Table of Contents

Introduction

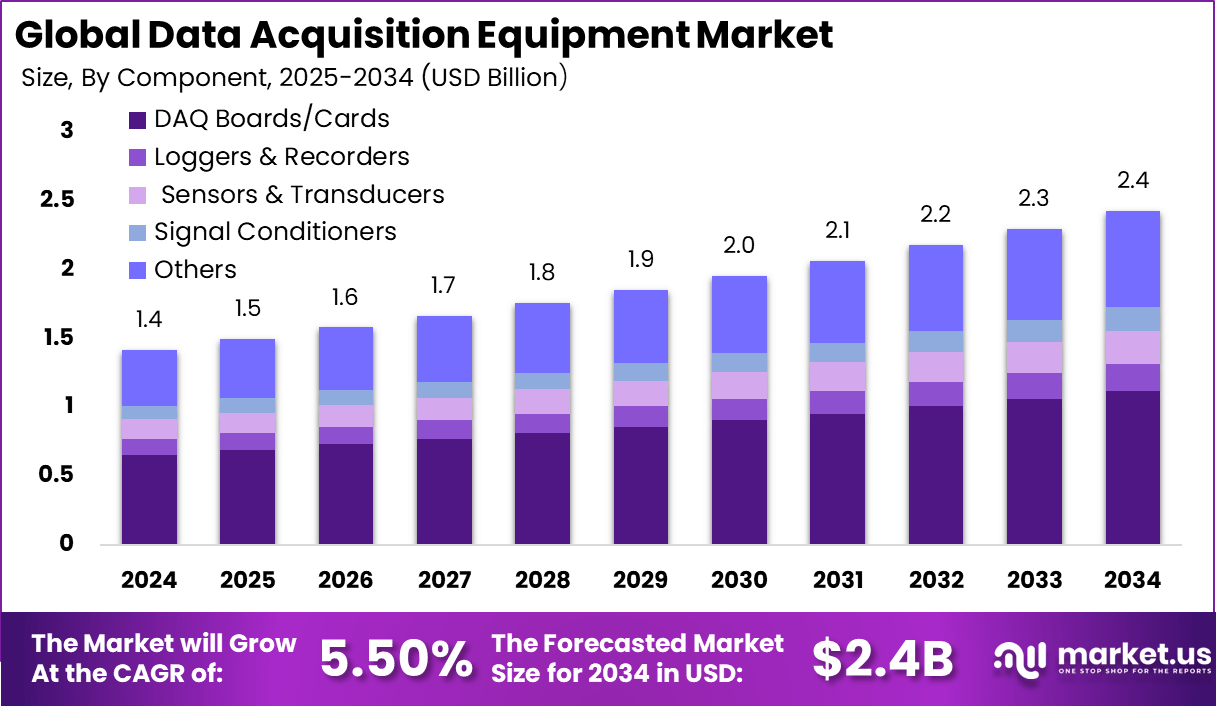

Accoridng to Market.us, The global data acquisition equipment market generated USD 1.4 billion in 2024 and is expected to expand from USD 1.5 billion in 2025 to nearly USD 2.4 billion by 2034, reflecting a CAGR of 5.50% over the forecast period. Market growth is supported by increasing demand for accurate real time data monitoring across industrial automation, research laboratories, energy systems, and testing applications.

In 2024, North America dominated the market with more than 32.8% share, generating approximately USD 0.46 billion in revenue. Strong adoption of advanced measurement technologies, continued investment in industrial digitalization, and widespread use of data driven decision making are supporting steady regional market expansion.

The data acquisition equipment market covers tools that measure, record and analyze physical or electrical signals such as temperature, vibration, pressure, voltage and sound. These systems convert real-world signals into digital data for testing, monitoring and control. Industries including manufacturing, automotive, aerospace, energy, laboratories and electronics rely on data acquisition systems to improve reliability, verify performance and support research activities.

Top Market Takeaways

- DAQ boards and cards lead with 46.2% share, driven by broad use in testing, signal processing, and industrial data collection.

- Manufacturing and quality control account for 33.7%, supported by rising adoption of automated inspection and real-time process monitoring.

- The automotive sector holds 26.3%, fueled by EV testing, ADAS validation, and advanced vehicle development needs.

- North America captures 32.8%, backed by mature automation ecosystems and strong R&D spending.

- The U.S. market is valued at around USD 0.41 billion in 2025, reflecting steady industrial demand.

- The market is growing at a ~4.51% CAGR, supported by digitalization, Industry 4.0 adoption, and increasing system complexity.

Emerging Trends

One notable trend is the shift toward modular and portable data acquisition systems. Many users prefer compact devices that can be deployed in field environments for real-time inspection, maintenance and troubleshooting. This trend is driven by the need for flexible testing in distributed or mobile applications.

Another trend is rising use of software-defined data acquisition platforms. Users now expect advanced signal processing, remote access and cloud connectivity. Modern systems integrate with analytical software so that collected data can be visualized, compared and shared through centralized platforms.

Growth Factors

A major growth factor is the expansion of industrial automation. Automated machines and robotic systems require constant monitoring to maintain performance and safety. Data acquisition equipment supports this by measuring key parameters and alerting operators when conditions move outside acceptable limits.

Another growth factor is the growth of electric vehicles, renewable energy systems and advanced electronics. These technologies require detailed testing during development and operation. Data acquisition systems help engineers evaluate battery performance, inverter behaviour, motor efficiency and environmental conditions.

Driver Analysis

A key driver is the need for precise measurement in research and engineering. As products become more complex, testing procedures require higher sampling rates and more accurate sensors. Data acquisition systems provide high-quality measurements that support validation of designs and optimization of processes. Another driver is increased focus on predictive maintenance. Many organizations use data acquisition tools to track vibration, temperature or stress on equipment. Early detection of abnormal behaviour helps prevent failures and reduces maintenance cost, encouraging adoption across industries.

Restraint Analysis

A major restraint is the high cost of advanced data acquisition systems, especially those designed for high-speed or multi-channel measurement. Smaller companies may delay adoption due to budget limitations. Another restraint is the need for specialized expertise. Setting up channels, selecting sensors, configuring sampling rates and interpreting signals require technical skill. Limited availability of trained professionals can slow deployment in some regions.

Opportunity Analysis

There is strong opportunity in integrating data acquisition systems with cloud analytics. Remote monitoring and long-term storage can help users identify performance trends that are not visible in short tests. This offers new service opportunities for equipment providers. Another opportunity is expansion into emerging sectors such as smart infrastructure, precision agriculture and environmental monitoring. These fields require continuous measurement of environmental or structural conditions, creating new demand for reliable data acquisition tools.

Key Market Segments

By Component

- DAQ Boards/Cards

- Loggers & Recorders

- Sensors & Transducers

- Signal Conditioners

- Others

By Application

- Research & Development

- Manufacturing & Quality Control

- Environmental Monitoring

- Medical & Healthcare

- Others

By End-User

- Automotive

- Aerospace & Defense

- Electronics & Semiconductors

- Energy & Power

- Healthcare

- Others

Top Key Players in the Market

- ABB

- National Instruments (NI)

- Keysight Technologies

- Teledyne Technologies

- AMETEK

- Spectris (HBK)

- ADInstruments

- Dewesoft

- Campbell Scientific

- DATAQ Instruments

- HBM

- Siemens

- Yokogawa Electric

- Schneider Electric

- Honeywell

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.4 Bn |

| Forecast Revenue (2034) | USD 2.4 Bn |

| CAGR(2025-2034) | 5.50% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |