Table of Contents

BYOD Market Size

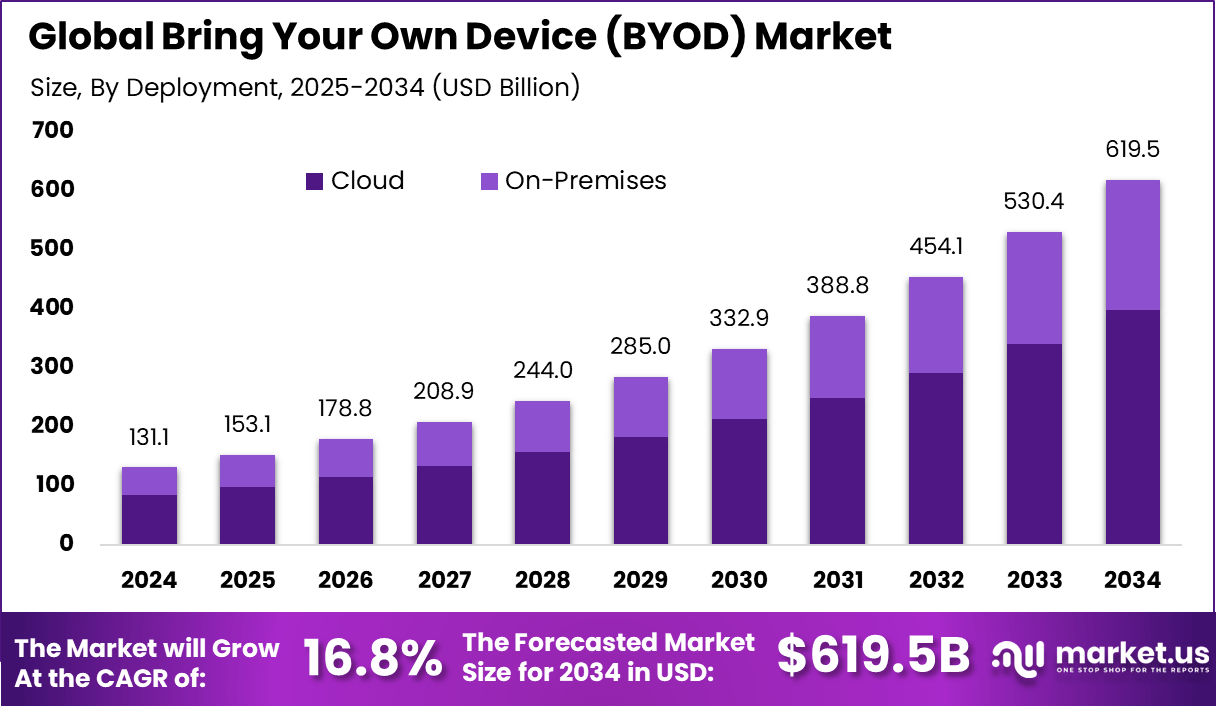

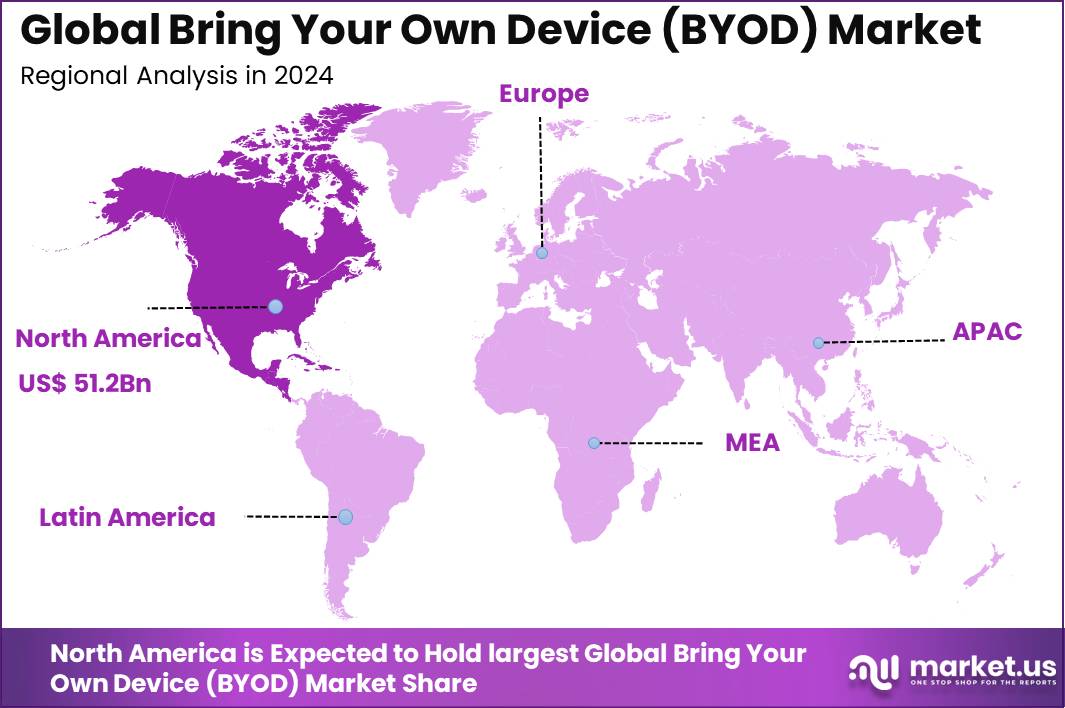

The global bring your own device market generated USD 131.1 billion in 2024 and is projected to grow from USD 153.1 billion in 2025 to approximately USD 619.5 billion by 2034, registering a CAGR of 16.8% over the forecast period. In 2024, North America held a dominant position with more than 39.1% market share, accounting for around USD 51.2 billion in revenue, driven by widespread enterprise mobility adoption and flexible work policies.

The bring your own device (BYOD) market refers to policies and solutions that allow employees to use their personal smartphones, tablets, laptops, and other devices for work purposes. Organizations adopt BYOD strategies to support flexible work practices, enhance employee mobility, and reduce hardware costs. BYOD implementations rely on security tools, mobile device management (MDM) systems, and access control measures to ensure that corporate data remains protected across personal devices.

Growth in this market is driven by the increasing prevalence of mobile work, remote work arrangements, and demand for quick access to business systems from anywhere. As technology evolves and personal devices become more capable, businesses are more willing to support employee-owned devices. Effective BYOD policies balance user convenience with robust security and compliance controls.

Top Market Takeaways

- Cloud deployment leads with 64.2%, supported by scalability, cost efficiency, and smooth integration with enterprise mobility platforms.

- Smartphones account for 50.1% of device usage, confirming their role as the primary tool for workplace connectivity and remote access.

- Mobile Device Management security solutions hold 41.5%, highlighting their importance in protecting enterprise data on employee-owned devices.

- Large enterprises represent 58%, driven by broad adoption of BYOD policies to improve productivity and lower hardware spending.

- North America captures 39.1% share, supported by mature IT infrastructure, strong remote work culture, and advanced enterprise mobility adoption.

Usage and Adoption Statistics

- About 67% of employees use personal devices for work, even when formal policies are not in place.

- More than 95% of organizations allow BYOD in some form across their workforce.

- Smartphones dominate BYOD usage, contributing over 50% of related revenue due to app availability and ease of use.

- Key employee drivers include convenience, single-device usage for work and personal needs, and dissatisfaction with company-issued devices.

- Businesses report cost savings of up to $341 per employee each year, along with higher productivity and better support for hybrid work.

- BYOD adoption is highest in education at 69%, followed by finance, IT, government, and healthcare sectors.

BYOD Statistics and Impact

- Around 82% of companies have formally adopted a BYOD policy, while over 80% actively encourage its use.

- Nearly 69% of U.S. IT leaders view BYOD as a positive and long-term strategy.

- Organizations can reduce device-related costs by up to 11% by shifting from employer-provided devices to BYOD models.

- Employees use an average of 2.5 devices for work, with 66% relying mainly on smartphones.

- BYOD improves productivity by 55% and raises employee satisfaction by 56%.

- Security concerns remain the main barrier, cited by 39% of organizations.

- A BYOD-enabled employee generates roughly $350 in additional annual value and typically works about 2 extra hours per week.

- About 87% of businesses rely on smartphones for employee access to business applications.

By Geography

In 2024, North America accounted for 39.1% of the global BYOD market, supported by high smartphone penetration, flexible workplace culture, and advanced IT infrastructure.

Emerging Trends

In the bring your own device (BYOD) market, a prominent trend is the integration of zero trust and identity-centric security frameworks. Organisations are moving beyond simple device-based controls to models that verify users and contexts continuously before granting access to corporate resources. This shift supports secure use of personal devices without relying solely on network perimeters, which is critical as remote and hybrid work patterns persist.

Another emerging trend is the use of unified endpoint management (UEM) and containerisation technologies to separate personal and corporate data on the same device. These tools allow organisations to apply corporate policies selectively while preserving user privacy and personal usage. The capability to manage diverse device types and operating systems through a central console streamlines administrative processes and improves compliance with organisational security standards.

Growth Factors

A key growth factor in the BYOD market is the persistent rise of remote and flexible work arrangements. Employees increasingly expect the ability to use their personal smartphones, tablets, and laptops for professional purposes. BYOD policies supported by robust management platforms help organisations enable effective remote productivity while maintaining oversight of corporate data access.

Another factor supporting growth is the focus on employee experience and satisfaction. Allowing individuals to work on devices they are familiar with can improve efficiency and reduce onboarding time. Organisations that support personal device use can also reduce the total cost of device procurement and maintenance, while enabling employees to choose tools that best fit their work styles.

Driver

A principal driver of the BYOD market is the need for cost optimisation in device provisioning. BYOD policies reduce the burden of purchasing, deploying, and refreshing company-owned hardware. When supported by secure management solutions, allowing employees to use personal devices can shift capital expenditure to operational expenditure, which is attractive for organisations seeking lean operating models.

Another driver is the increasing adoption of cloud-based productivity and collaboration tools. As organisations migrate applications and data to cloud environments, secure access from a variety of personal devices becomes both feasible and necessary. Cloud-native architectures support flexible BYOD usage while ensuring that corporate resources remain protected.

Restraint

A notable restraint in this market is the challenge of maintaining robust security and data protection. Personal devices may not receive regular updates, may run unauthorised applications, or may be shared among multiple users. Ensuring that corporate data remains protected on such devices requires sophisticated policies, encryption controls, and ongoing monitoring, which can be complex to implement.

Another restraint relates to privacy concerns among employees. BYOD environments must balance organisational security needs with respect for personal data and usage patterns. Users may be reluctant to adopt corporate management tools if they perceive that their personal information is being monitored without clear boundaries and transparency.

Opportunity

A strong opportunity exists in the development of advanced policy automation and contextual access controls. Solutions that can dynamically adjust permissions based on factors such as location, device health, user role, and behaviour can reduce administrative overhead while improving security. Such automation supports scalable BYOD adoption while mitigating risk.

Another opportunity lies in expanding integration with identity and access management (IAM) and secure access service edge (SASE) frameworks. By aligning BYOD management with broader secure access strategies, organisations can streamline authentication, authorisation, and monitoring across diverse environments. This integration enhances operational coherence and reduces complexity.

Challenge

One of the main challenges for the BYOD market is ensuring seamless interoperability across heterogeneous devices and operating systems. Employees use a wide variety of personal devices, and ensuring consistent policy enforcement across different platforms remains technically demanding. Testing, support, and maintenance must accommodate this diversity without compromising security or usability.

Another challenge involves balancing control with user experience. Overly restrictive management policies can frustrate users and reduce productivity, while lax controls can expose corporate assets to risk. Designing frameworks that protect organisational interests while maintaining intuitive, unobtrusive user experiences requires careful strategy and ongoing refinement.

Key Market Segments

By Deployment

- On-Premises

- Cloud

By Device Type

- Smartphones

- Tablets

- Laptops

- Wearables and Other Endpoints

By Security Solution

- Mobile Device Management (MDM)

- Unified Endpoint Management (UEM)

- Identity and Access Management (IAM)

By Organization Size

- Large Enterprises

- Small and Mid-Sized Enterprises (SMEs)

By End-User Vertical

- IT and Telecom

- Healthcare

- Government and Public Sector

- Retail

- BFSI

- Manufacturing and Automotive

- Other End-User Verticals

Top Key Players in the Market

- ALE International

- Apperian

- Avaya LLC

- AT&T Intellectual Property

- Hewlett Packard Enterprise Development LP

- Cisco Systems Inc.

- Gallagher Insurance Brokers Private Limited

- Averail

- Duo

- Fixmo

- IBM

- Ivanti

- iPass Inc.

- Mobiquity Inc.

- Oracle

- Verivo

- Verizon

- LexisNexis Risk Solutions

- Vox Mobile

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 131.1 Bn |

| Forecast Revenue (2034) | USD 619.5 Bn |

| CAGR(2025-2034) | 16.8% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |