Table of Contents

Introduction

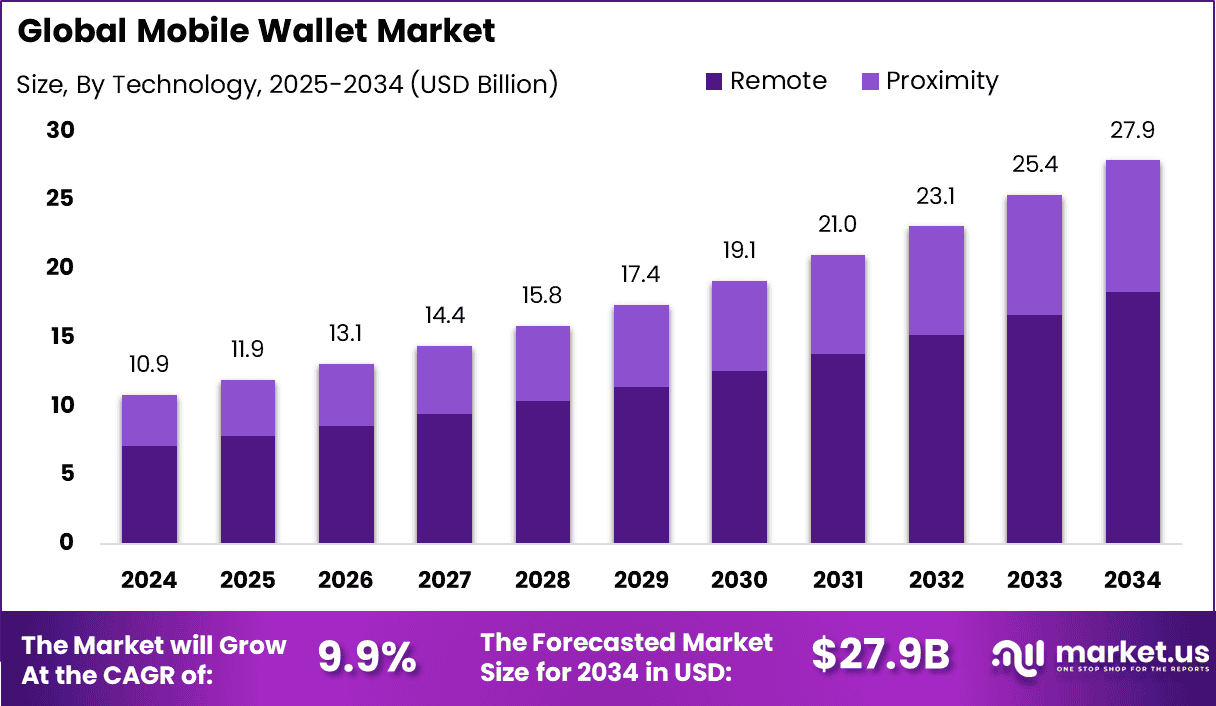

The global mobile wallet market is set to experience significant growth, with its size projected to reach USD 27.9 billion by 2034, up from USD 10.9 billion in 2024. This market is expected to grow at a CAGR of 9.9% from 2025 to 2034, driven by increasing consumer preference for digital payment solutions and growing smartphone penetration. North America holds a dominant position, capturing 35.7% of the market share in 2024, with a revenue of USD 3.8 billion. The rise of mobile wallet applications, enhanced security features, and the adoption of contactless payments are fueling the market’s expansion.

How Growth is Impacting the Economy

The rapid growth of the mobile wallet market is having a positive impact on the global economy by driving innovation in the financial services and payments sectors. The increasing adoption of mobile wallets is reducing the reliance on cash transactions and promoting a shift toward digital payments, improving overall transaction efficiency.

As mobile wallets facilitate faster and more secure payments, businesses are experiencing improved cash flow and reduced operational costs. Additionally, mobile wallets are fostering financial inclusion by providing unbanked populations with access to digital payment solutions, promoting greater participation in the global economy. The growth of mobile wallet usage also creates new opportunities for fintech companies, retail businesses, and e-commerce platforms to offer innovative payment solutions and reach a broader customer base.

➤ Unlock growth! Get your sample now! – https://market.us/report/global-mobile-wallet-market/free-sample/

Impact on Global Businesses

The growing mobile wallet market is presenting both challenges and opportunities for global businesses. The rise in demand for digital payment solutions has led to increased competition in the fintech industry, driving innovation and forcing companies to invest in secure and user-friendly mobile wallet platforms. Rising costs associated with technology development, cybersecurity measures, and compliance with financial regulations are impacting businesses in the mobile wallet space.

Supply chain shifts are also occurring as mobile wallet providers are partnering with banks, financial institutions, and retail businesses to expand payment capabilities and reach more consumers. Sector-specific impacts are particularly noticeable in the retail, hospitality, and e-commerce sectors, where mobile wallets are becoming the preferred method of payment for customers. These industries are investing in digital payment solutions to enhance customer experience, improve transaction speed, and reduce the risk of fraud.

Strategies for Businesses

To capitalize on the growth of the mobile wallet market, businesses should focus on enhancing user experience by offering seamless, secure, and fast payment solutions. Integrating mobile wallet platforms with existing payment systems and e-commerce platforms will improve accessibility for users and increase adoption rates. Additionally, businesses should prioritize security by implementing strong encryption and multi-factor authentication to ensure consumer trust.

Developing partnerships with financial institutions, retailers, and payment processors will enable businesses to offer a wider range of services and expand their customer base. Companies should also focus on regional market expansion, particularly in emerging markets where mobile wallet adoption is growing rapidly. Offering features like loyalty programs, rewards, and promotions can also help businesses differentiate themselves in an increasingly competitive market.

Key Takeaways

- The mobile wallet market is projected to grow from USD 10.9 billion in 2024 to USD 27.9 billion by 2034, at a CAGR of 9.9%.

- North America holds the largest market share at 35.7%, with USD 3.8 billion in revenue in 2024.

- The growing adoption of digital payments and smartphone penetration is driving the market’s growth.

- Businesses must focus on security, user experience, and partnerships to stay competitive in the market.

- Increasing adoption of mobile wallets in emerging markets presents additional growth opportunities.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=159317

Analyst Viewpoint

The mobile wallet market is currently experiencing strong growth, with consumers increasingly adopting digital payment solutions for convenience, speed, and security. As smartphone penetration continues to rise globally, the adoption of mobile wallets is expected to accelerate. The future outlook for the market is positive, with continued innovation in payment solutions, enhanced security measures, and greater integration with retail and e-commerce platforms. Businesses that focus on offering seamless, secure, and feature-rich mobile wallet platforms will be well-positioned to capture market share as consumer preferences shift towards digital payments.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Retail | Increasing consumer demand for seamless and contactless payment solutions |

| E-commerce | Mobile wallet adoption driving growth in online and mobile commerce payments |

| Hospitality | Adoption of mobile wallets for contactless check-ins and payments in hotels |

| Financial Services | Rise in mobile wallet usage for personal finance management and transfers |

| Consumer Electronics | Integration of mobile wallets into smart devices for easy payments |

Regional Analysis

In 2024, North America leads the mobile wallet market, holding 35.7% of the market share with USD 3.8 billion in revenue. The region’s dominance is driven by high smartphone penetration, advanced payment infrastructure, and widespread adoption of mobile wallets among consumers. Europe follows closely, with increasing adoption of digital payments, particularly in countries like the UK, Germany, and France. The Asia-Pacific region is expected to experience the highest growth rate due to the rise in smartphone usage, digital banking, and mobile wallet solutions in countries like China, India, and Japan. Emerging markets in Latin America and the Middle East are also experiencing rapid mobile wallet adoption as digital payment solutions become more accessible.

Business Opportunities

The mobile wallet market presents significant business opportunities for companies in fintech, retail, and e-commerce. Businesses can capitalize on the growing demand for digital payment solutions by integrating mobile wallets into their payment systems and offering value-added services such as loyalty programs and instant transactions. Financial institutions have the opportunity to partner with mobile wallet providers to offer secure digital banking services, including mobile money transfers and payments. Additionally, retailers and e-commerce platforms can enhance customer experience by offering seamless, secure, and contactless payment options through mobile wallet integration.

Key Segmentation

The mobile wallet market is segmented into:

- By Type: Open Wallet, Closed Wallet, Semi-closed Wallet

- By Payment Mode: Proximity Payments, Remote Payments

- By Application: Retail, E-commerce, Financial Services, Entertainment, Others

- By Region: North America, Europe, Asia Pacific, Rest of the World

Key Player Analysis

Key players in the mobile wallet market are focusing on innovation and partnerships to capture a larger share of the growing digital payment solutions market. Companies are investing in developing user-friendly mobile wallet platforms that offer enhanced security, seamless integration with payment systems, and multi-device compatibility. Collaboration with financial institutions, retailers, and e-commerce platforms is crucial for expanding service offerings and improving market penetration. Mobile wallet providers are also focusing on integrating loyalty programs, rewards, and personalized promotions to differentiate themselves from competitors and attract a wider customer base.

- Amazon Web Services, Inc.

- Visa Inc.

- American Express

- PayPal Holdings Inc.

- Apple Inc.

- Google Inc.

- Bharti Airtel Ltd.

- Mastercard

- Alipay

- Samsung Electronics Co. Ltd

- AT&T

- Others

Recent Developments

- Leading mobile wallet providers are enhancing security features by implementing biometric authentication and multi-factor authentication.

- Partnerships between mobile wallet providers and financial institutions are expanding digital payment capabilities.

- Mobile wallet platforms are increasingly integrating with loyalty programs and rewards to attract consumers.

- The rise in contactless payments is driving adoption of mobile wallets in the retail and transportation sectors.

- Emerging markets in Asia Pacific and Latin America are experiencing rapid growth in mobile wallet adoption.

Conclusion

The mobile wallet market is poised for continued growth, driven by rising consumer demand for digital payment solutions and advancements in mobile technology. As businesses increasingly adopt mobile wallets to enhance customer experience and streamline transactions, the market presents substantial opportunities for innovation. North America remains the dominant region, but emerging markets are rapidly adopting mobile wallets, further expanding the market’s global footprint.