Table of Contents

Introduction

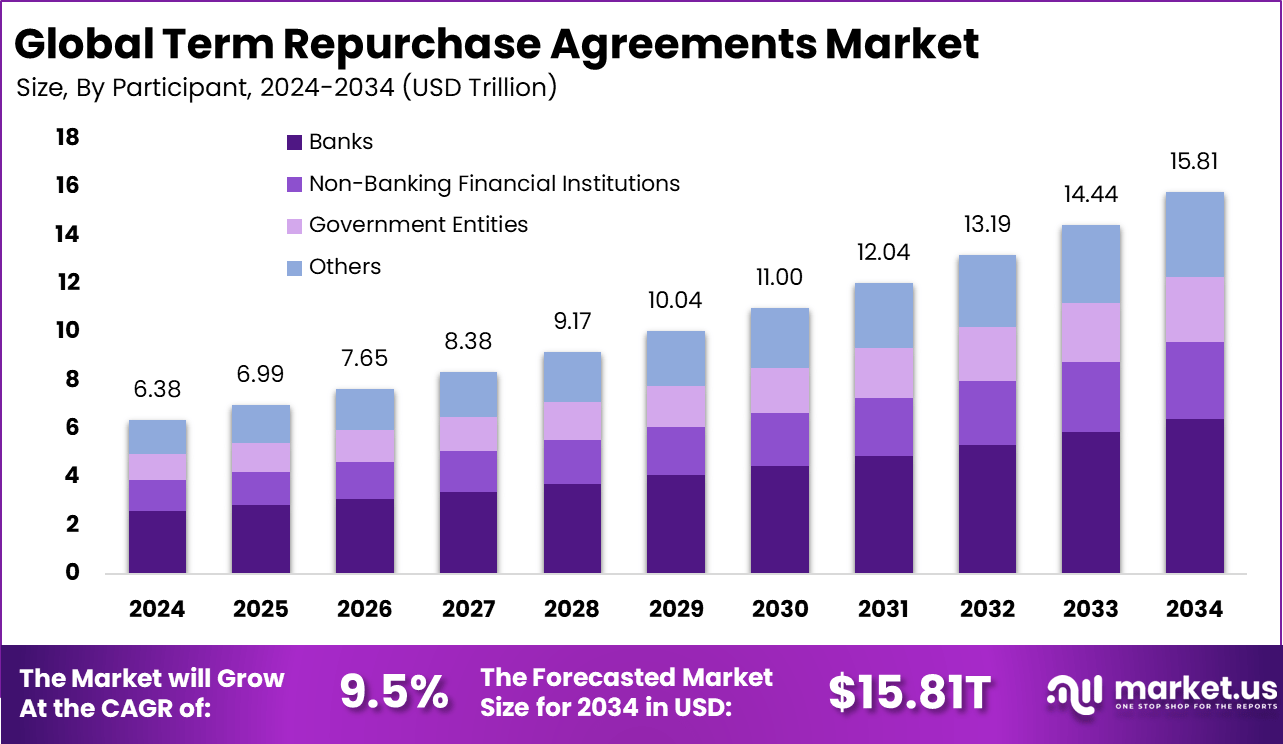

The Global Term Repurchase Agreements (Repo) Market is projected to grow from USD 6.38 trillion in 2024 to USD 15.81 trillion by 2034, at a CAGR of 9.5%. In 2024, North America held a dominant position with 34.5% market share, accounting for USD 2.20 trillion in revenue. The repo market, where short-term borrowing and lending occur with securities as collateral, plays a crucial role in liquidity management for financial institutions. The growth in this market reflects the increasing need for secure, flexible, and efficient capital management solutions, supporting both government and corporate financing needs.

How Growth is Impacting the Economy

The significant growth in the term repurchase agreements market is positively influencing the global economy by improving financial liquidity and market efficiency. The repo market is a cornerstone for the banking sector, providing low-cost, short-term financing for banks, investment firms, and central banks. As the market expands, it enhances the stability of financial institutions by providing easier access to short-term capital, fostering economic growth.

With more institutions utilizing repo transactions, market confidence is strengthened. Furthermore, as global regulatory frameworks around capital management evolve, the increased reliance on repo agreements helps mitigate systemic risks. This growth also supports broader financial markets by providing a secure avenue for monetary policy implementation, particularly during times of economic uncertainty. It enables the effective management of government debt and offers critical support for risk-averse investors, which strengthens economic resilience.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/term-repurchase-agreements-market/free-sample/

Impact on Global Businesses

As the term repo market grows, global businesses are increasingly relying on repurchase agreements for liquidity management, helping to mitigate the effects of rising costs and shifting supply chains. In the face of inflation and supply chain disruptions, businesses are using repo agreements to secure short-term capital, allowing them to meet immediate financial obligations without the need for long-term borrowing.

The financial sector, particularly banks and asset management firms, benefits greatly from the repo market’s liquidity, while industries like real estate, automotive, and energy leverage repo agreements to manage working capital and investment needs.

In times of economic instability, businesses can secure low-interest, short-term loans, providing them the flexibility needed to navigate fluctuating supply chain dynamics. Repo transactions also help businesses reduce financial risk by using high-quality collateral, which enhances investor confidence and minimizes exposure to volatile markets.

Strategies for Businesses

To maximize the benefits of the growing term repo market, businesses must adopt strategic approaches to liquidity management. This includes utilizing repurchase agreements as a key tool for short-term funding, especially during periods of financial uncertainty. Financial institutions should leverage technology to improve the efficiency and transparency of repo transactions, reducing the risks associated with counterparty defaults and enhancing collateral management.

Companies can also diversify their portfolio by engaging in repos with various counterparties, improving their access to capital across different sectors. Businesses should also be proactive in understanding evolving regulatory frameworks related to repos, as these could affect their ability to execute transactions efficiently. Additionally, firms must prioritize maintaining high-quality collateral to ensure favorable repo terms and minimize borrowing costs.

Key Takeaways

- The term repo market is expected to grow from USD 6.38 trillion in 2024 to USD 15.81 trillion by 2034, at a CAGR of 9.5%.

- North America leads the market with 34.5% market share, representing USD 2.20 trillion in 2024.

- Repo agreements provide a cost-effective and flexible way for businesses to manage short-term liquidity.

- Growth is driven by increasing demand for short-term financing, regulatory changes, and the need for efficient capital management.

- Key sectors impacted include banking, asset management, real estate, and energy.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=169016

Analyst Viewpoint

The term repurchase agreements market is currently benefiting from increasing demand for short-term financing and improved liquidity solutions. As financial markets evolve, the repo market will continue to grow, driven by regulatory changes, advancements in technology, and the increasing need for flexible capital management.

In the future, the market is expected to expand further, driven by the continued adoption of repos as an essential financial tool by governments, banks, and corporations. Technological advancements in blockchain and digital currency are also likely to revolutionize repo transactions, increasing transparency and efficiency. The future of the repo market looks promising, with robust growth expected in both developed and emerging markets.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Short-Term Financing | Increasing demand for low-cost, secure funding |

| Capital Management | Efficient management of liquidity and working capital |

| Government Debt Management | Repo agreements used to manage public sector debt |

| Financial Market Stability | Enhancing liquidity and reducing systemic risks |

| Investment Firms | Leverage repos for secure, short-term capital access |

Regional Analysis

North America holds a dominant market share of 34.5%, valued at USD 2.20 trillion in 2024. The region’s well-established financial infrastructure and regulatory environment have facilitated the growth of the term repo market. Europe follows closely, driven by increasing financial market activity and stringent regulatory requirements.

The Asia Pacific region is anticipated to experience the fastest growth due to the rise in financial services and increased demand for short-term funding in emerging economies. Repo market growth in these regions is attributed to expanding financial markets, growing capital needs, and increased adoption of digital technologies in financial transactions.

➤ Want more market wisdom? Browse reports –

- Property Damage Insurance Market

- Threat Deception Platform Market

- Subscription Scanning Market

- Browser Security Platform Market

Business Opportunities

The growing term repo market presents various opportunities for financial institutions, particularly in providing liquidity solutions to businesses across different sectors. Banks and asset management firms can expand their repo offerings, targeting government and corporate clients who require flexible capital management solutions.

Furthermore, as the market grows, opportunities for technological innovation arise, particularly in enhancing collateral management, improving transaction speed, and reducing operational risks. Emerging economies in the Asia Pacific region provide a key growth area, as businesses in these markets increasingly turn to repurchase agreements for short-term financing solutions. Additionally, financial service providers can create specialized repo products for various industries, such as real estate, energy, and banking.

Key Segmentation

The term repo market can be segmented into:

- By Product Type: Government securities, corporate bonds, asset-backed securities

- By Transaction Type: Overnight repos, term repos

- By End-User: Banks, investment firms, hedge funds, government institutions

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

These segments drive the market by providing tailored solutions for different financial and liquidity needs, contributing to the rapid market expansion.

Key Player Analysis

Key players in the term repo market are focusing on increasing transparency, improving the speed and efficiency of transactions, and expanding their portfolio of repo products. By adopting advanced technologies, such as blockchain and AI, financial institutions can improve collateral management, reduce risks, and enhance market liquidity.

Companies are also expanding their offerings to include a range of securities and repo transaction types, catering to various industries and financial needs. Strategic partnerships and acquisitions are allowing players to strengthen their market presence and provide more flexible, scalable repo solutions.

- J.P. Morgan

- Goldman Sachs

- Bank of America

- Citigroup

- Morgan Stanley

- Barclays

- Deutsche Bank

- UBS

- Credit Suisse

- BNP Paribas

- HSBC

- Societe Generale

- Wells Fargo

- Nomura Holdings

- Mizuho Financial Group

- Sumitomo Mitsui Banking Corporation (SMBC)

- Royal Bank of Canada (RBC)

- ING Group

- State Street Corporation

- BNY Mellon

- Others

Recent Developments

- January 2025: A leading financial institution launched a blockchain-based repo platform to improve transparency and transaction speed.

- February 2025: A major bank introduced a new repo service targeting emerging market governments for short-term funding needs.

- March 2025: A global investment firm expanded its repo offerings with a focus on asset-backed securities and green bonds.

- April 2025: A new regulatory framework for repos was introduced in the EU to enhance liquidity management and reduce systemic risks.

- May 2025: A major repo market participant announced a partnership to provide digital collateral management solutions.

Conclusion

The repurchase agreements market is witnessing significant growth, driven by the increasing demand for short-term financing, liquidity management, and secure capital solutions. As the market continues to evolve, businesses and financial institutions will benefit from new opportunities, innovations, and efficient financial tools that strengthen global markets.