Table of Contents

Introduction

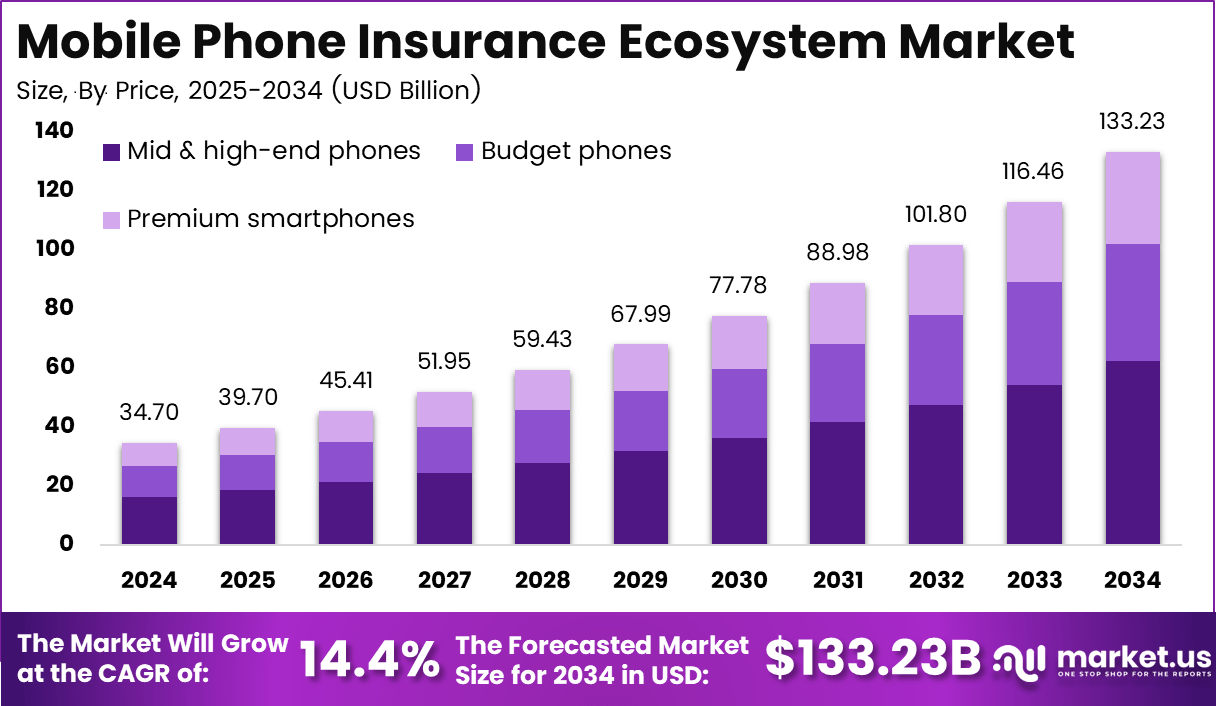

The Global Mobile Phone Insurance Ecosystem Market is anticipated to grow significantly, reaching a valuation of USD 133.23 billion by 2034, up from USD 34.7 billion in 2024, representing a robust CAGR of 14.4% during the forecast period from 2025 to 2034. In 2024, North America dominated the market, accounting for over 34.6% of the total revenue, with a value of USD 12.0 billion.

As mobile phones become essential in daily life, the demand for insurance coverage is expected to rise, particularly with the increasing cost of smartphones and rising awareness of protection plans. The expanding role of mobile phones in various sectors, such as finance, entertainment, and work, further drives the need for mobile phone insurance solutions.

How Growth is Impacting the Economy

The rapid growth of the mobile phone insurance ecosystem is positively impacting global economies by increasing the revenue streams of service providers, insurers, and mobile phone manufacturers. As consumers become more reliant on their mobile devices, the demand for insurance coverage continues to grow, particularly in developed regions like North America and Europe.

This surge in demand has led to the creation of new jobs in the insurance and technology sectors, as companies invest in mobile insurance products, customer support infrastructure, and digital platforms. Additionally, insurers are adopting advanced technologies such as AI and machine learning to streamline claims processing and improve customer experiences, further contributing to economic growth.

In emerging markets, the rising adoption of smartphones and the increasing awareness of insurance benefits are expected to fuel market growth, driving financial inclusion and broadening access to insurance products. This shift is encouraging more people to protect their assets, fostering a more resilient digital economy and enabling insurers to diversify their offerings, contributing to economic stability.

➤ Unlock growth! Get your sample now! – https://market.us/report/global-mobile-phone-insurance-ecosystem-market/free-sample/

Impact on Global Businesses

The mobile phone insurance ecosystem’s growth is reshaping global businesses by creating new opportunities and challenges. The increase in smartphone sales and the rising reliance on mobile devices have made insurance an essential component of mobile ownership. Rising insurance premiums and shifting market dynamics are causing businesses to adjust their strategies. Providers must innovate to meet evolving consumer needs, while mobile manufacturers are increasingly bundling insurance offerings with new device purchases to drive sales.

For insurers, rising claims costs and the increasing complexity of smartphone technology are leading to shifts in risk management strategies. As mobile phones become more sophisticated, with features such as foldable screens and advanced cameras, businesses in the insurance industry are adjusting their policies to accommodate these changes. The supply chain for mobile phones and accessories also experiences shifts, with manufacturers needing to collaborate more closely with insurers to offer customized insurance plans that match the evolving product landscape.

Strategies for Businesses

To capitalize on the growing mobile phone insurance market, businesses should consider the following strategies:

- Leverage partnerships with mobile manufacturers and retailers to offer bundled insurance packages.

- Invest in AI-driven platforms to streamline the claims process and improve customer satisfaction.

- Focus on educating consumers about the benefits of mobile phone insurance to increase adoption rates.

- Enhance policy offerings by incorporating coverage for emerging mobile phone features, such as foldable devices.

- Expand into emerging markets where smartphone penetration is increasing rapidly and insurance awareness is growing.

Key Takeaways

- The mobile phone insurance ecosystem market is projected to grow from USD 34.7 billion in 2024 to USD 133.23 billion by 2034, at a CAGR of 14.4%.

- North America is the leading market, holding over 34.6% of the total revenue share in 2024.

- Increased smartphone sales and consumer awareness are key growth drivers.

- Businesses should focus on bundling insurance products and leveraging AI for improved service delivery.

- The market is expected to benefit from growing smartphone adoption in emerging markets.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=157159

Analyst Viewpoint

The mobile phone insurance ecosystem market is experiencing impressive growth, driven by the increasing value of smartphones and the heightened awareness among consumers about protecting these devices. In the future, we anticipate continued growth as emerging technologies such as foldable phones and 5G networks increase the demand for specialized insurance products. Positive market developments will likely result in improved coverage options, more competitive pricing, and innovative services.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Device Protection Plans | Increasing reliance on smartphones and higher device prices drive the demand for insurance solutions that offer device protection. |

| Warranty Extensions | Rising costs of repair and replacement fuel the growth of extended warranty offerings, providing customers with peace of mind. |

| Loss or Theft Coverage | With growing theft and loss rates, consumers are opting for insurance to secure their devices and reduce financial risk. |

Regional Analysis

North America is leading the mobile phone insurance ecosystem market, with a dominant market share of 34.6% and USD 12.0 billion in revenue in 2024. This is due to high smartphone penetration, a strong presence of insurance providers, and the increasing cost of mobile devices. Europe and Asia Pacific are also witnessing growth, driven by smartphone adoption and increasing awareness of mobile insurance products. Emerging markets in Asia Pacific and Latin America are anticipated to experience rapid growth, fueled by rising disposable incomes and the growing demand for digital services.

➤ Don’t Stop Here—check Our Library

- Emotion AI Advertising Terminal Market

- AI in Precision Agriculture Market

- Content Disarm and Reconstruction Market

- Wildlife Tracking System Market

Business Opportunities

The growing mobile phone insurance ecosystem presents a variety of business opportunities. Companies can capitalize on these opportunities by offering innovative and customized insurance packages for smartphones, including options for screen protection, theft coverage, and extended warranties. Additionally, as consumers demand seamless experiences, businesses can integrate AI and machine learning technologies into claims processing to improve efficiency and reduce operational costs. The rise of smartphone insurance also opens opportunities in emerging markets where digital adoption is accelerating and consumer awareness of insurance is increasing.

Key Segmentation

The mobile phone insurance ecosystem market is segmented as follows:

- By Insurance Type: Theft & Loss Coverage, Damage Coverage, Extended Warranty, Accidental Coverage

- By Distribution Channel: Online, Retail, Carrier Partnerships

- By End User: Individual Consumers, Enterprises, Mobile Device Retailers

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading players in the mobile phone insurance ecosystem market are focusing on technological innovations and customer-centric service models to differentiate themselves in a competitive market. They are offering a variety of customized policies and leveraging partnerships with mobile manufacturers and service providers to enhance the reach of their insurance products. Additionally, market players are increasingly integrating AI-powered platforms to simplify the claims process, reduce fraud, and improve the overall customer experience.

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc.

- Asurion

- AT&T Intellectual Property.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

- Others

Recent Developments

- In January 2025, a major mobile carrier launched a bundled insurance plan, offering theft, damage, and warranty coverage for smartphones.

- In March 2025, a leading insurer introduced AI-driven claims processing technology to expedite customer service in the mobile phone insurance space.

- In June 2025, a mobile phone manufacturer partnered with an insurance provider to offer device protection plans as part of their device bundle.

- In July 2025, a key player in the market expanded its coverage options to include protection for foldable smartphones and emerging mobile technologies.

- In September 2025, a global insurer rolled out a subscription-based model for mobile insurance, enabling customers to pay monthly premiums for coverage.

Conclusion

The mobile phone insurance ecosystem market is set to grow significantly, driven by increasing smartphone adoption and higher awareness of the need for device protection. With emerging technologies and evolving consumer demands, the market will continue to present opportunities for businesses to innovate and enhance customer experiences.