Table of Contents

- Underwater Transducer Market Size

- Quick Market Facts

- Top Driving Factors

- Increasing Adoption Technologies

- Investment and Business Benefits

- By Product Type

- By Application

- By Material

- By End User

- By Region

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Future Outlook and Opportunities

- Report Scope

Underwater Transducer Market Size

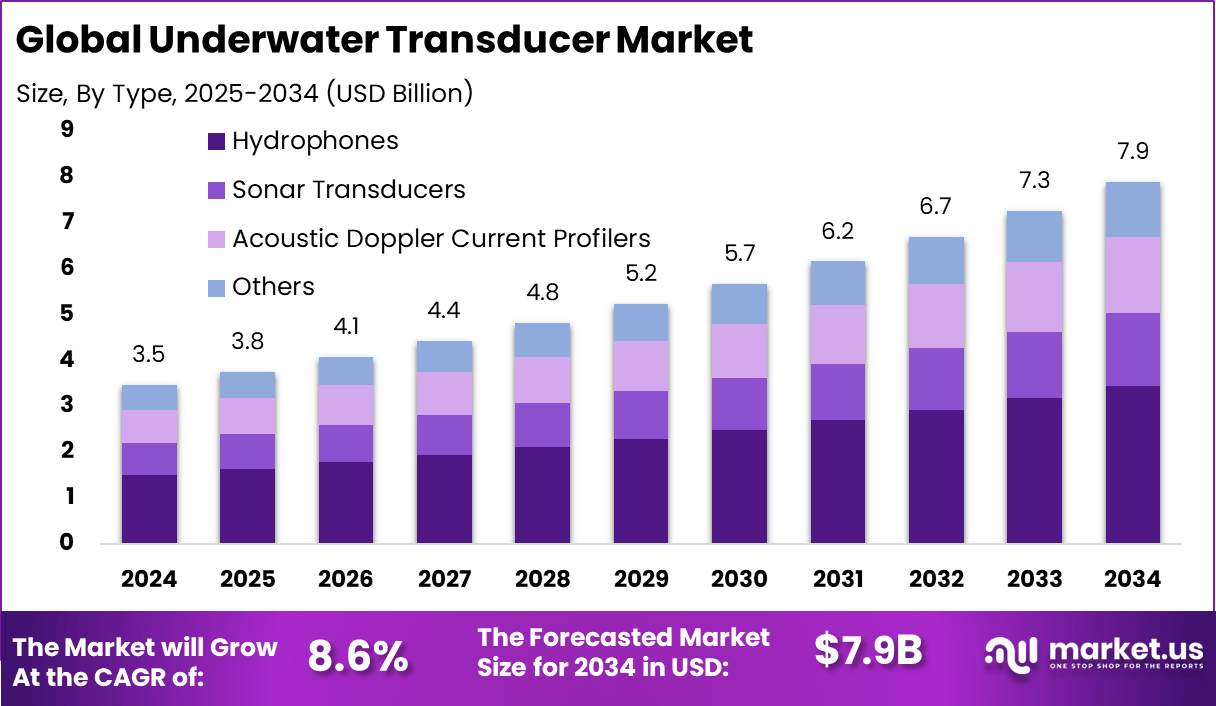

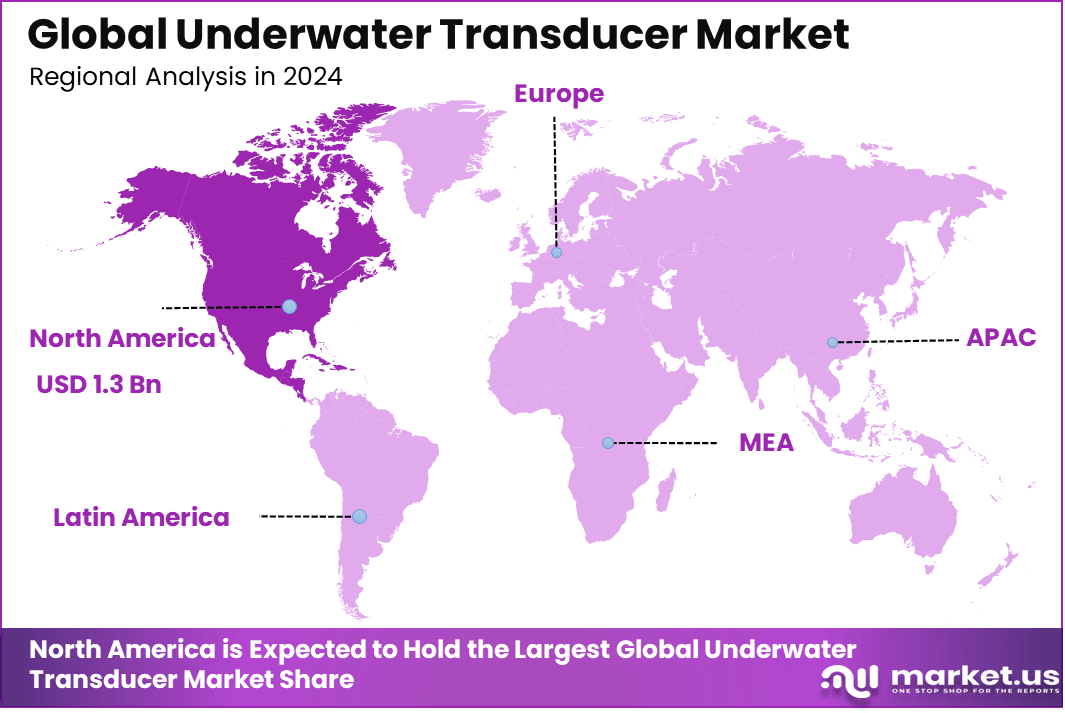

The global underwater transducer market generated USD 3.5 billion in 2024 and is projected to grow from USD 3.8 billion in 2025 to approximately USD 7.9 billion by 2034, registering a CAGR of 8.6% over the forecast period. In 2024, North America held a dominant position with more than 38.4% market share, accounting for around USD 1.3 billion in revenue, supported by strong demand from naval defense, offshore energy, and marine research applications.

The underwater transducer market focuses on devices that convert electrical signals into acoustic waves and receive reflected sound signals underwater. These systems are essential for sonar, navigation, communication, depth measurement, and object detection in marine environments. Underwater transducers are widely used in naval defense, commercial shipping, offshore energy, fisheries, ocean research, and underwater robotics. The market plays a critical role in enabling safe navigation, environmental monitoring, and subsea operations where visibility is limited.

Avail a limited-time 60% Christmas Sale discount on this research report @ https://market.us/purchase-report/?report_id=165416

This market plays a crucial role in underwater sensing and communication. Transducers allow vessels and underwater systems to detect obstacles, map seabeds, track marine life, and support subsea construction activities. In defense and security, they are used for surveillance and threat detection. In offshore energy and marine research, transducers support inspection, maintenance, and data collection. Marine studies indicate that acoustic sensing remains the most reliable method for underwater detection, with sound traveling nearly 4x faster in water than in air.

Quick Market Facts

- Hydrophones led with a 43.7% share, driven by their critical role in sonar, underwater communication, and acoustic monitoring.

- Marine research accounted for 38.4%, supported by rising demand for oceanographic studies and environmental monitoring.

- Piezoelectric ceramics dominated materials with 52.6%, valued for high sensitivity and durability in deep-water applications.

- The commercial end-user segment captured 48.8%, fueled by offshore energy, marine infrastructure, and fisheries activity.

- North America held 38.4% of the global market, backed by strong defense and maritime research investments.

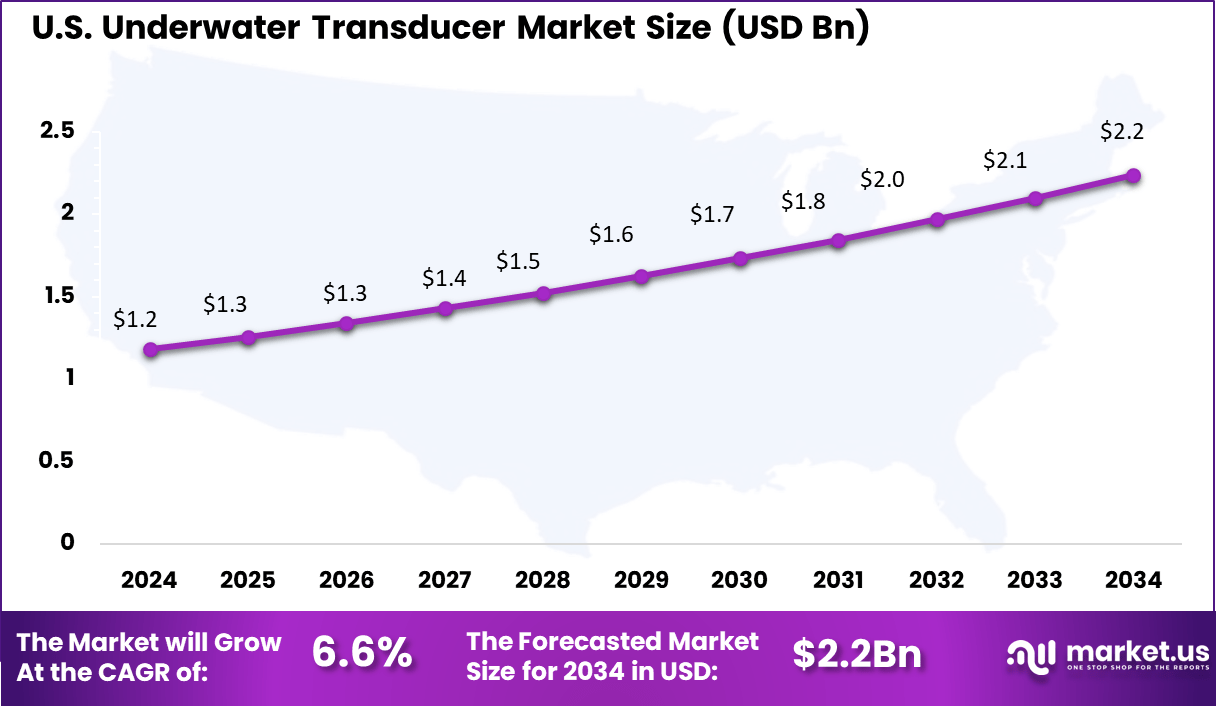

- The U.S. market reached USD 1.18 billion in 2024, growing at a steady 6.6% CAGR, reflecting continued leadership in advanced underwater acoustic technologies.

Top Driving Factors

Growth is driven by increasing maritime security needs and rising offshore activities. Expansion of offshore wind farms, oil and gas exploration, and subsea cable installations has increased demand for reliable underwater sensing tools. Naval modernization programs have also supported adoption. Advances in materials and signal processing have improved accuracy and durability. Global maritime reports indicate that over 70% of subsea monitoring systems rely on acoustic transducer technology.

Demand for underwater transducers is rising across defense, commercial marine, and scientific research sectors. Navies and coast guards require advanced sonar systems for surveillance and navigation. Commercial vessels use transducers for depth sounding and collision avoidance. Research institutions deploy these devices for seabed mapping and climate studies. Fisheries also depend on transducers for fish finding and stock assessment. Marine technology studies show that acoustic equipment usage in commercial vessels has increased by more than 25% over the past decade.

Increasing Adoption Technologies

Key technologies supporting adoption include multibeam sonar systems, digital signal processing, wideband transducers, and integration with autonomous underwater vehicles. Improved piezoelectric materials have enhanced sensitivity and operating life. Artificial intelligence is increasingly used to interpret sonar data and reduce noise interference. Industry research indicates that nearly 60% of new underwater sensing systems now support digital and software based signal analysis.

Organizations adopt underwater transducers for accuracy, reliability, and long range detection capabilities. These devices operate effectively in low visibility environments where optical systems fail. They support real time decision making in navigation and underwater operations. Reduced risk and improved operational safety are major reasons for adoption. Surveys among marine operators show that more than 55% consider acoustic sensing essential for daily operations.

Investment and Business Benefits

Investment opportunities exist in advanced sonar systems, compact transducers for autonomous platforms, and environmentally friendly acoustic technologies. Growth in underwater drones and robotic inspection systems is creating demand for lightweight and energy efficient transducers. Coastal monitoring and marine conservation programs also offer new opportunities. Global ocean technology investment trends indicate that funding for subsea sensing solutions is growing at over 20% annually.

Underwater transducers deliver strong business benefits by improving safety, reducing operational risks, and enabling precise underwater measurements. They help lower costs associated with accidents and equipment damage. Efficient seabed mapping and monitoring support faster project execution in offshore industries. Organizations using advanced acoustic systems report up to 30% improvement in operational efficiency during subsea activities.

By Product Type

The hydrophones segment dominated with 43.7%, reflecting their critical role in underwater sound detection and acoustic monitoring. Hydrophones are widely used to capture sound waves in marine environments, supporting applications such as sonar operations, seismic surveys, and underwater communication.

Demand for hydrophones continues to grow as underwater monitoring becomes more important for security, navigation, and research activities. Their ability to operate across wide frequency ranges and withstand harsh underwater conditions supports sustained adoption across both civil and defense applications.

By Application

Marine research held 38.4%, highlighting the growing focus on oceanographic studies and environmental monitoring. Underwater transducers are essential tools for studying marine life behavior, seabed mapping, and water quality analysis. This segment is supported by rising investment in climate research and ocean exploration. Accurate acoustic data helps researchers better understand underwater ecosystems and supports long-term marine conservation efforts.

By Material

Piezoelectric ceramics led the market with 52.6%, driven by their high sensitivity and strong acoustic performance. These materials convert mechanical pressure into electrical signals with high accuracy, making them suitable for deep-water and high-pressure environments. Their durability and reliability support widespread use in demanding underwater applications. Piezoelectric ceramics are preferred in sonar systems and research instruments where consistent performance is required over long operating periods.

By End User

The commercial segment accounted for 48.8%, fueled by growing use of underwater transducers in offshore energy, marine construction, and fisheries. These industries rely on acoustic systems for inspection, navigation, and operational monitoring. Commercial adoption is increasing as offshore activities expand into deeper waters. Underwater transducers help improve safety, reduce operational risk, and support efficient asset management in complex marine environments.

By Region

North America held a dominant 38.4% share, supported by strong investment in maritime research and underwater defense systems. The region benefits from advanced research infrastructure and continued focus on naval and ocean monitoring technologies. Ongoing development of offshore energy projects and marine science programs further strengthens regional demand. These factors position North America as a key contributor to technological advancement in underwater acoustics.

United States

The U.S. market reached USD 1.18 billion in 2024 and is expanding at a CAGR of 6.6%, underlining its leadership in underwater acoustic solutions. Growth is driven by sustained investment in defense, marine research, and offshore infrastructure. Rising focus on advanced sonar systems and environmental monitoring continues to support market expansion. The United States remains a major center for innovation and deployment of underwater transducer technologies.

Driver Analysis

Growing Demand for Marine Exploration and Mapping

A key driver for this market is increasing marine exploration activities. Governments, research institutions, and private enterprises invest in seabed mapping for scientific research, offshore construction, and resource identification. Underwater transducers help generate detailed acoustic images of the ocean floor, enabling precise mapping and safer navigation. This growing focus on marine data continues to stimulate demand for advanced transducer systems.

Another driver is expanding use in commercial fisheries and aquaculture. Transducers help fishermen locate schools of fish and monitor underwater conditions, supporting more efficient harvesting and stock management. In aquaculture, these devices support monitoring of cages, water quality, and feeder operations. As seafood production and sustainable practices gain importance, demand for reliable underwater sensing tools increases.

Restraint Analysis

High Cost of Advanced Transducer Systems

One restraint on the market is the cost of high-precision underwater transducers. Advanced models used in deep water and industrial applications often require specialized materials, robust design, and precision engineering. These factors increase manufacturing costs, which may limit adoption among smaller operators with restricted budgets. Cost concerns can slow investment in newer technologies, especially in regions with limited marine activity.

Another restraint is the requirement for technical expertise during installation and operation. Many underwater transducers must be calibrated and configured precisely to match the vessel or system environment. Improper installation can lead to inaccurate readings or system failure. This need for skilled personnel increases operational overhead and limits adoption where trained technicians are not readily available.

Opportunity Analysis

Expansion of Offshore Energy and Infrastructure Projects

An important opportunity lies in the growth of offshore energy development and underwater infrastructure. Projects such as offshore wind farms, undersea pipelines, and cable networks require detailed acoustic surveys before and during construction. Underwater transducers are used to map the seabed, monitor structural integrity, and support maintenance activities. As investment in offshore infrastructure increases, demand for transducers that provide reliable data is expected to grow.

Another opportunity is the integration of underwater transducers with digital analytics platforms. When transducers are paired with data processing systems that visualize acoustic data, users can derive more actionable insights from their measurements. This supports applications such as environmental monitoring, oceanographic research, and maritime security. Suppliers who offer bundled solutions that include hardware and data interpretation tools can attract wider interest.

Challenge Analysis

Environmental and Operational Limitations

A key challenge in this market is the impact of environmental conditions on device performance. Factors such as water temperature, salinity, currents, and marine life noise can affect acoustic signal clarity. Transducers must be designed and tuned for specific conditions, which increases design complexity. Inconsistent environments may reduce measurement accuracy and require frequent recalibration, complicating field operations.

Another challenge involves standards and compatibility across systems. Underwater transducers are used with various sonar, navigation, and monitoring equipment from different manufacturers. Lack of common standards can make integration and interoperability difficult. Users may face challenges when upgrading systems or replacing components, which can slow broader adoption of newer transducer technologies.

Key Market Segments

By Type

- Hydrophones

- Sonar Transducers

- Acoustic Doppler Current Profilers

- Others

By Application

- Marine Research

- Defense & Military

- Oil & Gas Exploration

- Underwater Communication

- Others

By Material

- Piezoelectric Ceramics

- Magnetostrictive Materials

- Others

By End-User

- Commercial

- Defense

- Research

- Others

Top Key Players in the Market

- Teledyne Marine

- Kongsberg Maritime

- Sonardyne International Ltd.

- EdgeTech

- Benthowave Instrument Inc.

- Neptune Sonar Ltd.

- Airmar Technology Corporation

- Ultra Electronics Maritime Systems

- Massa Products Corporation

- Furuno Electric Co., Ltd.

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- General Dynamics Mission Systems, Inc.

- L3Harris Technologies, Inc.

- Atlas Elektronik GmbH

- Thales Group

- Wärtsilä Corporation

- Hydroacoustics Inc.

- Reson A/S

- Simrad (Kongsberg Gruppen)

- Other Major Players

Future Outlook and Opportunities

The future outlook for the underwater transducer market remains positive as maritime activities expand and ocean monitoring gains importance. Opportunities are expected in defense modernization, offshore renewable energy, and autonomous underwater systems. Environmental monitoring and climate research will also drive demand. As technology advances, transducers will become more compact, energy efficient, and intelligent. Marine technology outlook studies suggest that over 75% of future underwater platforms will rely on advanced acoustic sensing solutions.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.5 Bn |

| Forecast Revenue (2034) | USD 7.9 Bn |

| CAGR(2025-2034) | 8.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |