with revenue of USD 7.05 billion.

Strategy games are a genre of video games where the emphasis is primarily on strategic, tactical, and sometimes logistical challenges. Players are often required to engage in planning, resource management, and decision-making to achieve objectives. These games can be turn-based, where players take turns making decisions, or real-time, where decisions are made on the fly amid ongoing action. Popular sub-genres include real-time strategy (RTS), turn-based strategy (TBS), and grand strategy games, each offering unique challenges that require foresight and adaptability.

The strategy games market has seen consistent growth, driven by a strong community of players seeking intellectually challenging gameplay. This market benefits significantly from the rise of digital distribution platforms, which make it easier for developers to reach global audiences without the need for physical distribution channels. The proliferation of mobile gaming has also expanded the market, introducing casual strategy games to a broader audience. This genre’s adaptability to new technologies like AI and cloud gaming promises further growth, as these innovations can enhance game complexity and accessibility, attracting a new wave of strategy gaming enthusiasts.

The demand for strategy games is fueled by their ability to engage players in complex decision-making and strategic planning, appealing to both casual gamers and hardcore enthusiasts. The trend towards mobile gaming has particularly expanded the reach of strategy games, making them accessible to a larger audience and contributing to the overall growth of the market. Mobile technologies, supported by the increasing penetration of smartphones and high-speed internet like 5G networks, are pivotal in driving consumer engagement in the strategy games sector.

Opportunities within the strategy games market are vast, with significant growth potential in regions like Asia-Pacific, which is expected to hold a considerable market share. This region is characterized by a strong gaming culture, substantial investments in online and mobile gaming infrastructure, and a growing community of gamers. Game developers are continuously innovating and expanding their portfolios with games that offer new challenges and complex gameplay to meet the sophisticated demands of strategy game enthusiasts.

Technological innovations such as high-definition 3D graphics, Virtual Reality (VR), and Augmented Reality (AR) are enhancing the visual appeal and immersion of strategy games, making them more engaging for players. The integration of these technologies has led to a more realistic and detailed gaming experience, which is crucial for the strategy games market as it relies heavily on depth and complexity to attract gamers.

Key Takeaways

- The Global Strategy Games Market is poised for significant growth, with projections indicating an increase from USD 17.6 Billion in 2023 to USD 38.4 Billion by 2033. This represents a Compound Annual Growth Rate (CAGR) of 8.1% over the forecast period from 2024 to 2033. This upward trend highlights a robust expansion trajectory fueled by evolving gaming preferences and technological advancements in gaming platforms.

- In the device type segmentation, Mobile platforms have emerged as the market leaders within the Strategy Games sector. In 2023, Mobile devices accounted for a substantial 42.3% market share, underscoring their pivotal role in the accessibility and popularity of strategy games. This dominance is driven by the widespread adoption of smartphones and the increasing preference for gaming on-the-go among users worldwide.

- Regarding the business model, the Freemium model has captured a significant portion of the market. In 2023, it held a dominant 54.0% market share, illustrating its effectiveness in engaging users and generating revenue through in-app purchases and ad-based monetization strategies. This model has proven particularly successful in attracting a broad user base and fostering high engagement rates by offering core game features for free while monetizing additional content and functionalities.

- Geographically, the Asia-Pacific region stands as a dominant force in the Strategy Games Market. In 2023, it held a 40.1% market share with revenues reaching USD 7.05 Billion. This dominance is attributed to the high penetration of mobile devices, coupled with a strong gaming culture in countries such as China, Japan, and South Korea, making Asia-Pacific a crucial market for strategy games developers and marketers aiming to capitalize on this growing sector.

Strategy Games Statistics

- The global shooting games market is forecasted to demonstrate significant growth over the next decade. From a valuation of USD 102.5 million in 2023, it is expected to reach approximately USD 201.6 million by 2033, representing a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2024 to 2033.

- In comparison, the strategy games segment exhibited robust performance in 2022, generating an impressive revenue of $16.3 billion, positioning it as the second most lucrative gaming genre, trailing only behind role-playing games. This segment experienced around 1.5 billion downloads in the same year, underscoring its widespread popularity.

- Prominent among the top earners in the strategy games category were Romance of Three Kingdoms and Clash of Clans, which garnered revenues of $504 million and $472 million, respectively, in 2022. The sustained interest in these games is reflected in their substantial revenue figures.

- Looking ahead, the strategy games market is poised for continued expansion with projected revenues reaching approximately $30.62 billion by 2029. This growth trajectory is supported by player engagement trends where 58% of strategy gamers prefer games that offer smooth gameplay. Additionally, 48% of strategy gamers and 63% of casual gamers engage in gaming primarily to pass the time, indicating a significant overlap in gaming motivations across different genres.

- In the realm of monetization strategies, 64% of players engaged in free-to-play games expressed their willingness to view advertisements in exchange for in-game benefits such as points, new levels, extra lives, and enhanced skills. This trend highlights the potential for revenue generation through ad-based models in the gaming industry.

- Furthermore, the quick decision-making behavior of mobile gamers, with 59% downloading a game within a day of discovery, underscores the importance of effective marketing and visibility strategies for game developers aiming to capture and retain the attention of this rapidly moving audience segment.

Emerging Trends

- Increased Variety and Complexity: New strategy games are expanding the complexity and variety of gameplay mechanics, incorporating elements from other genres to enhance strategic depth and player engagement.

