Table of Contents

Introduction

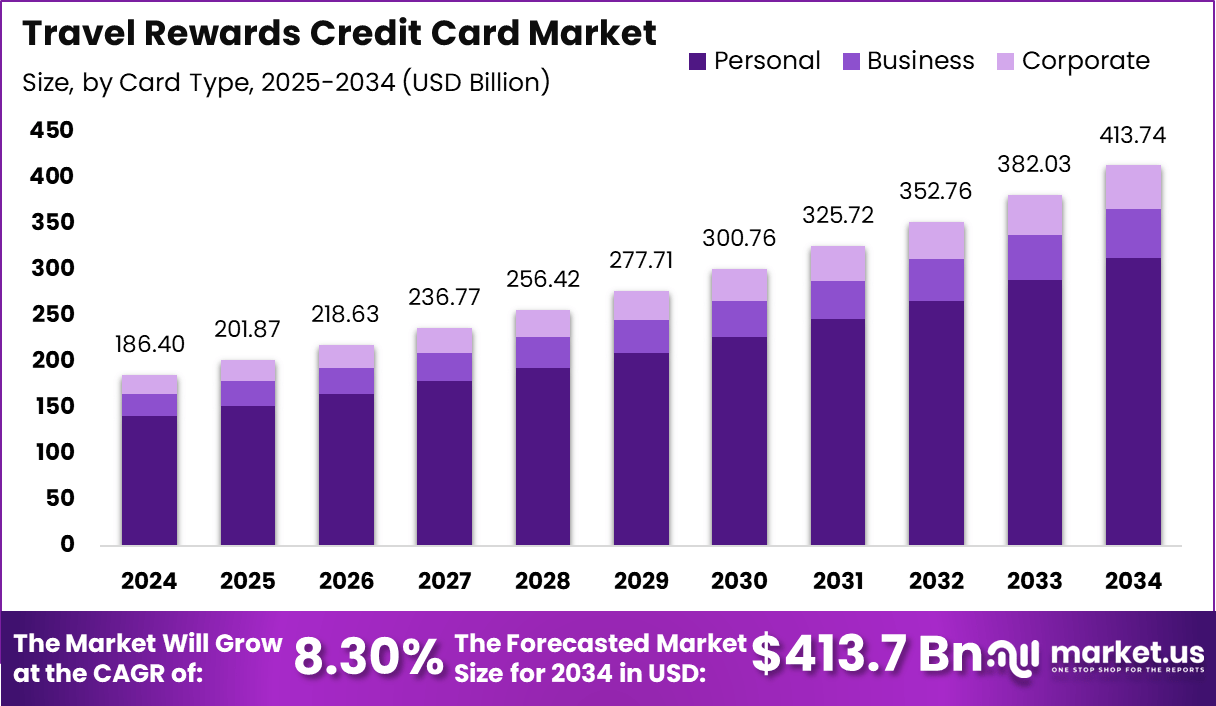

The travel rewards credit card market was valued at USD 186.4 billion in 2024 and is projected to grow at a steady CAGR of 8.30%, reaching approximately USD 413.7 billion by 2034. Growth is supported by the recovery of global tourism, rising adoption of digital payments, and strong consumer preference for reward based financial products. Travel related benefits such as air miles, hotel points, lounge access, and partner discounts continue to drive higher card usage across domestic and international bookings.

The Travel Rewards Credit Card Market is a rapidly expanding segment of the financial services industry, focused on offering consumers incentives such as air miles, hotel points, lounge access, and travel discounts in exchange for spending on eligible purchases. These cards have become a preferred choice for frequent travelers seeking value and convenience, driving significant innovation and competition among card issuers. The market is characterized by a wide range of products tailored to different travel preferences and spending behaviors, making it a dynamic and evolving space in the global financial landscape.

Buy this research report now and save up to 60% in the Christmas Sale@ https://market.us/purchase-report/?report_id=169883

The Travel Rewards Credit Card Market plays a crucial role in shaping consumer financial behavior and travel preferences. By offering incentives for spending, these cards encourage higher transaction volumes and foster long-term customer loyalty. They also facilitate greater spending on travel and related services, contributing to the growth of the broader travel and hospitality industries.

The growth of the Travel Rewards Credit Card Market is largely fueled by rising global travel activity, increasing digital payment adoption, and a growing consumer preference for reward-based financial products. More people are prioritizing travel experiences, especially among younger demographics, and are actively seeking cards that provide tangible benefits for their travel spending. Enhanced digital payment infrastructure and aggressive marketing by financial institutions further accelerate this trend, as issuers strive to attract and retain customers through attractive rewards programs.

Key Takeaways

- The global market reached USD 186.4 billion in 2024, showing strong consumer interest in travel-linked rewards.

- Market value is projected to grow to USD 413.7 billion by 2034, reflecting sustained long-term expansion.

- The market is expanding at a 8.30% CAGR, supported by rising travel spending and card usage.

- North America leads with 46.5% share, driven by high credit card penetration and frequent travel activity.

- North America’s market size stood at USD 86.6 billion in 2024.

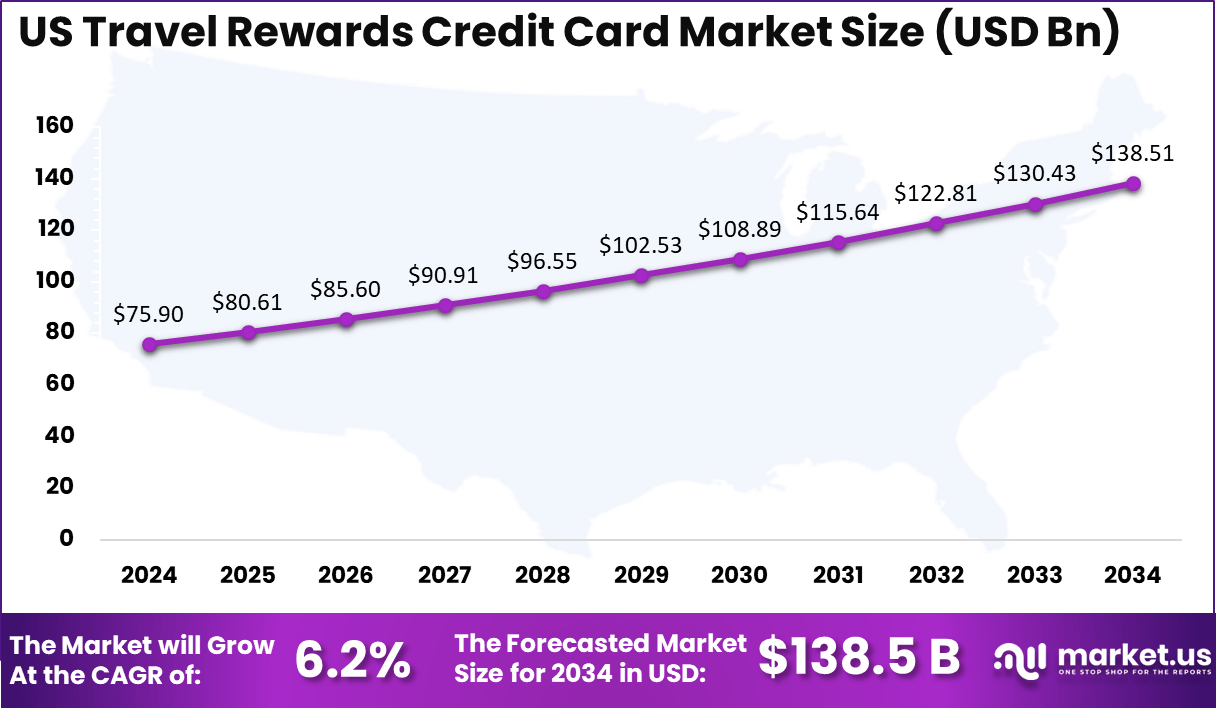

- The U.S. contributed USD 75.9 billion in 2024, making it the single largest national market.

- The U.S. market is expected to reach USD 138.5 billion by 2034, growing at a 6.2% CAGR.

- Personal cards dominate with a 75.6% share, reflecting strong individual consumer adoption.

- Points-based reward programs lead with 54.3%, favored for flexibility and redemption ease.

- Online booking accounts for 32.5% of application usage, aligning with digital travel planning trends.

- Individuals represent the main end-user group with an 83.1% share, underscoring consumer-driven demand.

US Market Size

The market is projected to reach USD 138.5 billion by 2034, expanding at a 6.2% CAGR, supported by rising travel frequency, wider adoption of online booking, and increased usage of mobile banking apps for reward tracking and redemption.

Driver Analysis

Increase in Travel Activity and Reward Preference

A major driver is the steady rise in domestic and international travel. As more people resume flying and staying in hotels, the value of earning points or miles becomes more attractive. Cardholders see direct financial benefits when rewards offset the cost of tickets, rooms, or upgrades. This motivates frequent travelers to choose travel-linked credit cards over general credit cards.

Another driver is the appeal of travel privileges. Features such as lounge access, priority services, and bonus points on travel spending create a sense of added value. Many consumers view these features as useful in improving their travel experience. This combination of savings and comfort encourages more people to adopt travel rewards credit cards.

Restraint Analysis

High Fees and Complex Reward Conditions

A key restraint is the cost associated with these cards. Many travel rewards credit cards charge higher annual fees than standard cards. Some users find it difficult to justify these fees, especially if they travel only once or twice a year. This reduces adoption among occasional travelers who may not use the card often enough to gain meaningful benefits.

Another restraint is the complexity of earning and redeeming rewards. Some programs have rules that are difficult for consumers to understand. Conditions such as limited seat availability, point expiration, or tier-based redemption can reduce the perceived value of the rewards. When benefits are difficult to use, customers may shift to simpler financial products.

Opportunity Analysis

Rising Middle-Class Travel Demand in Emerging Markets

There is a strong opportunity in regions where the middle class is growing and travel spending is increasing. As more households gain access to international travel, demand for payment products that offer travel rewards rises. Credit card issuers can expand their presence by designing products that match local travel habits and spending capacities.

Another opportunity exists in offering flexible and transparent reward options. Consumers prefer programs that allow easy redemption across airlines, hotels, and travel services. Cards that provide simple reward structures and clear value can attract more users. This creates room for innovation in how rewards are earned and used.

Challenge Analysis

Changing Payment Preferences and Competitive Pressure

A major challenge comes from the shift toward alternative payment methods. Mobile wallets, direct bank payments, and installment payment options are becoming more common. As consumers adopt these methods, the total spending on credit cards may decline. This reduces the opportunities for card issuers to capture travel-related purchases.

Another challenge lies in maintaining trust. Some users report frustration when reward programs change values or introduce new conditions. If customers feel that rewards are not reliable, they may reduce card usage or move to another provider. Maintaining clear and consistent reward policies is important for long-term customer confidence.

Key Market Segments

By Card Type

- Personal

- Business

- Corporate

By Reward Type

- Points

- Miles

- Cashback

- Others

By Application

- Domestic Travel

- International Travel

- Online Booking

- In-store Purchases

- Others

By End-User

- Individuals

- SMEs

- Large Enterprises

Top Key Players in the Market

- American Express

- Chase

- Citi

- Capital One

- Bank of America

- Barclays

- Wells Fargo

- HSBC

- Discover

- U.S. Bank

- TD Bank

- Royal Bank of Canada (RBC)

- Scotiabank

- ANZ (Australia and New Zealand Banking Group)

- Westpac

- NatWest Group

- Santander

- Standard Chartered

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 186.4 Billion |

| Forecast Revenue (2034) | USD 413.7 Billion |

| CAGR(2025-2034) | 8.30% |

| Base Year for Estimation | 2024 |