Table of Contents

Introduction

Earned Wage Access (EWA) is a financial service that lets employees get part of their earned wages before their official payday. This is crucial because nearly 80% of workers live paycheck to paycheck, facing financial stress that impacts their work focus and wellbeing. By offering EWA, companies help reduce this stress: about 77% of users report feeling less anxious, while 72% gain more control over their money. This service helps workers avoid costly loans and late fees, improving their financial health and job satisfaction.

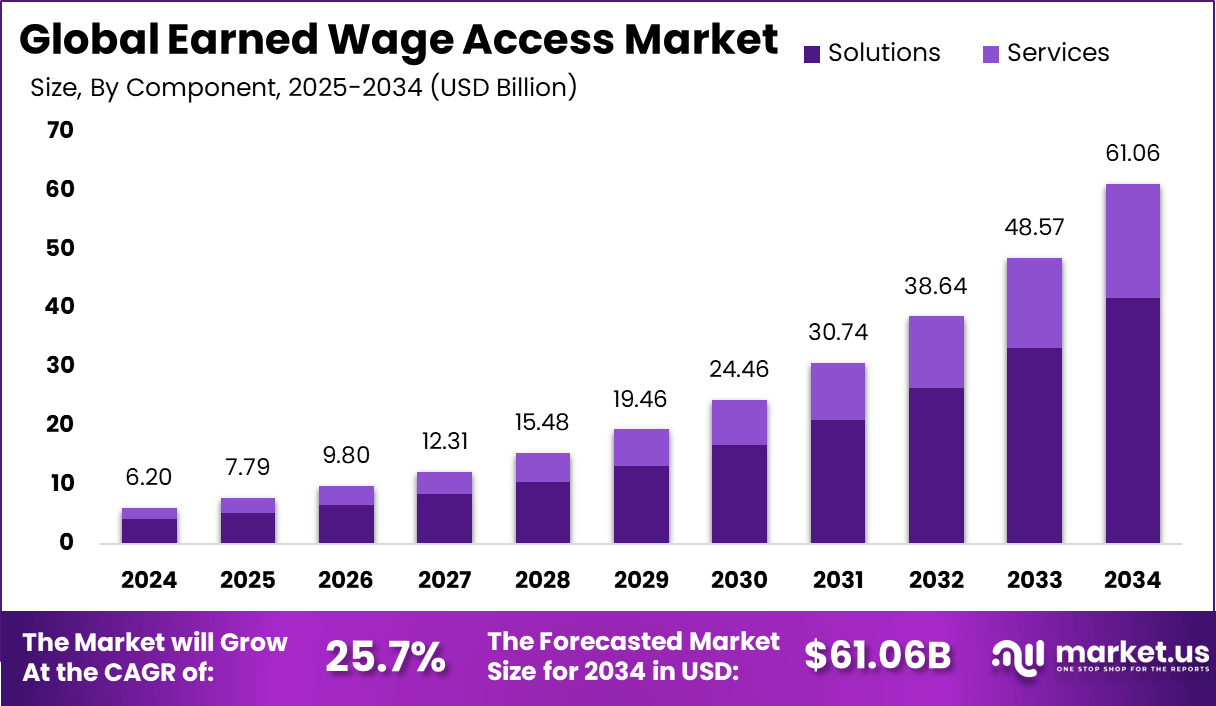

According to Market.us, The Global Earned Wage Access (EWA) Market is projected to grow from USD 6.2 billion in 2024 to approximately USD 61.06 billion by 2034, expanding at a CAGR of 25.7% from 2025 to 2034. The market growth is driven by rising demand for financial flexibility among employees, growing employer adoption of on-demand pay solutions, and increasing awareness of financial wellness programs.

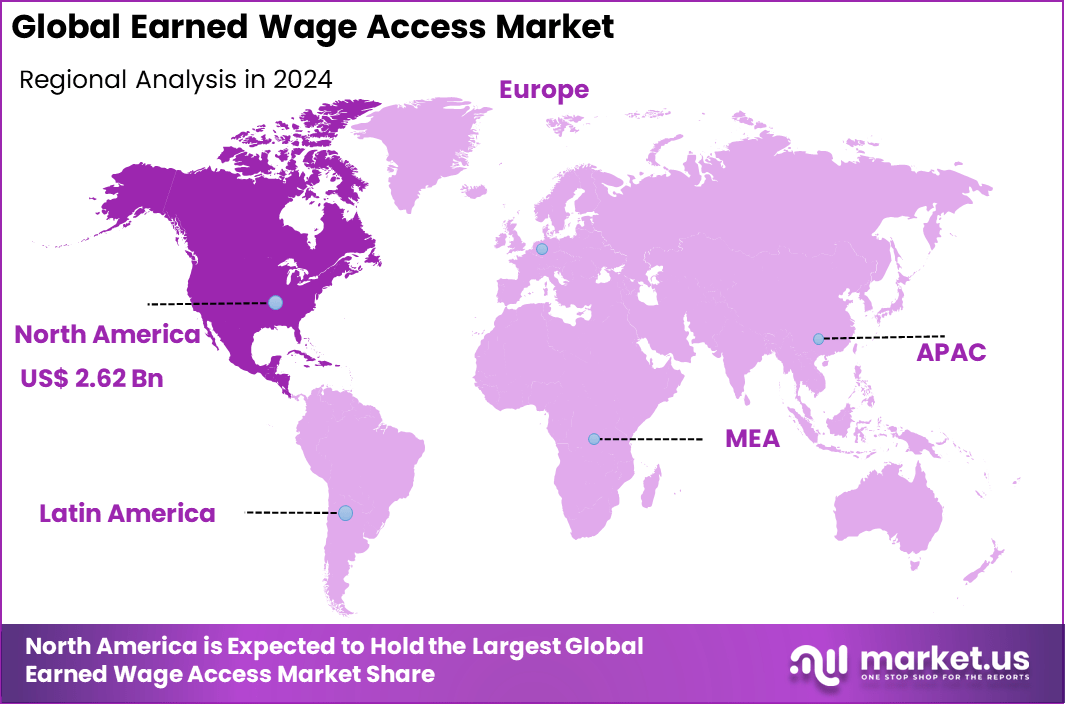

In 2024, North America dominated the global market, accounting for more than 42.4% of total revenue and generating around USD 2.62 billion. This dominance is supported by a mature fintech ecosystem, strong presence of EWA service providers, and favorable regulatory developments promoting financial inclusion and employee-centric compensation models.

Quick Market Facts

| Key Segment | Lead Segment | Market Share / Value |

|---|---|---|

| By Component | Solutions | 68% |

| By Deployment | Cloud-based | 81% |

| By Organization Size | Large Enterprises | 59.7% |

| By Industry | Retail & E-commerce | 21% |

| By Region | North America | 42.4% |

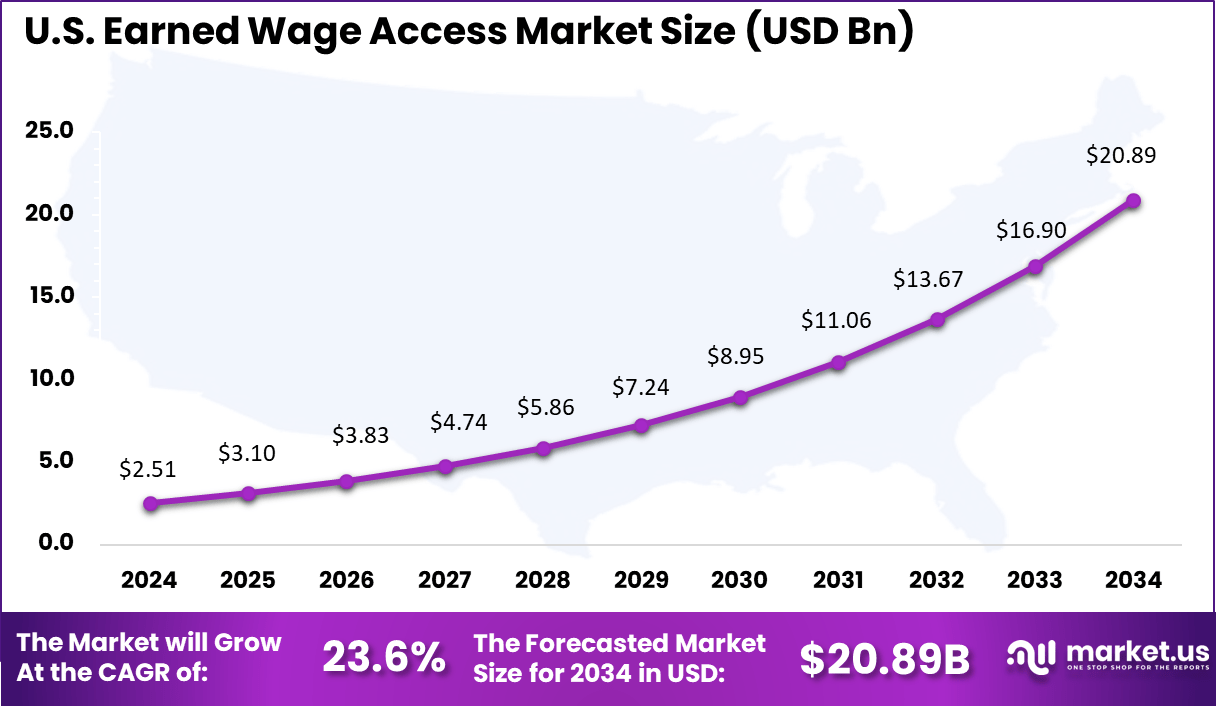

| By Country | United States | USD 2.51 Billion |

| Global Market | 2024 Value | USD 6.2 Billion (CAGR 25.7%) |

Earned Wage Access Statistics

- Based on data from llcbuddy, Around 28% of employees earning USD 50,000 – 99,999 annually live paycheck-to-paycheck, and 70% of them are in debt, showing widespread financial vulnerability even among mid-income earners.

- Nearly 48% of U.S. workers report that financial stress distracts them at work, emphasizing that EWA programs can enhance workforce focus and productivity.

- Approximately 80% of American workers live paycheck-to-paycheck, highlighting the urgent need for flexible pay solutions.

- 74% of job seekers prefer employers offering financial planning, budgeting, and savings tools, showing that EWA and wellness benefits improve recruitment appeal.

- Only 10% of employers currently offer early wage access as part of employee benefits, indicating a large untapped opportunity for adoption.

- Among EWA users, 77% reported reduced stress, while 72% felt greater control and confidence over their finances.

- A strong 91% of users understand how EWA services work, and 89% are aware of any associated fees, reflecting high user transparency.

- 82% of users felt less stressed about money, 81% experienced higher self-esteem, and 77% saw improvements in mental health outcomes.

- About 60% of employees said their employer does not provide financial management tools, suggesting significant room for employer-driven initiatives.

- 88% of respondents agreed that timely pay access during the pandemic was essential for their financial stability.

- Over 60% of U.S. workers believe all employers should provide instant or same-day pay options.

- Nearly 70% said they would recommend employers offering EWA programs to friends and job seekers.

- Interest is particularly strong among younger generations – 84% of Millennials and 87% of Gen Z would apply for jobs offering same-day pay.

- Overall, 60% of U.S. workers desire direct daily access to their earned wages, underlining EWA’s growing importance as a standard workplace benefit.

Analysts’ Viewpoint

Demand for EWA is strong among hourly, gig, and part-time employees who need quick access to wages for unexpected expenses or emergencies. The market is driven by a shift in employee expectations for on-demand pay, reflecting a broader trend towards financial flexibility and wellbeing. Workers use EWA to avoid costly payday loans, reduce overdraft fees, and manage cash flow more effectively. Employers also benefit from reduced absenteeism and turnover, as financially secure employees tend to be more engaged and reliable.

Technologies driving adoption include cloud-based payroll integration, mobile app interfaces, AI for secure transactions, and blockchain for transparency. These innovations ensure ease of use, rapid access, and enhanced security. Adoption of EWA is motivated by the need to empower employees with control over their finances and helps employers demonstrate care for workforce wellbeing, which is a strong competitive advantage for attracting and retaining talent.

Investment opportunities in the Earned Wage Access market are robust due to growing demand from employers and workers alike. Strategic partnerships between fintech firms and payroll providers improve service offerings and market penetration. Emerging markets are beginning to adopt EWA solutions, presenting significant potential for expansion driven by rising financial inclusion and mobile technology penetration. Continuous innovation in security and user experience will further attract investors.

Role of Generative AI

Generative AI is playing an increasingly important role in the earned wage access (EWA) landscape by enhancing the efficiency of financial services and workforce management. Studies show that generative AI supports between 0.5% and 3.5% of total U.S. work hours, improving productivity by automating routine tasks and generating efficient communication, which can streamline wage access processes.

Additionally, 89% of enterprises are advancing their generative AI projects, indicating strong industry confidence in AI’s role to optimize payroll systems and wage distribution. This AI-driven automation helps reduce administrative burdens and accelerates real-time wage access for employees, improving user experience and operational effectiveness.

Further, generative AI boosts workforce productivity by up to 15% on average, helping companies implement EWA solutions more effectively. Its ability to handle complex language tasks enables better communication and customer support in the EWA ecosystem, benefiting both employees and employers alike. As AI adoption grows, the integration of generative AI within EWA platforms is expected to deepen, fostering smarter, faster, and more personalized wage accessibility options for workers.

Earned Wage Access: Emerging Trends

An emerging trend in the earned wage access market is the wider adoption of mobile and cloud-based platforms, which are making on-demand pay more accessible and scalable across industries. The shift towards integration with digital wallets and prepaid cards is growing rapidly, aligning with the preferences of gig workers and hourly employees who seek fast and flexible access to their earnings. This has contributed to North America holding a dominant position with over 42% market share, showcasing strong regional adoption fueled by technological improvements and worker demand for financial flexibility.

Another notable trend is the increasing regulatory attention on EWA programs, with more than 20 U.S. states enacting laws to govern earned wage access offerings. This regulatory momentum aims to protect workers while encouraging responsible fintech innovation. Employers are now incorporating EWA not just as a payroll feature but as a critical benefit to attract and retain talent in competitive labor markets. These trends together imply that EWA is evolving from a niche fintech service into a mainstream financial wellness tool embraced by both employees and regulators.

Earned Wage Access: Growth Factors

Financial stress remains a primary growth driver for earned wage access solutions. Data from recent studies indicate that 97% of full-time U.S. employees experience financial stress, and 87% admit it affects their daily lives. As inflation and cost of living rise, workers increasingly seek ways to ease immediate financial burdens, making on-demand pay a practical solution. This growing focus on employee financial wellbeing encourages more companies to adopt EWA programs to support workforce satisfaction and reduce turnover.

The rise of gig and hourly workforces also fuels EWA growth. Approximately 28% of employees earning between $50,000 and $99,999 live paycheck to paycheck, demonstrating the need for wage flexibility. Coupled with advances in payroll software and increased mobile accessibility, these factors help push EWA into a critical role for many employers and workers. The evolving labor market, characterized by dynamic work arrangements and financial unpredictability, continues to set the stage for the expanded use of earned wage access solutions.

Driver

Growing Focus on Employee Financial Wellness

The demand for Earned Wage Access is largely driven by the increasing need among employees to manage their financial health better. Many workers, particularly hourly wage earners, live paycheck to paycheck, often facing unexpected expenses before payday. EWA gives employees the ability to access earned wages early, helping reduce reliance on costly payday loans and improving overall financial stability. Companies offering EWA solutions report improved employee satisfaction, reduced turnover, and enhanced productivity due to lower financial stress. This focus on boosting employee well-being is a key market growth factor.

Restraint

Regulatory Uncertainty Limits Adoption

Despite its benefits, the EWA market faces significant hurdles from unclear and evolving regulations. Since EWA sits in a grey area between wage payments and credit, many jurisdictions lack specific rules governing these services. Regulatory bodies like the Consumer Financial Protection Bureau continue to scrutinize EWA programs, causing hesitation among providers and employers concerned about compliance risks. This uncertainty delays broader adoption and investment since companies navigate the risk of future regulatory changes or restrictions that could alter operational models or financial viability.

Opportunity

Strategic Partnerships with Fintech and Neobanks

A major growth opportunity lies in forming alliances between EWA providers and fintech companies or neobanks. These collaborations help embed EWA services directly into mobile-centric financial platforms popular among younger, tech-savvy workers. Fintech partners provide advanced infrastructure and user-friendly interfaces, which enhance scalability and increase adoption rates. Moreover, such partnerships can introduce additional financial tools like budgeting and planning services, contributing to longer-term financial wellness for users, thus expanding market reach and value.

Challenge

Risk of Employee Overdependence

One significant challenge for the EWA market is the potential for users to become overly reliant on early wage access. While EWA addresses immediate liquidity needs, frequent use may trap employees in a cycle of dependency that prevents developing healthy financial habits or savings. Critics warn that constant access to early wages could mask underlying financial instability without solving root issues, leading to repeated short-term borrowing that can worsen financial stress. Providers and employers need to balance accessibility with financial education to mitigate this risk.

Regional Insight

U.S. Market Size

The United States leads within the region with a market value of approximately USD 2.51 billion in 2024. This market is buoyed by strong interest from both commercial and individual gamers, with a compound annual growth rate (CAGR) of 25.7%. The US remains a critical hub for AI gaming monitor development, combining cutting-edge hardware with rapidly evolving AI features to enhance gaming experiences globally.

North America commands a 42.4% share of the AI gaming monitor market, reflecting its leadership in gaming culture and technology adoption. The region benefits from a large base of gamers, developers, and esports organizations, supporting robust demand and innovation. Advanced infrastructure and high disposable incomes also encourage premium product penetration.

Key Market Segments

Component

- Solutions

- Employer-Integrated EWA

- Direct-to-Consumer (D2C) EWA

- Services

Deployment Mode

- Cloud-Based

- On-Premise

End-User

- Large Enterprises

- SMEs

Industry Vertical

- Retail & E-commerce

- Hospitality

- Healthcare

- Transportation & Logistics

- Manufacturing

- BFSI

- Others

Top Key Players in the Earned Wage Access Market

- DailyPay

- Earnin

- PayActiv

- Even (U.S., acquired by Walmart)

- Rain

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- Other Key Players