Table of Contents

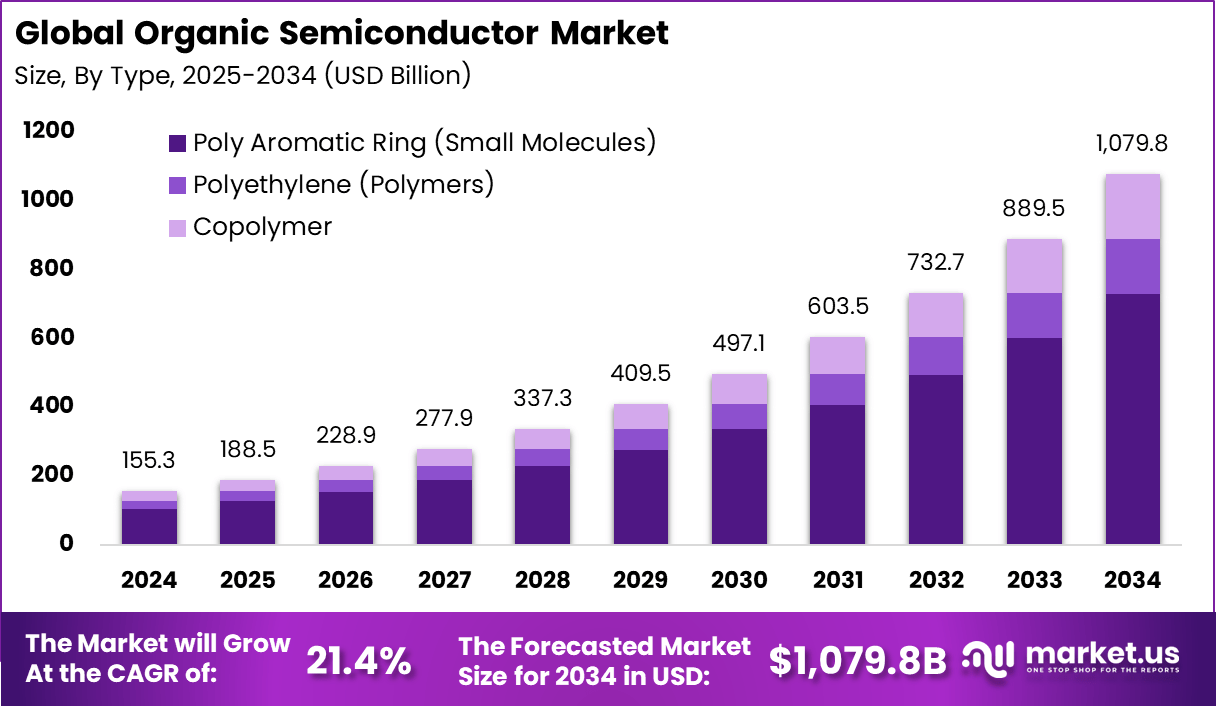

New York, NY – December, 2025: The global organic semiconductor market generated USD 155.3 billion in 2024 and is projected to expand from USD 188.5 billion in 2025 to nearly USD 1,079.8 billion by 2034, reflecting a strong CAGR of 21.4% during the forecast period. Growth is driven by increasing adoption of flexible and lightweight electronic materials across displays, sensors, solar cells, and wearable devices, along with rising demand for energy efficient and low cost manufacturing processes.

Buy this report directly from here: [Discounts: Up To 60% OFF]: https://market.us/purchase-report/?report_id=169005

The organic semiconductor market refers to the ecosystem of materials and technologies built around semiconducting compounds composed primarily of carbon-based molecules or polymers that exhibit charge-transport properties. Organic semiconductors differ from conventional inorganic semiconductors by their lightweight, mechanical flexibility, and ability to be processed in large-area thin films, enabling novel electronic devices in displays, photovoltaics, sensors, and flexible electronics.

These materials often operate through mechanisms of charge injection, hopping transport, and exciton generation, providing unique opportunities for integration in devices where flexibility and low-temperature processing are advantageous. Growth in the organic semiconductor space is supported by increasing demand for flexible and energy-efficient electronics, driven by applications such as organic light-emitting diodes (OLEDs) for displays, organic photovoltaics for solar energy harvesting, and organic field-effect transistors for flexible circuits.

Industry developments focus on materials that are lighter, mechanically adaptable, and compatible with low-cost manufacturing processes, including printing techniques. Emphasis on sustainable materials and lightweight electronic systems is pushing adoption in consumer electronics, wearable devices, and next-generation sensor technologies.

Top Market Takeaways

- Poly aromatic ring small molecules accounted for 67.5%, reflecting their strong suitability for high-performance organic semiconductor fabrication.

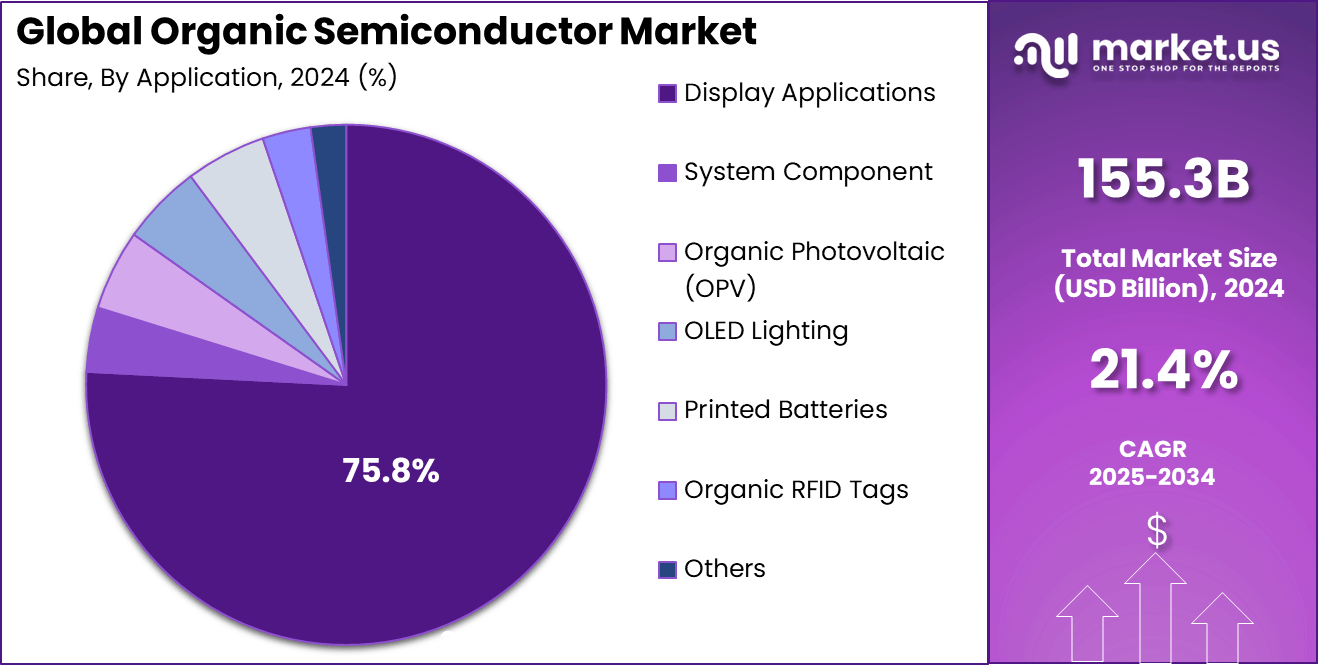

- Display applications held 75.8%, showing that most commercial demand is driven by OLED panels, flexible screens, and next-generation visual interfaces.

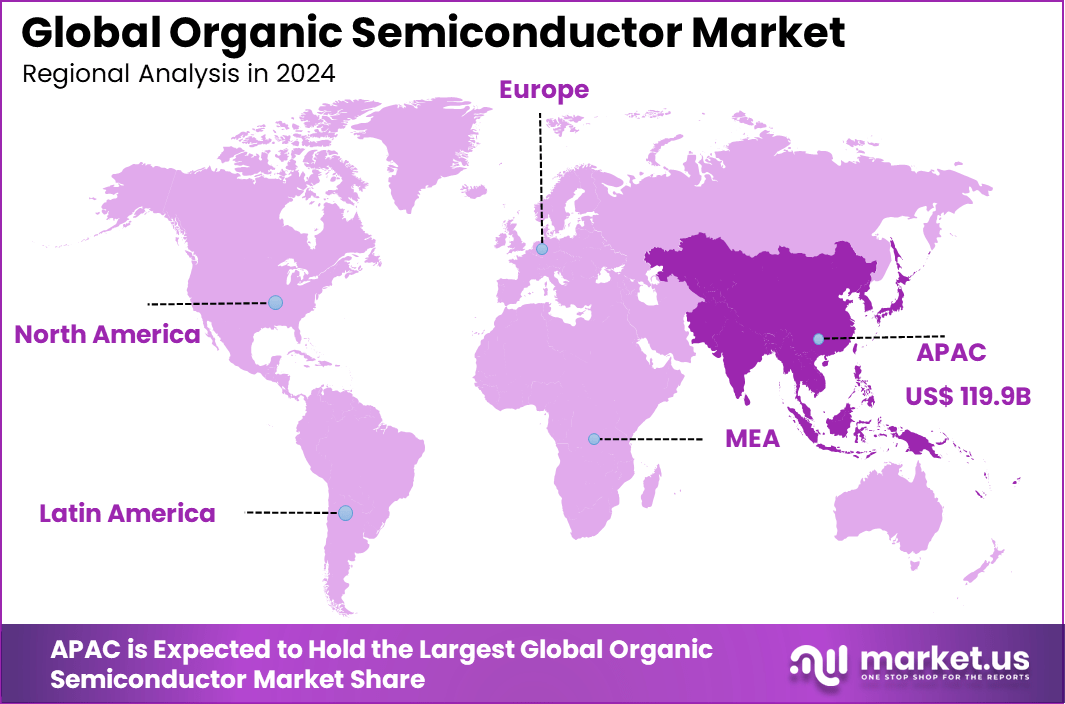

- Asia Pacific captured 77.2%, supported by large manufacturing ecosystems and government-backed electronics clusters.

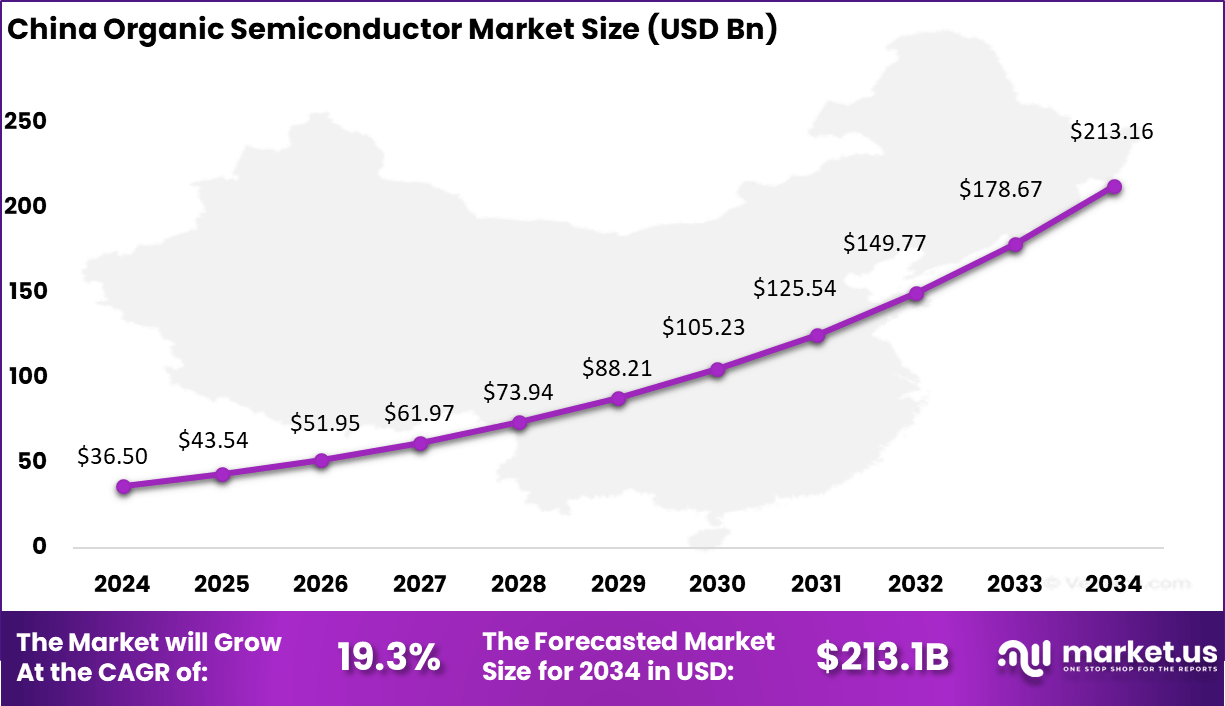

- China reached USD 36.5 billion, highlighting its advanced supply chain for organic materials and device assembly.

- A 19.3% CAGR signals fast expansion as flexible electronics, wearables, and energy-efficient display technologies gain wider adoption.

Increasing Adoption Technologies

Technological adoption in this market is supported by continuous improvements in organic materials chemistry, fabrication methods, and device architectures. Advances in small-molecule and polymer semiconductors enhance charge transport and stability, while scalable processing such as solution printing enables lower manufacturing complexity. Integration of organic semiconductors with flexible substrates supports emerging product categories in wearables, foldable displays, and flexible sensors. Ongoing research aims to improve performance metrics such as carrier mobility, exciton diffusion, and operational lifetime to expand viability across applications.

Organizations deploy organic semiconductor materials to achieve lightweight, flexible, and energy-efficient electronic systems. Their compatibility with large-area and low-temperature processing reduces manufacturing costs compared to traditional silicon-based devices. The inherent flexibility of organic materials enables innovative product designs including curved, foldable, or wearable electronics that would be difficult to realize using rigid inorganic semiconductors. Additionally, organic semiconductors support applications where low power consumption and adaptability are critical, such as in portable and IoT devices.

Investment and Business Benefits

Investment opportunities are concentrated in material innovation, device integration, and production scalability. Development of organic materials with higher charge mobility, improved stability, and broader operational temperature ranges presents significant value creation potential. Organic semiconductor applications in displays, photovoltaic cells, and flexible electronics represent expanding segments where differentiated material platforms can provide competitive advantage.

Innovations in manufacturing technologies such as roll-to-roll processing and solution printing also offer pathways to reduce cost and enhance production speed, attracting interest from materials developers and device manufacturers alike. From a business perspective, organic semiconductors enable product differentiation and new form factors that traditional semiconductors struggle to support.

Products built with organic materials can be lighter, thinner, and more adaptable, appealing to consumer preferences for flexible and wearable devices. The potential for simplified and lower-cost manufacturing supports competitive pricing, while energy-efficient properties align with expectations for longer battery life and reduced environmental impact. Moreover, organic electronics can open new revenue streams in applications such as smart textiles, flexible displays, and integrated sensor devices.

Type Segment

Poly aromatic ring small molecules accounted for 67.5%, reflecting their strong suitability for high performance organic semiconductor fabrication. Their molecular structure provides stable charge transport and consistent film formation, which supports high device efficiency. These materials are widely used in display technologies due to their strong optical and electronic properties. The segment continues to grow as manufacturers seek reliable organic materials that can be scaled across large production lines. Their compatibility with solution processing and thin film deposition methods strengthens adoption across next generation electronic devices.

Application Segment

Display applications held 75.8%, showing that most commercial demand comes from OLED panels, flexible screens, and emerging visual interfaces. Organic semiconductors are valued in these applications because they support lightweight designs, improved contrast, and energy efficient performance. The dominance of display applications is supported by rapid expansion of high resolution screens in smartphones, televisions, and wearable devices. Growing interest in foldable displays and rollable screens continues to drive research and large scale production of organic semiconductor materials.

Regional Segment: Asia Pacific

Asia Pacific captured 77.2%, supported by large scale production ecosystems and strong government backed electronics manufacturing clusters. The region houses major fabrication hubs, advanced material suppliers, and a strong consumer electronics market that fuels high demand. Its leadership is reinforced by continuous investment in display technology, semiconductor manufacturing, and rapid adoption of flexible electronic devices. Collaboration between industry players, research institutions, and government programs further strengthens regional dominance.

China – USD 36.5 Billion

China reached USD 36.5 billion, highlighting its advanced supply chain for organic electronic materials and device assembly. The country benefits from extensive production capacity, strong procurement networks, and rapid integration of new display technologies. China’s focus on next generation electronics, including flexible screens and advanced OLED displays, continues to boost material demand. Local manufacturers are expanding production lines to support both domestic and global brands, which strengthens market growth.

Key Market Segments

By Type

- Polyethylene (Polymers)

- Poly Aromatic Ring (Small Molecules)

- Copolymer

By Application

- Display Applications

- System Component

- Organic Photovoltaic (OPV)

- OLED Lighting

- Printed Batteries

- Organic RFID Tags

- Others

Top Key Players in the Market

- BASF SE

- Cambridge Display Technology Ltd.

- DuPont de Nemours, Inc.

- Eni S.p.A.

- Heliatek GmbH

- Hodogaya Chemical Co., Ltd.

- Konica Minolta, Inc.

- LG Chem Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Novaled GmbH

- Polyera Corporation

- Samsung SDI Co., Ltd.

- Sony Corporation

- Sumitomo Chemical Co., Ltd.

- Universal Display Corporation (UDC)

- BOE Technology Group Co., Ltd.

- MBRAUN.

- Hicenda Technology Co.

- Youritech

- Others

Market Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 155.3 Bn |

| Forecast Revenue (2034) | USD 1,079.8 Bn |

| CAGR(2025-2034) | 21.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |