Table of Contents

Introduction

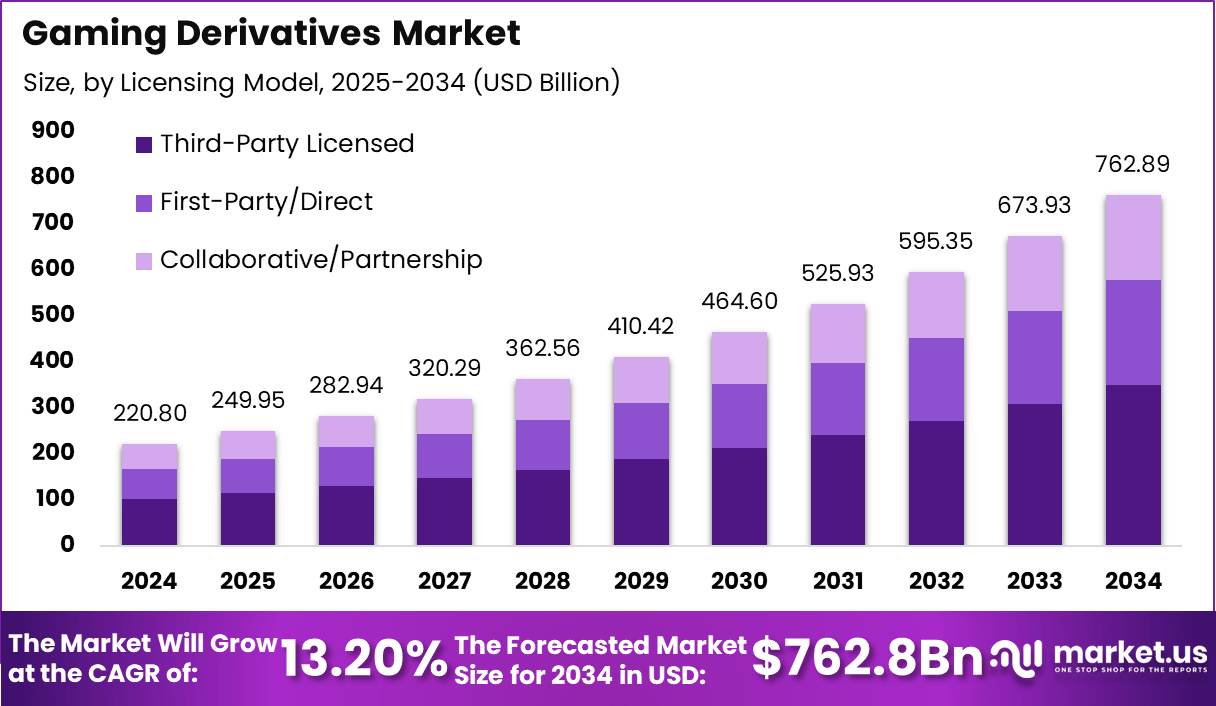

The global Gaming Derivatives Market is projected to surge from USD 220.8 billion in 2024 to USD 762.8 billion by 2034, expanding at a strong CAGR of 13.2%. Asia-Pacific dominates with a 45.1% share, contributing USD 99.85 billion in 2024. China alone generated USD 38.04 billion and is expected to reach USD 192.4 billion by 2034 at a remarkable CAGR of 17.6%. Rising digital participation, rapid monetization models, and expanding virtual asset ecosystems continue to accelerate industry momentum.

How Growth is Impacting the Economy

The rapid expansion of gaming derivatives is reshaping economic structures by driving new revenue streams, accelerating digital transactions, and fostering job creation across virtual asset trading, game development, and blockchain engineering. Higher consumer spending on digital goods supports tax revenues, while cross-border gaming activity contributes to foreign exchange inflows.

The increasing tokenization of gaming assets is stimulating financial innovation, encouraging new regulatory frameworks, and boosting fintech-gaming collaborations. Moreover, the integration of derivatives with esports and virtual economies strengthens digital commerce, supporting economic resilience and reducing dependency on traditional entertainment markets.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/gaming-derivatives-market/free-sample/

Impact on Global Businesses

Global businesses are witnessing rising operational costs due to increased demand for secure servers, blockchain integration, and compliance frameworks. Supply chain shifts toward cloud-native infrastructure have intensified investments in data centers and cybersecurity. Sector-specific impacts include fintech firms strengthening digital payment rails, entertainment companies expanding metaverse-based offerings, and telecoms accelerating high-speed connectivity rollouts. Retail and media sectors are also adapting through gamified commerce and token-based loyalty ecosystems.

Strategies for Businesses

Businesses should integrate blockchain-enabled asset tracking, strengthen cybersecurity investments, develop multi-platform gaming ecosystems, adopt dynamic monetization models, and forge cross-industry partnerships. Enhancing cloud scalability, enabling faster payment settlements, and focusing on user-centric engagement mechanics will further strengthen competitiveness.

Key Takeaways

- Strong CAGR of 13.2% from 2024–2034

- Asia-Pacific leads with 45.1% share

- China projected to reach USD 192.4 billion by 2034

- Expanding digital asset trading drives innovation

- Cloud, fintech, and telecom sectors gain the maximum uplift

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163496

Analyst Viewpoint

The present Gaming Derivatives Market shows strong digital momentum fueled by rising participation in virtual assets, metaverse applications, and esports platforms. Continuous investment in blockchain-based asset systems and high-speed networks enhances market depth. Future prospects remain positive as tokenization, cross-platform trading, and AI-driven personalization reshape revenue models. Strong Asia-Pacific dominance and China’s accelerating CAGR reinforce long-term scalability and innovation potential.

Use Case & Growth Factors

| Category | Details |

|---|---|

| Use Cases | Surge in digital participation, expansion of blockchain ecosystems, rising esports viewership, and scalable cloud infrastructure |

| Growth Factors | Surge in digital participation, expansion of blockchain ecosystems, rising esports viewership, scalable cloud infrastructure |

Regional Analysis

Asia-Pacific remains the leading region with 45.1% market share and strong digital adoption supported by China’s accelerating growth trajectory. North America shows robust expansion driven by advanced gaming infrastructure, early blockchain adoption, and strong developer ecosystems. Europe experiences steady growth supported by regulatory clarity and cross-border esports engagement. Emerging markets in Latin America and the Middle East are witnessing rising mobile-first gaming penetration, contributing to future market diversification.

➤ Want more market wisdom? Browse reports –

Business Opportunities

Expanding virtual asset marketplaces, cross-platform gaming ecosystems, and real-time derivatives trading models create strong opportunities for technology developers and investors. The rise of decentralized gaming finance (GameFi), esports monetization, and tokenization of in-game assets presents avenues for new revenue generation. Companies focusing on scalable cloud infrastructure, AI-driven personalization, and mobile-first game environments are well-positioned to leverage future demand.

Key Segmentation

The market is segmented into gaming asset derivatives, esports-linked derivatives, platform-based financial instruments, and metaverse-driven digital derivatives. Each segment caters to virtual asset valuations, price speculation, risk-hedging models, and transaction-based revenue systems. Growth is strongest across blockchain-enabled models, where transparent pricing and decentralized ownership support high user adoption and long-term revenue scalability.

Key Player Analysis

Leading market participants focus on expanding their digital ecosystems, investing in blockchain infrastructure, and integrating real-time trading engines to improve user engagement. They prioritize developing secure derivative tools, enhancing metaverse experiences, strengthening cloud architecture, and enabling cross-platform interoperability. With rising competition, companies increasingly adopt user-centric monetization, global expansion strategies, and continuous innovation in digital asset management.

- Tencent Holdings Ltd.

- CME Group Inc.

- Eurex Frankfurt AG

- Intercontinental Exchange, Inc.

- Shanghai Futures Exchange

- Dalian Commodity Exchange

- Cboe Global Markets, Inc.

- China Financial Futures Exchange

- Hong Kong Exchanges and Clearing Limited

- Singapore Exchange Limited

- Zhengzhou Commodity Exchange

- Others

Recent Developments

- In 2024, major platforms expanded blockchain-powered derivative trading options.

- In early 2025, multiple providers announced AI-driven risk-assessment engines.

- In 2024, new regulatory guidelines improved transparency in virtual asset trading.

- In 2025, metaverse gaming firms introduced cross-border derivative settlements.

- In 2024, cloud service providers strengthened scalable infrastructure for gaming platforms.

Conclusion

The Gaming Derivatives Market is entering a high-growth era, driven by digital adoption, asset tokenization, and advanced infrastructure. With strong regional momentum and evolving business models, the industry is set for continued expansion and long-term value creation.