Table of Contents

Introduction

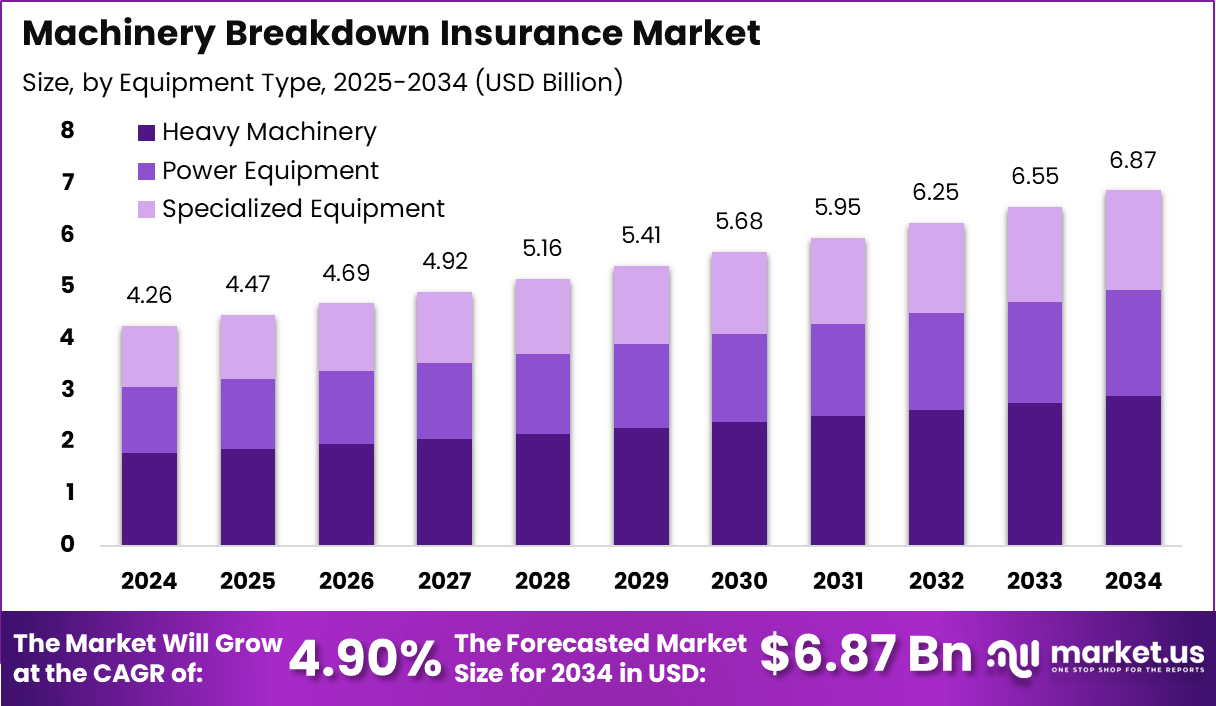

The Machinery Breakdown Insurance Market is valued at USD 4.26 billion in 2024 and is projected to grow to USD 6.87 billion by 2034, reflecting a CAGR of 4.90%. North America holds the largest market share, accounting for 38.5%, driven by advanced industrial infrastructure, equipment modernization, and heightened awareness of risk management. In 2024, North America’s market size stands at USD 1.64 billion, with the US contributing USD 1.48 billion. This growth is underpinned by the increasing adoption of advanced manufacturing systems, energy-intensive industries, and the rising importance of operational reliability and automation in industrial sectors.

How Growth is Impacting the Economy

The steady growth of the Machinery Breakdown Insurance market is having a positive impact on the global economy by enhancing the stability of key industries that rely on heavy machinery and equipment. As industrial sectors become increasingly reliant on complex systems and automation, the demand for machinery breakdown insurance is rising. This enables businesses to continue operations smoothly in case of unexpected failures, reducing downtime and mitigating the risk of financial loss.

The market expansion encourages manufacturers to modernize their equipment, boosting demand for technology solutions and creating a ripple effect across the supply chain. As more industries, from energy to manufacturing, invest in insurance to protect their assets, the broader economic environment becomes more resilient to disruptions. Moreover, as insurance penetration rises in emerging markets, businesses in these regions can better manage operational risks, supporting long-term economic development and industrial growth.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/machinery-breakdown-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The increasing demand for machinery breakdown insurance is contributing to rising premiums as insurers account for the higher risks associated with industrial operations. The escalation of operational costs is particularly noticeable in asset-heavy sectors, where machinery downtime can result in significant revenue losses. Additionally, the rising cost of equipment, coupled with the need for advanced maintenance, is pushing businesses to allocate larger portions of their budgets to insurance coverage. Supply chain shifts are also occurring as businesses move towards more automation and sophisticated machinery, further driving the need for protective insurance.

Sector-Specific Impacts

In sectors like manufacturing, mining, and energy, where machinery plays a pivotal role, the demand for insurance solutions is critical to mitigate risks from equipment failure. For the energy sector, particularly in oil and gas, machinery breakdowns can halt production, leading to costly downtimes. Similarly, in manufacturing and automotive industries, machinery breakdown insurance is essential for minimizing disruptions that can affect the supply chain, production timelines, and revenue. The increasing reliance on industrial automation also creates more complex systems that require robust insurance solutions.

Strategies for Businesses

- Invest in preventative maintenance to reduce the frequency and severity of machinery breakdowns.

- Adopt advanced technologies for real-time monitoring and predictive maintenance, enabling proactive issue resolution.

- Collaborate with insurers to tailor insurance policies that meet specific operational needs and risks.

- Explore bundled insurance packages that combine machinery breakdown coverage with other types of industrial insurance.

- Implement robust risk management frameworks to optimize operations and minimize insurance costs over time.

Key Takeaways

- The Machinery Breakdown Insurance Market is expected to grow from USD 4.26 billion in 2024 to USD 6.87 billion by 2034.

- North America holds a dominant market share of 38.5%, driven by mature industrial infrastructure and equipment modernization.

- The US market is projected to grow at a 3.96% CAGR, reaching USD 2.18 billion by 2034.

- Increasing adoption of advanced manufacturing systems and industrial automation is a key driver.

- Asset-heavy sectors, including energy and manufacturing, contribute significantly to market growth.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=168587

Analyst Viewpoint

Currently, the Machinery Breakdown Insurance market is experiencing moderate growth, driven by the increasing adoption of automation and advanced manufacturing technologies. In the future, the market is expected to expand significantly as industries worldwide continue to prioritize equipment reliability and risk management. The growing trend of industrial automation and the need for continuous operation in critical sectors will fuel the demand for specialized insurance products.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Manufacturing Industry | Increased automation and reliance on complex machinery |

| Energy Sector | Higher equipment risk exposure and operational uptime |

| Automotive Industry | Growing reliance on machinery and production systems |

| Mining and Heavy Equipment Operations | Increased need for downtime protection and cost management |

| Industrial Automation | Rise in predictive maintenance technologies and system reliability |

Regional Analysis

North America is expected to maintain its leadership in the Machinery Breakdown Insurance Market, driven by its established industrial base and high levels of machinery adoption. The region’s mature infrastructure and robust industrial standards lead to a strong demand for machinery breakdown coverage.

The US, with its large asset-heavy sectors and expanding industrial automation, contributes significantly to this growth. In the coming years, markets in Europe and the Asia-Pacific are expected to experience steady growth, as these regions modernize their manufacturing processes and adopt advanced technology solutions to mitigate equipment failure risks.

➤ Want more market wisdom? Browse reports –

- Property Damage Insurance Market

- Threat Deception Platform Market

- Subscription Scanning Market

- Browser Security Platform Market

Business Opportunities

The growing Machinery Breakdown Insurance market presents significant opportunities for insurers to expand their product offerings to cater to different industrial sectors. As businesses increasingly automate their operations and invest in advanced machinery, the demand for comprehensive coverage is expected to rise.

Additionally, insurers can collaborate with technology providers to offer bundled solutions that include real-time monitoring and predictive maintenance features. Emerging markets also present opportunities for insurers to develop tailored products for small and medium-sized enterprises (SMEs) that are increasingly investing in modern machinery but may lack sufficient coverage options.

Key Segmentation

- By Type: Equipment Breakdown Insurance, Operational Downtime Coverage, Comprehensive Insurance Packages

- By End-User: Manufacturing, Energy, Automotive, Mining, Industrial Automation

- By Region: North America, Europe, Asia-Pacific, Middle East & Africa, Latin America

- By Coverage: Single-Equipment Coverage, Multi-Equipment Coverage, Customizable Plans

Key Player Analysis

The Machinery Breakdown Insurance market includes a range of key players that offer a variety of coverage options for industries such as manufacturing, energy, and automotive. These players are focusing on customizing policies to meet the unique needs of asset-heavy industries.

By leveraging data analytics and predictive technologies, insurers are enhancing their ability to assess risk and offer more accurate premiums. As industrial automation continues to grow, these players are expected to expand their coverage options, providing businesses with greater flexibility in managing operational risks.

- Allianz SE

- Zurich Insurance Group

- Chubb

- AXA XL

- AIG

- Liberty Mutual

- Travelers

- FM Global

- Hartford Steam Boiler (HSB)

- Berkshire Hathaway

- Swiss Re

- Munich Re

- Sompo International

- Markel

- QBE Insurance

- Others

Recent Developments

- January 2024: An insurance provider launched a new policy designed specifically for manufacturing businesses to cover machinery breakdown and supply chain disruptions.

- April 2024: A major insurer expanded its machinery breakdown offerings to include real-time monitoring services for energy-sector equipment.

- June 2024: A global insurer introduced a customizable breakdown coverage package for small and medium-sized enterprises (SMEs) in the automotive sector.

- September 2024: A new partnership between an insurer and a technology firm was formed to develop predictive maintenance tools integrated with insurance coverage for industrial clients.

- November 2024: A leading insurer rolled out a policy combining machinery breakdown coverage with cyber risk insurance for companies in high-tech industries.

Conclusion

The Machinery Breakdown Insurance market is poised for steady growth, driven by industrial automation, increasing machinery reliance, and risk management priorities. As businesses focus on operational reliability, the demand for specialized coverage will rise, offering opportunities for insurers to tailor products to meet evolving market needs.