Table of Contents

Introduction

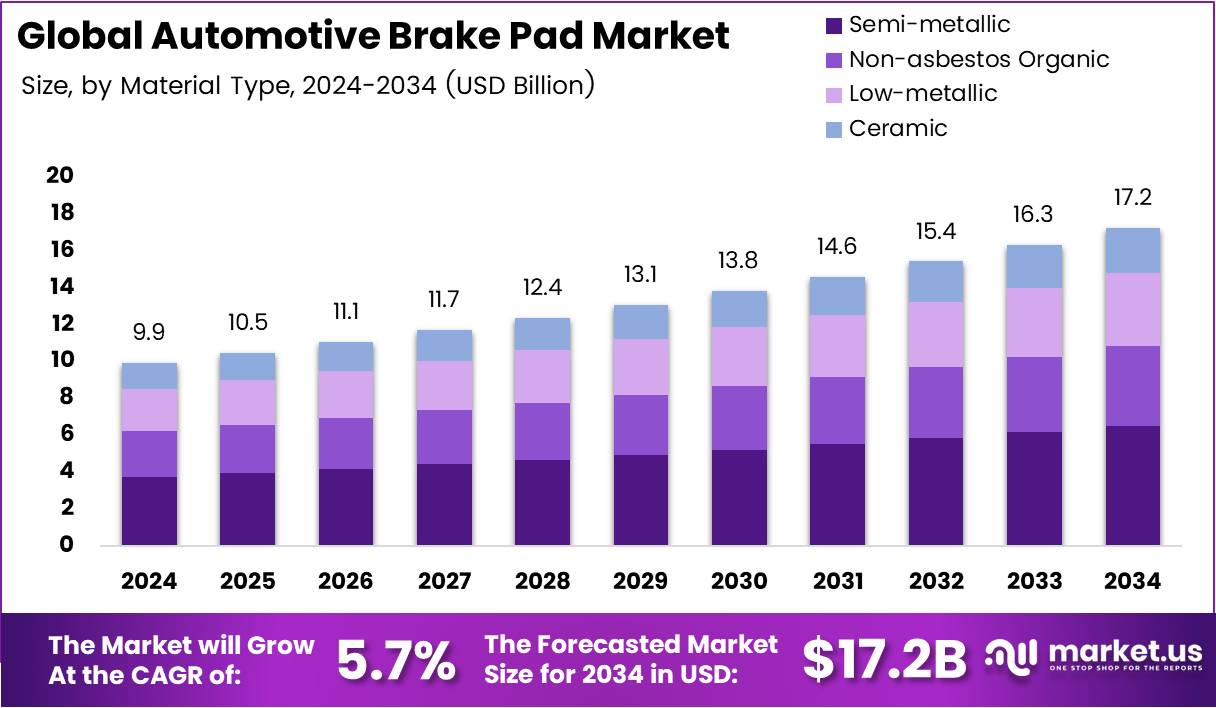

The Global Automotive Brake Pad Market is projected to reach USD 17.2 Billion by 2034, rising from USD 9.9 Billion in 2024 at a CAGR of 5.7% during 2025–2034. This steady growth reflects the automotive industry’s ongoing commitment to safety, performance, and sustainability in braking systems.

Brake pads play a critical role in vehicle safety, converting kinetic energy into heat to ensure effective stopping. Rising vehicle production, coupled with tightening safety standards, continues to drive market expansion. Moreover, the growth of electric and hybrid vehicles further accelerates demand for advanced and low-dust braking systems.

Additionally, the introduction of eco-friendly brake pads is creating new opportunities for innovation. Governments and manufacturers alike are investing heavily in research to reduce particulate emissions, enhance durability, and ensure compliance with environmental regulations across key automotive markets.

Key Takeaways

- Global Automotive Brake Pad Market size is expected to reach USD 17.2 Billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

- Semi-metallic segment held 37.8% market share in 2024, driven by its durability and performance balance.

- Front position type held 68.9% market share in 2024 due to higher braking loads.

- Passenger cars commanded 62.5% market share in 2024, supported by strong replacement demand.

- Aftermarket segment accounted for 62.4% of the market in 2024, driven by affordability and frequent replacements.

- Asia Pacific region holds 42.8% market share, valued at USD 4.2 Billion, led by robust automotive growth in China and India.

Market Segmentation Overview

The semi-metallic brake pad segment dominates the material landscape with a 37.8% share in 2024. These pads offer an ideal combination of cost-effectiveness and performance, suiting a wide range of vehicle types. Manufacturers continue to refine compositions to enhance durability and reduce wear, boosting market adoption globally.

The front position type segment led with a 68.9% share, as front brake pads bear most of the braking load. They wear faster and require more frequent replacements. The segment’s dominance underscores the strong aftermarket potential and the importance of ongoing innovation in material and heat dissipation technology.

Passenger cars remain the leading vehicle type, holding a 62.5% market share in 2024. The sheer volume of passenger vehicles and frequent replacement cycles support consistent demand. Rising consumer awareness around safety and maintenance continues to drive the replacement rate in both developed and emerging economies.

The aftermarket channel dominates with 62.4% of total revenue in 2024, favored by cost-conscious consumers and fleet operators. The accessibility of aftermarket pads, coupled with rapid product availability, contributes to the segment’s steady expansion, while OEM channels focus on vehicle-specific, high-end products.

Drivers

Increasing Vehicle Production and Sales

Global vehicle production growth directly fuels brake pad demand. As automotive output expands across Asia, North America, and Europe, the need for reliable braking systems intensifies. Manufacturers are investing in advanced friction materials to meet performance and safety expectations in both passenger and commercial vehicles.

Government Safety Regulations

Stringent safety and environmental regulations are compelling automakers to adopt high-performance braking solutions. Standards governing stopping distances, particulate emissions, and dust control drive continuous innovation. Compliance initiatives also encourage manufacturers to transition toward copper-free, sustainable brake pad materials.

Use Cases

Electric and Hybrid Vehicles

Brake pads designed for electric and hybrid vehicles cater to regenerative braking systems. These specialized pads experience less wear but must maintain consistent friction performance. As EV adoption grows, demand for quieter, dust-free brake solutions optimized for low-temperature operations is accelerating.

Heavy-Duty and Commercial Fleets

Commercial fleets rely on durable brake pads for safety under high-load conditions. These vehicles require frequent maintenance and replacements, creating strong aftermarket demand. Manufacturers offering extended-life brake pads tailored to trucks and buses are securing long-term supply contracts globally.

Major Challenges

Volatile Raw Material Prices

Fluctuations in steel, copper, and resin prices significantly impact production costs. Manufacturers face margin pressures as material costs fluctuate, making long-term pricing strategies complex. This volatility forces suppliers to explore cost-effective formulations and secure stable sourcing agreements to maintain profitability.

Supply Chain Disruptions

Global logistics constraints and raw material shortages disrupt brake pad manufacturing and distribution. Supply chain instability affects production timelines and delivery consistency. Companies are responding with regional production facilities and inventory localization to mitigate risks and ensure timely supply to OEMs and distributors.

Business Opportunities

Eco-Friendly Brake Pad Development

Sustainability initiatives are encouraging the creation of copper-free and low-dust brake pads. Governments in Europe and North America are tightening emission standards, creating a fertile market for eco-compliant friction materials. Innovators focusing on biodegradable or ceramic alternatives are well-positioned for future growth.

Smart Brake Technologies

Integration of sensors for predictive maintenance offers a promising opportunity. Smart brake pads capable of monitoring wear in real-time enhance safety and reduce operational costs. This technology is particularly valuable for fleet management systems, where preventive maintenance reduces downtime and improves vehicle reliability.

Regional Analysis

Asia Pacific – 42.8% Market Share, USD 4.2 Billion Value

Asia Pacific dominates the global landscape, driven by massive vehicle production in China, Japan, and India. Increasing automotive safety norms, coupled with booming aftermarket activity, reinforce regional growth. Strong local manufacturing capabilities and government support for sustainable mobility further accelerate expansion.

North America and Europe Trends

North America’s demand is bolstered by electric vehicle penetration and strong aftermarket networks. The U.S. leads in innovation for advanced friction materials and autonomous braking systems. Europe, meanwhile, emphasizes green technologies, with strict environmental regulations driving adoption of copper-free and noise-optimized brake pads.

Recent Developments

- December 2024: Momentum USA, Inc. acquired Max Power Friction in Toronto, Canada, enhancing its North American market presence and expanding its friction product portfolio.

- September 2024: Monroe Capital launched a USD 1 Billion fund to support small automotive suppliers transitioning toward electric vehicle technologies, ensuring industry competitiveness.

Conclusion

The Automotive Brake Pad Market is poised for strong, sustained growth through 2034, driven by rising vehicle production, electrification, and stringent safety regulations. Manufacturers embracing sustainable materials, smart technologies, and cost-efficient production will gain a decisive competitive edge.

As governments and consumers demand safer, greener mobility, the industry is rapidly evolving toward innovation-driven solutions—positioning brake pads not just as essential components, but as key enablers of the automotive sector’s sustainable future.