Table of Contents

Puddling Robot Market Size

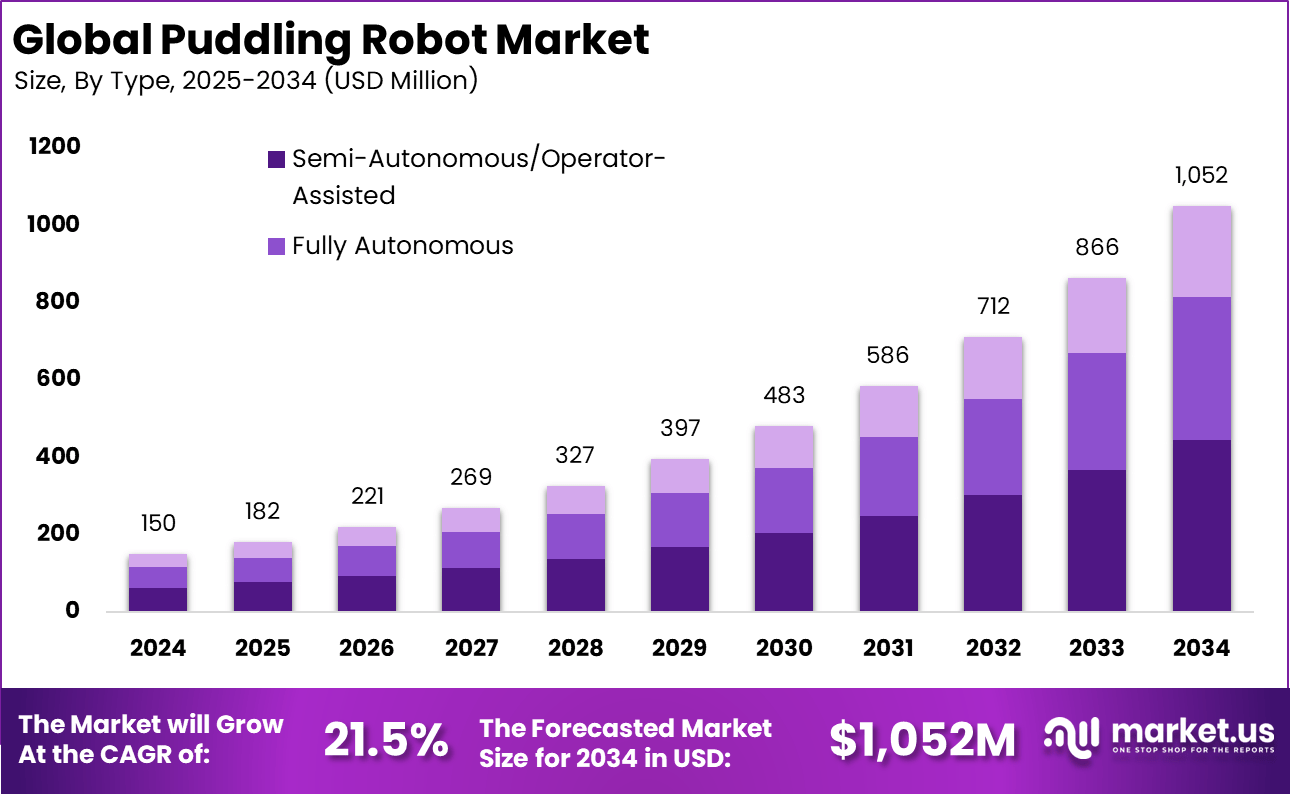

The global puddling robot market was valued at USD 150 million in 2024 and is projected to reach approximately USD 1,052 million by 2034, expanding at a CAGR of 21.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant position with more than 73.4% market share, generating around USD 110.1 million in revenue, supported by strong infrastructure development and early adoption of construction automation technologies.

Key Takeaway

- The semi-autonomous and operator-assisted segment led with 42.5%, reflecting market preference for solutions that combine automation benefits with human oversight and control.

- Electric and battery-powered systems dominated with 74.3%, driven by the shift toward energy-efficient, low-emission agricultural machinery.

- Large-scale commercial farming accounted for 62.4%, highlighting strong adoption of robotics to improve productivity and reduce dependence on manual labor.

- The China market reached USD 44.3 million in 2024 and is growing at a 25.8% CAGR, supported by government programs focused on smart farming and mechanization.

- Asia-Pacific held a leading 73.4% share globally, driven by extensive paddy cultivation, labor shortages, and rapid uptake of agricultural robotics technologies.

Market Overview

The Puddling Robot Market refers to the segment of automated machines designed to perform puddling in industrial and construction settings. These robots are engineered to uniformly mix soil or materials by repetitive kneading actions, enhancing compaction and structural properties. The market is shaped by the increasing demand for automation in construction and agriculture to improve operational efficiency and safety. Manufacturers in this market focus on modular designs, sensor integration, and compatibility with existing construction workflows.

Adoption of puddling robots is driven by the need to reduce manual labor and improve the consistency of material conditioning. These robots are deployed in applications requiring precise control over soil and material properties prior to construction activities. The market spans various end use sectors including infrastructure development, land reclamation, and large scale agricultural projects. Continued interest in robotics for heavy duty tasks supports ongoing innovation and adoption.

Top Driving Factors

One primary factor driving the Puddling Robot Market is the labor shortage in construction and agricultural industries. Skilled operators are increasingly difficult to secure, and automation offers a way to mitigate workforce constraints. Puddling robots can perform repetitive and physically demanding tasks with minimal human intervention. This reduces reliance on manual labor and enhances project continuity.

Another significant driver is the emphasis on improving operational efficiency and quality control. Manual puddling processes are subject to variation depending on operator skill and environmental conditions. By contrast, robotic systems can deliver consistent compaction and material transformation across large work areas. This reliability in performance supports project timelines and reduces rework costs.

Demand Analysis

Demand for puddling robots is rising in large scale infrastructure projects due to the need for precision and speed. Governments and private developers are investing in roads, bridges, and urban development where soil preparation is critical. Use of automated puddling contributes to uniform subgrade preparation, which is essential for structural integrity. This has encouraged procurement of advanced robotic systems.

In the agricultural sector, demand is emerging from farms and land management services seeking improved soil conditioning. Traditional methods are labor intensive and may not yield uniform results across expansive land parcels. Puddling robots offer repeatable performance that can enhance soil aeration and readiness for planting. Interest is especially noted in regions with high mechanization adoption.

Increasing Adoption of Technologies

Integration of sensor technology is accelerating the capabilities of puddling robots. Sensors enable real time monitoring of soil conditions, ensuring that the robot adapts to variations in moisture and density. This enhances precision and outcome predictability during operation. Development efforts continue to improve sensor arrays and feedback systems.

Artificial intelligence is also being adopted to support autonomous navigation and task optimization. AI driven control systems allow robots to plan efficient paths and adjust operational parameters without constant human input. This reduces the need for onsite supervision and improves safety. Combined with machine learning, these systems can refine performance over time with repeated use.

Key Reasons for Adoption

A key reason for adopting puddling robots is the improvement in workplace safety. Traditional puddling activities can expose workers to hazards such as heavy equipment, uneven terrain, and repetitive strain. Robots eliminate direct human involvement in these high risk tasks. Organizations prioritize safety to reduce injury rates and comply with occupational health standards.

Another reason for adoption is the reduction of operational costs over the project lifecycle. While initial investment in robotic systems may be significant, long term savings arise from reduced labor costs and minimized rework. Enhanced consistency in material preparation also contributes to lower downstream maintenance needs. These benefits support financial planning and resource allocation.

Investment Opportunities

Investment opportunities are present in hardware innovation focused on durability and ease of maintenance. Puddling robots that can withstand harsh environments and prolonged use are likely to attract interest from industrial buyers. Development of standardized components can reduce costs and support aftermarket services. Investors may find value in startups advancing ruggedized robotic platforms.

Software and control system development also present opportunities for investment. Enhanced algorithms for autonomous operation and adaptive control can differentiate product offerings. Platforms that support remote monitoring and fleet management can appeal to larger contractors. Investment in cloud based analytics and data services tied to robot performance can create recurring revenue streams.

Business Benefits

Organizations that implement puddling robots can achieve higher throughput in soil preparation tasks. Automated systems maintain consistent performance and reduce delays caused by labor gaps. This contributes to smoother project execution and improved schedule adherence. Enhanced reliability can also strengthen client satisfaction and contractor reputation.

Cost savings is another business benefit realized through reduced labor dependency and fewer errors. Robots can operate for extended periods with minimal fatigue and maintenance downtime. This reduces variability in operational output and supports predictable budgeting. Over time, these efficiencies can improve profitability and competitiveness.

Regulatory Environment

The regulatory environment for the Puddling Robot Market is influenced by safety and automation standards. Robotics used in construction and industrial environments must comply with regulations governing machine safety, operator training, and site operations. Compliance ensures that robotic deployment does not introduce undue risk to workers or property. Standards bodies and authorities provide frameworks that manufacturers must follow.

Environmental regulations also play a role, particularly where soil disturbance and material handling are involved. Robots must be designed to minimize negative impacts on surrounding ecosystems during puddling activities. Compliance with environmental protection requirements can affect product design and operational protocols. Adherence to these regulations supports sustainable deployment and market acceptance.

Emerging Trend Analysis

The Puddling Robot Market is being influenced by rapid adoption of precision agriculture technologies that combine robotics with artificial intelligence for autonomous field operations. These systems use sensors, GPS positioning, and soil data to automatically control soil puddling depth and consistency with minimal human intervention. By improving accuracy and repeatability, these robots help farmers optimize field conditions before planting. Precision algorithms also support adaptive responses to varying soil conditions, enhancing overall field preparation quality.

Another notable trend is the integration of connectivity and cloud-based data platforms into puddling equipment, enabling remote monitoring and performance analytics. Farmers can access operational metrics and soil status in real time via mobile or desktop dashboards, enabling more informed decisions. This connectivity supports fleet coordination when multiple robots are deployed across large agricultural areas. Growing digital infrastructure in rural regions is further accelerating this trend and expanding market relevance.

Key Market Segments

By Type

- Fully Autonomous

- Semi-Autonomous/Operator-Assisted

- Manual Remote-Controlled

By Power Source

- Electric/Battery-Powered

- Diesel-Powered

- Hybrid

By Application

- Large-Scale Commercial Farming

- Small & Medium Enterprises (SMEs)

- Research & Educational Institutions

Top Key Players in the Market

- Kubota Corporation

- Pudu Technology Inc.

- Yanmar Holdings Co., Ltd.

- Yamabiko Corporation

- ISEKI & Co. Ltd

- ArvaTec

- Waybot Robotics

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 150 Million |

| Forecast Revenue (2034) | USD 1,052 Million |

| CAGR(2025-2034) | 21.5% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |