Table of Contents

Introduction

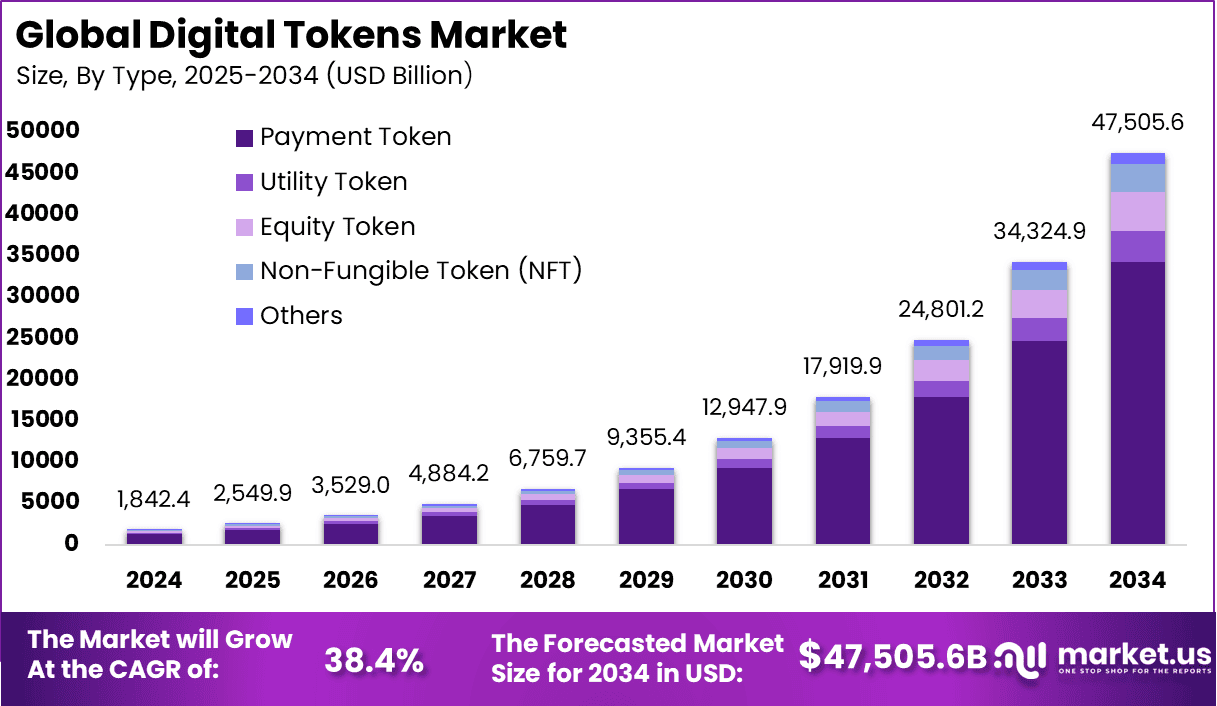

The Global Digital Tokens Market is experiencing strong expansion, having generated about USD 1,842.4 billion in 2024 and projected to grow from USD 2,549.9 billion in 2025 to approximately USD 47,505.6 billion by 2034 at a CAGR of 5.94%. In 2024, North America secured a leading role, accounting for more than 43.2% of global revenues, or around USD 795.9 billion, supported by deep capital markets, institutional participation, and advanced regulatory frameworks. This market momentum is reinforced by the broader digital asset ecosystem, where total crypto market capitalization nearly doubled in 2024 and peaked at roughly USD 3.9 trillion, while the number of cryptocurrency owners climbed above 560 million worldwide, representing close to 7% of the global population.

At the same time, trading volumes in leading stablecoins surpassed USD 23 trillion in 2024, rising about 90% year on year and signalling growing reliance on tokenized value transfer in both retail and institutional use cases. Together, these indicators suggest that digital tokens are moving from a niche speculative asset class toward a core component of modern financial infrastructure, underpinning payments, investment products, and real world asset tokenization on a global scale.

Key Takeaways

- Payment tokens account for about 72.1% of the market, showing that most users prefer digital assets mainly for everyday payments and transactions.

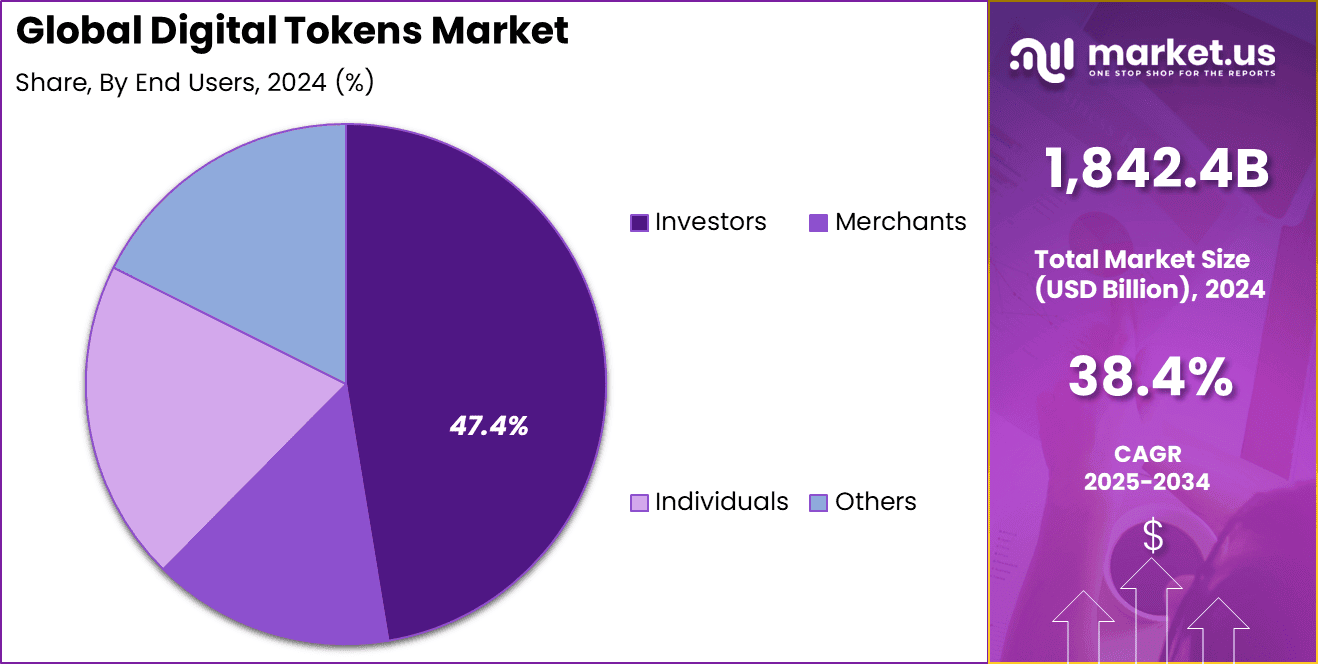

- Investors are estimated to account for nearly 47.4% of all end users, suggesting that digital tokens are widely seen as an alternative investment.

- Financial services account for around 42.7% of digital asset usage, driven by growing use in trading, settlements, and newer digital finance systems.

- North America accounts for roughly 43.2% of global market activity, helped by clearer rules and greater involvement from large financial institutions.

