Table of Contents

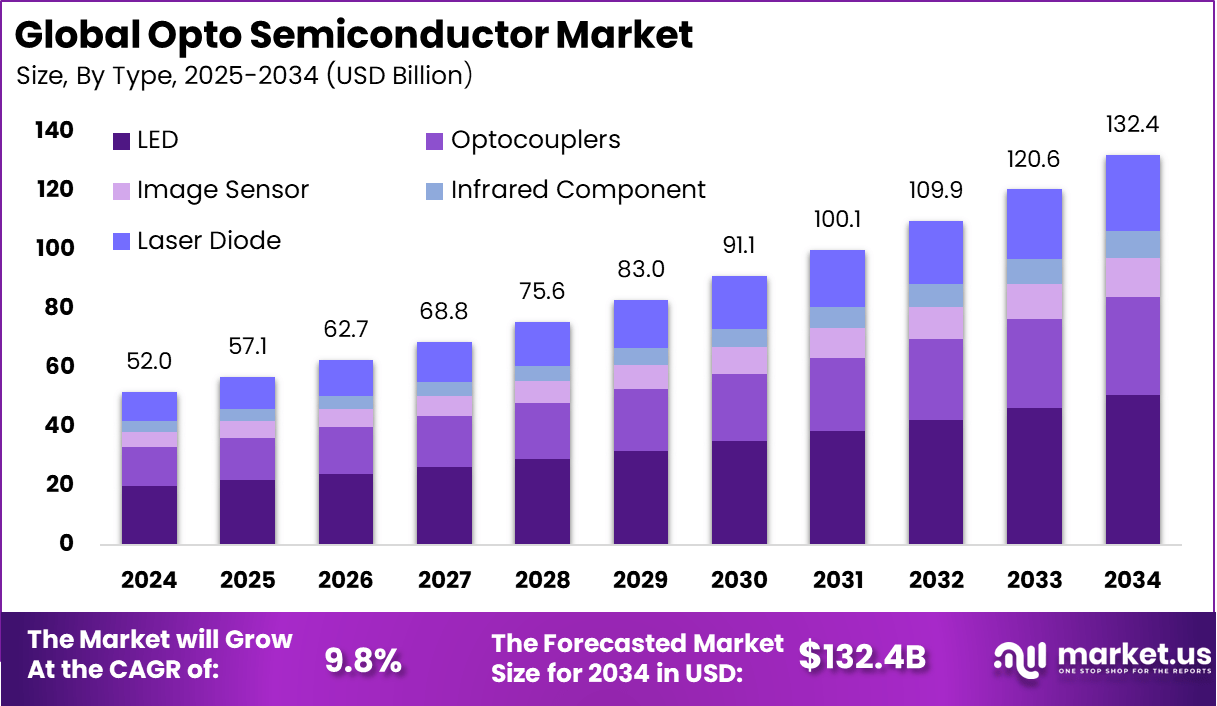

New York, NY – December, 2025: The global opto semiconductor market generated USD 52 billion in 2024 and is expected to expand from USD 57.1 billion in 2025 to nearly USD 132.4 billion by 2034, registering a CAGR of 9.8% during the forecast period. Growth is driven by rising adoption of opto semiconductor components across consumer electronics, automotive lighting, industrial automation, and communication systems.

In 2024, Asia Pacific dominated the market with over 48% share, generating approximately USD 24.9 billion in revenue. The region benefits from strong manufacturing capacity, expanding electronics production, and increasing investment in advanced technologies such as LEDs, sensors, and optical communication devices, supporting sustained market expansion.

Purchase the report here: [Christmas and Year End Sale | Up to 60% OFF until December 31, 2025]: https://market.us/purchase-report/?report_id=168493

Opto Semiconductor Market Overview

The opto semiconductor market refers to the segment of semiconductor technology that produces devices capable of emitting, detecting, or manipulating light as part of their operation. These devices include light-emitting diodes (LEDs), laser diodes, photodiodes, optical sensors, and other components that interact with light in addition to electrical signals. Opto semiconductors combine traditional semiconductor functions with optical properties to support communication, sensing, illumination, and imaging applications across consumer, industrial, automotive, and healthcare sectors. The underlying technology area is often described as optoelectronics, where optical and electronic functionalities are integrated into solid-state components.

Key Insights Summary

- The LED segment accounted for 38.5% in 2024, showing its strong use in lighting, display backlights, automotive signaling, and general illumination.

- The industrial segment held 53%, reflecting continued demand from factory automation, sensing equipment, and power management systems.

- Asia Pacific led with 48%, supported by its large electronics manufacturing base and rapid integration of opto semiconductor components across consumer, industrial, and automotive production.

Top Driving Factors

Growth in the opto semiconductor domain is supported by the widespread replacement of traditional lighting and sensing technologies with energy-efficient optical solutions and the increasing use of light-based communication systems. LED lighting and display components are now central to modern electronics, offering improved efficiency and durability.

Optical sensors and laser modules enable advanced features such as high-speed optical data transmission, precision measurement, and enhanced imaging capabilities. The convergence of communication systems and the adoption of high-speed optical interfaces also elevate the importance of opto semiconductor components in networking and data infrastructure.

Demand Analysis

Demand for opto semiconductors is shaped by the expansion of consumer electronics, automotive innovation, industrial automation, and healthcare technologies. LED lighting has increasingly become a standard for residential, commercial, and outdoor illumination due to its efficiency and longevity.

Vehicle systems employ optical sensors and laser diodes for advanced driver assistance systems, adaptive lighting, and safety functions. Industrial automation relies on optical detection and measurement devices for process control and robotics. The healthcare sector uses optical components in imaging equipment, diagnostics, and monitoring systems. These diverse end-use applications sustain a broad base of demand for opto semiconductor technologies.

Increasing Adoption Technologies

Opto semiconductor adoption is enabled by continuous improvements in light-emitting materials, sensor design, and integration techniques. Advances in LED materials and packaging enhance luminous efficiency and color accuracy. Photodetectors and image sensors become more sensitive and faster, supporting applications from mobile cameras to autonomous systems.

Laser diodes and optical communication modules improve bandwidth and signal fidelity in networking contexts. Integration with complementary technologies such as embedded processors and edge computing allows opto semiconductor devices to deliver intelligent sensing and real-time response in connected systems. Organizations and product developers adopt opto semiconductor solutions to obtain greater energy efficiency, improved performance, and enhanced functionality in light-based applications.

LEDs reduce energy use and heat generation compared to older lighting technologies. Optical sensors enable precise detection in automated processes, safety systems, and environmental sensing. Photodiodes and laser diodes support high-speed data links and accurate distance measurement for communication and navigation systems. These devices offer improved reliability and longevity, making them suitable for mission-critical and high-usage environments.

Investment and Business Benefits

Investment opportunities are present in next-generation optical materials, integrated photonic components, and smart sensing modules that support emerging applications. Development of highly efficient LEDs with expanded color range and reduced manufacturing cost can open opportunities in lighting and display markets. Integrated optical sensors with advanced signal processing present value in automation, robotics, and safety systems.

High-performance laser diodes and optical transceivers are critical for data center communications and autonomous navigation technologies. Expanding applications in connected devices and IoT ecosystems increase scope for tailored opto semiconductor innovations. From a business perspective, opto semiconductor technologies enhance product differentiation by enabling energy savings, improved performance, and expanded functionalities.

LED-based lighting and display systems attract consumers with lower operating costs and superior visual quality. Optical sensing and imaging solutions improve operational efficiency and safety in industrial and automotive settings. Integrating optical components into digital devices supports advanced user experiences and connectivity features that strengthen competitive positioning. The durability and reliability of opto semiconductor devices also reduce maintenance costs over product lifetimes.

Emerging Trends

A significant trend is the increasing use of optical sensing in advanced automotive and safety systems. Technologies such as LiDAR, image sensors and infrared detectors are becoming standard in advanced driver assistance systems and autonomous driving features. These optical components help detect obstacles, support collision avoidance and enable enhanced driver safety.

Another trend is the expansion of optical communication for high data rate transmission. With the rollout of 5G networks and growth in cloud computing, there is rising demand for energy-efficient optical communication modules that can handle large traffic loads. Optical semiconductors play a key role by enabling light-based data transmission with higher speed and lower loss compared with traditional electrical interconnects.

Growth Factors

One major growth factor is the rising need for efficient lighting and sensing in consumer products. LEDs and image sensors are increasingly integrated into smartphones, smart TVs, wearables and smart homes, which expands demand for opto semiconductor devices that deliver reliable light emission and detection in compact formats.

Another important growth factor is the deployment of optical systems in industrial automation and manufacturing. Optical sensors and imaging modules help support quality control, machine vision and monitoring systems, making processes more precise and traceable. This need for optical precision drives demand for opto semiconductor modules in automated production environments.

Driver Analysis

A primary driver in the opto semiconductor market is the requirement for high speed and energy efficient data transmission. Optical communication systems use light in place of electrical signals to carry information, reducing energy loss and supporting higher data rates. Growth in data center traffic, cloud services and telecom networks increases usage of optical modules that depend on opto semiconductors.

Another driver is heavier integration of image sensors and optical components in mobile and consumer devices. Cameras, face recognition sensors and gesture tracking in smartphones and tablets rely on precise opto semiconductor devices. Rising consumer expectations for better imaging quality and interactive features supports sales of optical semiconductors worldwide.

Restraint Analysis

A key restraint in this market is production complexity. Many opto semiconductor devices require specialized fabrication processes and high quality control standards to maintain performance, which increases cost of manufacturing. This can limit adoption among suppliers with constrained resources. Another restraint is the variability in technology standards. Optical components must often meet strict performance criteria across different industries and interoperability rules. Achieving compliance with diverse industry requirements can slow product introduction and raise development expense.

Opportunity Analysis

There is strong opportunity in medical imaging and healthcare diagnostics markets. Devices such as endoscopes, CT and MRI scanners increasingly use optical sensors for precise imaging and measurement. Demand for advanced imaging components can support long term growth for opto semiconductor suppliers as healthcare systems modernize.

Another opportunity lies in building automation and smart infrastructure. Optical lighting solutions with energy efficient LEDs and optical sensing systems in building controls support energy management and enhanced user experience. As sustainability goals strengthen in many regions, demand for efficient optical components will grow.

Key Market Segments

By Type

- Optocouplers

- LED

- Image Sensor

- Infrared Component

- Laser Diode

By Application

- Industrial

- Residential

- Commercial

Top Key Players in the Market

- Vishay Intertechnology Inc.

- Ushio America Inc.

- ROHM Semiconductor

- Mitsubishi Electric Corporation

- TT Electronics plc

- SHARP CORPORATION

- OSRAM

- Fairchild Semiconductor International

- LITE-ON Technology Corporation

- Broadcom Inc

- TOSHIBA Corporation

- Renesas electronics corporation

- JENOPTIK

- Littelfuse Inc.

- IPG Photonics

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 52 Bn |

| Forecast Revenue (2034) | USD 132.4 Bn |

| CAGR(2025-2034) | 9.8% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |