Table of Contents

Introduction

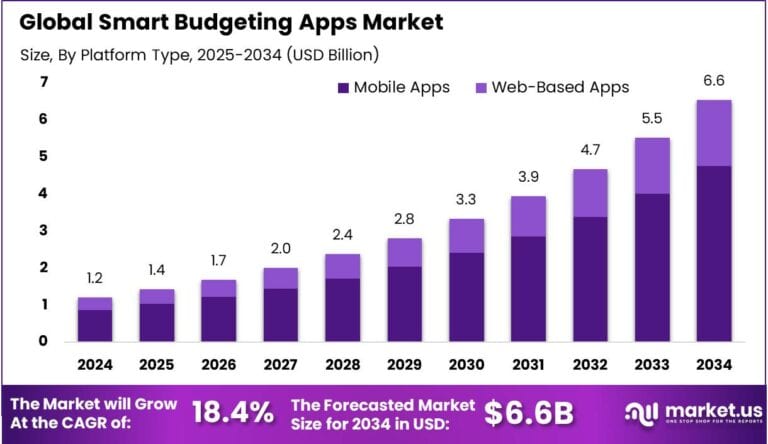

The Global Smart Budgeting Apps Market is projected to grow from USD 1.21 billion in 2024 to USD 6.6 billion by 2034, exhibiting a strong CAGR of 18.4%. In 2024, North America dominated the market with a 36.4% share, generating USD 0.4 billion in revenue.

The U.S. market, valued at USD 0.39 billion, is expected to grow at a 16.8% CAGR, fueled by increasing demand for digital financial management tools. Consumers and businesses alike are adopting smart budgeting apps to enhance financial planning, optimize expenses, and improve savings.

How Growth is Impacting the Economy

The rapid expansion of the smart budgeting apps market is positively influencing the global economy by promoting financial literacy and responsible money management. These apps empower users to track income, expenses, and investments efficiently, reducing financial stress and encouraging savings.

As adoption rises, the fintech sector experiences job growth in software development, analytics, and customer support, contributing to economic diversification. Increased personal financial management leads to more informed consumer spending, stimulating economic activity. Moreover, governments promoting digital financial inclusion benefit from reduced debt defaults and improved economic stability, fostering a healthier financial ecosystem worldwide.

➤ Get valuable market insights here @ https://market.us/report/smart-budgeting-apps-market/free-sample/

Impact on Global Businesses

Smart budgeting apps are transforming financial management across businesses by enabling better cash flow monitoring, cost control, and strategic planning. However, rising software development costs and data privacy compliance pose challenges. Supply chains for cloud services and cybersecurity solutions are evolving to support app scalability and security. Sector-specific impacts include increased adoption in SMEs for financial discipline, while large enterprises integrate budgeting apps with ERP systems. Businesses leveraging these tools improve operational efficiency and financial transparency but must navigate regulatory landscapes and technological complexities.

Strategies for Businesses

Businesses should invest in developing user-friendly, secure smart budgeting apps with advanced analytics and AI-driven insights. Prioritizing data privacy and compliance builds consumer trust. Offering customizable features for varied user segments enhances engagement. Strategic partnerships with financial institutions and fintech platforms can broaden market reach. Regular updates incorporating user feedback improve app relevance. Additionally, leveraging mobile compatibility and offline access increases usability. Integrating budgeting apps with other financial tools creates seamless user experiences, supporting long-term customer retention.

Key Takeaways

- Market projected to grow at 18.4% CAGR, reaching USD 6.6 billion by 2034

- North America leads with 36.4% market share in 2024

- Rising demand for digital financial management drives growth

- Development costs and data privacy are key challenges

- AI integration and user-centric design critical for success

➤ Buy Full PDF report here @ https://market.us/purchase-report/?report_id=149517

Analyst Viewpoint

The smart budgeting apps market is rapidly expanding as digital financial management gains popularity. AI and machine learning enhance personalized budgeting, improving user satisfaction. Future growth will be fueled by integration with broader fintech ecosystems and increasing digital financial literacy. The outlook is optimistic, with continuous innovation expected to drive adoption and empower users globally to make informed financial decisions.

Regional Analysis

North America holds a dominant 36.4% share in 2024, driven by advanced fintech adoption and consumer awareness. Europe follows with steady growth supported by regulatory frameworks promoting digital finance. Asia-Pacific is emerging rapidly, propelled by smartphone penetration and expanding middle-class populations. Latin America and the Middle East & Africa show gradual adoption, encouraged by financial inclusion initiatives. Regional variations in infrastructure and regulations influence market growth and app usage patterns.

➤ Discover More Trending Research

Business Opportunities

Key opportunities include developing AI-powered predictive budgeting features and personalized financial advice. Providers can target emerging markets with localized, language-specific apps. Collaboration with banks and fintech firms to integrate services expands the user base. Offering tiered subscription models caters to different customer segments. Additionally, partnerships with educational institutions to promote financial literacy through budgeting apps can drive adoption and social impact.

Key Segmentation

The smart budgeting apps market is segmented by deployment, user type, and platform:

- Deployment: Cloud-based, On-premises

- User Type: Individual Consumers, SMEs, Large Enterprises

- Platform: iOS, Android, Web-based

These segments reflect diverse deployment preferences and user demographics driving market demand.

Key Player Analysis

Market leaders focus on AI-driven personalization, robust security, and seamless multi-platform integration. Strategic alliances with financial institutions and fintech ecosystems enhance offerings and user reach. Continuous innovation in UX/UI and data analytics improves engagement and retention. Emphasis on compliance with data privacy regulations strengthens consumer trust. Scalable architectures and customizable features enable catering to varied market segments, reinforcing leadership in the competitive smart budgeting app landscape.

Top Key Players in the Market

- Mint (Intuit Inc.)

- YNAB (You Need A Budget LLC)

- PocketGuard Inc.

- Goodbudget (Dayspring Technologies)

- EveryDollar (Ramsey Solutions)

- Zeta Money Inc.

- Mobills Inc.

- Honeydue Inc.

- Wally Global Inc.

- Spendee a.s.

- Frollo (Frollo Pty Ltd)

- Pluto Money Inc.

- Others

Recent Developments

- Launch of AI-based personalized budgeting and expense forecasting tools

- Expansion of multilingual and localized app versions

- Partnerships with banks for integrated financial services

- Introduction of subscription-based premium features

- Enhancements in app security and data privacy protocols

Conclusion

The smart budgeting apps market is set for robust growth driven by rising financial awareness and technological advancements. Businesses investing in innovative, secure, and user-centric solutions will capture expanding opportunities in the evolving digital finance ecosystem.