Table of Contents

Digital Marketing Spending Market Introduction

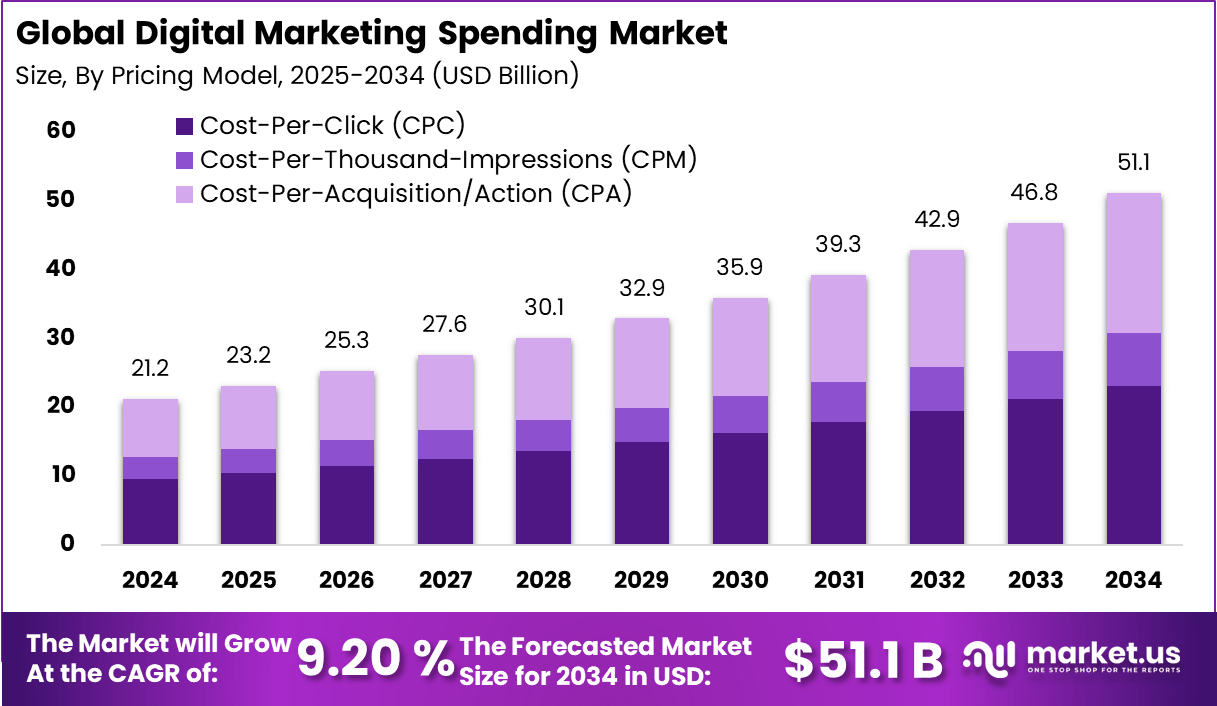

The global digital marketing spending market generated USD 21.2 Billion in 2024 and is predicted to grow to about USD 51.1 Billion by 2034, recording a CAGR of 9.20% across the forecast span. This growth reflects continued budget migration toward measurable, performance-led channels as brands focus on acquisition efficiency and retention. In 2024, North America held a dominant market position, capturing more than a 38.2 share and holding USD 8.0984 Billion revenue, supported by mature ad tech ecosystems, higher digital commerce intensity, and stronger adoption of data driven targeting. Spending is also rising as marketers diversify across search, social, video, and retail media to balance reach, conversion, and brand safety.

How Growth is Impacting the Economy

Rising digital marketing spend is strengthening economic activity by accelerating demand generation for businesses, improving customer discovery, and expanding digital commerce participation. As budgets scale, spending supports jobs and investment across creative services, media buying, analytics, marketing operations, and software platforms. It also improves market efficiency by enabling smaller firms to target niche audiences and compete beyond local markets, widening customer access and supporting entrepreneurship.

Increased digital advertising spend drives revenue for publishers and content ecosystems, helping fund digital media, creator economies, and app based services. In parallel, businesses are prioritizing attribution and measurement, which increases demand for data governance, privacy compliance, and secure customer data infrastructure. North America’s large 2024 revenue base indicates a faster reinvestment cycle into innovation, automation, and AI-enabled optimization that can improve marketing productivity and support broader business growth.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=166223

Impact on Global Businesses

Rising costs and supply chain shifts: Customer acquisition costs are rising as competition increases across auctions and high intent keywords. Businesses are also shifting partner strategies toward diversified channel mixes, stronger first party data use, and improved creative testing to maintain returns as platform policies and privacy rules evolve.

Sector specific impacts: Retail and e commerce benefit through conversion focused campaigns, retail media, and personalized promotions. Consumer packaged goods benefit through video, social commerce, and improved audience targeting for brand lift. Travel and hospitality benefit from intent based search and dynamic remarketing. B2B industries benefit from account based marketing, professional networks, and lead scoring systems. Healthcare and financial services face stricter compliance needs, shaping creative formats and targeting approaches.

Strategies for Businesses

Build a balanced channel portfolio across search, social, video, and commerce led placements to reduce dependency risk. Strengthen first party data programs through consent based collection, CRM integration, and clean measurement practices. Use continuous creative testing and audience segmentation to improve efficiency as acquisition costs rise. Invest in marketing analytics, attribution discipline, and incrementality testing to protect ROI and avoid wasted spend. Prioritize automation for bidding, budgeting, and personalization while maintaining governance to protect brand safety and compliance. Align campaigns with supply readiness and operational capacity so demand generation does not create stockouts or service strain, especially during peak seasons.

Key Takeaways

- The market generated USD 21.2 Billion in 2024 and is projected to reach about USD 51.1 Billion by 2034.

- Growth is expected at a CAGR of 9.20% across the forecast span.

- North America led in 2024 with more than a 38.2 share and USD 8.0984 Billion revenue.

- Spending is shifting toward measurable, performance-led channels and diversified media mixes.

- First party data, analytics, and automation are becoming central to sustaining returns as costs rise.

➤ Unlock growth! Get your sample now! @ https://market.us/report/digital-marketing-spending-market/free-sample/

Analyst Viewpoint

In the present market, digital marketing spending is expanding as brands prioritize measurable growth, faster experimentation, and always on customer engagement. North America’s 2024 leadership reflects mature digital commerce, advanced advertising technology, and higher adoption of analytics driven budget allocation. Looking ahead, the outlook remains positive as businesses increase personalization, expand video and commerce led placements, and improve lifecycle marketing to raise retention value. The market’s projected expansion to about USD 51.1 Billion by 2034 signals durable demand, especially for solutions that improve targeting quality while respecting privacy expectations. As measurement improves and automation scales, marketing productivity is expected to strengthen.

Use Cases and Growth Factors

| Use case | What digital marketing spend supports | Growth factors |

|---|---|---|

| Customer acquisition | Search and social campaigns that drive new buyers | Competitive markets and growth led budgets |

| Brand building | Video, creator, and premium placements for reach | Higher digital media consumption |

| Commerce growth | Retail media, marketplaces, and shoppable ads | Expansion of online buying behavior |

| Retention marketing | Email, app messaging, and loyalty campaigns | Focus on lifetime value and repeat purchase |

| B2B lead generation | Account based marketing and lead nurturing | Longer sales cycles and pipeline discipline |

| Local and service marketing | Geo targeted ads and call driven conversion | Demand for measurable local outcomes |

Regional Analysis

North America dominated in 2024, capturing more than a 38.2 share and holding USD 8.0984 Billion revenue, supported by higher digital ad intensity, stronger platform adoption, and larger performance marketing budgets. Europe is expected to grow steadily as brands optimize spend across privacy conscious environments and expand omnichannel measurement. Asia Pacific is projected to expand as mobile first commerce, social driven shopping, and growing SMB digitization increase demand for digital advertising. The Middle East and Africa is anticipated to progress through rising internet penetration and digital retail expansion in major cities. Latin America is expected to grow as e commerce participation increases and brands expand mobile targeted campaigns.

➤ Explore Huge Library Here –

- Kitchen Automation Systems Market

- Know Your Customer Software Market

- 5G Smartphone Antenna Tuner Market

- Robotics Retrofit Services Market

Business Opportunities

This market creates opportunities in performance optimization services, creative production at scale, analytics and measurement solutions, and privacy compliant data activation. Brands are seeking partners that can improve conversion efficiency while maintaining brand safety and regulatory alignment. There is rising demand for content that supports short form video, influencer collaborations, and commerce led formats, creating value for creative studios and campaign operators. As competition increases, lifecycle marketing and retention programs offer strong upside through improved customer value and lower reliance on expensive acquisition. Businesses that connect marketing spend to clear revenue outcomes through disciplined attribution and testing are expected to unlock stronger budget growth.

Key Segmentation

Digital marketing spending is commonly segmented by channel into search advertising, social media advertising, display advertising, video advertising, and commerce led placements, reflecting how brands allocate budgets to reach and convert audiences. By device, it is segmented into mobile and desktop, shaped by user behavior and format performance. By campaign objective, segmentation typically includes brand awareness, lead generation, and conversion focused spend, where measurement requirements differ. By end user industry, it is segmented across retail and e commerce, consumer goods, travel, finance, healthcare, and B2B services, each adopting different targeting, creative, and compliance strategies based on customer journeys.

Key Player Analysis

Market leaders are competing on reach quality, targeting capabilities, measurement transparency, and automation that improves return on ad spend. Differentiation is often built around ad formats that align with user behavior, strong creative optimization tooling, and reliable reporting across channels. Platforms and service providers with advanced analytics, identity resolution options, and privacy aligned data handling are gaining preference as marketers demand better attribution under evolving regulations. Competitive strength is also shaped by ecosystem integrations with commerce platforms and CRM tools that connect spend to outcomes. Providers that deliver consistent performance, brand safety controls, and scalable workflow automation are expected to maintain stronger share over time.

- Alphabet Inc.

- Meta Platforms Inc.

- Amazon.com Inc.

- Microsoft Corporation

- ByteDance

- Google LLC

- Baidu Inc.

- Alibaba Group Holdings Ltd.

- IBM Corporation

- Verizon Communications Inc.

- Twitter Inc.

- Hulu LLC

- Others

Recent Developments

- Faster budget shifts toward commerce led placements and performance focused formats.

- Increased emphasis on first party data activation and consent based targeting approaches.

- Wider use of automation for bidding, creative testing, and campaign pacing discipline.

- Growing demand for unified measurement and cross channel attribution reporting.

- Stronger focus on brand safety, fraud prevention, and quality traffic validation.

Conclusion

Digital marketing spending is expanding as businesses prioritize measurable growth, personalization, and diversified media strategies. With USD 21.2 Billion in 2024 and a projected rise to about USD 51.1 Billion by 2034 at a 9.20% CAGR, the outlook remains positive. North America’s 2024 dominance highlights strong near term adoption and reinvestment capacity.