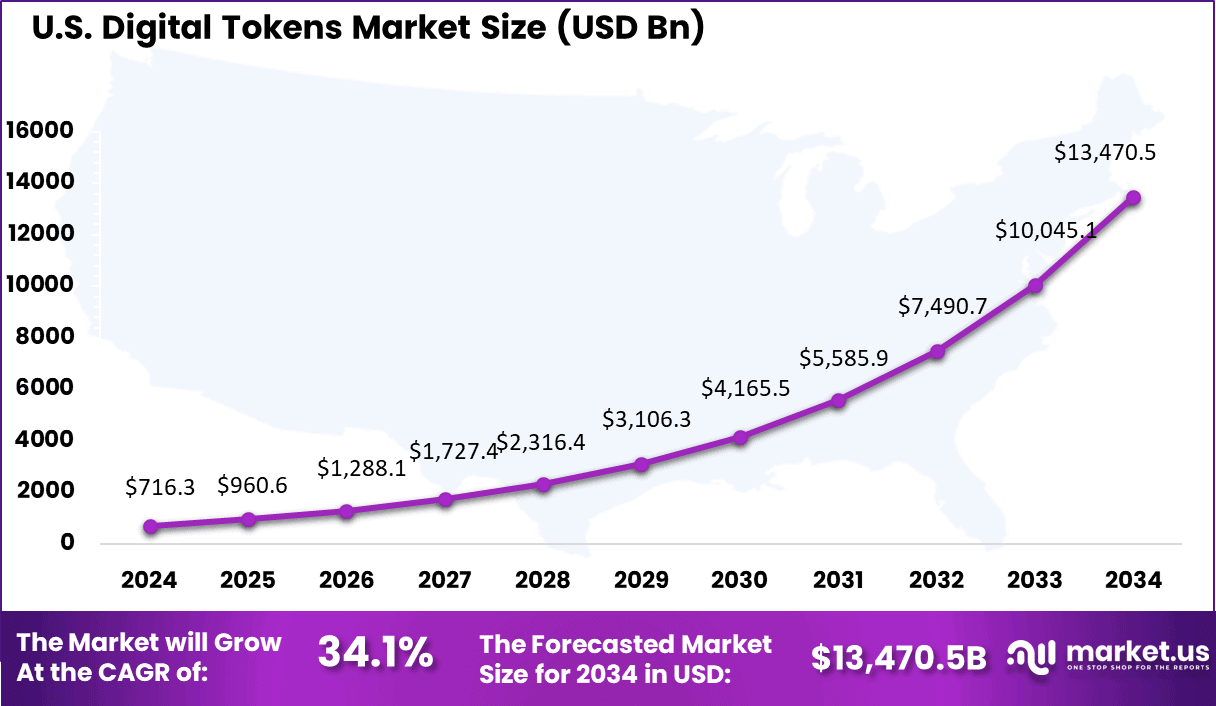

- The United States is leading global usage, as more consumers hold digital assets and more fintech solutions are being used for token-based payments.

- The overall market is reported to be growing at a compound annual growth rate of nearly 34.1%, indicating that digital tokens are being used more widely for payments, investments, and other financial applications.

- The total cryptocurrency market capitalisation reached about USD 3.89 trillion in October 2025, reflecting a strong 59.7% year-over-year increase in value.

- Daily global trading volume across all crypto assets is close to USD 329.17 billion, which shows that liquidity and active participation in these markets remain high.

- Global crypto ownership is estimated at around 562 million people in 2024, equal to about 6.8% of the world’s population, which is more than the combined populations of the European Union, the United States, and Japan.

- Bitcoin maintains a dominance rate of about 57%, confirming its position as the largest cryptocurrency by total market value.

- Ethereum holds around 12.6% market dominance and processed more than 1 million on chain transactions per day in August 2023, surpassing Bitcoin’s transaction count during that period.

- The total market capitalisation of stablecoins is around USD 313 billion, with Tether identified as the largest stablecoin, followed by USD Coin and Binance USD.

- Crypto assets remain highly volatile, as seen in May 2022 when Bitcoin declined by about 20% in one week and Ethereum fell by around 26%, which was a sharper fall than major stock indices.

- A study from 2020 reported that tokens listed on multiple exchanges delivered around 16% market adjusted returns within two weeks, along with stronger price movements, higher trading volume, and increased network usage.

- Tokenized assets were valued at about USD 0.4 trillion in 2023 and USD 0.6 trillion in 2024, with projections suggesting that this figure could rise to between USD 4 trillion and USD 5 trillion by 2030, indicating a rapid build up of tokenized value.

- Financial institutions are increasingly testing deposit tokens and launching tokenised funds, which signals deeper institutional participation in the tokenisation ecosystem.

- Tokenisation enables fractional ownership of high-value assets, such as real estate, allowing smaller and retail investors to access opportunities previously limited to large investors.

- Payment networks such as Visa use tokenisation to replace sensitive card details with secure tokens, enhancing the security of digital transactions.

- The payment tokenisation market was valued at around USD 3.32 billion in 2024 and is projected to reach nearly USD 12.83 billion by 2032, supported by an estimated compound annual growth rate of 18.3%.

Request Sample Report Before Purchasing: https://market.us/report/digital-tokens-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1,842.4 Bn |

| Forecast Revenue (2034) | USD 47,505.6 Bn |

| CAGR(2025-2034) | 38.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Type (Payment Token, Utility Token, Equity Token, Non-Fungible Token (NFT), Others), By End Users (Investors, Merchants, Individuals, Others), By Industry Vertical (Financial Services, Real Estate, Gaming, Supply Chain Management, Healthcare, Energy and Utilities, Others), |

| Regional Analysis | North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA |

| Competitive Landscape | Binance Holdings Ltd., Coinbase Global, Inc., Ripple Labs, Inc., Block, Inc., Circle Internet Financial, LLC, Payward, Inc., Gemini Trust Company, LLC, Bullish, Inc., Universal Navigation Inc., iFinex Inc., KuCoin Global, Tether Limited, ConsenSys Software Inc., Aux Cayes Fintech Co. Ltd., Others |

Segmentation Analysis

By Type

- Payment tokens maintained a dominant position in 2024, capturing 72.1% of the digital tokens market.

