Table of Contents

Introduction

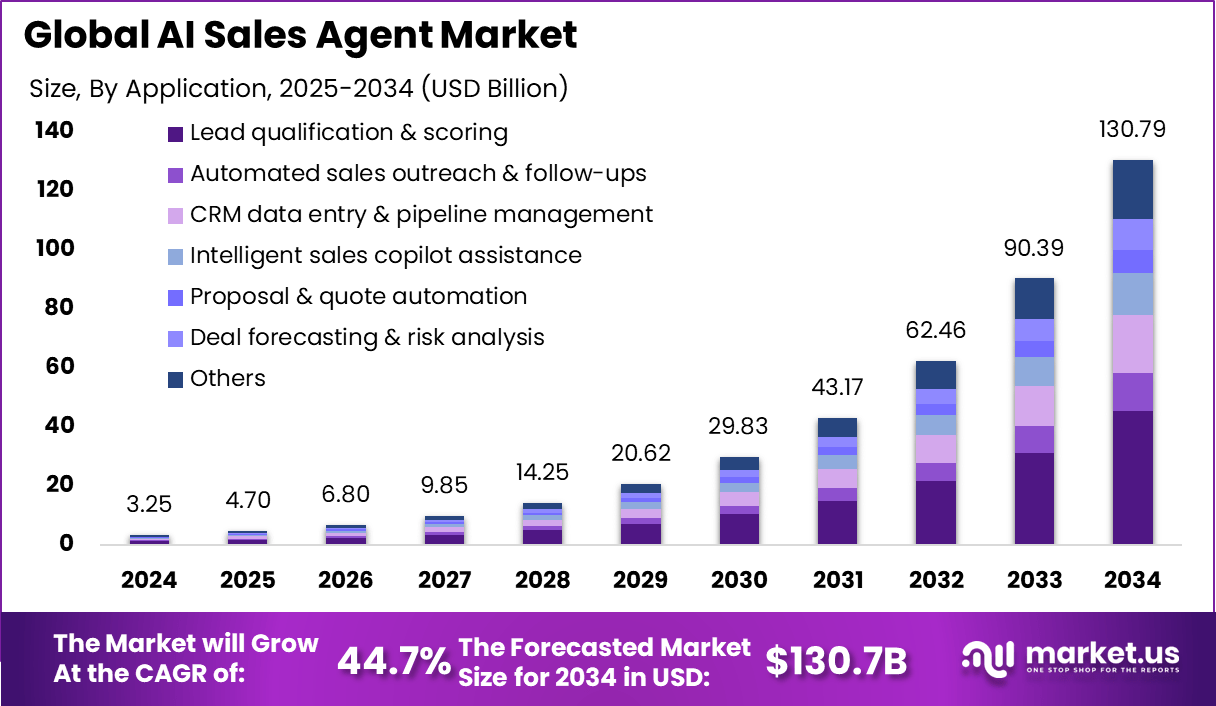

The global AI-based sales agent market generated USD 3.25 billion in 2024 and is projected to grow from USD 4.70 billion in 2025 to approximately USD 130.79 billion by 2034, recording a CAGR of 44.7% during the forecast period. In 2024 North America held a dominant market position, capturing over 39.63% share—about USD 1.2 billion in revenue.

The rapid expansion is driven by increased implementation of artificial intelligence in lead generation, customer engagement, and autonomous sales workflows. The transformation of sales processes through AI-agent-based systems is reshaping enterprise strategies and unlocking new revenue opportunities across sectors.

How Growth is Impacting the Economy

The surge in the AI-based sales agent market is influencing the wider economy through efficiency gains, job realignment and productivity boosts. As companies adopt AI-driven agents to automate repetitive sales tasks—such as lead screening, outreach, follow-up and quote management—human sales teams are being redeployed to higher value tasks, which enhances output without proportional labour cost increases. Enterprises investing in AI sales agents boost their revenue-per-employee metrics, which contributes to increased corporate profitability and tax revenues.

Moreover, the rising demand for AI-agent development, integration services and data-centric infrastructures is stimulating job creation in tech, analytics and cloud services, supporting economic growth in innovation hubs. Global trade flows benefit as companies scale faster, reach new customers and optimise their sales pipelines across borders, thereby fostering cross-border commerce and regional economic linkages. The overall effect is a more dynamic, digitally-enabled sales ecosystem that drives broader macroeconomic modernization.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/ai-sales-agent-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses shifting to AI-based sales agents face upfront investment in technology, integration, training and change management. The shift from manual sales workflows to autonomous agents entails reallocation of budget from head-count to software and infrastructure. Supply-chain dynamics change as firms must secure data-service providers, cloud compute capacity and AI-agent maintenance partners, altering vendor relationships and creating new ecosystem dependencies.

Sector-Specific Impacts

In the technology and software sector, AI sales agents accelerate deal cycles, enable self-serve quoting and improve lead conversion. In manufacturing and industrial goods, automated sales agents help manage large-volume product catalogues and multi-channel distribution. In retail and consumer services, AI agents drive multilingual outreach, personalisation and 24/7 engagement. In B2B services, these agents enable predictive lead scoring, account-based engagement and cross-sell/upsell automation.

Strategies for Businesses

Organizations should develop a phased roadmap for AI-sales-agent adoption, beginning with pilot use cases in high-volume, low-complexity sales tasks. They should partner with established AI-agent providers or build internal capabilities to align agents with CRM and sales-automation platforms. Training and change-management programmes are essential to ensure human sales teams adapt to hybrid workflows. Businesses should monitor performance metrics—such as conversion rate lift, cost per lead and sales-cycle reduction—to validate ROI. Supplier diversification and ecosystem partner management should be emphasised to mitigate dependency risks. Governance frameworks covering AI transparency, data privacy and ethical usage must accompany rollout. Lastly, organisations should continuously refine workflows and scale successful agent functions to maximise value.

Key Takeaways

- The market is expected to expand from USD 3.25 billion in 2024 to USD 130.79 billion by 2034, at a 44.7% CAGR.

- North America held ~39.63% of the market in 2024 (USD 1.2 billion).

- Economic effects include higher productivity, tech-job growth and increased digital trade flows.

- Businesses face higher investment costs but gain faster sales cycles, higher conversion and new revenue channels.

- Key sectors benefiting: technology/software, manufacturing, retail/consumer services, B2B services.

- Strategic imperatives: pilot adoption, human-agent hybrid workflows, performance tracking, ecosystem diversification and governance.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161714

Analyst Viewpoint

Currently the AI-based sales agent market is entering a rapid scaling phase as enterprises recognise the value of automating sales tasks and enhancing human-agent collaboration. In the near term, adoption is expected to accelerate across mid-market and large-enterprise segments. Looking ahead, the future remains very positive: as agent capabilities mature, integration costs fall and analytics become more sophisticated, AI sales agents are anticipated to become standard components of go-to-market operations. Over the next decade, these agents will not only augment human sales but enable entirely new sales models, self-serve platforms and autonomous deal-execution workflows, positioning companies for sustained competitive advantage.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Lead generation & qualification | Rising volume of digital leads, need for rapid qualification, integration with CRM systems |

| Outreach & customer engagement | Demand for personalised, multilingual, 24/7 outreach; pressure to reduce sales-cycle length |

| Quote & proposal automation | Large product catalogues, complex pricing models, need for speed in B2B deal execution |

| Upsell/cross-sell automation | Focus on customer lifetime value, multi-product bundling, AI-driven account insights |

| Sales performance analytics | Need for real-time insight into sales funnel, conversion bottlenecks, and ROI tracking |

Regional Analysis

In 2024 North America dominated the AI-based sales agent market with approximately 39.63% share, driven by mature sales-tech adoption, large enterprise budgets and advanced AI infrastructure. Europe and Asia-Pacific are forecast to witness higher growth rates, as companies in those regions increasingly adopt AI-agent-enabled sales workflows and ecosystem maturity expands. Asia-Pacific in particular benefits from digital-first markets, multilingual agent demand and a growing base of tech providers. Latin America and Middle East/Africa regions are expected to show nascent growth, as sales-automation infrastructure penetrates further and awareness of AI-agent benefits rises.

➤ More data, more decisions! see what’s next –

- Zero-emission Aircraft Market

- Data Monetization Platform Market

- Recurring Payments Market

- Content Security Gateway Market

Business Opportunities

The burgeoning AI-based sales agent market presents multiple opportunities: technology vendors can offer plug-and-play agents tailored to specific sales workflows; systems integrators and consultancies can deliver implementation and change-management services; cloud providers and data-analytics firms can support infrastructure and model training; enterprises can build proprietary agent-ecosystems for internal optimisation and external customer engagement; niche players can address underserved verticals or geographies with multilingual, localisation-focused sales agents. Additionally, as AI-agent adoption rises, value-added services such as agent-performance analytics, regulatory compliance modules and AI-governance frameworks will become revenue streams themselves.

Key Segmentation

The AI-based sales agent market can be segmented by component (software, services), deployment model (cloud-based, on-premises, hybrid), functionality (lead generation & qualification, outreach & engagement, quote/proposal automation, upsell/cross-sell, analytics) and industry vertical (technology/software, manufacturing, retail & consumer services, B2B services, other). Each segment addresses specific customer-needs and maturity levels—software enables agent capabilities, services provide integration and change management, deployment model reflects organisational IT preference, functionality maps to sales-workflow stage and vertical determines customisation requirement.

Key Player Analysis

Key companies in this market are scaling their offerings by integrating advanced natural-language processing, deep learning and workflow-automation features into their sales-agent platforms. They partner with CRM providers and cloud-infrastructure firms to ensure seamless deployment and enterprise-grade scalability. These firms emphasise differentiators such as ease of integration, model customisation, multilingual support and compliance frameworks. Subscription and platform-as-a-service business models are becoming prevalent to generate recurring revenue and expand user adoption. The firms are also investing in use-case expansion, global market entry and ecosystem partnerships to secure leadership in the rapidly growing landscape.

- Salesforce, Inc.

- Plivo Inc.

- SalesCloser AI

- Netla Inc.

- Automation Anywhere, Inc.

- OnSearch Pty Ltd

- Vonage

- Instantly Blog

- Creatio

- Other Major Players

Recent Developments

- A major enterprise reported ~40% increase in sales after deploying AI-agent tools in customer-service and sales workflows.

- Analysts note that fewer than 1% of enterprise applications included agentic AI in 2024, but this is expected to rise to 33% by 2028.

- AI-agent adoption in CRM and sales-automation platforms faces “decision fatigue” among enterprise buyers due to tool overload and unclear ROI.

- AI sales-enablement firms are now securing significant funding rounds (e.g., Rs 30 crore funding in India for a sales-agent platform).

- Research indicates AI agents are reducing human sales teams’ administrative tasks (e.g., non-selling time) and enabling higher win rates.

Conclusion

The AI-based sales agent market is poised for explosive growth and will reshape sales operations globally. Organisations that adopt, integrate and scale autonomous sales workflows stand to gain efficiency, market reach and competitive advantage in the new era of AI-augmented sales.