Table of Contents

Introduction

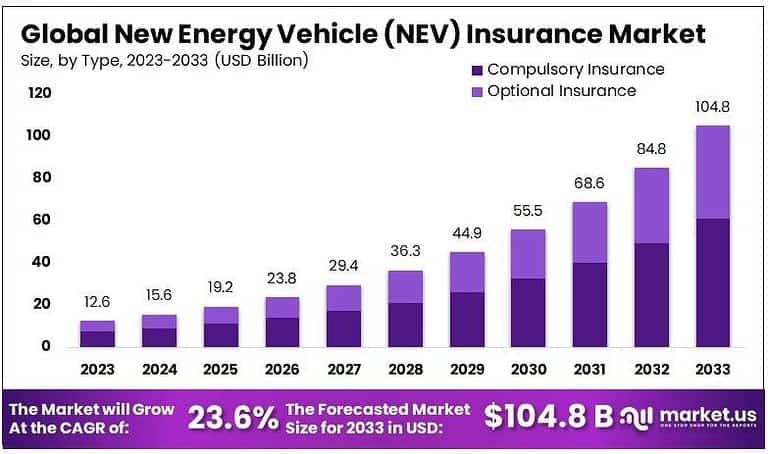

The Global New Energy Vehicle (NEV) Insurance Market is expected to grow from USD 12.6 billion in 2023 to approximately USD 104.8 billion by 2033, advancing at a CAGR of 23.6% during 2024–2033. The surge in demand for electric vehicles (EVs) and hybrid vehicles, coupled with government incentives for sustainable transportation, is driving the expansion of NEV insurance. The increasing adoption of new energy vehicles (NEVs) as part of global efforts to reduce carbon emissions is directly influencing the rise in specialized insurance products tailored to these vehicles.

How Growth is Impacting the Economy

The rapid growth of the NEV insurance market is stimulating economic activity by promoting the adoption of electric vehicles, thereby reducing dependency on fossil fuels. With rising NEV sales, the insurance sector is expanding to meet the needs of this growing industry.

The market is also fostering job creation within the insurance sector, particularly in risk assessment, claims processing, and customer service. Additionally, the increased number of NEVs on the road is pushing forward the development of charging infrastructure, which further enhances economic growth in the green energy sector and creates additional business opportunities for industries related to clean energy, automotive, and technology.

➤ Unlock growth! Get your sample now! – https://market.us/report/new-energy-vehicle-nev-insurance-market/free-sample/

Impact on Global Businesses

Businesses in the automotive and insurance sectors are directly impacted by the rise of NEVs. Car manufacturers are increasingly offering NEVs with specialized insurance options, leading to the creation of new partnerships with insurance companies. Insurance providers are introducing customized plans for NEVs, addressing concerns such as battery coverage, charging infrastructure, and the specialized maintenance requirements of electric vehicles. The growth in the NEV sector is also transforming the traditional automotive aftermarket services, with increased demand for parts, repair services, and software updates unique to NEVs. This shift is creating new revenue streams for automotive service providers.

Strategies for Businesses

To capitalize on the growth of the NEV insurance market, businesses are focusing on developing specialized insurance products that cater to the unique needs of NEVs, including battery coverage, roadside assistance for charging issues, and theft protection for electric vehicle components. Partnerships between automakers and insurance companies are being strengthened to offer bundled insurance and vehicle purchases, providing convenience to customers.

Data analytics and AI are increasingly being integrated into risk management practices for NEV insurance, enabling companies to offer more personalized and accurate pricing models. Additionally, businesses are investing in sustainability and electric vehicle-related infrastructure to enhance their market offerings.

