Table of Contents

Robotics Red Team Services Market Introduction

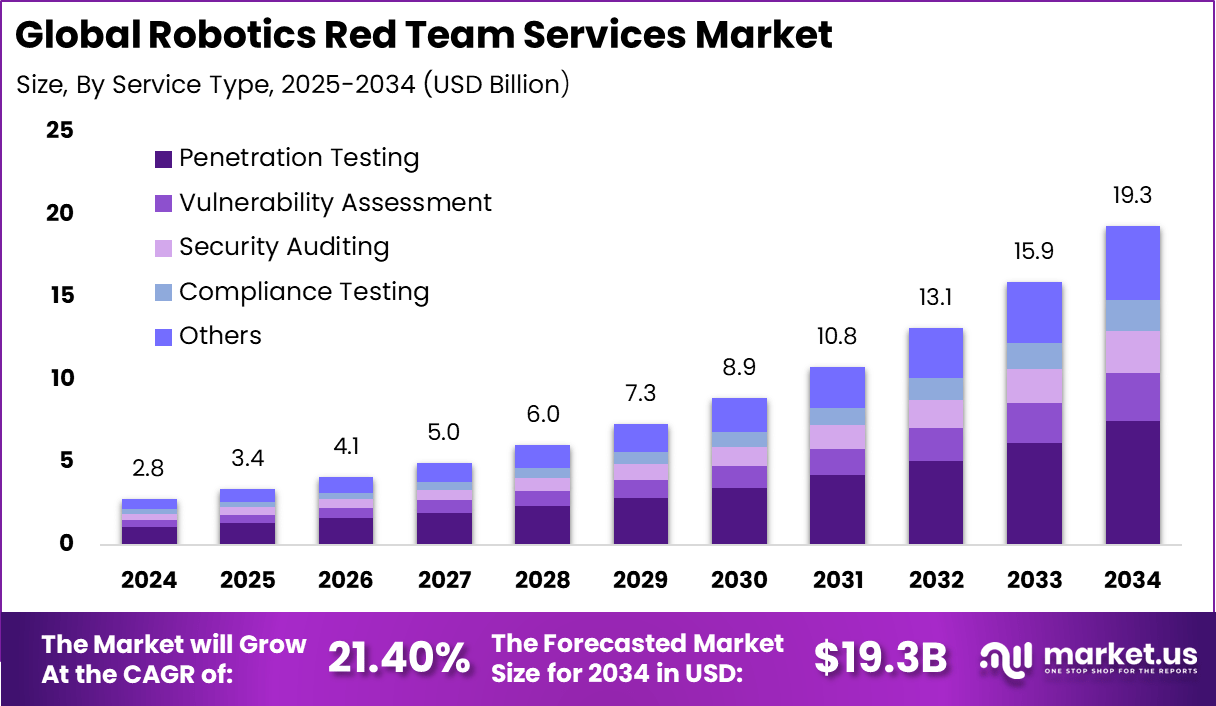

The global robotics red team services market generated USD 2.8 billion in 2024 and is predicted to grow from USD 3.4 billion in 2025 to about USD 19.3 billion by 2034, recording a CAGR of 21.40% throughout the forecast span. This rapid expansion reflects increasing use of autonomous robots in warehouses, factories, healthcare facilities, and critical infrastructure, where cyber physical failures carry high safety and financial risks. In 2024, North America held a dominant market position, capturing more than a 38.9% share and holding USD 1.08 Billion revenue, supported by higher robotics adoption, stricter security expectations, and broader compliance-driven testing across enterprise environments.

How Growth is Impacting the Economy

Robotics red team services growth is strengthening economic resilience by reducing the likelihood of disruptive cyber physical incidents that can halt production, damage assets, or compromise worker safety. As robotics expands, spending on security testing and validation supports high skill jobs across offensive security, robotics engineering, safety assurance, and industrial network defense. It also improves productivity by helping organizations deploy automation with greater confidence, reducing downtime linked to vulnerabilities and misconfigurations.

Increased testing activity stimulates investment in secure by design development practices, incident readiness, and continuous monitoring tools, which strengthens the broader cybersecurity economy. In parallel, more robust robotics security lowers systemic risk for sectors such as logistics and manufacturing that influence supply continuity. North America’s strong 2024 revenue base indicates faster adoption of specialized assessment services, accelerating security maturity across robotic deployments.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=170389

Impact on Global Businesses

Rising costs and supply chain shifts: Businesses are facing higher operational risk costs as robotic fleets expand, pushing budgets toward continuous testing, patch validation, and secure integration across vendors. Supply chain shifts also increase exposure because robots often depend on third party components, remote support tools, and connected software updates, raising the need for vendor risk review and security verification.

Sector specific impacts: Manufacturing needs protection against robot downtime and unsafe motion scenarios. Warehousing and logistics require resilience for routing systems, vision sensors, and fleet orchestration. Healthcare requires strict controls for connected devices and patient safety. Energy and utilities need secure robotics for inspection and maintenance. Retail and hospitality face reputational risk if customer facing robots are compromised.

Strategies for Businesses

Adopt a robotics security program that combines red teaming, safety testing, and continuous vulnerability management across devices, networks, and control systems. Prioritize threat modeling early in procurement and require security controls in contracts, including patch timelines and secure update mechanisms. Run regular scenario based exercises focused on remote access, firmware integrity, and robot fleet orchestration systems. Segment networks and enforce strong identity controls to limit lateral movement from IT to operational environments. Track remediation with clear ownership and validation retesting. Align testing schedules with production cycles to reduce operational disruption while maintaining frequent assurance for high risk deployments.

Key Takeaways

- The market generated USD 2.8 billion in 2024 and is projected to reach about USD 19.3 billion by 2034.

- Growth is expected at a CAGR of 21.40% across the forecast span, with USD 3.4 billion in 2025 as the next step up.

- North America led in 2024 with more than a 38.9% share and USD 1.08 Billion revenue.

- Demand is rising as autonomous robots expand in high consequence environments.

- Continuous testing, vendor risk management, and secure fleet operations are becoming core buying priorities.

➤ Unlock growth! Get your sample now! @ https://market.us/report/robotics-red-team-services-market/free-sample/

Analyst Viewpoint

In the present market, robotics red team services are moving from occasional audits to recurring assurance because robotic systems are increasingly connected, software defined, and deployed at scale. North America’s 2024 dominance reflects strong adoption of automation alongside higher security expectations for industrial and enterprise environments.

Looking ahead, the outlook remains positive as organizations expand robot fleets and regulators and insurers emphasize safety and cyber resilience. Growth toward about USD 19.3 billion by 2034 signals sustained demand for specialized expertise that blends offensive security with robotics engineering. Providers that can validate real world attack scenarios, deliver actionable remediation, and support continuous testing cycles are expected to gain stronger positions.

Use Cases and Growth Factors

| Use case | What red team services test | Growth factors |

|---|---|---|

| Warehouse robot fleets | Fleet control, navigation, and remote access exposure | Rapid automation in fulfillment and logistics |

| Industrial robots | Controller security, safety boundaries, downtime scenarios | Smart factory expansion and OT digitization |

| Healthcare robots | Connected workflows, access controls, data pathways | Patient safety and compliance expectations |

| Field inspection robots | Communications links, update channels, mission reliability | Robotics adoption in energy and infrastructure |

| Service robots in public spaces | Identity abuse, user interaction risks, reputational threats | Customer facing automation growth |

| Robotics software platforms | APIs, cloud management, orchestration vulnerabilities | Shift toward software defined robotics |

Regional Analysis

North America dominated in 2024, capturing more than a 38.9% share and holding USD 1.08 Billion revenue, supported by advanced robotics deployments and mature cybersecurity spending. Europe is expected to expand as industrial automation remains strong and safety focused validation becomes more routine in production environments.

Asia Pacific is projected to grow rapidly as manufacturing automation scales and enterprises strengthen OT security programs. The Middle East and Africa is anticipated to see selective growth tied to critical infrastructure projects and robotics for inspection and operations. Latin America is expected to progress as logistics modernization and industrial upgrades increase the need for robotics security assurance.

➤ Explore Huge Library Here –

- SLAM LiDAR Mapping Systems Market

- Workload Identity Security Market

- Mobile Phishing Protection Market

- Remote Operation Platform Market

Business Opportunities

This market offers strong opportunities in managed red teaming, continuous testing programs, and specialized assessments for robot firmware, safety controls, and fleet orchestration. Buyers increasingly need providers that can translate findings into engineering fixes and verify remediation without disrupting operations.

There is also opportunity in vendor qualification services that evaluate robotics components, remote support pathways, and software update mechanisms before large deployments. As organizations scale robot fleets, demand rises for repeatable testing frameworks, training for internal teams, and incident simulation workshops focused on cyber physical threats. Service providers that align testing with production schedules and deliver clear risk reduction metrics are expected to secure longer contracts.

Key Segmentation

The market can be segmented by service type into penetration testing for robotic systems, adversary simulation, firmware and hardware security assessment, wireless and network testing, and post remediation validation. By deployment environment, it is segmented into manufacturing and industrial sites, warehouses and logistics hubs, healthcare facilities, public venue deployments, and critical infrastructure operations.

Engagement model, segmentation typically includes one time assessments, recurring testing retainers, and continuous security validation programs. By robot category, demand spans industrial arms, mobile robots, collaborative robots, service robots, and inspection robots, each requiring different safety and threat scenario coverage based on control systems and connectivity.

Key Player Analysis

Participants compete on their ability to combine offensive security with robotics engineering knowledge, enabling realistic attack simulations that reflect cyber physical impacts. Differentiation is driven by expertise in industrial protocols, embedded firmware, wireless links, and fleet management platforms. Strong providers deliver repeatable methodologies, safety aware testing practices, and clear remediation guidance that engineering teams can implement quickly. Competitive advantage is also shaped by the ability to test across multi vendor environments and validate fixes through retesting and monitoring recommendations. As buyers prioritize measurable risk reduction, providers that offer continuous testing models and actionable reporting are expected to gain stronger long term adoption.

- Alias Robotics

- GRIMM

- Cylance (BlackBerry)

- Rapid7

- IOActive

- RoboSec

- NCC Group

- Mandiant (Google Cloud)

- FireEye

- Kaspersky Lab

- Dragos

- Cybernetix

- Forescout Technologies

- Darktrace

- Trustwave

- Synopsys

- Trend Micro

- McAfee

- Positive Technologies

- CrowdStrike`

- Others

Recent Developments

- Increased shift from annual assessments to recurring red team retainers for robot fleets.

- Higher focus on firmware integrity testing and secure update validation for connected robots.

- Wider adoption of safety plus cybersecurity combined testing for industrial deployments.

- Growing demand for testing fleet orchestration platforms and cloud management interfaces.

- Stronger emphasis on vendor risk reviews for third-party robotics components and tools.

Conclusion

Robotics red team services are expanding rapidly as autonomous systems scale in high risk environments. With USD 2.8 billion in 2024 and growth toward about USD 19.3 billion by 2034 at a 21.40% CAGR, demand is expected to remain strong. North America’s 2024 lead highlights faster adoption and higher security maturity.