Table of Contents

Smart City Cloud Infrastructure Market Introduction

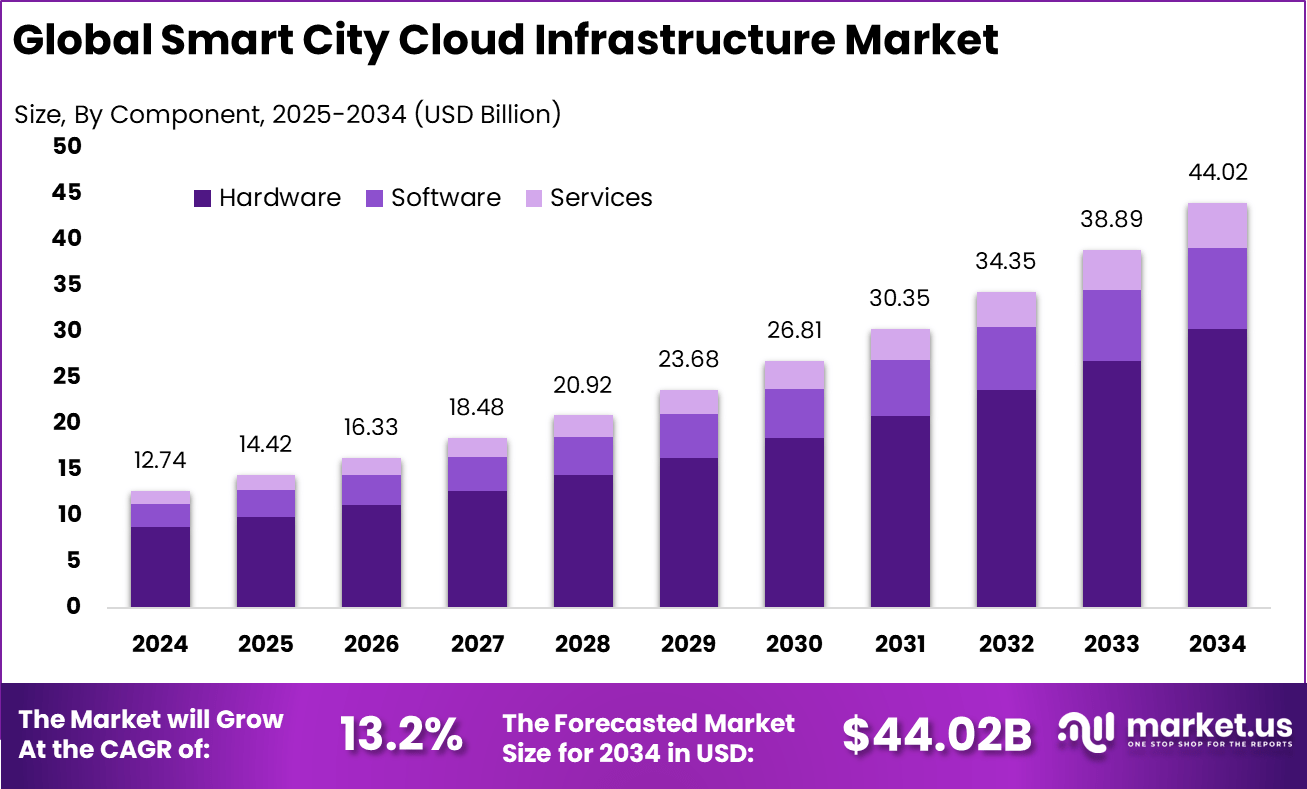

The global smart city cloud infrastructure market size is expected to be worth around USD 44.02 billion by 2034, from USD 12.74 billion in 2024, growing at a CAGR of 13.2% during 2025 to 2034. This expansion reflects rising cloud adoption across municipal services, connected infrastructure, and urban data platforms that support faster decision making.

North America held a dominant market position in 2024, capturing more than a 36.4% share and holding USD 4.63 billion in revenue, supported by stronger digital public infrastructure, higher smart city program maturity, and wider deployment of cloud based platforms for transportation, utilities, public safety, and citizen services.

How Growth is Impacting the Economy

Smart city cloud infrastructure growth is strengthening local and national productivity by improving how cities manage transport, utilities, permitting, and emergency response with data driven workflows. As cloud platforms scale, public agencies and private partners invest in integration, cybersecurity, analytics, and managed operations, which supports skilled employment and vendor ecosystems. Cloud enabled operations also reduce administrative friction by accelerating service delivery, improving asset utilization, and lowering downtime across critical systems.

In parallel, better digital services improve the business environment through faster approvals, improved mobility, and more reliable utilities, which supports commercial activity. The market’s expansion is also encouraging new procurement models, including outcome based contracts and shared platforms across agencies, improving spending efficiency. North America’s 2024 dominance signals quicker reinvestment into modernization programs, helping cities unlock measurable savings and service level improvements over time.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=170539

Impact on Global Businesses

Rising costs and supply chain shifts: Businesses supporting smart cities are facing higher compliance and security requirements, driving spending on resilient architectures, governance, and long term support. Procurement is also shifting toward scalable, interoperable platforms to reduce vendor lock in and avoid costly rework as city programs expand.

Sector specific impacts: Utilities benefit from cloud based monitoring, outage response, and demand planning. Transportation ecosystems gain from traffic analytics, fleet visibility, and real time routing coordination. Construction and real estate benefit from smarter permitting, digital inspections, and connected building integrations. Retail and tourism benefit from improved mobility, safety, and citizen engagement services that raise footfall confidence. IT and telecom partners benefit from recurring platform operations and managed service demand as cities increase reliance on cloud delivered systems.

Strategies for Businesses

Focus on high value municipal use cases with measurable outcomes such as outage reduction, response time improvement, and operational cost control. Build solutions with strong governance, data residency controls, and security by design, including identity management and continuous monitoring. Prioritize interoperability through open APIs and standardized integration methods so platforms can connect across agencies.

Use modular deployments, starting with priority corridors or districts and scaling citywide as performance proves out. Strengthen delivery capacity with local implementation partners and clear service level commitments for uptime, incident response, and patching. Align commercial models with public sector procurement realities by offering phased contracts, managed services, and transparent total cost of ownership.

Key Takeaways

- The market is expected to be worth around USD 44.02 billion by 2034, up from USD 12.74 billion in 2024.

- Growth is projected at a CAGR of 13.2% during 2025 to 2034.

- North America led in 2024 with more than a 36.4% share and USD 4.63 billion in revenue.

- Demand is rising as cities modernize utilities, mobility systems, and public services on cloud platforms.

- Interoperability, cybersecurity, and managed operations are becoming key buying priorities for city scale deployments.

➤ Unlock growth! Get your sample now! @ https://market.us/report/smart-city-cloud-infrastructure-market/free-sample/

Analyst Viewpoint

In the present market, smart city programs are prioritizing cloud infrastructure to unify fragmented municipal systems and enable real time decision making across agencies. North America’s leadership in 2024 reflects stronger digital readiness and a larger base of modernization projects that require scalable platforms. Looking ahead, the outlook remains positive as cities expand connected infrastructure, collect more operational data, and seek faster service delivery for citizens and businesses.

Growth is expected to be reinforced by broader adoption of cloud native architectures, improved data governance, and higher demand for resilient and secure operations. As procurement shifts toward outcomes and lifecycle support, providers that deliver measurable performance improvements are anticipated to gain stronger long term positions.

