Table of Contents

Standalone NPN Market Overview

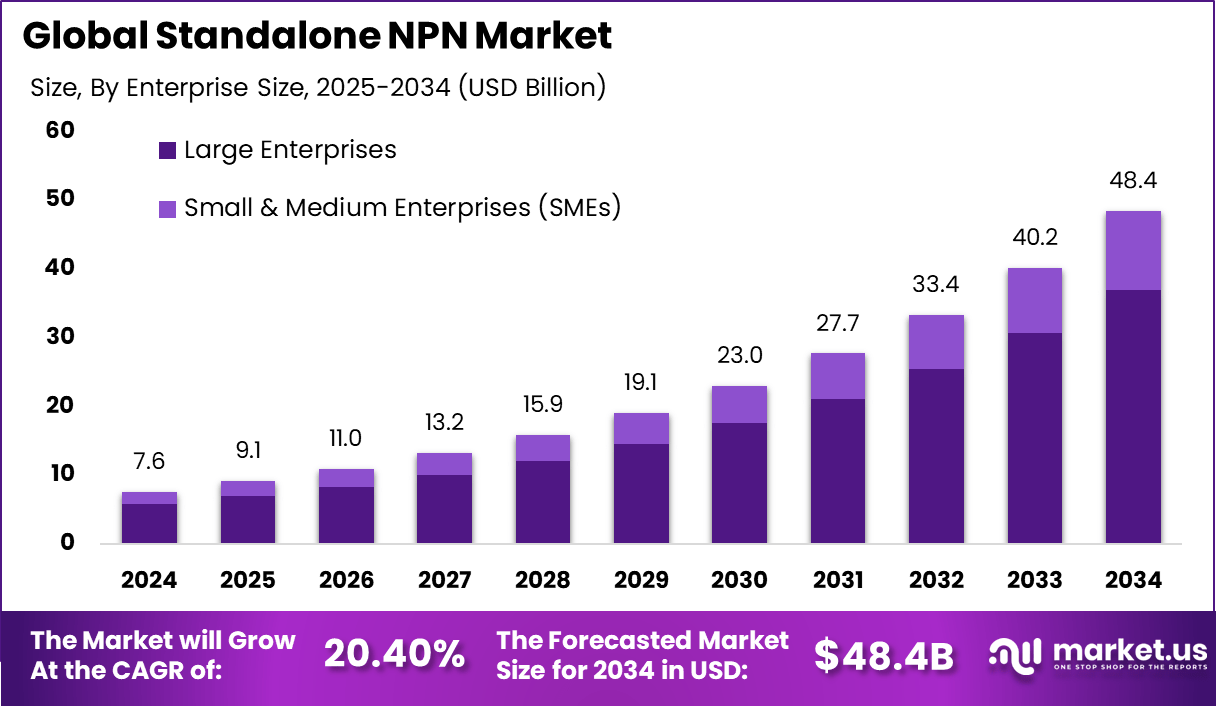

The global Standalone NPN market generated USD 7.6 billion in 2024 and is expected to expand rapidly over the forecast period. Revenue is projected to increase from USD 9.1 billion in 2025 to approximately USD 48.4 billion by 2034, reflecting a strong CAGR of 20.40% throughout the forecast span. This growth is driven by rising demand for private 5G networks and increased adoption of standalone network architectures across industrial and enterprise applications.

The standalone NPN market refers to the sector encompassing discrete NPN (Negative-Positive-Negative) bipolar junction transistors (BJTs) used as individual semiconductor components in electronic circuits. Standalone NPN transistors serve as fundamental switching and amplification elements in a wide range of applications, including power supplies, industrial automation systems, consumer electronics, automotive electronics, and communication equipment. These discrete devices deliver controlled current flow when a small base current modulates the larger collector–emitter current, enabling signal amplification, switching, and digital logic interfacing. As electronic systems continue to evolve in complexity and functionality, standalone NPN transistors remain a core component due to their simplicity, reliability, and cost-effectiveness.

Market development has been shaped by sustained demand for discrete power and signal components, particularly in designs where integrated solutions are impractical or cost-prohibitive. While integrated circuits and MOSFETs have absorbed many high-level functions, standalone NPN transistors continue to persist where specific voltage, current, or thermal characteristics are required. Their role in legacy systems, retrofit solutions, and specialised industrial equipment reinforces their ongoing relevance.

Top Driving Factors

One major driver of the standalone NPN market is the continued adoption of electronic control systems in industrial automation and power management. Manufacturing facilities, robotics systems, and process control units use discrete transistors for switching, relay driving, and signal buffering. These environments demand robust, predictable transistor performance that standalone NPN devices reliably provide. Growth in automation investments globally supports stable demand for these components.

Another key driver is the emergence of automotive electronics and electrification trends. Modern vehicles incorporate numerous control modules, sensing interfaces, and power distribution units that utilise discrete transistors as part of their electronic architectures. NPN transistors support functions such as headlight driving, motor control, and battery management. As electrified and hybrid vehicle adoption grows, so does the opportunity for standalone transistor deployment.

Demand Analysis

Demand for standalone NPN transistors is influenced by sectors where discrete component selection delivers advantages in performance, repairability, and customisation. Industrial equipment with harsh operating conditions often requires components that can be individually replaced and tested. Discrete NPN transistors allow engineers to tailor amplification and switching characteristics without reliance on integrated substitutes. This preference for discrete flexibility sustains recurring demand.

Demand is also shaped by maintenance and legacy system support cycles. Many installed systems in manufacturing, utilities, and transportation depend on tried-and-true transistor designs. Replacement parts and service inventories must align with original component specifications, prompting ongoing procurement of standalone NPN devices. This after-market demand stabilises long-term market resilience.

Increasing Adoption Technologies

Advances in compound semiconductor processing and packaging are enhancing the performance and reliability of standalone NPN transistors. Improved material purity, die attach techniques, and thermal management reduce failure rates and extend operational lifetimes. These enhancements make NPN transistors more competitive in demanding environments where temperature stability and electrical stress tolerance are critical. Improved packaging also supports miniaturisation trends in embedded systems.

Simulation and modelling software adoption is also influencing how standalone NPN transistors are designed and deployed. Modern circuit design tools enable engineers to simulate transistor behaviour under varying load, temperature, and frequency conditions before physical prototyping. These capabilities support more precise component selection and system optimisation, improving design efficiency and reducing development costs.

Key Reasons for Adopting These Solutions

One key reason organisations adopt standalone NPN transistors is their predictable and well-characterised switching behaviour. Unlike some alternative semiconductor devices, NPN transistors offer consistent gain, straightforward biasing, and simple interfacing with discrete circuit elements. For designs where behaviour must be tightly controlled, such as precision analog amplification or discrete logic switching, NPN devices provide clear advantages. This predictability supports reliability in mission-critical applications.

Another reason is the ease of sourcing and broad component availability. Discrete NPN transistors have been standard elements in electronics for decades, and extensive supplier ecosystems ensure global availability of multiple variants. Engineers can source replacements and alternatives that meet specific voltage, current, and package requirements without extensive redesigns. This supply reliability supports design continuity and serviceability.

Investment Opportunities

Investment opportunities in the standalone NPN market exist in high-performance discrete transistor variants tailored for automotive and industrial applications. Transistors designed with enhanced thermal tolerance, higher current capacity, or radiation-hardening features can command premium positioning. Investors may focus on manufacturers that develop specialised transistor lines that meet emerging sector standards.

Another opportunity lies in manufacturing and supply chain optimisation. As demand persists for discrete components in legacy systems and specialised equipment, suppliers that streamline production, inventory management, and global distribution can achieve cost leadership. Investments in automated manufacturing, quality control technologies, and regional production hubs can strengthen competitive advantage.

Business Benefits

Adoption of standalone NPN transistors enables designers to build modular, serviceable, and easily testable circuits. Discrete components simplify troubleshooting and replacement in field-service scenarios, reducing downtime and maintenance cost. For systems with long operational lifespans, such as industrial controllers or transportation electronics, this modularity delivers operational value.

Standalone NPN transistors also support cost-efficient designs where integrated solutions are unnecessary or inefficient. By selecting discrete components that exactly match performance requirements, organisations can avoid over-engineering and reduce BOM (bill of materials) costs. This cost control supports competitive product pricing and efficient resource allocation.

Regional Analysis

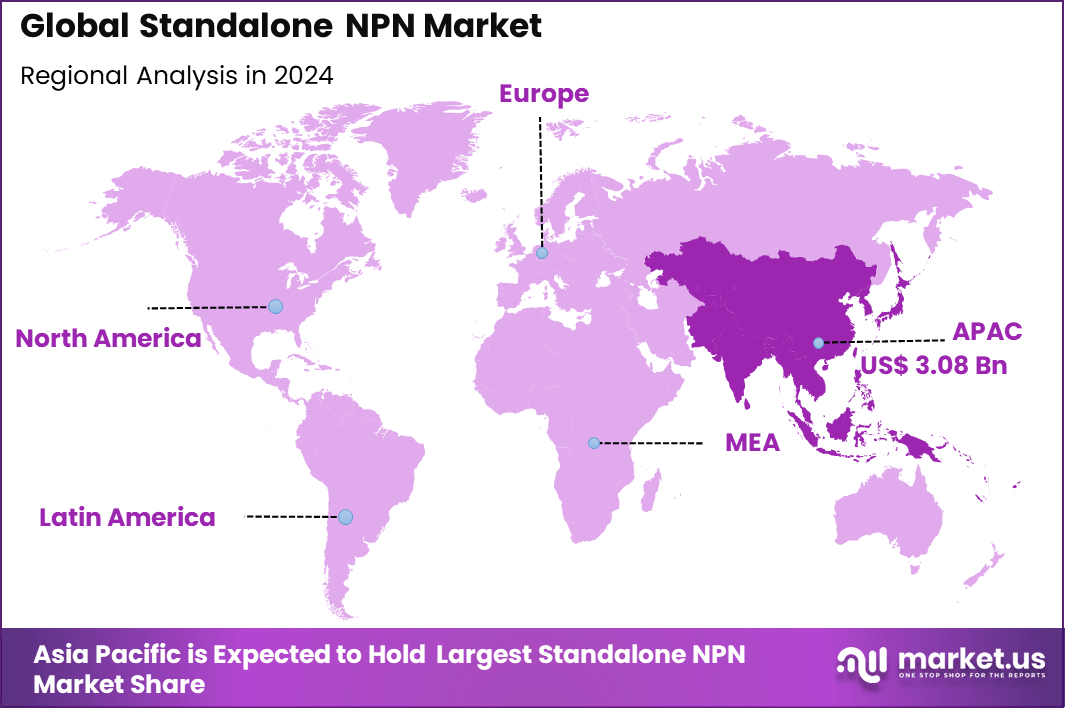

In 2024, Asia Pacific held a dominant position in the global market, accounting for more than 40.8% of total revenue. The region generated around USD 3.08 billion, supported by large scale industrial digitalization and strong investment in advanced connectivity infrastructure. Rapid deployment of private networks in manufacturing, logistics, and smart infrastructure strengthened regional leadership. As a result, Asia Pacific continued to shape adoption trends in the standalone NPN market.

Regulatory Environment

The regulatory environment affecting the standalone NPN market includes environmental and material standards such as RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives. Manufacturers must ensure that discrete transistors comply with mandated restrictions on lead, cadmium, and other hazardous materials. Compliance ensures lawful sale and reduces environmental impact.

Industry-specific safety and reliability standards also shape adoption, particularly in automotive, aerospace, and industrial sectors. Transistors used in safety-critical systems must meet applicable certification or qualification criteria that govern electrical performance and failure rates. Adherence to these regulatory frameworks supports product acceptance and reduces legal risk for both suppliers and end users.

Key Market Segments

By Spectrum Type

- Licensed Spectrum

- Unlicensed Spectrum

- Hybrid Spectrum

By Component

- Core Network

- Radio Access Network (RAN)

- Management & Orchestration Software

- Services

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Healthcare

- Government & Defense

- Others

By Network Technology

- 5G Standalone NPN

- 4G/LTE Standalone NPN

Top Key Players in the Market

- ON Semiconductor

- STMicroelectronics

- Nexperia

- Infineon Technologies

- Texas Instruments

- Toshiba Corporation

- Vishay Intertechnology

- Diodes Incorporated

- Rohm Semiconductor

- Fairchild Semiconductor

- Microchip Technology

- Panasonic Corporation

- Renesas Electronics

- Central Semiconductor

- Littelfuse

- Alpha & Omega Semiconductor

- Sanken Electric

- Hitachi

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 7.6 Bn |

| Forecast Revenue (2034) | USD 48.4 Bn |

| CAGR(2025-2034) | 20.40% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |