Table of Contents

Introduction

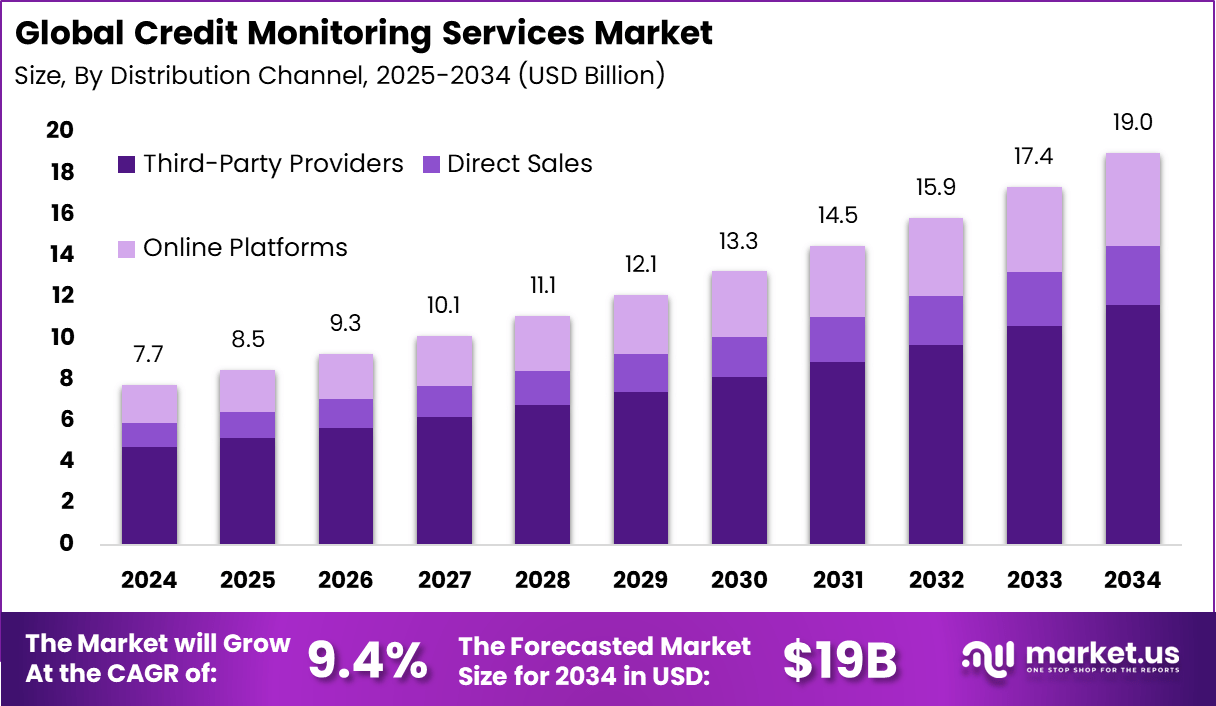

The Global Credit Monitoring Services Market is projected to grow from USD 7.7 billion in 2024 to approximately USD 19 billion by 2034, reflecting a robust CAGR of 9.4%. North America currently dominates the market, capturing 56.7% of the total share, with a market value of USD 4.3 billion in 2024. This growth is driven by increasing consumer awareness of credit health, rising identity theft concerns, and the growing adoption of digital financial tools. As individuals and businesses seek ways to manage and protect their credit profiles, credit monitoring services have become integral to personal finance management and risk mitigation strategies.

How Growth is Impacting the Economy

The expansion of the Credit Monitoring Services market is positively influencing the economy by promoting financial literacy and credit awareness among consumers. As individuals gain better control over their credit scores and personal finances, they are more likely to make informed financial decisions, contributing to overall economic stability. This growth is also helping to reduce the risk of identity theft and fraud, further enhancing financial security across sectors.

The rise of digital platforms and the integration of AI and machine learning into credit monitoring services are creating new jobs and opportunities in the tech and finance industries. Additionally, the growing awareness of credit health is driving demand for related services such as financial advising, lending, and insurance, further boosting economic activity in financial services. As more consumers and businesses adopt credit monitoring solutions, there is an increase in demand for advanced technologies, resulting in investment in fintech startups and innovation within the financial sector.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/credit-monitoring-services-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The growth in the Credit Monitoring Services market has led to a surge in demand for enhanced security features, driving up operational costs for providers. Companies are investing heavily in technology to meet consumer demands for advanced fraud detection and real-time credit score monitoring. This increase in operational costs is also influencing supply chain dynamics, especially in the tech sector, where data storage, cybersecurity, and AI-driven solutions are in high demand. As businesses face rising costs, they must balance investments in technology with maintaining affordability for consumers.

Sector-Specific Impacts

The financial services sector has experienced the most significant impact, with banks and credit bureaus increasingly partnering with credit monitoring firms to offer bundled services. The insurance sector also benefits from the rise in credit monitoring services, as it helps insurers assess risk more accurately. For e-commerce and retail businesses, understanding consumers’ credit profiles has become crucial for offering targeted promotions and facilitating credit-based purchases. Moreover, as more individuals seek financial planning and advisory services, this has led to increased demand for credit health management tools, benefiting fintech companies that specialize in credit and financial management.

Strategies for Businesses

- Invest in advanced fraud detection and AI technologies to enhance credit monitoring services.

- Expand service offerings to include personalized credit improvement plans and identity theft protection.

- Partner with financial institutions to offer bundled credit monitoring and loan services.

- Leverage digital marketing strategies to raise awareness about the importance of credit monitoring.

- Focus on affordability and user-friendly interfaces to attract a wider consumer base, including underserved populations.

Key Takeaways

- The Credit Monitoring Services Market is projected to reach USD 19 billion by 2034, growing at a 9.4% CAGR.

- North America holds the dominant market share, accounting for 56.7% in 2024.

- The market growth is driven by increasing awareness of credit health and rising identity theft concerns.

- Demand for AI-driven solutions and real-time monitoring services is expected to fuel market expansion.

- The financial services, insurance, and e-commerce sectors are particularly impacted by this growth.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=168790

Analyst Viewpoint

Currently, the Credit Monitoring Services market is growing rapidly, driven by rising concerns over identity theft and the increasing need for financial security. In the future, this growth will be further bolstered by technological advancements such as AI and machine learning, making credit monitoring services more accurate and accessible. As more consumers become aware of the importance of managing their credit, demand will continue to rise, offering substantial growth opportunities for providers.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Personal Finance Management | Increased consumer awareness of credit health |

| Identity Theft Protection | Rising cybercrime and fraud incidents |

| Loan Application Assistance | Growing demand for credit score-based lending |

| Financial Advising | Increased demand for personalized financial services |

| Risk Assessment for Insurers | Need for accurate credit profiling for better underwriting |

Regional Analysis

North America leads the global Credit Monitoring Services market with a 56.7% market share in 2024, driven by advanced financial infrastructure, high consumer awareness, and regulatory support. The US, contributing USD 4.3 billion, is expected to continue dominating the market, with a projected increase to USD 6.8 billion by 2034. Europe is also experiencing growth, with increasing demand for credit monitoring services, particularly in the UK and Germany. Asia-Pacific is expected to witness the fastest growth due to the expanding middle class and rising digital finance adoption in emerging markets like India and China.

➤ Want more market wisdom? Browse reports –

- In-House Banking Platforms Market

- Robotic Pool Skimmer Market

- Property Damage Insurance Market

- Threat Deception Platform Market

Business Opportunities

The growing Credit Monitoring Services market presents a wealth of opportunities for businesses. Companies can develop partnerships with financial institutions and insurers to offer bundled services that combine credit monitoring with loans, insurance, and financial planning. There is also significant potential for fintech startups to innovate in areas like artificial intelligence, providing smarter and more personalized credit health management tools.

Additionally, expanding services to underserved markets, including developing economies, presents growth opportunities as more individuals become aware of the importance of credit management. Furthermore, there is a rising demand for credit monitoring apps and services tailored to businesses seeking to protect their corporate credit profiles.

Key Segmentation

- By Service Type: Credit Report Monitoring, Identity Theft Protection, Credit Score Tracking, Fraud Detection

- By End-User: Individual Consumers, Financial Institutions, E-commerce Platforms, Insurance Companies

- By Region: North America, Europe, Asia-Pacific, Middle East & Africa, Latin America

- By Technology: Artificial Intelligence, Machine Learning, Cloud-Based Solutions

Key Player Analysis

Key players in the Credit Monitoring Services market are focusing on expanding their service portfolios and enhancing the user experience. These players invest in technology to improve the accuracy of credit reports and fraud detection. Some companies are also integrating their services with financial institutions to offer a more comprehensive suite of solutions, enabling consumers to monitor and improve their credit profiles. In addition, partnerships with mobile app developers and e-commerce platforms are expanding the reach of credit monitoring services, making them more accessible to a broader audience.

- Experian

- Equifax

- CheckMyFile

- TransUnion

- Norton LifeLock

- IdentityForce

- PrivacyGuard

- Aura

- Zander

- ID Watchdog

- IdentityIQ

- Kroll

- Epiq

- McAfee

- Bitdefender

- CreditLadder

- Jovia Financial

- Nav

- Others

Recent Developments

- January 2024: A leading provider introduced a new AI-driven credit monitoring service for personalized credit score tracking.

- March 2024: A major fintech company launched a mobile app designed for real-time credit monitoring and identity theft protection.

- June 2024: An international insurer expanded its offerings by integrating credit monitoring services into its policy packages.

- September 2024: A startup introduced a machine learning-powered credit fraud detection tool, improving service accuracy.

- November 2024: A financial institution partnered with a credit monitoring company to offer bundled services for personal loans and financial planning.

Conclusion

The Credit Monitoring Services market is on a strong growth trajectory, driven by increased consumer awareness of credit health and identity theft protection. With ongoing technological advancements and growing demand for comprehensive financial management tools, this market offers promising opportunities for businesses to expand their offerings and enhance consumer access to credit health services.