Key Takeaways

- The NEV insurance market is expected to grow to USD 104.8 billion by 2033, at a CAGR of 23.6%

- The rise of electric and hybrid vehicles is driving demand for specialized insurance coverage

- Automakers are collaborating with insurers to offer tailored products for NEVs

- Data analytics and AI are transforming risk management and pricing models

- Governments’ push for clean energy vehicles is accelerating market growth

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=129428

Analyst Viewpoint

The NEV insurance market is poised for exponential growth, fueled by the global shift toward clean energy and the increasing adoption of electric and hybrid vehicles. In the coming decade, specialized insurance offerings will continue to evolve to meet the unique needs of NEV owners, including coverage for batteries, charging infrastructure, and new risks associated with autonomous and connected vehicle technologies. The market outlook remains highly positive, with insurance companies gaining competitive advantages by embracing technological advancements and aligning their products with the growing demand for sustainable transportation solutions.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Battery insurance for NEVs | Increasing concerns over battery performance and lifespan |

| Charging infrastructure protection | Growth of EV charging networks and installations worldwide |

| Roadside assistance for NEVs | Rise in the number of NEVs on the road requiring specialized support |

| Autonomous NEV coverage | Rising adoption of autonomous driving technologies |

| Green insurance policies | Government initiatives promoting electric vehicle ownership |

Regional Analysis

North America is leading the market, driven by the strong adoption of electric vehicles in the US and Canada, along with governmental policies supporting clean energy vehicles. Europe follows with robust growth, particularly in countries like Norway, the UK, and Germany, where NEV adoption is rapidly increasing. Asia-Pacific, led by China, is set to become the fastest-growing region due to the government’s push for clean energy vehicles and large-scale EV production. Other regions, including Latin America and the Middle East, are also expected to see increasing demand for NEV insurance as the adoption of electric vehicles rises in these markets.

➤ Don’t Stop Here — Check Our Library

- Utilities Services Market

- AI Visual Inspection System Market

- Time Series Databases Software Market

- Soldier Systems Market

Business Opportunities

The NEV insurance market presents significant opportunities in creating specialized policies that address the unique needs of electric vehicle owners. Insurers can expand into emerging markets where NEV adoption is still in the early stages by offering customized plans that incentivize the purchase of electric vehicles. Additionally, partnerships with automakers, charging station providers, and technology firms can enhance product offerings and customer reach. As new EV-related risks emerge, insurers that can quickly adapt to these changes by offering innovative, tailored coverage will maintain a competitive edge.

Key Segmentation

By type of insurance, the market includes liability insurance, comprehensive coverage, battery insurance, and roadside assistance. In the Application, the market spans electric vehicles, hybrid vehicles, and plug-in hybrids. By distribution channel, the market is divided into direct sales, brokers, and online platforms. Each segment is growing due to the increasing need for specialized risk management for new energy vehicles, with battery and charging infrastructure coverage gaining significant traction.

Key Player Analysis

Key players in the NEV insurance market are focusing on expanding their offerings by providing more comprehensive coverage, including battery damage, charging issues, and autonomous vehicle components. Many insurance companies are collaborating with automakers and technology providers to develop integrated solutions that address the unique risks associated with NEVs. Additionally, data analytics, AI, and IoT are increasingly being used to offer personalized and flexible pricing models. As NEV adoption grows, insurers that innovate and align with sustainability efforts will position themselves as leaders in this emerging market.

- AXA

- Liberty Mutual Group

- Mitsui Sumitomo Insurance

- Aviva

- Auto Owners

- Generali Group

- Chubb

- AmTrust NGH

- Progressive Corporation

- Tesla

- Other Key Players

Recent Developments

- Launch of battery-specific insurance coverage for electric vehicles

- Partnerships between insurance providers and EV manufacturers to offer bundled solutions

- Introduction of AI-driven pricing models for NEV insurance

- Expansion of roadside assistance coverage for charging-related issues

- Governments are incentivizing electric vehicle ownership through insurance discounts

Conclusion

The NEV insurance market is set to experience robust growth driven by the global shift towards electric and hybrid vehicles. As NEV adoption accelerates, specialized insurance products will become essential to cover the unique risks associated with these vehicles. With a focus on sustainability, technology, and data-driven solutions, the future of the NEV insurance market holds strong potential for innovation and industry growth.