Table of Contents

Introduction

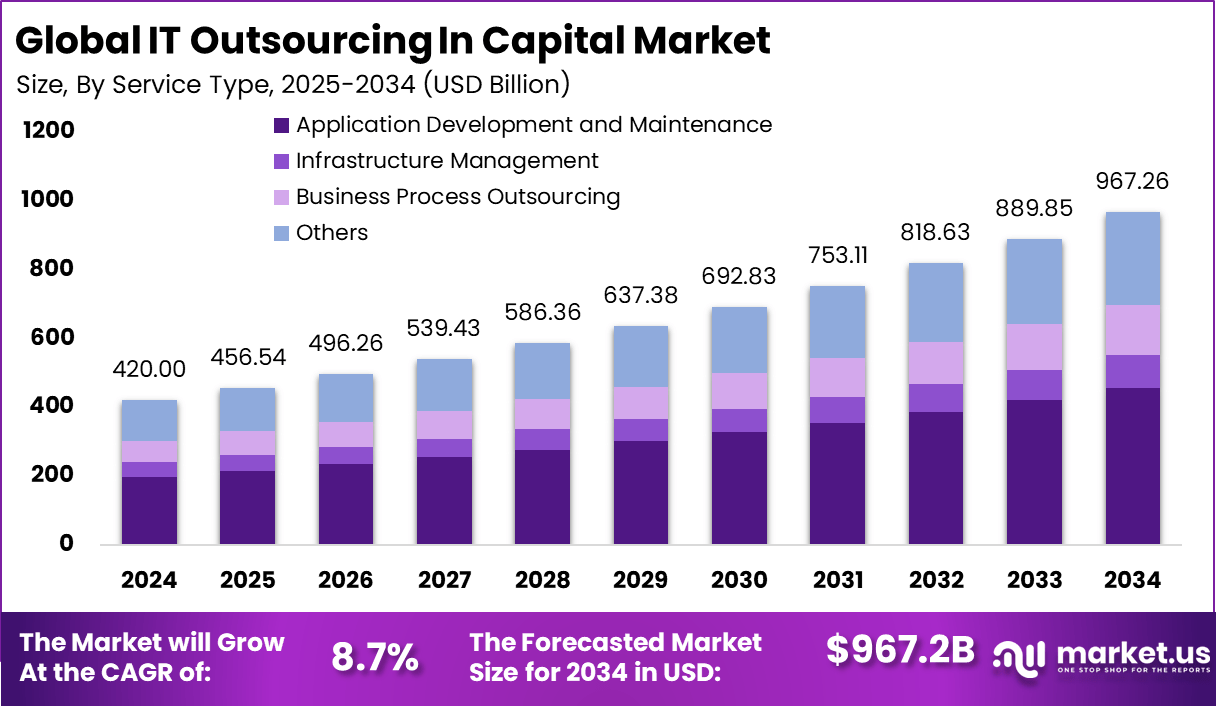

The Global IT Outsourcing in the Capital Market is set to grow from USD 420 billion in 2024 to USD 967.2 billion by 2034, registering a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, North America dominated the market with a 40.2% share, generating USD 168.84 billion in revenue. The increasing reliance on technology for managing large-scale financial transactions, automation in trading platforms, and regulatory compliance needs are driving the adoption of IT outsourcing in capital markets. This shift is reshaping how financial institutions manage risk, improve efficiencies, and innovate within the sector.

How Growth is Impacting the Economy

The IT outsourcing market in the capital sector is positively impacting the global economy by creating high-value jobs in IT, cybersecurity, and data analytics. As financial institutions increasingly turn to outsourcing to streamline operations, they are able to focus on core business areas, thus driving economic growth in key regions.

Outsourcing also enables banks and investment firms to leverage cutting-edge technologies like AI, machine learning, and blockchain without investing heavily in in-house infrastructure, thus enabling more efficient resource allocation. As capital markets embrace digital transformation, the demand for specialized IT services grows, fueling innovation and competition. Additionally, outsourcing helps reduce operational costs, improve scalability, and enable market players to access global talent, driving further growth and resilience in the financial ecosystem.

➤ Unlock growth! Get your sample now! – https://market.us/report/global-it-outsourcing-in-capital-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

IT outsourcing helps businesses reduce costs related to infrastructure, staffing, and maintenance while ensuring access to global expertise. With increasing cybersecurity threats and regulatory complexities, outsourcing partners are being relied upon to offer comprehensive solutions that address compliance and security challenges.

Sector-Specific Impacts

- Banks & Financial Institutions: Focus on outsourcing cybersecurity, data management, and cloud computing.

- Investment Firms: Leveraging outsourcing for AI-driven trading systems and regulatory compliance solutions.

- Asset Management: Use of outsourced platforms for portfolio management and client reporting.

- Capital Market Exchanges: Increased adoption of outsourced IT for high-frequency trading platforms.

Strategies for Businesses

To stay competitive, businesses must adopt advanced cybersecurity measures, integrate AI and machine learning, and focus on enhancing customer experiences through digital transformation. Collaborating with trusted outsourcing partners who offer scalable solutions will enable businesses to stay agile, improve operational efficiencies, and minimize risks. Furthermore, businesses should prioritize outsourcing partnerships that offer regulatory compliance expertise to navigate ever-evolving financial regulations.

Key Takeaways

- Market expected to grow from USD 420 billion in 2024 to USD 967.2 billion by 2034.

- CAGR of 8.7% during the forecast period.

- North America leads with 40.2% market share in 2024.

- Outsourcing aids in cost reduction and access to specialized IT solutions.

- Growing adoption of AI, cloud, and blockchain technologies in financial institutions.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=157799

Analyst Viewpoint

Present: The IT outsourcing market in capital markets is seeing steady growth as financial institutions increasingly leverage outsourcing for cost savings and access to advanced technologies. North America remains a dominant player, while other regions are gradually expanding their outsourcing initiatives.

Future Positive View: The market is set to experience accelerated growth as AI, automation, and blockchain transform capital market operations. The increasing demand for compliance, risk management, and cybersecurity will continue to fuel outsourcing opportunities, offering businesses a path to innovation, cost efficiency, and greater scalability.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Risk & Compliance Management | Rising regulatory pressure and cybersecurity threats |

| Trading Systems | Demand for high-frequency, AI-driven trading platforms |

| Data Management | Increasing data volume and need for real-time processing |

| Cloud-Based Solutions | Cost-effective and scalable infrastructure for financial services |

| IT Support Services | Growing reliance on technology for everyday operations |

Regional Analysis

North America is currently the market leader, with USD 168.84 billion in revenue in 2024, driven by the presence of major financial hubs and well-established outsourcing providers. Europe is also a significant player, particularly in regulatory compliance outsourcing, while the Asia-Pacific region is seeing rapid growth driven by technological adoption, lower operational costs, and a growing financial services industry. Emerging markets in Latin America and Africa are increasing outsourcing partnerships to improve digital capabilities in capital markets, though the adoption rate remains slower compared to more mature regions.

➤ Don’t Stop Here—check Our Library

- Digital Signage for Events Market

- Display Market

- Cargo Transportation Insurance Market

- M-Education Market

Business Opportunities

There are abundant opportunities in IT outsourcing for capital markets, particularly in AI-based trading platforms, data analytics services, and cloud infrastructure. As financial institutions continue to focus on cost optimization, outsourcing partners offering specialized services like blockchain integration, risk management, and compliance monitoring are set to thrive. Additionally, with the rise in cybersecurity threats, firms focusing on secure IT solutions for financial markets will witness robust demand. Emerging markets offer growth potential for global outsourcing providers, especially in regions with growing investment in digital transformation and regulatory frameworks.

Key Segmentation

The IT outsourcing in the capital market can be segmented as follows:

- By Service Type: Infrastructure management, application management, cybersecurity, cloud services, business process outsourcing.

- By End-User: Banks, investment firms, asset management firms, stock exchanges.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Key Player Analysis

The market is highly competitive, with players focusing on offering customized solutions to meet specific needs in risk management, regulatory compliance, and high-performance trading systems. Leading players are investing heavily in automation, AI, and cybersecurity to stay ahead of market demands. Additionally, firms are focusing on strengthening relationships with capital market players through strategic partnerships and joint ventures. The market is also witnessing a surge in M&A activities as companies seek to expand their service offerings and geographic reach.

- IBM Corporation

- Accenture plc

- Tata Consultancy Services Limited (TCS)

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Wipro Limited

- Capgemini SE

- HCL Technologies Limited

- DXC Technology Company

- NTT DATA Corporation

- Fujitsu Limited

- Tech Mahindra Limited

- Atos SE

- CGI Inc.

- EPAM Systems, Inc.

- Larsen & Toubro Infotech Limited (LTI)

- Mindtree Limited

- Virtusa Corporation

- Syntel, Inc.

- Genpact Limited

- Others

Recent Developments

- Expansion of AI-driven trading systems to improve decision-making and efficiency.

- Increased focus on providing blockchain-enabled outsourcing solutions for transparency and security.

- Partnerships with financial institutions to offer cloud-based regulatory compliance platforms.

- Rise of managed services for end-to-end IT solutions in capital markets.

- Adoption of automated cybersecurity frameworks by financial outsourcing service providers.

Conclusion

The IT outsourcing market in capital markets is experiencing rapid growth, driven by the need for cost efficiency, regulatory compliance, and access to cutting-edge technologies. With AI, cloud, and cybersecurity becoming integral to operations, businesses that embrace outsourcing solutions will gain a competitive edge, ensuring scalability, security, and enhanced service offerings in the evolving capital market landscape.