- Their strong lead was supported by higher usage in day to day transactions, where tokens are increasingly preferred for fast and secure digital payments.

- Growing adoption of cashless systems contributed to wider acceptance of these tokens across retail and online channels.

- The expansion of digital wallets and cross border payment tools resulted in significantly higher transaction values, often recorded in USD across global platforms.

By End-Users

- Investors represented 47.4% of all end users in 2024, which confirms that digital tokens were used mainly for investment-driven purposes rather than everyday transactions. This dominance shows that investors continue to treat tokens as a structured financial asset that can strengthen portfolio diversification.

- Global crypto market capitalization reached nearly USD 4.2 trillion, recording an increase of about 13% compared to its late 2024 peak. This higher valuation created a stronger environment for investor participation as asset strength and liquidity improved.

- Worldwide digital currency ownership grew to about 562 million people, equal to 6.8% of the global population. This broader user base indicates that investor participation rises as more individuals gain exposure to digital assets.

- Stablecoins exceeded USD 300 billion in circulating value, supported by around USD 3.1 trillion in average daily transactions. Their stability and high usage reinforced investor confidence because they offer a liquid and predictable entry point into the token economy.

- Daily global crypto trading volume averaged nearly USD 150 billion, enabling investors to adjust portfolios quickly during market shifts. This liquidity strengthened the perception of tokens as flexible instruments suited for tactical and long term investment strategies.

- The share of 47.4% held by investors highlights the strong preference for tokens as an asset that provides potential price appreciation, passive income options, and thematic exposure to blockchain innovation, all accessible with lower minimum capital requirements.

By Industry Vertical

- The financial services sector accounted for a dominant 42.7% share of the digital tokens market in 2024, indicating that most institutional activity continues to be concentrated in banking, payments, and investment platforms.

- Banking and fintech institutions increased the use of token based payment flows, contributing to higher settlement efficiency and lowering operational expenses, with many platforms reporting multi million USD reductions in yearly processing costs.

- Asset tokenization gained strong traction as regulated institutions adopted digital representations of bonds, funds, and real world assets, allowing fractional ownership that attracted new investor groups and supported additional liquidity exceeding USD 1 billion across selected tokenized products.

- The sector also expanded the use of digital securities, where token based settlement helped reduce clearing times from days to minutes, improving capital mobility and enhancing overall transaction reliability for high volume financial operations.

Key Market Segments

By Type

- Payment Token

- Utility Token

- Equity Token

- Non-Fungible Token (NFT)

- Others

By End Users

- Investors

- Merchants

- Individuals

- Others

By Industry Vertical

- Financial Services

- Real Estate

- Gaming

- Supply Chain Management

- Healthcare

- Energy and Utilities

- Others

US Digital Tokens Market Size

- The United States market has been valued at USD 716 billion, supported by a 34.1% CAGR, which illustrates the strong pace of expansion and sustained investor participation in digital tokens.

- Growth in the U.S. is reinforced by higher institutional involvement, gradual regulatory clarity, and rising consumer confidence in digital asset usage.

- Government backed pilots and blockchain focused programs are further strengthening the national environment for token adoption.

- North America maintains a leading 43.2% share of the global digital tokens market, supported by an advanced fintech ecosystem and stronger uptake of blockchain applications across industries.

- The region’s position is influenced by well defined regulatory structures, a broad institutional investor base, and the rapid integration of tokenization into conventional financial services.

Buy Complete Report At Discounted Rate: https://market.us/purchase-report/?report_id=161792

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top Key Players in the Market

- Binance Holdings Ltd.

- Coinbase Global, Inc.

- Ripple Labs, Inc.

- Block, Inc.

- Circle Internet Financial, LLC

- Payward, Inc.

- Gemini Trust Company, LLC

- Bullish, Inc.

- Universal Navigation Inc.

- iFinex Inc.

- KuCoin Global

- Tether Limited

- ConsenSys Software Inc.

- Aux Cayes Fintech Co. Ltd.

- Others

Role of AI in Digital Tokens Market

- Generative AI enhances market research and decision making in the digital tokens market by processing huge data flows from exchanges and blockchains. Around 562 million people, equal to about 6.8% of the world population, already own cryptocurrencies, which creates a very large stream of on-chain and trading data that AI models can analyze for token adoption patterns and investor behavior.

- AI strengthens trading strategies and liquidity in digital token markets by powering algorithmic and high-frequency trading. Various studies indicate that algorithmic trading accounts for roughly 60 to 75% of trading volume in major equity markets, while in India algorithms already drive about 60% of all trades, and globally algorithmic or high-frequency traders often contribute more than 50% of volume, which shows how AI-driven execution is becoming standard in electronic markets that also trade tokenized assets and crypto derivatives.

- AI improves risk management and market surveillance in digital tokens by monitoring large, volatile trading flows in real time. In October 2025 the overall crypto market recorded daily trading volumes of about USD 193 billion, while Bitcoin spot markets alone handled around USD 300 billion in trading during that month, and crypto futures and options on one major derivatives venue averaged USD 14.1 billion in notional volume per day in the third quarter of 2025, so AI systems are needed to detect wash trading, market manipulation, and abnormal liquidation cascades across such large flows.

- Generative AI supports token design, documentation, and smart contract development by helping teams draft white papers, audit reports, and code explanations more quickly. Financial institutions already spent about USD 35 billion on AI technologies in 2023, and many of these investments are being directed into areas such as automated code review, contract generation, and scenario testing that can reduce human error when launching or upgrading digital tokens and tokenized financial products.

- AI increases institutional participation in digital tokens because it is widely adopted inside banks, brokers, and asset managers that are entering this asset class. One central-bank survey in 2024 found that 75% of financial firms in a major market were already using AI, with a further 10% planning to adopt it, while another global survey showed about 76% of leading financial institutions are using or planning AI or machine learning and 94% expect AI usage to rise over the next three years, which means most organizations trading or issuing tokens will rely on AI across front, middle, and back-office functions.

- AI enhances investor analytics and personalization in digital token platforms by tailoring dashboards, research, and recommendations to individual users. Research on crypto adoption shows that global ownership grew by about 34% in a single year, from 420 million to 562 million holders, which creates a very diverse user base where AI models can segment behavior by geography, trading style, risk tolerance, and preferred token types to deliver more relevant investment insights and risk warnings.

- Generative AI plays a growing role in marketing, education, and community management for token projects through automated content creation and support. In wealth and banking sectors, one survey reported that 88% of finance leaders are already investing heavily in AI training for staff, and large institutions are deploying AI assistants to summarize documents, respond to client queries, and translate materials into multiple languages, which can be replicated in token platforms to educate millions of retail users and reduce operational workload.

- AI supports regulatory compliance and anti-money-laundering in digital token ecosystems by screening transactions and counterparties at scale. Central bank and international policy work has highlighted both the benefits and risks of AI in financial stability, noting that AI can enhance monitoring of complex networks of transactions but also brings model risk and data challenges, so supervisors and regulated token platforms are beginning to combine AI-driven anomaly detection with stricter human oversight to manage billions of on-chain movements more safely.

- AI improves the functioning of token-linked investment products such as exchange-traded funds and derivatives by tracking flows and adjusting strategies. For example, Bitcoin exchange-traded funds in the United States recorded about USD 1.21 billion of net inflows in a single day in 2025, which is the second-largest daily figure on record, and such concentrated flows can be monitored by AI systems that optimize hedging, liquidity management, and pricing for token issuers and market makers.

- Generative AI accelerates innovation cycles in the broader digital asset ecosystem by supporting research, simulation, and strategy testing. With cryptocurrency ownership already reaching 562 million people and algorithmic methods driving a majority of trading in many markets, AI models are increasingly used to stress-test new token designs, simulate network effects, and estimate the impact of different fee structures or governance rules, which can help both issuers and investors refine token economics before capital is committed.

Emerging Trends

Accelerating scale of digital tokens

In 2025, the broader digital asset ecosystem has reached significant scale, with the global cryptocurrency market capitalization standing at around USD 3.26 trillion. Stablecoins are settling approximately USD 475 billion in value every month in 2024, and more than 560 million people, or about 6.8% of the world’s population, hold some form of cryptocurrency. This depth of liquidity and user base forms the foundation on which the digital tokens market and its newer use cases such as real world asset tokenization and institutional products are expanding.

Real-world asset tokenization expanding rapidly

A key emerging trend is the tokenization of real world assets, where physical and financial instruments such as private credit, real estate, and government securities are converted into programmable digital tokens. The value of tokenized real world assets on public blockchains has already crossed roughly USD 18–30 billion, and some estimates indicate that the overall tokenized asset base, including stablecoins, is around USD 331 billion in 2025. Within this context, the specific market segment described has grown by over 260% in the first half of 2025, supported by institutional pilots in tokenized government bonds and private credit funds. The appeal lies in better liquidity, fractional ownership of high value assets, and faster cross border settlement compared with traditional infrastructure.

Liquidity, fractional ownership, and faster settlements as structural shifts

Tokenization is reshaping how assets are held and traded by enabling fractional units that can be purchased in smaller ticket sizes, improving access for a wider pool of investors. Liquidity is strengthened because tokenized instruments can trade on a near continuous basis, rather than only within limited market hours. Settlement times that previously took two or more days are reduced to near real time, which allows working capital to be freed sooner and reduces counterparty risk. These characteristics are important for institutional portfolios that seek both yield and operational efficiency when allocating capital to tokenized credit, real estate, or trade finance.

AI powered compliance automation in token platforms

Another notable trend is the use of AI to automate compliance functions within tokenization platforms. Around 49% of institutional investors identify regulatory uncertainty as a principal barrier to scaling digital tokens, particularly for cross border products that must meet several local and international rules at once. AI systems are increasingly used to streamline KYC and AML checks, monitor transactions in real time, and pre screen counterparties for sanctions or adverse media risks. Automated review of smart contracts is also being introduced to detect potential vulnerabilities before issuance. This reduces legal and compliance costs, shortens onboarding times, and makes it easier for platforms to launch multi jurisdictional token offerings while maintaining regulatory standards.

Platform providers dominating market structure

Industry assessments indicate that platforms offering tokenization and lifecycle management solutions account for nearly 79% of the digital tokens market. These platforms handle the creation, issuance, trading, and custody of tokenized assets for banks, asset managers, and fintech firms. Their dominance reflects demand for end to end infrastructure that can integrate smart contract logic, investor onboarding, secondary market connectivity, and secure settlement into a unified environment. As a result, many institutions prefer to partner with such platforms instead of building tokenization stacks internally, which further concentrates volume in technology providers that can demonstrate security, regulatory alignment, and scalability.

Institutional allocations to digital assets rising

Institutional demand has become one of the strongest growth drivers for digital tokens. More than 75% of surveyed institutional investors indicate that they intend to increase allocations to digital assets in 2025, with a focus on both liquid crypto tokens and regulated tokenized instruments. This shift is supported by the maturation of custody solutions, clearer guidance in several jurisdictions, and the perception that tokenized products can offer competitive yield or diversification relative to traditional fixed income and alternative assets. As more pension funds, insurers, and asset managers move beyond experimental allocations, their activity supports deeper liquidity and broader acceptance of tokenized structures.

Stablecoins as a bridge for yield and transactions

Stablecoins are becoming a central component in the digital tokens landscape. About 84% of firms report that they either already use or are interested in using stablecoins to support yield strategies and everyday transactions. Stablecoins settled around USD 5.7 trillion in value during 2024, which is roughly USD 475 billion per month and puts them in a similar range to some large traditional card networks. At the same time, roughly 76% of institutions plan to allocate capital to tokenized assets by 2026 as part of portfolio diversification. This combined use of stablecoins for liquidity and tokenized assets for yield is reinforcing the role of digital tokens in both treasury operations and long term investment strategies.

Institutional momentum reinforcing market legitimacy

The high levels of institutional engagement and the growing volume of regulated token issuance are helping to strengthen the perceived legitimacy of digital tokens. With over 560 million global crypto owners and digital asset markets now comparable in size to several large traditional asset classes, regulators and policymakers are giving more structured attention to tokenization frameworks. This regulatory focus, combined with AI enabled compliance automation and the strong presence of specialized tokenization platforms, is creating conditions in which digital tokens are increasingly viewed as a durable part of global capital markets rather than a short term experiment.