Table of Contents

Introduction

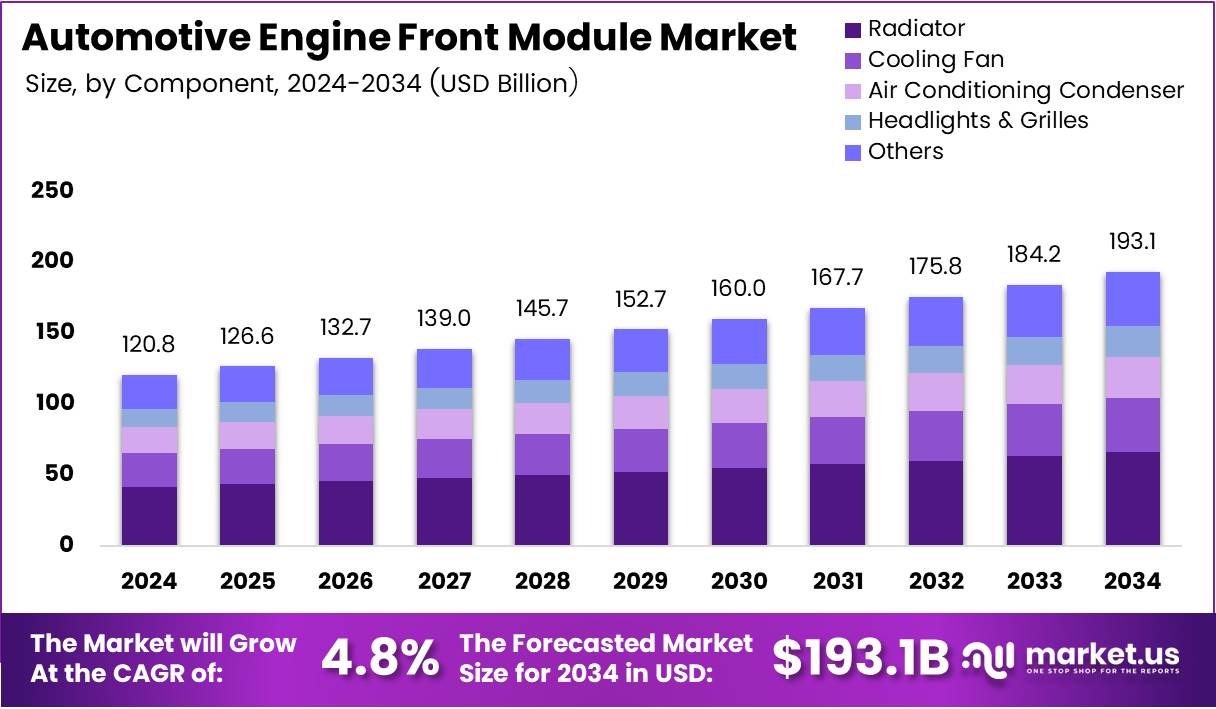

The Global Automotive Engine Front Module (EFM) Market is poised for substantial growth, projected to reach USD 193.1 Billion by 2034, up from USD 121.1 Billion in 2024, expanding at a CAGR of 4.6% between 2025 and 2034. This growth reflects the automotive industry’s strong shift toward efficiency, safety, and sustainability.

Moreover, as automakers prioritize lightweight designs and energy-efficient solutions, EFMs are evolving to integrate structural, aesthetic, and functional components. The convergence of regulatory mandates and technological innovation continues to propel the market, creating opportunities for material advancements and smart integration.

Additionally, the rising adoption of electric and hybrid vehicles is reshaping design needs. EFMs now serve critical roles in thermal management and battery cooling, reinforcing their importance in next-generation vehicle architectures across global markets.

Key Takeaways

- The Global Automotive Engine Front Module Market is expected to reach USD 193.1 Billion by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

- The Radiator segment holds a dominant market share of 34.2% in 2024 due to its essential role in thermal management systems.

- Passenger Vehicles dominate the market with a 73.4% share in 2024, driven by high production volume and diverse application needs.

- The Metal segment leads with a 51.7% share in 2024, known for its performance characteristics and familiarity in manufacturing.

- The OEM sales channel dominates with an 89.7% share in 2024, due to direct integration with vehicle production lines.

- Asia Pacific holds a dominant market share of 42.9%, valued at USD 51.9 Billion, driven by a strong manufacturing base and demand for fuel-efficient vehicles.

Market Segmentation Overview

The Component segment is led by Radiators (34.2%), which remain central to engine thermal management. Complementary systems like Cooling Fans, Condensers, and Headlights & Grilles enhance performance and aesthetics, while Others—including sensors and mounts—further improve integration and efficiency.

By Vehicle Type, Passenger Vehicles dominate with a 73.4% market share, supported by rising consumer demand and high production volumes. Commercial Vehicles follow, emphasizing durability, thermal capacity, and structural strength for demanding operational environments.

The Material segment is spearheaded by Metals (51.7%), offering strength, heat resistance, and established manufacturing reliability. Composites are gaining traction due to lightweighting, while Plastics expand in non-critical applications for cost and design flexibility.

In Sales Channel, OEMs (89.7%) lead through integrated production partnerships and quality consistency. The Aftermarket segment serves vehicle maintenance and repair demands, offering revenue continuity beyond new vehicle cycles.

Drivers

Increasing Demand for Fuel-Efficient Vehicles

Rising fuel costs and stringent emission norms drive manufacturers toward lightweight EFMs, optimizing vehicle efficiency. As consumers prioritize eco-friendly mobility, EFMs designed with advanced materials and streamlined structures are critical to reducing drag, improving mileage, and supporting regulatory compliance.

Integration of Advanced Safety Features

Modern EFMs incorporate adaptive bumpers, impact sensors, and reinforced crash structures to meet evolving safety standards. These innovations not only enhance crashworthiness but also enable smarter vehicle systems, aligning with global mandates for occupant protection and advanced driver assistance technologies.

Use Cases

Electric and Hybrid Vehicles

EFMs play a pivotal role in EV and hybrid systems, facilitating battery cooling, thermal regulation, and sensor integration. As the EV market accelerates, demand for customized EFM architectures tailored to electric powertrains is creating new growth opportunities for suppliers.

Autonomous and Connected Vehicles

With the rise of autonomous mobility, EFMs are evolving into sensor hubs. Integrating LIDAR, cameras, and radar systems, they form the foundation for intelligent front-end architectures, enabling vehicle perception, collision avoidance, and predictive safety functions.

Major Challenges

Integration Complexity in Electric Powertrains

Shifting from ICE to EV platforms introduces design complexity. EV-specific EFMs require new layouts for cooling, electronics, and aerodynamics, demanding high precision and re-engineering of legacy systems—challenges that increase development time and cost.

Regulatory and Compliance Costs

Stringent global safety and emission standards impose high compliance burdens. Adhering to evolving regional regulations—particularly in Europe and North America—necessitates costly testing, certification, and redesigns, straining smaller suppliers and delaying product launches.

Business Opportunities

Rising Demand for Lightweight Materials

The push for lightweighting fosters opportunities in composite and advanced polymer EFMs. These materials improve fuel economy, noise reduction, and design flexibility. Manufacturers investing in sustainable materials gain a competitive advantage in meeting efficiency targets.

OEM Collaboration and Modular Innovation

Strategic OEM–supplier partnerships are driving modular innovation, streamlining production, and reducing costs. Collaborative R&D accelerates custom EFM designs, integrating smart technologies and eco-friendly components aligned with vehicle electrification goals.

Regional Analysis

Asia Pacific Leads with 42.9% Market Share

Accounting for USD 51.9 Billion, Asia Pacific dominates due to robust automotive manufacturing hubs in China, Japan, and India. The region’s emphasis on fuel efficiency, EV expansion, and regulatory advancements bolsters sustained EFM adoption and innovation.

Europe’s Commitment to Electrification and Safety

Europe’s stronghold stems from stringent safety laws and carbon-neutral initiatives. With leading automakers focusing on EV integration, lightweight materials, and crash-resilient modules, Europe remains a critical hub for EFM R&D and premium vehicle applications.

Recent Developments

- Jan 2025 – Eccentric Engine raised $5 million in Pre-Series A funding to enhance fuel efficiency technologies.

- Sep 2024 – DeepDrive secured €30 million Series B to scale electric drivetrains.

- Jun 2025 – RIIICO obtained $5 million Seed Funding to advance robotics and automation.

- Aug 2025 – Motive raised $150 million to expand AI-powered fleet management solutions.

Conclusion

The Automotive Engine Front Module Market is undergoing transformative growth, fueled by trends in electrification, lightweighting, and autonomous driving. With a projected valuation of USD 193.1 Billion by 2034, the sector’s evolution is underpinned by regulatory compliance, OEM collaboration, and technological innovation.

As automakers pivot toward sustainable, connected, and safe mobility, EFMs will remain central to future vehicle architectures. Companies leveraging smart materials, integrated electronics, and advanced modularity will lead this decade of dynamic automotive transformation.