Table of Contents

Introduction

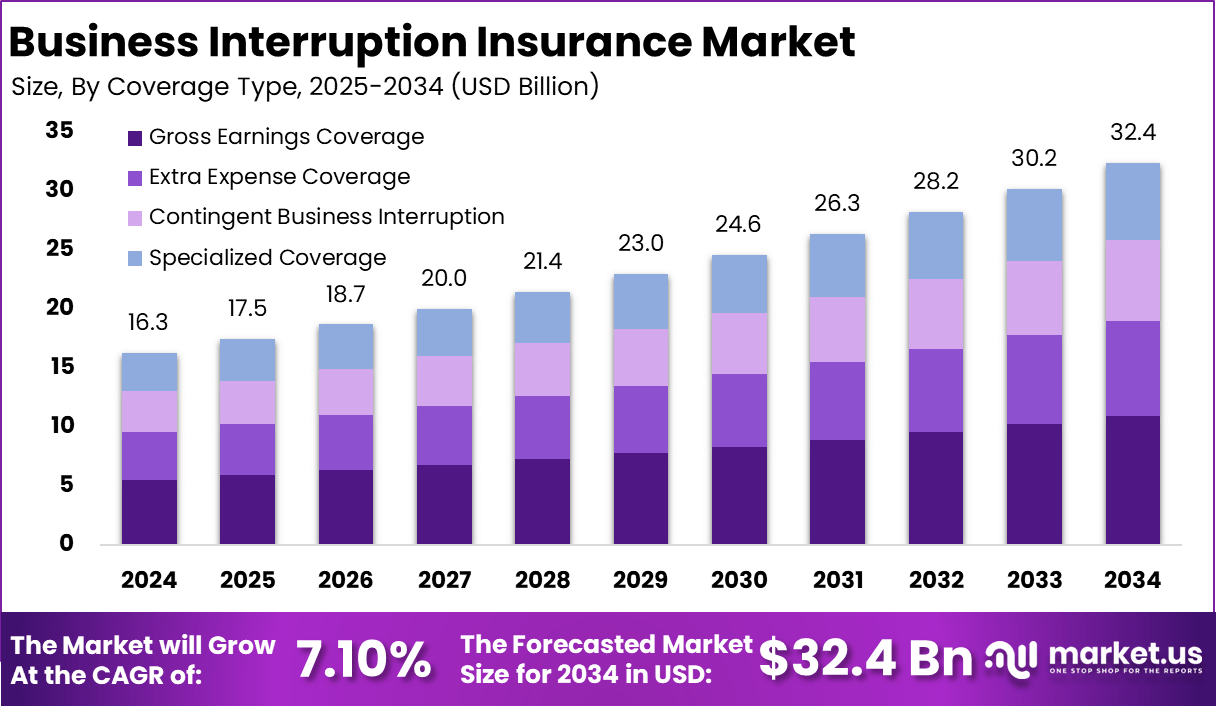

The Business Interruption Insurance Market is valued at USD 16.3 billion in 2024 and is expected to grow to USD 32.4 billion by 2034, reflecting a CAGR of 7.10%. North America holds the largest market share, at 36.7%, driven by high insurance penetration, greater risk awareness, and stringent business continuity requirements.

In 2024, the region’s market size is USD 5.98 billion, with the US leading at USD 2.39 billion, projected to reach USD 4.31 billion by 2034. This growth is fueled by increasing demand for protection against potential disruptions to business operations, highlighting the expanding role of business interruption coverage in risk management strategies.

How Growth is Impacting the Economy

The growth of the Business Interruption Insurance market is positively impacting the global economy by enhancing business resilience. As more companies opt for business interruption insurance, they are better prepared to manage financial losses due to unforeseen events, such as natural disasters, cyber-attacks, or pandemics. The increasing availability of insurance coverage fosters greater confidence in the business environment, encouraging investment, especially in high-risk sectors.

This market expansion is also contributing to the financial services sector’s growth, driving job creation and fostering innovation in insurance products. Furthermore, as businesses become more risk-aware, they can better withstand economic downturns, helping stabilize markets in times of crisis. Additionally, the increasing insurance penetration in emerging markets is expected to drive economic growth by providing small and medium-sized enterprises (SMEs) with a safety net to stay afloat during disruptions, leading to overall economic stability and sustainable growth.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/business-interruption-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The expansion of the Business Interruption Insurance market is contributing to rising premiums as insurers factor in the increased risk exposure across industries. Companies are experiencing higher insurance costs, which could lead to operational changes and shifts in pricing strategies. Supply chain disruptions also play a significant role in escalating demand for business interruption coverage. Companies operating in vulnerable regions or industries may find it difficult to secure affordable coverage due to higher perceived risks, pushing businesses to explore alternative solutions or adjust their business models accordingly.

Sector-Specific Impacts

Different sectors are experiencing varied impacts. In manufacturing, high operational costs and supply chain disruptions make insurance coverage essential to mitigate production downtime. Similarly, businesses in the retail sector, particularly e-commerce, face a higher risk of disruption from logistical challenges, requiring tailored insurance solutions. Financial institutions are leveraging business interruption insurance to safeguard their operations against potential market downturns, while the healthcare industry is increasingly using such policies to protect against unforeseen disruptions, ensuring the continuity of patient care.

Strategies for Businesses

- Evaluate risk exposure across the supply chain and adjust insurance coverage accordingly.

- Invest in technology to better predict potential disruptions and prevent business interruption.

- Explore partnerships with insurers to offer customized coverage packages for specific industries.

- Leverage government incentives and policies designed to support businesses during crises.

- Proactively plan for disaster recovery and business continuity to minimize downtime.

Key Takeaways

- The Business Interruption Insurance Market is projected to reach USD 32.4 billion by 2034.

- North America holds the largest market share (36.7%) in 2024.

- The US market size is expected to grow from USD 2.39 billion in 2024 to USD 4.31 billion by 2034.

- The market is growing at a CAGR of 7.10%.

- Increasing risk awareness and demand for business continuity plans are key drivers of market growth.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=168732

Analyst Viewpoint

Currently, the Business Interruption Insurance Market is undergoing rapid expansion, driven by rising global uncertainties and increased risk awareness. As businesses continue to adapt to evolving risk landscapes, the market is expected to grow at a steady pace. Looking forward, the demand for comprehensive business interruption coverage is projected to increase, with significant growth in emerging markets as companies recognize the importance of maintaining operational continuity during disruptions.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Supply Chain Protection | Increased disruption risks due to natural disasters and geopolitical issues |

| Cybersecurity Protection | Surge in cyber-attacks on businesses and e-commerce platforms |

| Manufacturing & Production Downtime | Business continuity strategies driving demand for insurance coverage |

| Emergency Services Continuity | Rising health crises and natural disasters leading to higher demand for uninterrupted services |

| Financial Institution Security | Increasing awareness among financial institutions about potential operational risks |

Regional Analysis

North America dominates the global Business Interruption Insurance Market, contributing a significant 36.7% market share in 2024. The market’s growth in the region is driven by high insurance penetration, strong risk management practices, and a well-developed regulatory environment. The US remains the most influential contributor to this market, and its projected growth from USD 2.39 billion in 2024 to USD 4.31 billion by 2034 at a CAGR of 6.07% reflects the region’s strong demand for business continuity solutions. Europe is expected to grow steadily, while the Asia-Pacific region presents significant growth opportunities due to increasing insurance awareness in emerging economies.

➤ Want more market wisdom? Browse reports –

- Banking Mini Apps Platform Market

- Trade Lifecycle Management Market

- In-House Banking Platforms Market

- Robotic Pool Skimmer Market

Business Opportunities

As the Business Interruption Insurance market grows, new opportunities are emerging for insurers to offer customized solutions to diverse industries, especially in the wake of the COVID-19 pandemic. There is increasing demand for coverage tailored to specific business types, particularly in manufacturing, retail, and healthcare sectors. Additionally, the expansion of the market in emerging economies presents an opportunity for insurers to introduce new products to address the unique risks of SMEs. Technological advancements in risk management tools, data analytics, and disaster recovery planning will further drive demand for comprehensive insurance solutions.

Key Segmentation

- By Type: Property Damage Insurance, Revenue Loss Insurance, Combined Policies

- By End-User: Small and Medium Enterprises (SMEs), Large Enterprises, Financial Institutions, Healthcare Providers

- By Region: North America, Europe, Asia-Pacific, Middle East & Africa, Latin America

- By Industry: Manufacturing, Retail, Healthcare, IT & Telecom, Financial Services

Key Player Analysis

The Business Interruption Insurance Market includes major players that provide customized coverage options across industries. These players are focusing on expanding their digital capabilities and offering flexible products that cater to the specific needs of businesses. Insurers are adopting new technologies to improve risk assessment processes and provide more accurate premium pricing. Collaboration with tech firms is becoming essential to enhance disaster recovery planning and offer seamless insurance solutions. As demand for more personalized insurance grows, these players are investing in R&D to innovate and stay ahead of industry trends.

- Allianz SE

- Zurich Insurance Group

- Chubb

- AXA XL

- AIG

- Liberty Mutual

- Travelers

- Nationwide

- The Hartford

- Berkshire Hathaway

- FM Global

- Swiss Re

- Munich Re

- Hiscox

- Markel

- Others

Recent Developments

- January 2024: A global insurance provider launched a tailored business interruption insurance product designed specifically for e-commerce businesses.

- April 2024: A major insurer introduced a digital platform for real-time claims processing, improving efficiency and reducing downtime for policyholders.

- June 2024: New regulations were introduced in the US, making business interruption coverage mandatory for certain high-risk industries.

- September 2024: A leading insurer expanded its offerings in the Asia-Pacific region, targeting SMEs with affordable business interruption insurance products.

- November 2024: A European insurer developed an AI-powered tool for risk assessment, helping businesses better understand their vulnerabilities and insurance needs.

Conclusion

The Business Interruption Insurance Market is set to grow significantly, driven by increasing demand for business continuity solutions. Companies that embrace customized coverage options and leverage technology will be well-positioned to benefit from this market’s expansion. As global uncertainties continue, businesses will increasingly turn to insurance to safeguard against unexpected disruptions.