Table of Contents

Introduction

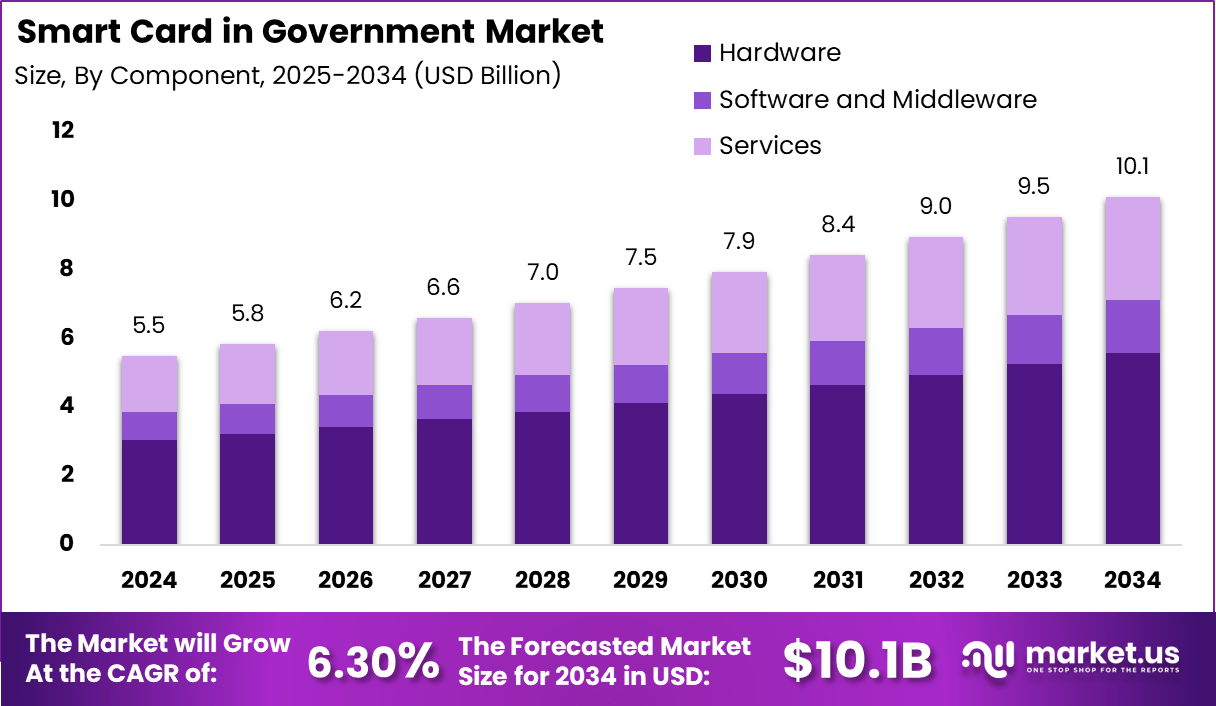

The Global Smart Card in Government Market generated USD 5.5 billion in 2024 and is projected to grow from USD 5.8 billion in 2025 to approximately USD 10.1 billion by 2034, reflecting a CAGR of 6.3%. The rising need for secure identity verification, e-governance initiatives, and biometric integration is driving this growth.

Europe dominated with a 35% share, generating USD 1.92 billion in revenue in 2024. Governments are increasingly implementing smart card-based national ID systems, digital driver’s licenses, and healthcare cards to enhance security, streamline citizen services, and ensure data protection, fueling continuous technological innovation and market expansion.

How Growth is Impacting the Economy

The growth of smart card implementation in the government sector is enhancing administrative efficiency, reducing fraud, and promoting digital inclusivity. Economically, it is generating employment in semiconductor design, software development, and cybersecurity services. Moreover, digital identity projects are stimulating national economies by improving tax compliance, subsidy delivery, and border control efficiency.

Countries investing in advanced identification systems are also attracting global partnerships and investments in ICT infrastructure. The integration of smart cards within financial and healthcare systems minimizes economic leakages and improves resource allocation, further solidifying the foundation for digital economies and e-governance transformation worldwide.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/smart-card-in-government-market/free-sample/

Impact on Global Businesses

The rising adoption of smart cards in government operations is causing global supply chain shifts due to increased demand for secure chips and embedded microcontrollers. This has led to higher raw material and component costs, particularly for semiconductors and encryption hardware. Manufacturing firms are reconfiguring their supply chains to localize production and ensure compliance with government data security norms. Sector-wise, IT and security firms are witnessing demand surges, while logistics and manufacturing sectors face challenges in managing just-in-time inventory for secure components, leading to a broader restructuring of procurement and vendor diversification strategies across regions.

Strategies for Businesses

Businesses are focusing on vertical integration, localized production, and R&D investment in encryption and biometrics. Establishing strategic alliances with government agencies and adopting open standards like ISO/IEC 7816 and 14443 enhances compliance. Companies are prioritizing eco-friendly materials, embedded AI analytics, and blockchain-enabled identity management to gain a competitive advantage. Emphasizing cybersecurity certifications and interoperability across sectors ensures long-term partnerships. Diversification of supplier networks, workforce upskilling, and participation in public–private partnership projects remain vital strategies to navigate evolving regulatory landscapes and capture emerging opportunities in global government digitalization initiatives.

Key Takeaways

- CAGR of 6.3% projected through 2034.

- Europe dominated with 35% market share in 2024.

- Smart ID and e-Governance driving market expansion.

- Semiconductor demand and cybersecurity innovation rising.

- Localization and public–private partnerships shaping growth.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=164752

Analyst Viewpoint

The smart card in the government market is currently witnessing strong demand due to accelerated digital transformation and increased cyber threats. Governments are focusing on multi-factor authentication and contactless ID systems to improve security and convenience. Over the long term, integration with AI-driven identity analytics and blockchain-based verification systems is expected to create new value chains and elevate efficiency in public services. The future outlook remains optimistic as digital infrastructure investments and interoperability standards continue to strengthen global adoption.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| National ID Programs | Secure identity verification and efficient citizen service delivery |

| E-Passports | Rising cross-border travel security needs |

| Digital Healthcare Cards | Efficient patient data management and fraud reduction |

| Driver’s Licenses & Vehicle Registration | Streamlined transportation and compliance tracking |

| Voting & Social Security Cards | Enhanced transparency and fraud prevention |

Regional Analysis

Europe led with over 35% share in 2024 due to early adoption of e-ID programs and EU digital governance policies. North America is expanding rapidly, driven by data protection mandates and the modernization of citizen identity systems. Asia-Pacific is anticipated to grow fastest with initiatives like India’s Aadhaar and China’s digital ID rollout. Latin America and the Middle East are gradually digitizing national records, supported by growing investments in cybersecurity and ICT infrastructure, enhancing global market penetration.

➤ More data, more decisions! see what’s next –

- Heavy Lift Delivery Drones Market

- AI Video Market

- Pesticide Spraying Drone Market

- Edge AI Chipsets Market

Business Opportunities

Growing government focus on digital transformation, smart city frameworks, and identity authentication systems is creating strong investment opportunities. Emerging economies are prioritizing electronic ID infrastructure and secure payment interfaces. Integration of smart cards with AI, IoT, and blockchain technologies offers vendors scope to develop interoperable and high-security solutions. Additionally, collaborations between semiconductor companies and public agencies present significant potential for technology transfer and capacity building, creating a fertile environment for innovation-driven business expansion globally.

Key Segmentation

The market is segmented by Type (Contact-Based, Contactless, Dual Interface), by Component (Hardware, Software, Services), by Application (National ID, Healthcare, E-Passport, Transportation, Social Security, Voting), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). Among these, contactless smart cards are projected to dominate due to increased adoption in digital identity programs and public healthcare systems that require fast and secure authentication mechanisms.

Key Player Analysis

Leading manufacturers are emphasizing scalable production, secure chip architecture, and compliance with global standards. Companies are integrating AI-based fraud detection and biometric matching capabilities to enhance smart card efficiency. Continuous innovation in encryption and microprocessor technology is enabling reliable cross-border identity systems. Firms are strategically investing in regional facilities to mitigate geopolitical risks and are forming alliances with government institutions for large-scale projects to expand their global footprint and strengthen long-term contract portfolios.

- Thales Group (Gemalto NV)

- IDEMIA

- Giesecke+Devrient GmbH (G+D)

- Infineon Technologies AG

- NXP Semiconductors

- HID Global Corporation (Assa Abloy)

- CardLogix Corporation

- Watchdata Technologies

- CPI Card Group Inc.

- Valid S.A.

- Eastcompeace Technology Co., Ltd.

- Shanghai Huahong Integrated Circuit Co., Ltd.

- Athena Smartcard Solutions

- Bundesdruckerei GmbH

- SecuGen Corporation

- Identiv, Inc.

- NEC Corporation

- STMicroelectronics

- Samsung Electronics Co., Ltd.

- Atos SE

Recent Developments

- March 2025: Launch of biometric-enabled smart ID for healthcare access in Europe.

- April 2025: Introduction of blockchain-based e-passport verification system in Asia-Pacific.

- June 2025: Implementation of smart social security cards across Latin America.

- August 2025: Rollout of next-gen dual-interface smart cards for transportation services.

- September 2025: Partnership between global chipmakers and governments to enhance data security.

Conclusion

The global smart card in the government market is positioned for robust expansion driven by digital governance initiatives, technological innovation, and security demands. Sustained investments in e-ID infrastructure and interoperability standards are expected to reshape public administration and digital identity ecosystems worldwide.