Table of Contents

Introduction

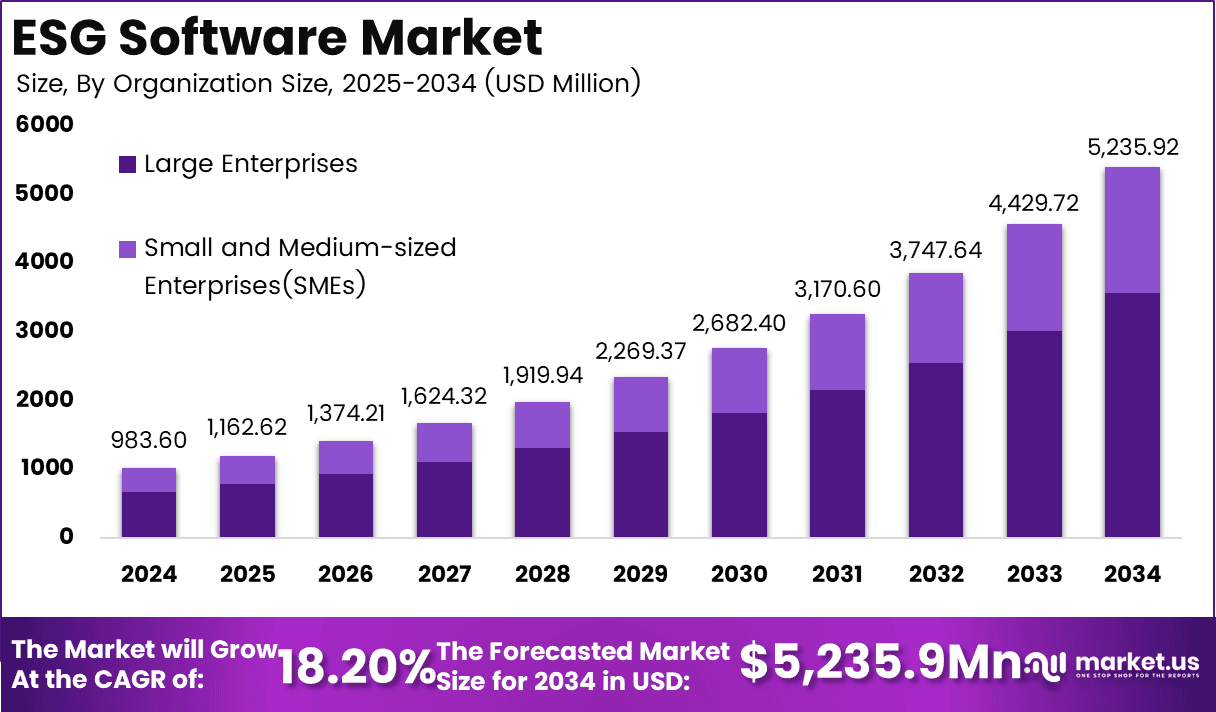

The Global ESG Software Market is projected to grow significantly, reaching an estimated value of USD 5,235.9 Million by 2034, up from USD 983.6 Million in 2024, with a robust CAGR of 18.2% from 2025 to 2034. This growth reflects an increased emphasis on sustainability and environmental, social, and governance (ESG) practices across industries.

As companies adopt ESG frameworks, the demand for specialized software to track, report, and manage sustainability efforts has skyrocketed. In 2024, North America led the market, with 36.7% market share, contributing USD 360.9 Million in revenue.

How Growth is Impacting the Economy

The rapid growth of the ESG Software Market is having a profound impact on the global economy. As businesses adopt ESG strategies, there is a shift towards more sustainable practices that not only benefit the environment but also create long-term economic value. The surge in ESG adoption is promoting transparency and accountability, enhancing investor confidence. Companies that prioritize sustainability are witnessing improved brand image and customer loyalty, resulting in greater market share.

As ESG compliance becomes a key focus for regulatory bodies globally, organizations are increasingly investing in specialized ESG software. This transition drives job creation, especially in the tech sector, boosting innovation and economic resilience. Furthermore, the increased use of ESG software fosters better risk management, ultimately improving corporate governance. In the long run, this will spur economic growth by creating a new segment of businesses focused on sustainability and responsible practices, while also pushing traditional sectors to evolve in response to global climate goals.

➤ Unlock growth! Get your sample now! – https://market.us/report/esg-software-market/free-sample/

Impact on Global Businesses

Rising costs and supply chain shifts are significantly impacting global businesses, particularly as sustainability becomes a priority. Companies are increasingly facing pressure to integrate ESG factors into their operations, which often leads to increased initial costs for software adoption and data reporting. Furthermore, supply chains are being recalibrated to focus on sustainability, causing shifts in production processes and logistics, which could lead to inefficiencies or cost disruptions in the short term. Sector-specific impacts are noticeable in industries like manufacturing, energy, and finance.

These sectors face challenges in aligning with stricter environmental regulations, yet stand to benefit from improved risk management and new revenue streams in the long term. However, these disruptions also present opportunities for innovation, creating an ecosystem for new technology solutions. As businesses focus on reducing their carbon footprint and improving ESG reporting, the cost of inaction will outweigh the investment in the long term, driving transformation across industries.

Strategies for Businesses

- Investing in ESG Software: Businesses must invest in the right ESG software to ensure effective reporting and compliance.

- Leveraging Automation: Automating ESG tracking and reporting can significantly reduce operational costs.

- Focus on Data Integrity: Ensuring the accuracy of ESG data is critical for companies to gain credibility with stakeholders.

- Building Partnerships: Collaborating with other sustainability-focused companies or platforms can streamline ESG efforts.

- Adapt to Regulations: Staying ahead of regulatory changes related to ESG reporting can provide a competitive advantage.

Key Takeaways

- The ESG Software Market is growing at a CAGR of 18.2%.

- North America holds a dominant market share of 36.7%.

- Companies investing in ESG software benefit from improved sustainability efforts and enhanced reputation.

- The transition to ESG-focused operations brings both challenges and opportunities for businesses.

- Sustainability will be central to future business strategies, driving growth and market relevance.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=158866

Analyst Viewpoint

Presently, the ESG Software Market is experiencing robust growth, with companies across various sectors recognizing the need to invest in sustainability tools. In the future, as regulatory pressures intensify and demand for transparency increases, the market is expected to continue expanding. Positive growth in the ESG software sector is anticipated, with enhanced adoption across regions and industries. The integration of AI and automation into ESG tools will further streamline reporting and boost market efficiency.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Sustainability Reporting | Rising regulatory demands and stakeholder expectations |

| Supply Chain Transparency | Increased focus on ethical sourcing and environmental impact |

| Investor Relations | Growing emphasis on ESG criteria in investment decisions |

| Risk Management | Proactive ESG risk identification and mitigation |

Regional Analysis

North America currently dominates the ESG Software Market, capturing over 36.7% of the global share. This region’s leadership is driven by strict regulations, strong technological infrastructure, and a high level of corporate commitment to sustainability. The Asia-Pacific region is projected to grow at a rapid pace due to increasing regulatory pressures, coupled with growing adoption of green initiatives by large enterprises. Meanwhile, Europe is making strides with ESG regulations, further supporting market growth. As awareness increases in emerging economies, Latin America and MEA regions are expected to experience steady growth, driven by sustainability trends.

➤ Don’t Stop Here—check Our Library

- Railway Cybersecurity Market

- Military Cyber Security Market

- AI Watermarking Market

- Electronic Wearable Market

Business Opportunities

As the ESG Software Market continues to expand, businesses have ample opportunities to capitalize on growing demand. Companies can develop niche solutions for industry-specific challenges such as supply chain traceability, carbon footprint reduction, and financial transparency. The increasing demand for tailored solutions presents a prime opportunity for startups and software developers to introduce innovative tools that cater to both large corporations and small businesses. Moreover, partnerships with regulatory bodies and sustainability-focused organizations can create new revenue streams and enhance credibility.

Key Segmentation

The market can be segmented into Product Type, End-User, and Region:

- Product Type: ESG Reporting, Data Management, Compliance Monitoring

- End-User: Large Enterprises, SMEs

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Key Player Analysis

Key players in the ESG Software Market have been focusing on expanding their product offerings through advanced technology integration. Leading companies emphasize user-friendly platforms that simplify ESG reporting and compliance tracking. Many also leverage artificial intelligence to enhance data analytics capabilities, helping businesses make more informed decisions. By focusing on customer-centric solutions, players are positioning themselves for long-term growth in this rapidly evolving market.

- Datamaran

- EcoVadis

- NAVEX Global, Inc.

- OneTrust, LLC

- Refinitiv

- SAS Institute Inc.

- Sustainalytics

- TruValue Labs

- Verisk 3E

- Wolters Kluwer N.V.

- Other

Recent Developments

- Partnerships between ESG software companies and global corporations are increasing to streamline sustainability reporting processes.

- New regulatory compliance features are being integrated into ESG platforms.

- Artificial intelligence is being incorporated to improve data analytics and reporting accuracy.

- Companies are expanding their geographic reach to emerging markets where ESG adoption is growing.

- New customizable modules are being introduced, targeting specific industries for more tailored ESG solutions.

Conclusion

The ESG Software Market is poised for significant growth, driven by increasing demand for sustainability solutions across industries. With regulatory pressures rising and businesses recognizing the importance of ESG practices, the market will continue to expand, creating ample opportunities for innovation and investment.