Table of Contents

Market Overview

Next Generation Non Volatile Memory (NGNVM) refers to advanced storage technologies that retain data without power, surpassing traditional flash memory in speed, density, and efficiency. These include Resistive RAM (ReRAM), Phase-Change Memory (PCM), Magnetoresistive RAM (MRAM), and Spin-Transfer Torque MRAM (STT-MRAM). They address limitations of older non-volatile options by combining non-volatility with DRAM-like performance. NGNVM supports data centers, AI systems, IoT devices, and edge computing where fast, reliable storage is essential. Unlike volatile memory that loses data on power loss, NGNVM ensures persistence while enabling real-time processing. This makes it a key enabler for modern applications requiring both speed and durability.

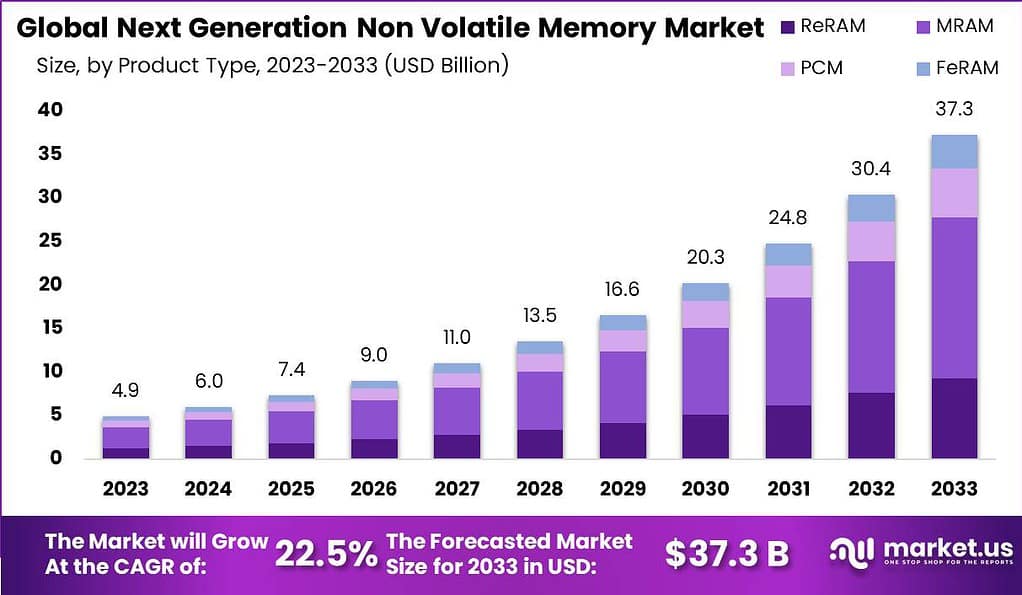

According to Market.us, The global next generation non volatile memory market was valued at USD 6.0 billion in 2023 and is projected to reach approximately USD 37.7 billion by 2033, registering a steady CAGR of 22.5% during the forecast period from 2024 to 2033. Growth is driven by rising demand for high performance, energy efficient memory solutions across data centers, consumer electronics, and emerging AI and IoT applications. Growth in AI workloads requires memory that processes large datasets quickly without delays. Billions of IoT devices need low-power storage to operate in remote areas. 5G networks boost edge computing, where efficient memory cuts energy use and speeds up tasks.

Exponential data growth from AI and IoT drives demand for next-generation NVM solutions. Traditional memory struggles with speed and power needs in modern workloads. Data centers seek scalable options to handle massive streams without performance drops. Cloud providers and edge devices fuel this trend through requirements for instant access and endurance. High-frequency trading and autonomous systems amplify needs for low-latency storage. Overall, sectors handling real-time data push market expansion steadily.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | US$ 7.4 Bn |

| Forecast Revenue (2033) | US$ 37.3 Bn |

| CAGR (2024-2033) | 22.5% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

Key Takeaways

- The next generation non volatile memory market is expanding rapidly, supported by strong annual growth momentum as demand for advanced storage solutions accelerates.

- A wide range of emerging memory technologies is shaping the market, including ReRAM, PCM, and MRAM, each offering faster access, higher endurance, and improved efficiency compared to conventional flash memory.

- MRAM held a dominant position in 2023 with a 49.7% share, driven by its fast read write performance, low power consumption, and long operational life.

- FeRAM also maintains a meaningful presence, supported by its reliability and suitability for applications requiring frequent data rewriting.

- Mobile phones represent a key application area, as manufacturers adopt advanced memory to support faster processing and stable data retention.

- Cache memory and enterprise storage continue to see strong adoption, benefiting from high speed data access and improved system performance.

- Market growth is driven by rising data generation, continuous semiconductor innovation, and increasing use of advanced memory in AI systems and autonomous technologies.

Key Technology Statistics

- High-Bandwidth Memory led the next-generation memory landscape in 2024 with a 58.85% revenue share, driven by strong demand from AI-focused data centers.

- MRAM accounted for 31% of revenue within the non-volatile memory segment, supported by its speed, endurance, and low power consumption.

- Nano-RAM is emerging as the fastest-growing memory type, with a projected 38% CAGR through 2030 as commercialization advances.

- 300 mm wafers dominated production in 2024 with a 60.25% share, reflecting cost efficiency and higher output yields.

Increasing Adoption of Technologies

Various NVM technologies are gaining adoption due to their unique performance benefits. For instance, MRAM (Magnetoresistive RAM) is becoming popular in embedded systems and industrial devices because of its endurance and non-volatility. Similarly, ReRAM and PCM are being tested for their scalability and ability to perform well under high temperature and endurance conditions, making them suitable for AI processing and mobile applications.

Manufacturers are also integrating these technologies into 3D architectures to increase density and reduce cost per bit. The transition from traditional NAND and DRAM to emerging memory types is gradually taking place, supported by technological innovations and standardization efforts. Each adoption step aims to improve processing speeds, reduce power draw, and enable new classes of intelligent and energy-efficient devices.

Organizations adopt next-generation NVM solutions primarily for their superior performance characteristics compared to conventional memory. These technologies combine the speed of DRAM with the persistence of flash memory, creating a high-performance, low-latency option for applications that demand continuous data access. Additionally, they reduce the need for frequent refreshing cycles, which helps lower overall power consumption and extend battery life in portable electronics.

Another major reason for adoption is durability and reliability. Traditional flash and DRAM degrade over time under heavy read/write operations, whereas new NVM types offer greater endurance, supporting critical workloads like AI model training, automotive control systems, and high-frequency trading platforms. The result is improved data retention, longer component life, and lower total cost of ownership.

Emerging Trends

Shift Toward High-Speed and Low-Power Architectures

A major trend is the move toward memory technologies that combine strong performance with low energy use. Many next generation memory formats reduce the delay seen in conventional storage and allow systems to perform rapid data access. This trend is important for applications such as artificial intelligence, autonomous systems, and real-time analytics where fast response is essential.

Another trend involves integrating next generation memory into compact devices. Smartphones, wearables, and edge computing hardware require memory that offers high capacity while using minimal power. New memory designs allow efficient operation in these space-restricted devices. As consumer electronics evolve, interest in these technologies grows steadily.

Growth Factors

Rising Data Center Demand and Increasing AI Workloads

One important growth factor is the expansion of data centers. Cloud platforms handle large numbers of transactions and complex workloads. They require memory solutions that can support fast caching, efficient storage layering, and stable performance during peak demand. Next generation memory technologies help reduce latency and improve system response.

Another growth factor is the increase in AI and machine learning applications. These workloads require continuous data access and high-speed processing. Memory with stronger durability and faster switching speeds supports AI model training and edge inference. As more industries adopt AI tools, demand for advanced memory solutions rises.

Driver Analysis

Need for Faster Performance and Stronger Endurance

A key driver is the need for higher read and write speeds. Traditional flash memory faces limits in switching performance, which affects the computing speed of modern devices. Next generation memory formats reduce delay and support real-time processing. This performance improvement attracts industries that depend on rapid data handling.

Another driver is the need for stronger memory endurance. Industrial automation, automotive systems, and mission-critical equipment require memory that can sustain continuous writing cycles without degradation. Next generation memory offers better durability and increased reliability, making it suitable for long-term applications.

Restraint Analysis

High Development Costs and Manufacturing Challenges

A major restraint is the cost of developing and manufacturing next generation memory technologies. These formats often require new production methods and specialized materials. The cost of establishing new fabrication processes can be high, which slows adoption among manufacturers.

Another restraint is the limited availability of large-scale production. Some memory types remain in early development or small-volume manufacturing. This affects pricing and creates supply limitations. Industries that require consistent, high-volume supply may hesitate to adopt newer formats until production capacity improves.

Opportunity Analysis

Expansion Into Automotive Electronics and Edge Computing

There is strong opportunity in automotive electronics. Modern vehicles depend on data-rich applications such as advanced driver assistance systems, real-time sensing, and in-vehicle infotainment. These systems require memory that can operate under temperature variation and continuous load. Next generation memory technologies offer qualities suited for these conditions, creating new market opportunities.

Another opportunity lies in edge computing. Edge devices need fast, reliable memory to process information close to the source without relying on cloud infrastructure. Compact and low-power memory designs support these needs. As edge computing expands across industrial, retail, and smart city applications, adoption of next generation memory is expected to grow.

Challenge Analysis

Integration With Existing Architectures and Compatibility Issues

A major challenge is integrating new memory technologies into existing device architectures. Many systems are designed around traditional memory interfaces. Replacing them with advanced options may require redesigning boards, controllers, and software. This increases transition time and slows large-scale adoption.

Another challenge involves compatibility across different manufacturing ecosystems. Each memory technology has unique characteristics. Ensuring consistent standards for performance, reliability, and testing is necessary to support adoption across industries. Meeting these requirements remains an ongoing challenge for suppliers and device manufacturers.

Recent Developments

- In November 2024, GlobalFoundries was awarded USD 1.5 billion in funding through the U.S. CHIPS Act to support the expansion of domestic semiconductor manufacturing. The funding will be used to develop new production facilities in Vermont and New York, generate over 1,500 new jobs, and improve supply reliability for essential sectors including automotive, aerospace, defense, IoT, and smart device manufacturing through long term supply agreements.

Key Market Segments

By Product

- FeRAM

- PCM

- MRAM

- ReRAM

By Application

- Industrial & Automotive

- Cache Memory & Enterprise Storage

- Mass Storage

- Mobile Phones

- Embedded MCU & Smart Cards

Market Key Players

- Intel Corporation

- Fujitsu Limited

- SK hynix Inc.

- Samsung Electronics Co., Ltd.

- Micron Technology, Inc.

- Everspin Technologies

- Toshiba Corporation

- Crossbar, Inc.

- Adesto Technologies

- Infineon Technologies AG

- Other Key Players

Our Trending Reports Here: