Table of Contents

Introduction

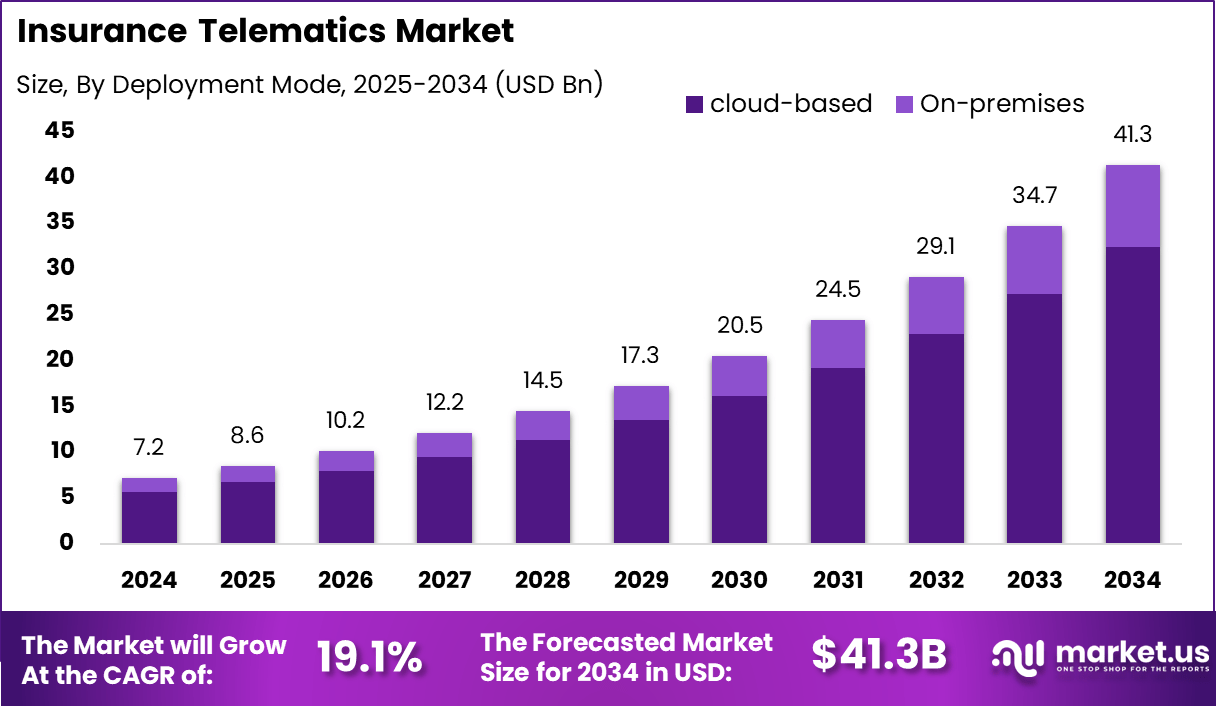

The global Insurance Telematics Market is projected to grow significantly from USD 7.2 billion in 2024 to USD 41.3 billion by 2034, reflecting a CAGR of 19.1% during the forecast period from 2025 to 2034. Insurance telematics involves the use of telematics devices to collect data on driving behavior and vehicle usage, which is then used by insurance companies to assess risk, set premiums, and offer discounts to safe drivers. The increasing adoption of connected car technologies, the rise of usage-based insurance (UBI), and growing consumer demand for personalized insurance plans are key drivers of this market. North America currently dominates the market with a 39.76% share, generating USD 2.8 billion in revenue in 2024.

How Growth is Impacting the Economy

The growth of the insurance telematics market is contributing to the global economy by improving risk assessment and pricing models for insurance companies, which can lead to more competitive and personalized offerings for consumers. By collecting real-time data on driving behavior, insurers can tailor premiums based on individual risk profiles, leading to more accurate pricing and, in many cases, lower insurance costs for safe drivers. Additionally, the adoption of telematics is promoting innovation in the automotive industry, encouraging the development of connected and autonomous vehicles, which further enhances economic activity in sectors such as automotive, technology, and insurance. The overall impact is more efficient, cost-effective solutions for businesses and consumers alike.

➤ Unlock growth! Get your sample now! – https://market.us/report/insurance-telematics-market/free-sample/

Impact on Global Businesses

The rise of telematics-based insurance is transforming the insurance sector, enabling companies to collect more granular data on customer behavior, assess risk more accurately, and offer more customized pricing. In the automotive sector, the increasing adoption of connected car technologies is enabling insurers to leverage telematics for more precise underwriting. This trend is also helping insurers reduce fraud and improve claims management by using real-time data to track vehicle usage and monitor driving behavior. As for vehicle manufacturers, the demand for telematics-enabled vehicles is growing, leading to increased collaboration between insurance companies and automotive OEMs (original equipment manufacturers) to provide integrated solutions for consumers.

Strategies for Businesses

- Leverage Data Analytics: Companies should invest in data analytics platforms that can efficiently process and analyze the large volumes of driving data generated by telematics devices.

- Expand Partnership Networks: Collaborate with automotive manufacturers and technology providers to integrate telematics solutions into vehicles and enhance product offerings.

- Enhance Consumer Engagement: Offer customers more personalized insurance plans based on telematics data, such as providing discounts for safe driving or offering incentives for eco-friendly driving behavior.

- Invest in IoT & Connected Vehicle Solutions: Invest in IoT and connected vehicle technologies to improve data collection and create more comprehensive telematics solutions.

Key Takeaways

- Strong Market Growth: The insurance telematics market is expected to grow at a CAGR of 19.1%, reaching USD 41.3 billion by 2034.

- North America Dominance: North America leads the market with 39.76% share and USD 2.8 billion in revenue in 2024.

- Personalized Insurance: Increasing demand for usage-based insurance (UBI) is driving the adoption of telematics solutions.

- Telematics Benefits: Enhanced risk assessment, pricing models, and fraud reduction are key benefits driving the market.

- Growing Automotive Collaboration: Collaboration between insurers and automotive manufacturers is expanding telematics adoption.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=157657

Analyst Viewpoint

The insurance telematics market is witnessing robust growth, driven by advancements in connected car technology, the increasing adoption of usage-based insurance (UBI), and the growing consumer preference for personalized insurance products. North America will continue to lead the market, but the demand for telematics solutions is rapidly increasing in Europe and Asia Pacific as well. Looking ahead, the future of the market looks positive, with the continued rise of connected and autonomous vehicles and greater data-driven personalization in insurance offerings. As technology continues to evolve, insurance companies will likely adopt more sophisticated telematics solutions, further accelerating market growth.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Usage-Based Insurance | Increasing demand for personalized pricing based on driving behavior. |

| Fleet Management | Telematics used to optimize fleet operations, reduce costs, and improve safety. |

| Autonomous Vehicles | Growing adoption of connected car technologies in autonomous vehicle development. |

| Driver Behavior Analysis | Insurance companies leveraging telematics data to assess driving patterns and manage risk. |

| Consumer Engagement | Offering discounts and incentives to consumers based on driving behavior data. |

Regional Analysis

North America is expected to maintain its dominant market position, capturing 39.76% of the global share in 2024, generating USD 2.8 billion in revenue. This is due to a combination of advanced telematics technology adoption, high penetration of connected vehicles, and the growing demand for personalized insurance offerings. Europe is also a strong market, with countries like Germany and the UK leading the way in the adoption of telematics-based insurance solutions. The Asia Pacific region is expected to experience the fastest growth, driven by increasing vehicle sales, the rise of connected vehicle technology, and an expanding middle class with greater purchasing power.

Business Opportunities

The insurance telematics market presents significant business opportunities for both established players and new entrants. Insurance companies can capitalize on this growing market by offering usage-based insurance products, targeting customers who prefer personalized pricing. Automotive manufacturers can explore opportunities to integrate telematics solutions into their vehicles, providing customers with more secure and data-driven insurance options. Additionally, technology providers can develop advanced telematics platforms and data analytics tools to meet the growing demand for real-time data processing and more accurate risk assessments in the insurance industry. Asia Pacific offers the highest growth potential, particularly in countries with rapidly expanding automotive markets like China and India.

Key Segmentation

- By Application: Usage-based insurance (UBI), fleet management, driver behavior analysis, and others.

- By End-User Industry: Insurance, automotive, technology, government, and others.

- By Technology: GPS, IoT, cloud computing, AI, and big data analytics.

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Key Player Analysis

Key players in the insurance telematics market are focusing on enhancing telematics solutions that provide real-time data collection, driver behavior analysis, and improved risk assessment models. Companies are increasingly collaborating with automotive manufacturers to integrate telematics systems directly into vehicles and offer comprehensive, data-driven insurance solutions. Additionally, many players are investing in artificial intelligence and machine learning to improve predictive analytics capabilities and further personalize insurance offerings. The market is highly competitive, with both large insurance companies and tech startups vying for market share in the rapidly expanding telematics sector.

Top Key Players in the Market

- Agero, Inc.

- Aplicom

- Trak Global Solutions Holdings (Canada) Inc.

- Masternaut Limited

- META SYSTEM S.P.A.

- MiX by Powerfleet

- Octo Group S.p.A

- Bridgestone Mobility Solutions B.V.

- Trimble

- Sierra Wireless S.A.

Recent Developments

- 2024: Introduction of advanced telematics solutions for electric vehicles to support insurance offerings based on driving patterns.

- 2024: Strategic partnership between an insurance provider and an automotive manufacturer to integrate telematics for usage-based insurance products.

- 2025: Launch of AI-powered telematics platforms that enable insurers to offer more personalized and dynamic pricing models.

- 2025: Expansion of telematics-based insurance offerings in Asia Pacific, particularly in China and India.

- 2025: Growth in the use of telematics for fleet management, with businesses leveraging real-time data to optimize operations and improve driver safety.

Conclusion

The insurance telematics market is experiencing strong growth, driven by advancements in connected car technology, usage-based insurance, and the increasing demand for data-driven, personalized insurance solutions. With a CAGR of 19.1%, the market is expected to reach USD 15.90 billion by 2034. As the market expands, North America will continue to lead, while Asia Pacific presents the highest growth opportunities. The future of the market is promising, with greater integration of telematics systems in vehicles and the rise of AI-powered solutions expected to further accelerate market growth.