- Blending Genres: Many upcoming titles are merging strategy with other genres, such as role-playing and simulation, to create richer, more immersive experiences. This includes games that mix tactical decision-making with narrative-driven elements.

- Cross-Platform Play: The trend of supporting cross-platform gameplay continues to grow, allowing players on different gaming systems to compete or cooperate, broadening the community and accessibility of strategy games.

- Advancements in AI: Artificial intelligence is playing a larger role in strategy games, both in terms of enemy AI and gameplay automation, making games more challenging and dynamic.

- Environmental Storytelling: More games are incorporating storytelling elements directly into the gameplay environment, using settings and scenarios to deepen the strategic gameplay without separate narrative sections.

Top Use Cases

- Training and Education: Strategy games are increasingly used in educational and training settings to teach problem-solving and strategic thinking skills in a complex, interactive environment.

- Competitive Gaming and eSports: With the rise of eSports, strategy games are becoming a popular choice for competitive play, featuring in tournaments that test players’ strategic thinking and quick decision-making.

- Social Interaction and Community Building: Multiplayer strategy games are facilitating social interaction and community building, offering players ways to connect, strategize, and compete with others globally.

- Cognitive Development: Playing strategy games can aid in cognitive development, improving skills such as critical thinking, planning, and spatial awareness.

- Simulation and Scenario Planning: Strategy games are utilized for simulation and scenario planning in various fields, including business and military applications, allowing users to simulate different outcomes based on strategic choices.

Major Challenges

- Complex Game Design: Strategy games often feature intricate design and mechanics which can be daunting for new or casual players. The need for long-term planning and tactical thinking may not appeal to those seeking quick entertainment, making these games less accessible to a broader audience.

- High Development Costs: Creating detailed and immersive strategy games requires significant investment, not just in terms of initial development but also for ongoing updates and maintenance. This can deter new developers from entering the market and limit the diversity of new games.

- Intense Competition: The strategy games sector faces fierce competition from numerous other gaming genres, necessitating continuous innovation and substantial marketing efforts to capture and retain player interest.

- Technological Constraints: Particularly in mobile strategy gaming, balancing sophisticated gameplay with the technical limitations of devices is challenging. This can impact the performance and reach of the games on various platforms.

- Market Saturation: With many established titles dominating the market, new entries must offer unique features or exceptional quality to stand out. This saturation can stifle innovation and deter players from trying new games, potentially leading to a stagnant market.

Top Opportunities

- Emerging Technologies: The integration of AI and VR into strategy games can create more interactive and complex gameplay, providing a deeply immersive experience that could attract tech-savvy players and renew interest in the genre.

- Mobile Gaming Expansion: There is significant growth potential in the mobile gaming sector due to the increasing performance capabilities of smartphones and tablets. Mobile platforms can help reach a broader, more diverse audience, including those who prefer gaming on the go.

- Social Gaming Platforms: Leveraging social gaming platforms can enhance player engagement and retention. These platforms allow for innovative monetization strategies through in-game purchases and advertisements, tapping into a larger pool of casual gamers.

- Global Expansion: Expanding into new geographic markets can offer fresh audiences and untapped potential. Tailoring games to meet regional preferences and playing styles can open up new revenue streams and diversify player bases.

- Indie and Niche Markets: There is growing interest in indie and niche strategy games, which can offer unique experiences outside the mainstream. This sector allows for creative freedom and innovation, catering to specific segments of the gaming community looking for something different.

Recent Developments

- Blizzard Entertainment: Blizzard’s parent company, Activision Blizzard, was officially acquired by Microsoft in October 2023. This acquisition, valued at $69 billion, places Microsoft as one of the largest gaming companies in the world. This deal is expected to strengthen Blizzard’s position in strategy game development, particularly with its popular StarCraft and Warcraft franchises.

- Electronic Arts (EA): In March 2023, EA laid off around 800 employees as part of a restructuring plan, impacting several divisions. The restructuring is aimed at optimizing EA’s development processes, including its focus on real-time strategy games like Command & Conquer.

- Paradox Interactive: Known for titles like Crusader Kings and Europa Universalis, Paradox Interactive has continued expanding its portfolio. In 2023, they launched new updates for Cities: Skylines and Surviving Mars, enhancing their strong presence in the strategy game genre. Paradox remains a leader in both grand and real-time strategy games.

- Creative Assembly: This SEGA subsidiary continues to innovate with its flagship Total War series. The latest release, Total War: Pharaoh, launched in July 2024, showcases Creative Assembly’s commitment to creating deep, historically rich strategy games.

- Epic Games: In April 2023, Epic Games acquired Brazil-based game developer Aquiris, expanding its reach into new markets. While primarily known for Fortnite, this acquisition signals Epic’s growing interest in other gaming genres, including strategy.

Conclusion

In conclusion, The strategy games market is positioned for sustained growth due to increasing demand from a diverse and expanding player base. The integration of emerging technologies such as AI and cloud gaming is enhancing game complexity and broadening accessibility, which in turn attracts a wider audience. Opportunities for market expansion are particularly pronounced in mobile gaming, where the ease of access can introduce strategy games to casual gamers around the world. As developers continue to innovate and adapt to new platforms and technologies, the strategy games market is likely to see significant growth and increased engagement across various demographics.