Table of Contents

Insurance Agency Software Market size

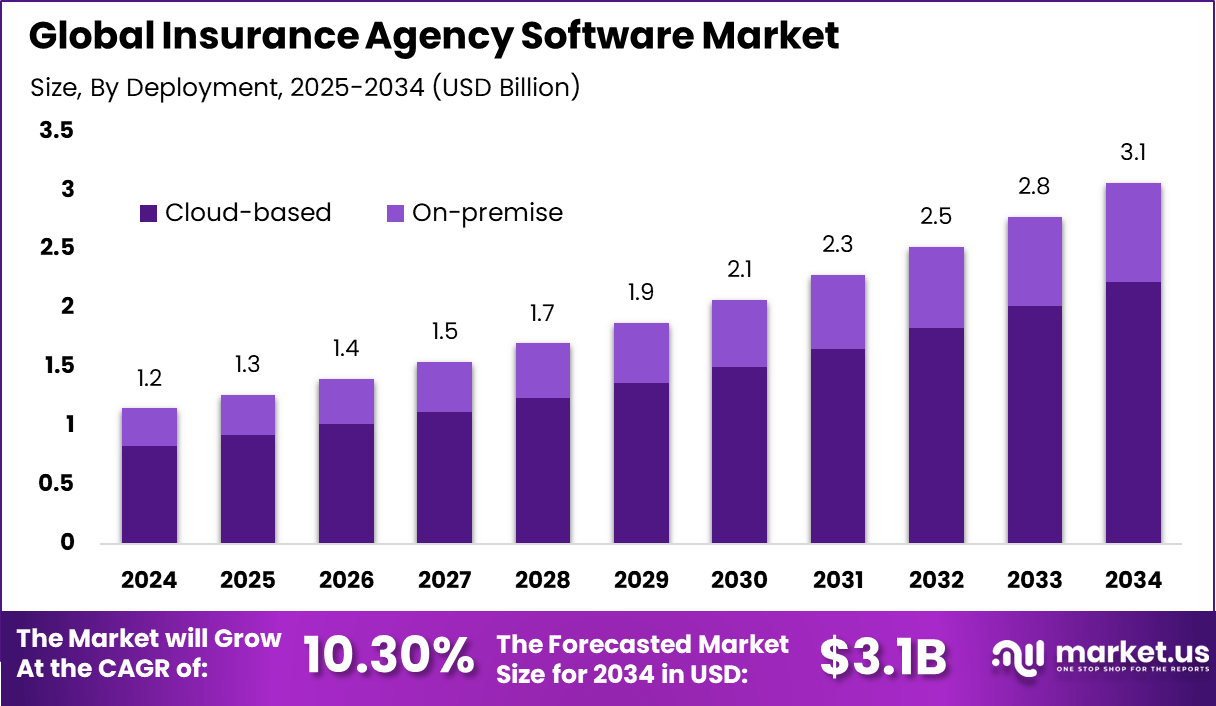

The global insurance agency software market was valued at USD 1.2 billion in 2024 and is expected to increase from USD 1.3 billion in 2025 to around USD 3.1 billion by 2034, growing at a CAGR of 10.30% over the forecast period. In 2024, North America led the market with more than 41.3% share, generating approximately USD 0.47 billion in revenue, supported by steady use of digital tools across insurance agencies and brokerage operations.

The insurance agency software market includes digital platforms that help insurance agencies manage policies, clients, claims, commissions, and daily operations. These solutions are used by independent agents, brokers, and small to mid-sized insurance firms. The software supports workflow automation, data management, and regulatory compliance. It plays an important role in improving operational accuracy and service delivery.

The market covers core agency management systems, customer relationship tools, document management, and reporting solutions. Deployment models include cloud-based and on-premise systems depending on agency size and regulatory needs. Agencies increasingly rely on software to manage growing policy volumes and customer interactions. As insurance operations become more complex, software adoption continues to expand.

Top Market Takeaways

- Agency management systems lead by software type with a 53.6% share, as insurers rely on unified tools for client records, policy servicing, commissions, and workflow control.

- Cloud-based deployment dominates with 72.6%, preferred for scalability, remote access, lower operating costs, and smooth integration with CRM, analytics, and compliance tools.

- Large enterprises account for 71.2%, reflecting the need to manage complex portfolios, multi-carrier links, and regulatory requirements at scale.

- Policy administration holds 46.1%, supporting efficient quoting, issuance, renewals, endorsements, billing, and accurate data handling with self-service options.

- Insurance agencies represent 56.8% of end users, using software for onboarding, claims tracking, reporting, and daily operational efficiency.

- North America captures about 41.3% share, supported by high digital adoption and mature insurance operations.

- The U.S. market is valued at approximately USD 0.43 billion in 2025.

- The market is expanding at a 9.03% CAGR, driven by digital transformation, regulatory demands, and demand for integrated platforms with AI analytics and mobile access.

Software Adoption Rates

- Agency management systems show near-universal use, with over 90% of U.S. independent agencies reporting active AMS adoption, while penetration among small agencies exceeds 80%.

- Digital transformation has become a core priority, as 66% to 74% of insurance agencies and executives identify digital strategy implementation as their top focus for 2025.

- Cloud hosting has largely replaced legacy on-premise systems, with around 82% of agencies running their software environments in the cloud as of 2025.

- Customer self-service portals have reached adoption levels of about 39%, with larger agencies leading uptake to improve client experience and operational efficiency.

Emerging Trends

In the insurance agency software market, one notable trend is the growing adoption of cloud-based platforms that allow agencies to manage policies, claims, customer records, and workflows from remote locations. By migrating core functions to the cloud, agencies improve accessibility for teams and reduce reliance on on-premises infrastructure. This shift supports more agile operations and promotes collaboration across geographically dispersed offices.

Another emerging trend is the integration of automation and artificial intelligence features into agency systems to streamline tasks such as policy issuance, renewal reminders, and customer communications. Automated workflows reduce manual effort on repetitive processes, enabling staff to focus on higher-value activities such as client engagement and advisory services. These intelligent capabilities enhance accuracy and improve service responsiveness without significantly increasing operational complexity.

Growth Factors

A key growth factor in the insurance agency software market is the increasing need for operational efficiency and digital transformation within insurance distribution channels. Agencies that adopt modern software solutions are better positioned to manage large volumes of policy data, track interactions, and streamline reporting. This efficiency is particularly valuable as insurers expand product portfolios and client bases.

Another factor supporting growth is the heightened emphasis on customer experience and engagement. Policyholders increasingly expect prompt responses, personalised communications, and digital self-service options. Software platforms that enable features such as client portals, automated notifications, and integrated communication tools help agencies deliver these expectations, strengthening customer satisfaction and loyalty.

Driver

A principal driver of the market is the demand for data-driven decision making. Insurance agencies generate and manage extensive data sets related to risk profiles, claims history, and customer preferences. Software that offers analytics and reporting capabilities allows agencies to gain insights that support targeted marketing, risk assessment, and strategic planning. This data orientation enables more informed decision making across sales, underwriting support, and service delivery.

Another driver is the move toward mobile and remote accessibility for agency personnel. As agents increasingly interact with clients outside traditional office environments, software solutions that support mobile access to critical functions help ensure continuity of service. Mobile-friendly platforms allow agents to review client information, generate quotations, or process transactions while in the field.

Restraint

A significant restraint in this market is the variation in technology adoption rates across agencies. Smaller or traditional firms may continue to rely on legacy systems or manual processes due to cost sensitivity or comfort with established methods. This uneven adoption can slow broader market penetration of modern agency software, particularly where perceived benefits are not immediately clear.

Another restraint is the complexity of integrating software with existing insurer systems and third party data sources. Agencies often work with multiple carriers, each with different data formats, communication protocols, and system capabilities. Ensuring seamless interoperability can require specialised technical resources and coordination, which can constrain implementation timelines.

Opportunity

A substantial opportunity exists in the expansion of analytics-enabled customer engagement tools within agency platforms. By leveraging machine learning and predictive models, software can help agencies anticipate client needs, recommend relevant products, and personalise interactions. These capabilities deepen client relationships and support upselling or cross-selling strategies.

Another opportunity lies in enhancing compliance and risk management features within insurance agency software. As regulatory requirements evolve, tools that support automated compliance checks, audit trails, and documentation workflows can reduce administrative burden and mitigate exposure to errors. These risk focused modules strengthen operational trust and help agencies maintain regulatory alignment.

Challenge

One of the main challenges for the insurance agency software market is ensuring data security and privacy protection. Agency systems store sensitive personal and financial information about clients. Safeguarding this information from breaches, unauthorised access, and misuse requires robust protective measures, continuous monitoring, and adherence to evolving data protection standards.

Another challenge is maintaining flexibility while avoiding system complexity. Agencies vary widely in size, product mix, and workflow preferences. Developing software solutions that are sufficiently flexible to support diverse business models without overwhelming users with complexity is critical to achieving sustained adoption and satisfaction.

Key Market Segments

By Software

- Agency Management Systems (AMS)

- Customer Relationship Management (CRM)

- Document Management

- Others

By Deployment

- Cloud-based

- On-premise

By Organization Size

- Large Enterprises

- Small & Medium Agencies

By Application

- Policy Administration

- Claims Management

- Sales & Marketing

- Commission Tracking

By End-User

- Insurance Agencies

- Brokerages

- Managing General Agents (MGAs)

- Independent Agents

Top Key Players in the Market

- Vertafore

- Applied Systems

- Salesforce

- Oracle

- Hawksoft

- EZLynx

- NowCerts

- Jenesis Software

- AgencyBloc

- QQSolutions

- Nexsure

- InsuredMine

- Agency Matrix

- ITC

- Partner XE

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.2 Bn |

| Forecast Revenue (2034) | USD 3.1 Bn |

| CAGR(2025-2034) | 10.30% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |