Table of Contents

The global fashion e-commerce market is expected to experience significant growth, projected to reach USD 2,328.6 billion by 2034, up from USD 897.8 billion in 2024, growing at a compound annual growth rate (CAGR) of 10%.

Asia Pacific holds the dominant market share, accounting for over 38% in 2024 with revenues of USD 341.1 billion. The apparel/clothing segment leads the market, capturing 52% of the share, followed by the mid-range segment at 46%. The business-to-consumer (B2C) segment is the dominant model, holding an 80% share, with women’s fashion leading the overall market with 52%.

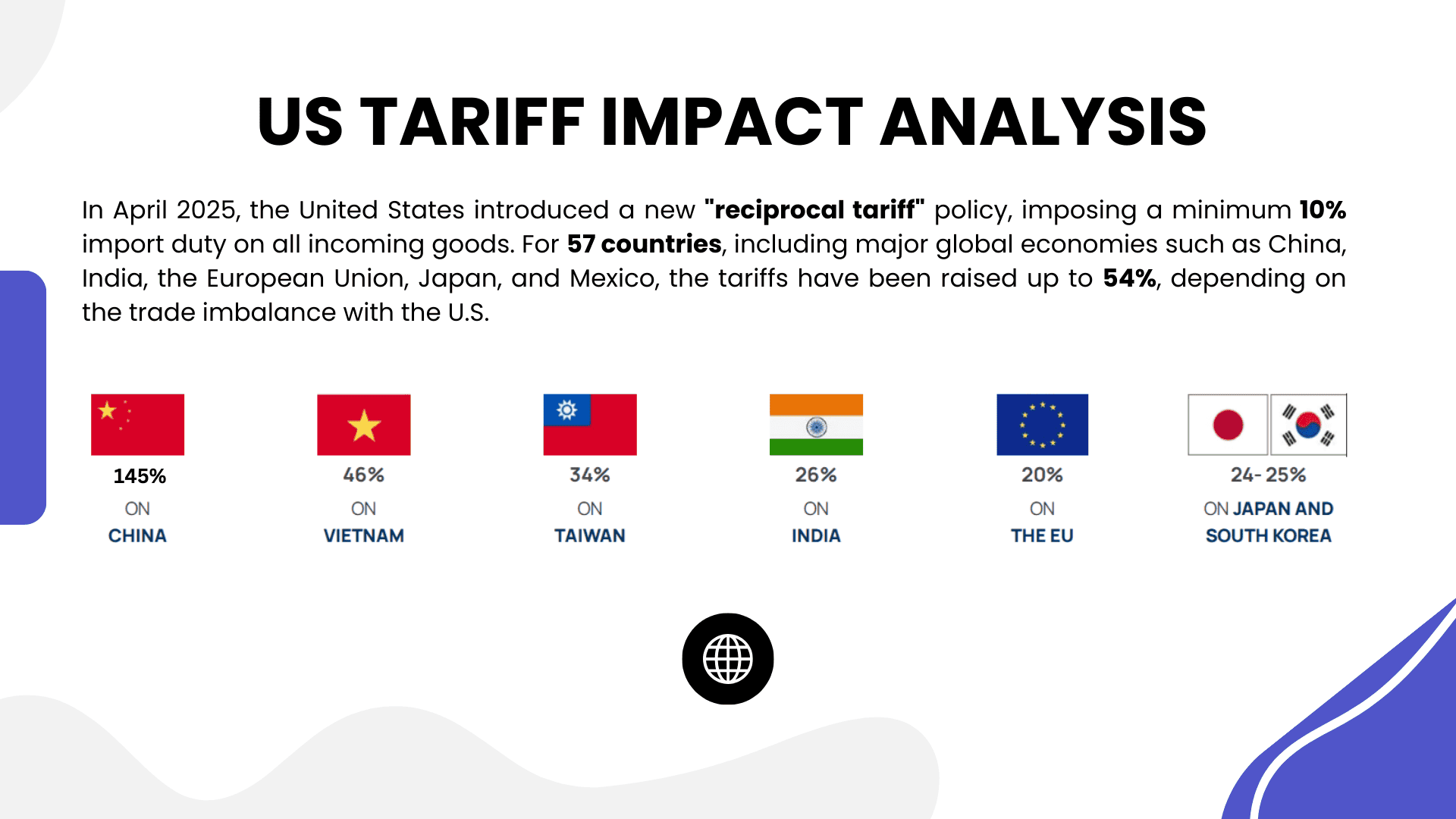

US Tariff Impact on Market

U.S. tariffs on imports, especially in the fashion sector, have had a notable impact on the fashion e-commerce market. Tariffs on apparel and accessories, particularly those from China, have increased production costs for many U.S.-based e-commerce retailers.

As a result, the prices of fashion items sold online have risen, which may slow down consumer spending in the short term. U.S. companies relying on international suppliers for manufacturing are feeling the strain, pushing some to seek alternative, tariff-free regions for sourcing.

However, the impact may drive some companies to increase domestic manufacturing, creating local production opportunities. Over the long term, despite tariff-induced cost increases, the demand for fashion e-commerce is expected to remain robust due to the convenience and broad appeal of online shopping.

➤➤➤ Get More Insights about US Tariff Impact Analysis @ https://market.us/report/fashion-e-commerce-market/free-sample/

- Economic Impact: Increased tariffs raise costs for U.S. fashion e-commerce companies, potentially leading to higher prices for consumers and affecting sales.

- Geographical Impact: U.S. fashion retailers are facing higher prices for imported apparel and accessories from China, pushing them to explore other sourcing options.

- Business Impact: Tariffs increase operational costs for fashion e-commerce businesses, leading to potential price hikes and margin pressures, slowing growth in price-sensitive segments.

Impact Percentage on Sectors

- Apparel and Clothing: +7-9%

- Accessories: +5-7%

Key Takeaways

- The global fashion e-commerce market is projected to reach USD 2,328.6 billion by 2034, growing at a CAGR of 10%.

- Asia Pacific dominates the market with a 38% share in 2024, with China’s fashion e-commerce market valued at USD 110.8 billion.

- Apparel/clothing leads the market, while B2C e-commerce and women’s fashion are the dominant segments.

- U.S. tariffs on imports from China have raised costs, impacting profit margins for U.S. retailers.

- Increased demand for mid-range fashion and a shift to online shopping drive long-term growth prospects.

Analyst Viewpoint

Currently, the fashion e-commerce market is expanding rapidly, driven by the convenience of online shopping and the growing demand for diverse fashion products. The U.S. tariff policies have introduced short-term challenges, particularly for apparel and accessories sourced from China, leading to higher prices and margin compression for U.S. businesses.

However, the long-term outlook remains strong as online shopping continues to grow and consumers seek convenience, variety, and competitive pricing. The trend toward mid-range fashion and the ongoing dominance of the B2C model will further drive market expansion. Retailers will need to innovate and adapt to new sourcing strategies to remain competitive.

Regional Analysis

Asia Pacific holds a dominant position in the global fashion e-commerce market, capturing more than 38% of the market share in 2024. China is a key player within the region, valued at USD 110.8 billion in 2024, and is projected to maintain a strong CAGR of 8%. The region benefits from a growing consumer base, increasing disposable income, and the widespread adoption of e-commerce platforms.

Additionally, advancements in logistics and payment systems have facilitated seamless cross-border transactions, boosting the demand for fashion e-commerce. North America follows closely, driven by strong demand for online shopping, but faces challenges due to U.S. tariffs on imports.

➤ Tariff effects on listed markets?

- Federated AI Learning Market

- Semiconductor Track System Market

- Agentic Retrieval-Augmented Generation Market

- Digital Billboards Market

Business Opportunities

The fashion e-commerce market presents significant business opportunities, particularly in the mid-range segment, which captures a large share of the market. Retailers can capitalize on the growing preference for online shopping by enhancing their digital platforms, improving the user experience, and expanding product offerings.

Companies in the U.S. may find opportunities in increasing domestic manufacturing or sourcing from countries not affected by tariffs. Additionally, the shift toward mobile commerce and the demand for personalized shopping experiences present opportunities for technological innovations, such as AI-powered recommendation engines and augmented reality for virtual try-ons. Fashion brands that focus on sustainability and eco-friendly products may also attract new consumer segments.

Key Segmentation

The global fashion e-commerce market is segmented as follows:

- Product Type: Apparel/Clothing, Footwear, Accessories, Jewelry

- Price Segment: Budget, Mid-Range, Premium

- Business Model: B2C, B2B

- Gender: Women, Men, Unisex

- Region: North America, Asia-Pacific, Europe, Rest of the World

Apparel/clothing leads the market with a 52% share, and mid-range fashion holds a dominant position with 46%. The B2C segment continues to lead with an 80% share. The online segment dominates the market, capturing 75% of the share, driven by growing consumer demand for e-commerce convenience.

Key Player Analysis

Key players in the fashion e-commerce market are focused on expanding their product offerings and improving customer engagement through enhanced online platforms. These companies are investing in user-friendly interfaces, personalized shopping experiences, and diverse product catalogs to attract a wider consumer base.

Additionally, players are focusing on logistics, ensuring fast delivery times, and exploring new markets globally. As U.S. tariffs on Chinese imports increase operational costs, companies are seeking alternative sourcing solutions and increasing their focus on domestic production to mitigate the tariff impact. E-commerce platforms are also leveraging AI and machine learning for customer insights and better targeting of promotions.

Top Key Players in the Market

- Amazon

- Alibaba

- Shein

- Zalando

- ASOS

- Boohoo

- Flipkart

- H&M

- eBay

- Ajio

- Farfetch

- Global Fashion Group

- Myntra

- Shopclues

- Other Key Players

Recent Developments

Recent developments in the fashion e-commerce market include the adoption of AI and machine learning technologies for better customer personalization. Companies are focusing on improving the online shopping experience with innovations such as virtual try-ons, augmented reality, and enhanced product visualization tools. Retailers are also strengthening their logistics networks to ensure faster delivery times.

Conclusion

In conclusion, the fashion e-commerce market is poised for steady growth, driven by increasing consumer demand for convenience and a diverse range of fashion products. While U.S. tariffs on imported apparel may impact short-term growth, the long-term outlook remains positive as e-commerce continues to grow globally. Retailers must adapt to shifting sourcing strategies and technological advancements to maintain a competitive edge in this expanding market.