Table of Contents

CRM Software Market Size

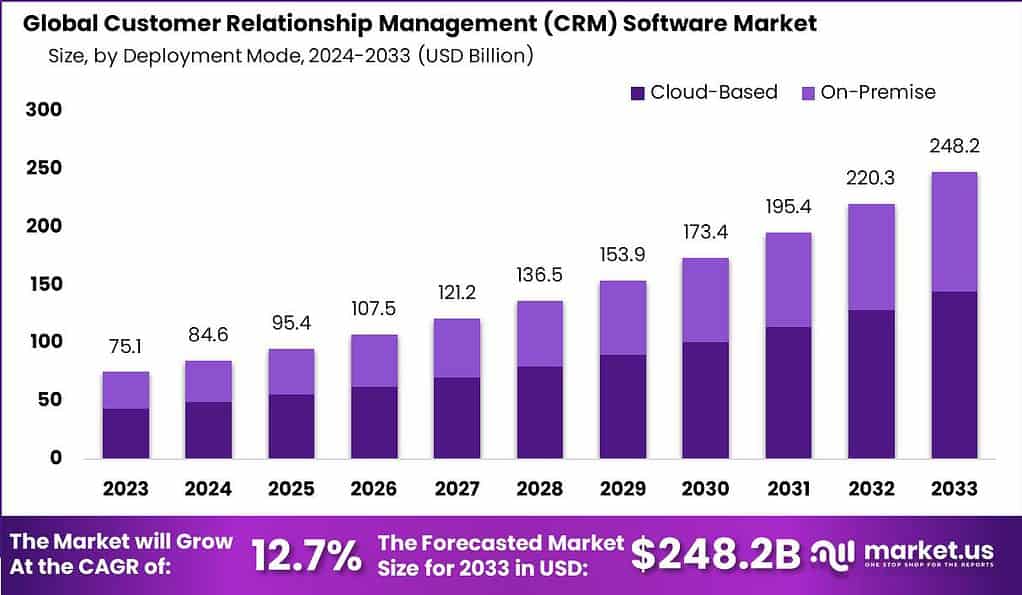

According to Market.us, The global customer relationship management software market was valued at USD 75.1 billion in 2023 and is projected to reach approximately USD 248.2 billion by 2033, expanding at a CAGR of 12.7% during the forecast period from 2024 to 2033.

The customer relationship management software market includes digital platforms that help organizations manage interactions with customers across sales, marketing, and service functions. These systems store customer data, track communication history, and support relationship building over time. CRM software is used across industries such as retail, banking, healthcare, manufacturing, and professional services. It plays a key role in improving customer engagement and operational coordination.

The market covers solutions ranging from basic contact management to advanced platforms with analytics and automation. Deployment options include cloud-based and on-premise systems, depending on data and compliance needs. Organizations adopt CRM software to create a single view of the customer. As customer expectations increase, CRM systems become central to business operations.

Key Takeaways

- The Customer Relationship Management software market reached USD 84.6 billion in 2024 and is expected to expand significantly by 2033, reflecting sustained enterprise investment in customer-focused digital platforms.

- In 2023, customer service solutions led adoption with over 24.5% share, as organizations prioritized support automation, case management, and customer experience improvement.

- Cloud-based deployment dominated with more than 58.3%, driven by scalability, lower infrastructure burden, and ease of integration with enterprise systems.

- Large enterprises accounted for over 63.2%, reflecting complex customer operations and higher demand for advanced CRM capabilities.

- The BFSI sector emerged as the leading industry vertical with a share exceeding 23%, supported by high customer interaction volumes, regulatory requirements, and data-driven engagement needs.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | US$ 75.1 Bn |

| Forecast Revenue (2033) | US$ 248.2 Bn |

| CAGR (2024-2033) | 12.7% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

Top Driving Factors

One major driving factor is the growing focus on customer retention and long-term relationships. Businesses recognize that retaining existing customers is more cost-effective than acquiring new ones. CRM software helps track customer behavior and preferences over time. This enables more informed and consistent engagement. Another driving factor is increasing competition across industries. Companies must respond faster and more accurately to customer needs. Manual tracking methods are no longer sufficient at scale. CRM systems provide structured workflows that support timely and coordinated responses.

Demand for CRM software continues to rise across small, mid-sized, and large organizations. Small businesses adopt CRM tools to organize customer data and manage sales pipelines. Larger enterprises demand advanced systems that integrate with multiple departments. This broad user base supports steady demand. Demand is also driven by the need for better visibility into customer activity. Organizations want real-time insights into sales performance and service outcomes. CRM dashboards and reporting tools address this requirement. As data-driven decision making grows, CRM demand strengthens further.

Increasing Adoption of Technologies

Cloud computing is a major technology driving CRM adoption. Cloud-based CRM platforms offer easier deployment and lower upfront costs. They also support remote access and regular system updates. This flexibility appeals to modern and distributed workforces. Automation and analytics technologies are also widely adopted within CRM systems. Automated workflows improve lead handling and follow-up processes. Analytics tools help businesses identify trends and performance gaps. These technologies enhance both efficiency and insight.

One key reason for adoption is improved sales effectiveness. CRM software helps sales teams manage leads and track deal progress. This reduces missed opportunities and improves forecasting accuracy. Sales processes become more consistent and transparent. Another reason is enhanced customer service quality. Service teams use CRM systems to access customer history quickly. This allows faster issue resolution and more personalized support. Consistent service experiences strengthen customer trust.

Emerging Trends

In the customer relationship management (CRM) software market, a major trend is the widespread adoption of artificial intelligence (AI) and automation. CRM platforms are increasingly embedding AI capabilities to automate routine tasks such as data entry, lead scoring, and follow-up scheduling. These intelligent systems help organisations reduce manual workload and deliver more timely and personalised customer engagements. Predictive insights derived from AI also improve sales forecasting and support smarter decision making.

Another emerging trend is the integration of omnichannel communication tools within CRM systems. Businesses are unifying data from email, chat, social media, messaging apps, and support platforms into a single customer profile. This consolidated view enhances service consistency and helps teams respond to customer needs more quickly, regardless of the channel used. The result is a more cohesive experience for customers and more efficient operations for organisations.

Growth Factors

One key growth factor in the CRM software market is the increasing emphasis on customer experience as a competitive differentiator. Organisations recognise that maintaining strong relationships with customers improves retention, brand loyalty, and lifetime value. CRM systems provide centralised tools for tracking interactions, preferences, and service history, enabling teams to tailor communications and support more effectively.

Another important factor supporting market growth is the expansion of digital sales and service channels. As companies serve customers through online platforms, mobile apps, and remote support functions, the volume and complexity of customer data increase. CRM solutions help businesses manage these diverse touchpoints and synthesise information into actionable insights, which strengthens operational efficiency and customer responsiveness.

Driver

A principal driver of the CRM software market is the need for enhanced data visibility across business functions. CRM platforms break down silos between sales, marketing, and customer support by providing a unified repository of customer information. This shared visibility improves coordination among teams, facilitates better targeting of campaigns, and reduces redundancy in communications.

Another driver is the rise of subscription-based and recurring revenue business models. Organisations that depend on long term customer engagement and renewals require systems that track ongoing relationships, manage contract cycles, and trigger proactive outreach. CRM systems are well positioned to support these requirements by automating lifecycle management and improving renewal rates.

Restraint

A significant restraint in this market is the challenge of integrating CRM solutions with legacy IT systems. Many organisations operate older software and databases that are not readily compatible with modern CRM platforms. This complexity can slow deployment, require costly customisation, and extend implementation timelines.

Another restraint relates to user adoption barriers within organisations. CRM systems are only effective if teams consistently use them to capture and update customer interactions. Resistance to change, lack of training, and inconsistent data entry practices can undermine the value of CRM initiatives and limit return on investment.

Opportunity

A substantial opportunity exists in the development of industry-specific CRM solutions. Verticalised platforms tailored to the unique needs of sectors such as healthcare, financial services, education, and hospitality can deliver greater relevance and faster time to value. These specialised systems can address regulatory requirements and workflow nuances more effectively than generic offerings.

Another opportunity lies in expanding analytics and customer insight capabilities. Embedded analytics that highlight trends in behaviour, churn risk, and lifetime value enable organisations to anticipate needs and personalise engagements at scale. CRM systems that support advanced segmentation and recommendation engines can strengthen competitive positioning.

Challenge

One of the main challenges for the CRM software market is ensuring data privacy and regulatory compliance as customer information is collected and processed. Organisations must adhere to laws governing personal data protection, which can vary across regions and industries. Designing CRM systems that balance rich data collection with strong privacy safeguards is essential to maintaining customer trust.

Another challenge involves scaling CRM implementations across distributed and global organisations. As companies expand into new markets, maintaining consistent CRM practices, governance standards, and data quality across geographies becomes complex. Ensuring that CRM systems adapt to local requirements without fragmenting data or processes requires careful strategy and coordination.

Key Market Segments

By Solution

- Customer Experience Management

- Customer Service

- Salesforce Automation

- Social Media Monitoring

- CRM Analytics

- Marketing Automation

- Other Solutions

By Deployment Mode

- On-premise

- Cloud

By Enterprise Size

- Small & Medium Enterprise

- Large Enterprises

By End-use

- Retail

- BFSI

- Discrete Manufacturing

- Healthcare

- IT & Telecom

- Government & Education

- Other End-Uses

Top Market Leaders

- Salesforce Inc.

- Oracle Corporation

- SAP SE

- Sage Group plc

- Adobe Inc.

- HubSpot

- SugarCRM Inc.

- Freshworks Inc.

- IBM Corporation

- Copper CRM, Inc.

- Zendesk Inc.

- Zoho Corporation

- Other Key Players