Table of Contents

- SEPP Interconnect Security Market Introduction

- How Growth is Impacting the Economy

- Impact on Global Businesses

- Strategies for Businesses

- Key Takeaways

- Analyst Viewpoint

- Use Case and Growth Factors

- Regional Analysis

- Business Opportunities

- Key Segmentation Overview

- Key Player Analysis

- Recent Developments

- Conclusion

SEPP Interconnect Security Market Introduction

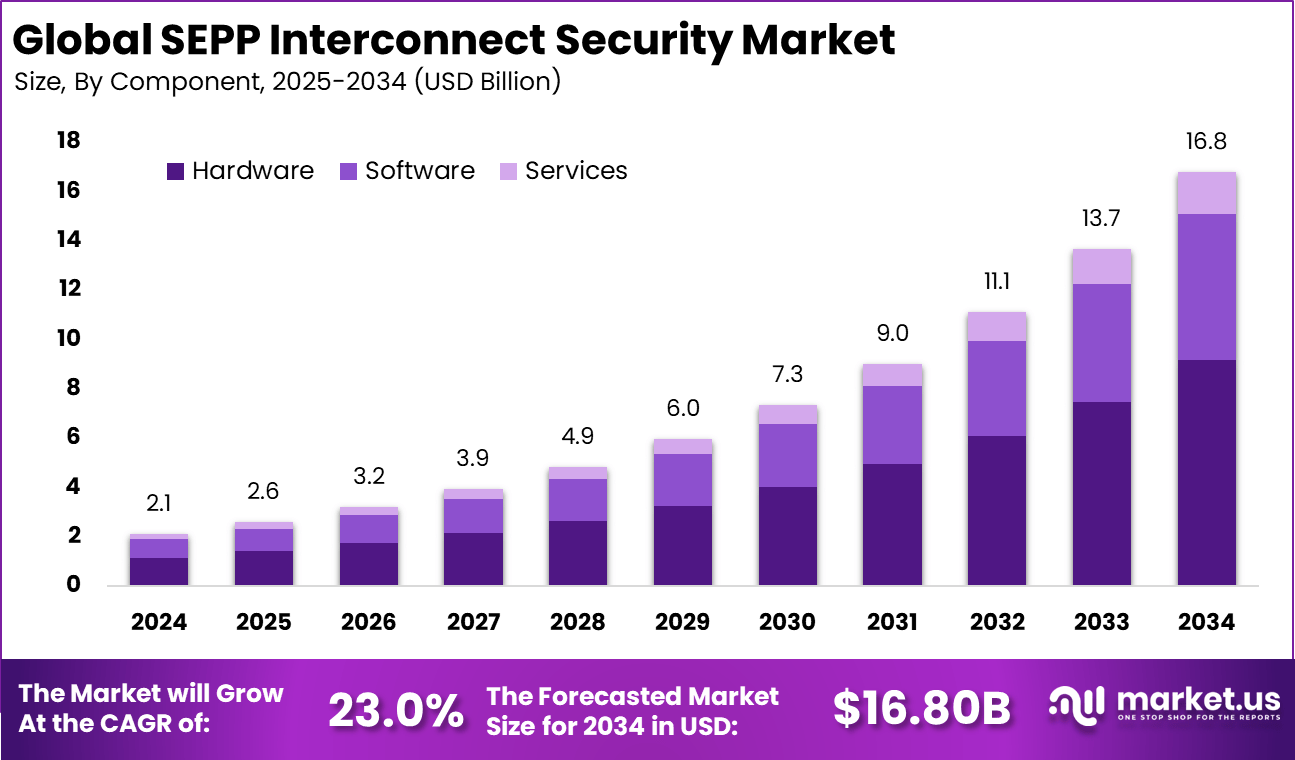

The global SEPP interconnect security market is experiencing rapid expansion, driven by the commercial rollout of 5G standalone networks and rising cross-border signaling traffic. The market size stood at USD 2.12 billion in 2024 and is expected to reach around USD 16.80 billion by 2034, registering a CAGR of 23.0% during 2025 to 2034.

SEPP has become a mandatory security function under 3GPP standards to protect inter-PLMN signaling and roaming interfaces. North America dominated the market with over 34.4% share, generating USD 0.72 billion in revenue, supported by early 5G adoption, high roaming volumes, and strong cybersecurity compliance frameworks.

How Growth is Impacting the Economy

The rapid growth of SEPP interconnect security is strengthening national and regional digital economies by safeguarding telecom infrastructure. Secure roaming reduces signaling fraud, revenue leakage, and service disruptions, directly improving operator financial stability. As telecom networks become more secure, consumer confidence in digital services increases, supporting growth in mobile banking, e-commerce, and digital government platforms.

Investment in SEPP solutions is also driving demand for cybersecurity engineering, cloud infrastructure, and telecom software development, contributing to high-value job creation. Governments benefit from improved protection of critical communications used in defense, emergency response, and public safety. Over time, secure interconnect environments are enabling broader 5G-driven innovation, supporting productivity gains across transportation, manufacturing, and smart infrastructure.

Year-End Sale: Hurry, Enjoy 60% off @ https://market.us/purchase-report/?report_id=170137

Impact on Global Businesses

Rising Costs and Supply Chain Shifts

Global enterprises face higher telecom security costs as operators invest in SEPP deployments and compliance upgrades. However, spending is increasingly shifting toward cloud-based software solutions, reducing dependence on specialized hardware and reshaping vendor supply chains toward virtualized and service-driven models.

Sector-Specific Impacts

Telecommunications companies gain improved roaming reliability and fraud prevention. Financial services benefit from secure mobile authentication and transaction signaling. Government and public sector organizations rely on SEPP-secured networks for protected cross-border communications. IT and network security providers see growing demand for integration as SEPP aligns with zero-trust architectures.

Strategies for Businesses

Businesses are prioritizing early SEPP adoption aligned with evolving 3GPP standards to ensure uninterrupted roaming services. Cloud-native deployment strategies are being favored to improve scalability and reduce long-term operational costs. The integration of SEPP with signaling firewalls, API security, and analytics platforms is becoming increasingly common to enhance threat detection. Organizations are also investing in continuous compliance monitoring and workforce upskilling to address the growing complexity of telecom security environments.

Key Takeaways

- SEPP is a mandatory security component for 5G interconnect and roaming

- Market growth is supported by a strong CAGR of 23.0% through 2034

- North America leads adoption due to early 5G standalone deployment

- Cloud-based SEPP solutions are reshaping telecom security architectures

- Secure interconnect enables broader digital and economic growth

➤Unlock growth! Get your sample now! @ https://market.us/report/sepp-interconnect-security-market/free-sample/

Analyst Viewpoint

At present, SEPP interconnect security is transitioning from regulatory compliance to a strategic investment for telecom operators. Adoption is strongest in regions with mature 5G networks and high roaming traffic. Looking ahead, the market outlook remains highly positive as global roaming volumes increase and signaling architectures become more complex.

Continued migration to cloud-native cores and service-based architectures is expected to expand SEPP functionality. Over the forecast period, SEPP is anticipated to evolve into a foundational layer of global mobile security, supporting innovation while ensuring trust and interoperability.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| International roaming security | Rising global 5G roaming traffic |

| Inter-PLMN signaling protection | Increase in signaling attacks and fraud |

| API exposure security | Expansion of service-based 5G architectures |

| Government communications | National security and regulatory compliance |

| Enterprise mobility | Demand for secure mobile authentication |

Regional Analysis

North America dominates the SEPP interconnect security market with more than 34.4% share, driven by early 5G standalone adoption and strict security regulations. Europe follows with strong compliance-driven deployments across cross-border roaming networks. Asia Pacific is emerging as a high-growth region due to expanding subscriber bases, increasing international travel, and aggressive 5G investments. The Middle East is adopting SEPP to support international transit traffic, while Latin America and Africa are gradually implementing solutions as telecom cores modernize.

➤ Explore Huge Library Here –

- Device Anti-Theft Software Market

- Maritime IoT Via Satellite Market

- Bridge Management Software Market

- Reality Modeling Software Market

Business Opportunities

Significant business opportunities exist in cloud-native and virtualized SEPP solutions designed for scalable 5G cores. Managed security services targeting small and medium operators are gaining traction. Integration of SEPP with AI-driven analytics, real-time threat intelligence, and policy management platforms offers value-added growth avenues. Emerging markets present long-term potential as roaming agreements expand and regulatory enforcement strengthens. Providers offering interoperable and standards-compliant solutions are expected to benefit most.

Key Segmentation Overview

The market is segmented by component into software, hardware, and services, with software emerging as the dominant category due to virtualization trends. By deployment mode, cloud-based solutions are expanding faster than on-premises models. Application segments include telecommunications as the leading segment, followed by IT and network security, financial services, government, and others. By organization size, large enterprises currently account for higher adoption, while small and medium enterprises increasingly access SEPP through managed services.

Key Player Analysis

Market participants focus on enhancing signaling protection, interoperability, and compliance with evolving 3GPP standards. Competitive positioning is shaped by cloud readiness, low-latency performance, and integration with broader telecom security ecosystems. Continuous investment in automation, analytics, and API security capabilities is strengthening solution differentiation. Long-term competitiveness depends on scalability, cross-border interoperability, and alignment with global roaming frameworks.

- Infineon Technologies AG

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics Co. Ltd

- Texas Instruments

- Renesas Electronics Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Cypress Semiconductor (Infineon)

- Analog Devices, Inc.

- Maxim Integrated (Analog Devices)

- ON Semiconductor Corporation

- Qualcomm Incorporated

- Intel Corporation

- Marvell Technology Group

- Lattice Semiconductor

- IDEMIA

- Gemalto (Thales Group)

- Giesecke+Devrient

- Sony Corporation

- Others

Recent Developments

- Increased deployment of cloud-native SEPP solutions for 5G standalone cores

- Rising adoption of managed SEPP services among regional telecom operators

- Integration of SEPP with signaling analytics and threat intelligence platforms

- Expansion of SEPP functionality to support API exposure security

- Stronger regulatory enforcement for secure international roaming

Conclusion

SEPP interconnect security is emerging as a cornerstone of secure global 5G connectivity. Strong growth, regulatory mandates, and rising roaming traffic are expected to sustain market expansion through 2034, positioning SEPP as a critical enabler of trusted digital communication worldwide.