Use Cases and Growth Factors

| Use case | What cloud infrastructure enables | Growth factors |

|---|---|---|

| Smart utilities | Meter data management, outage analytics, asset monitoring | Reliability targets and operational efficiency priorities |

| Intelligent transportation | Traffic optimization, transit coordination, incident response | Urban congestion pressures and mobility modernization |

| Public safety platforms | Unified command dashboards, faster alerts, analytics | Need for quicker response and situational awareness |

| Citizen digital services | Online permits, payments, service requests, engagement tools | Demand for convenient services and faster processing |

| Environmental monitoring | Air quality, noise, and water analytics | Sustainability priorities and compliance tracking |

| Smart buildings and districts | Energy optimization, occupancy analytics, connected operations | Growth of connected campuses and district level projects |

Regional Analysis

North America dominated in 2024, capturing more than a 36.4% share and holding USD 4.63 billion in revenue, supported by higher municipal cloud adoption, stronger partner ecosystems, and broader program execution capacity. Europe is expected to advance through city modernization initiatives, sustainability driven investments, and stronger governance frameworks for urban data platforms.

Asia Pacific is projected to expand as rapid urbanization, large infrastructure buildouts, and digital government initiatives increase demand for scalable cloud platforms. The Middle East and Africa is anticipated to see selective growth tied to large scale smart district projects and transport infrastructure upgrades. Latin America is expected to grow steadily as cities digitize services and improve utility and mobility management.

➤ Explore Huge Library Here –

- Digital Marketing Spending Market

- Augmented Reality Hardware Market

- Robotics Red Team Services Market

- Robot OTA Update Platforms Market

Business Opportunities

This market creates opportunities in secure cloud migration, multi agency integration, platform operations, and data governance services for city scale environments. Providers can capture value by offering packaged solutions for utilities, transportation, and citizen services that reduce deployment complexity and accelerate time to impact.

There is also strong opportunity in managed services, including monitoring, incident response, compliance reporting, and lifecycle optimization, as cities prefer predictable operating models. As municipal systems generate more data, demand is rising for analytics layers, AI enabled forecasting, and digital twin support built on cloud foundations. Companies that demonstrate measurable service improvements and scalable architectures are expected to secure repeat deployments across multiple cities and regions.

Key Segmentation

The market is commonly segmented by component into cloud platforms, infrastructure services, and managed services, reflecting both technology deployment and ongoing operations. By deployment model, it is segmented into public cloud, private cloud, and hybrid cloud, driven by data sensitivity and governance requirements.

By application, segmentation typically includes smart transportation, smart utilities, public safety, smart governance, environmental monitoring, and citizen services, each with different integration depth and performance needs. By end user, it is segmented across municipal governments, public utilities, transport authorities, and smart district operators, where purchasing decisions prioritize compliance, security, scalability, and long term service continuity.

Key Player Analysis

Key participants are competing through platform scalability, secure multi tenant architecture, and the ability to integrate complex legacy municipal systems. Differentiation is often built around compliance readiness, data governance tooling, and strong cybersecurity controls suitable for public sector environments.

Successful providers typically offer modular solution templates for high priority city functions, supported by implementation partners and proven operational playbooks. Competitive advantage is also shaped by interoperability and open integration capabilities that allow cities to avoid vendor lock in and expand across agencies. As programs scale, vendors with strong managed service capacity, transparent performance reporting, and reliable lifecycle support are expected to maintain stronger customer retention and larger multi year contracts.

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform

- International Business Machines Corporation

- Oracle Corporation

- Alibaba Cloud

- Cisco Systems

- Siemens Aktiengesellschaft

- Huawei

- SAP SE

- VMware

- Salesforce

- Bosch

- Hitachi Ltd.

- Schneider Electric SE

- Others

Recent Developments

- Higher adoption of hybrid cloud approaches to balance governance needs with scalability.

- Increased focus on cybersecurity controls and continuous monitoring for municipal workloads.

- Growing preference for interoperable platforms that connect multiple agencies through open APIs.

- Expansion of managed services as cities seek predictable operations and lifecycle support.

- Rising integration of analytics and forecasting layers on top of cloud infrastructure for faster urban decisions.

Conclusion

Smart city cloud infrastructure is expanding as cities modernize services, utilities, and mobility systems with scalable digital platforms. With growth from USD 12.74 billion in 2024 to around USD 44.02 billion by 2034 at a 13.2% CAGR, the outlook remains positive. North America’s 2024 dominance indicates strong near term execution momentum.