Table of Contents

Global Indoor 5G Market Introduction

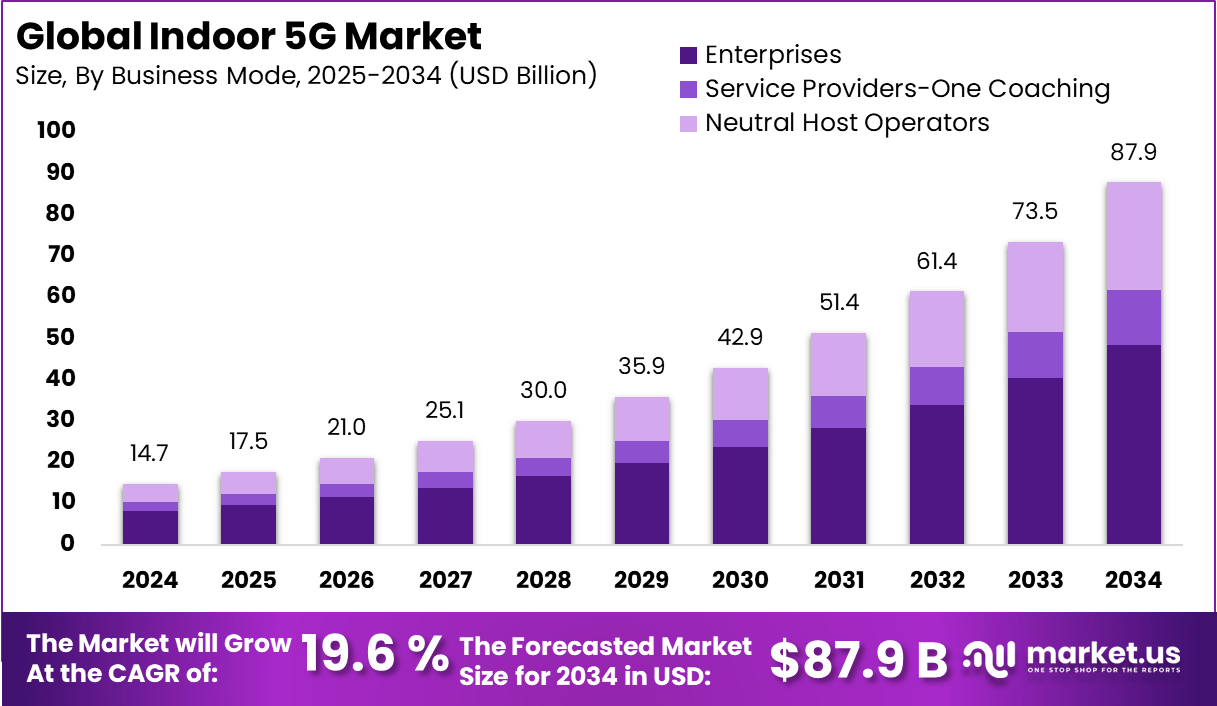

The global indoor 5G market generated USD 14.67 Billion in 2024 and is predicted to grow to about USD 87.9 Billion by 2034, recording a CAGR of 19.60% across the forecast period. This growth reflects rising demand for reliable, low latency wireless coverage inside factories, hospitals, offices, campuses, airports, and large venues where outdoor macro networks struggle to penetrate. In 2024, North America held a dominant market position, capturing more than a 35.4% share and holding USD 5.2 Billion revenue, supported by enterprise digitization, dense commercial infrastructure, and faster private network adoption.

How Growth is Impacting the Economy

Indoor 5G expansion is strengthening productivity by enabling higher equipment uptime, better asset utilization, and faster decision cycles across data intensive indoor environments. As enterprises modernize facilities, spending on indoor connectivity stimulates jobs across network design, radio planning, installation, integration, cybersecurity, and managed services. It is also improving competitiveness by supporting automation and real time quality control, which can lift output per worker in manufacturing and logistics.

In parallel, indoor 5G supports digital service growth in sectors such as healthcare delivery, smart retail, and building operations, encouraging higher value service models. Over time, the economic impact scales through reduced operational friction, fewer connectivity driven delays, and improved customer experiences in high footfall environments. North America’s large 2024 revenue base indicates faster regional reinvestment into advanced facilities and next generation enterprise applications.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=166169

Impact on Global Businesses

Rising costs and supply chain shifts: Global businesses are facing higher expectations for always on connectivity while balancing installation, integration, and lifecycle management costs. Indoor 5G decisions are also influencing sourcing strategies, with more preference for flexible architectures, multi vendor interoperability, and localized deployment partners to reduce rollout risk and shorten delivery timelines.

Sector specific impacts: Manufacturing benefits through connected machines, predictive maintenance, and safer automated workflows. Healthcare gains from reliable coverage for critical mobility, connected devices, and secure data movement within facilities. Retail and venues benefit from smoother digital engagement, real time analytics, and staff productivity tools. Logistics and transportation hubs benefit from better tracking, indoor positioning, and dependable connectivity in complex indoor layouts.

Strategies for Businesses

Prioritize use cases with measurable outcomes such as downtime reduction, throughput improvement, and safety compliance. Choose an indoor architecture aligned to the facility, including small cells, distributed antenna systems, or hybrid models, and design for scalability across sites. Adopt phased rollouts starting with high value zones and expand based on performance baselines.

Strengthen vendor governance by requiring interoperability, clear service level commitments, and lifecycle support. Build security into the design through segmentation, identity controls, and continuous monitoring, especially for private networks. Finally, integrate indoor 5G with edge computing and operational platforms to convert connectivity into operational impact rather than treating it as a standalone upgrade.

Key Takeaways

- The market generated USD 14.67 Billion in 2024 and is projected to reach about USD 87.9 Billion by 2034.

- The forecast growth rate is a CAGR of 19.60% across the period.

- North America led in 2024 with more than a 35.4% share and USD 5.2 Billion revenue.

- Demand is being driven by indoor coverage needs in enterprise, public venues, and mission critical facilities.

- Private and neutral host models are accelerating adoption where control, security, and performance are priorities.

➤ Unlock growth! Get your sample now! @ https://market.us/purchase-report/?report_id=166169

Analyst Viewpoint

In the present market, indoor 5G is moving from pilots to scaled deployments because enterprises are prioritizing resilient indoor connectivity for automation, mobility, and real-time operations. North America’s 2024 leadership reflects faster enterprise readiness and strong investment capacity, which is shaping deployment standards and partner ecosystems. Looking ahead, the outlook remains positive as more facilities adopt data-intensive workflows and require consistent indoor performance that supports secure connectivity, device density, and low latency. As architectures become more modular and interoperable, deployment complexity is expected to decline, improving adoption economics. The market’s projected trajectory to about USD 87.9 Billion by 2034 indicates durable, multi year demand across both new builds and retrofit projects.

Use Cases and Growth Factors

| Use case | What indoor 5G enables | Growth factors |

|---|---|---|

| Smart manufacturing | Reliable connectivity for machines, sensors, and automation | Industry digitization and performance driven operations |

| Healthcare facilities | Secure mobility for staff, devices, and critical workflows | Need for dependable indoor coverage and data security |

| Warehouses and logistics | Asset tracking, indoor positioning, and workflow optimization | Faster fulfillment expectations and operational efficiency goals |

| Offices and campuses | Consistent connectivity for collaboration and enterprise apps | Hybrid work enablement and IT modernization |

| Stadiums and large venues | High density user connectivity and real time experiences | Fan experience upgrades and venue digitization |

| Airports and transport hubs | Seamless indoor coverage across complex layouts | Passenger experience improvement and operational reliability |

Regional Analysis

North America dominated in 2024 with more than a 35.4% share and USD 5.2 Billion revenue, supported by higher enterprise spending, dense commercial infrastructure, and stronger momentum in private network deployments. Europe is expected to advance through smart building modernization, industrial digitization, and growing interest in secure indoor connectivity for critical infrastructure.

Asia Pacific is anticipated to expand as large scale manufacturing ecosystems, high density urban infrastructure, and new enterprise campuses increase indoor coverage needs. The Middle East and Africa is expected to see selective growth tied to major infrastructure projects, transport hubs, and premium commercial developments. Latin America is projected to progress as large enterprises modernize facilities and prioritize productivity-focused connectivity upgrades.

➤ Explore Huge Library Here –

Robot Mission Replay Tools Market

Robotic Plastering Systems Market

Robotic Fashion Inductor Market

Robotic Parcel Inductor Market

Business Opportunities

Indoor 5G is creating opportunities across design and deployment services, managed operations, integration with enterprise IT and operational technology, and security focused offerings. Enterprises are seeking end to end partners that can assess building RF challenges, propose the right architecture, deploy with minimal disruption, and maintain performance over time.

There is also growing opportunity in packaged solutions tailored to vertical needs, such as factories, hospitals, logistics hubs, and venues, where repeatable templates can reduce deployment risk. As demand increases for dependable indoor experiences, solution providers that combine connectivity with analytics, edge computing integration, and measurable operational outcomes are expected to capture higher value engagements.

Key Segmentation

The market is commonly segmented by solution type, including small cells, distributed antenna systems, and signal repeaters, based on building structure and coverage objectives. By deployment model, it is segmented into enterprise private networks, neutral host deployments, and operator led indoor coverage, reflecting different ownership and service approaches.

By end user, it is segmented across manufacturing, healthcare, retail, offices and campuses, public venues, and transportation hubs, each driven by distinct performance and security requirements. By technology approach, segmentation often reflects integration with edge capabilities, indoor positioning, and enterprise network management tools, as buyers increasingly prioritize outcomes such as reliability, coverage consistency, and scalable multi site management.

Key Player Analysis

Leading participants in the indoor 5G ecosystem are competing through breadth of indoor radio portfolios, deployment simplicity, and enterprise grade management capabilities. Differentiation is often built around the ability to support multiple indoor architectures, deliver predictable performance in challenging RF environments, and integrate securely with enterprise systems.

Strong execution typically includes certified deployment partner networks, robust planning tools, and lifecycle services that reduce rollout risk for multi site customers. Competitive advantage is also shaped by interoperability, scalable orchestration, and security controls suitable for mission critical environments. As the market expands, providers that demonstrate repeatable deployments, clear performance metrics, and strong post deployment support are expected to maintain stronger customer retention.

- Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- CommScope Holding Company, Inc.

- Corning Incorporated

- Comba Telecom Systems Holdings Limited

- AT&T Inc.

- Airspan Networks Holdings Inc.

- SOLiD Inc.

- Dali Wireless, Inc.

- Fujitsu Limited

- BTI Wireless, Inc.

- Sercomm Corporation

- PCTEL, Inc.

- Huber+Suhner AG

- Nextivity, Inc.

- JMA Wireless

- Proptivity AB

- LitePoint Corporation

- ALCAN Systems GmbH

- ExteNet Systems, Inc.

- LITEON Technology Corporation

- Mavenir Systems, Inc.

- Maven Wireless AB

- Boingo Wireless, Inc.

- Others

Recent Developments

- Increased adoption of neutral host indoor models to support multi tenant buildings and shared infrastructure.

- Stronger convergence between indoor 5G and enterprise Wi Fi strategies to optimize cost and performance.

- Wider use of modular indoor small cell designs to accelerate rollout speed and simplify expansion.

- Growing emphasis on managed services and lifecycle monitoring to maintain consistent indoor performance.

- Deeper integration of indoor connectivity with enterprise security controls and operational platforms.

Conclusion

Indoor 5G is scaling rapidly as enterprises prioritize reliable indoor coverage for automation, mobility, and data driven operations. With USD 14.67 Billion in 2024 and a path to about USD 87.9 Billion by 2034 at a 19.60% CAGR, the market outlook remains strongly positive, led by North America’s 2024 dominance.