Table of Contents

- Ethical Investment Platforms Market Size

- Market Key Takeaways

- Top Driving Factors

- Demand Analysis

- Driver Analysis

- Regional Analysis

- U.S. Market Size

- Increasing Adoption Technologies

- Key Reasons for Adopting These Solutions

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Key Market Segments

- Report Scope

Ethical Investment Platforms Market Size

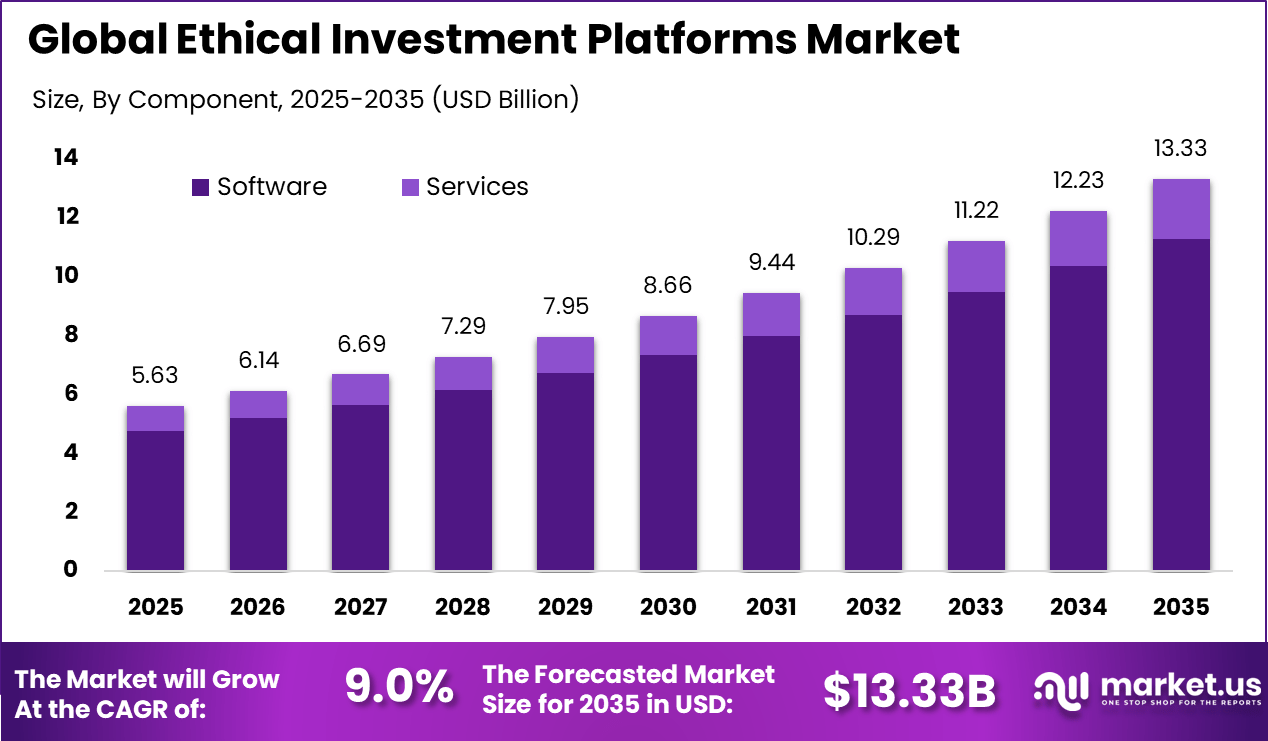

The global Ethical Investment Platforms market was valued at USD 5.63 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 13.33 billion by 2035, expanding at a CAGR of 9.0% from 2025 to 2034. This growth is supported by rising investor awareness of environmental, social, and governance principles and increasing demand for responsible investment options. Digital platforms are playing a key role in making ethical investing more accessible to a wider audience.

The ethical investment platforms market refers to digital platforms and services that enable investors to allocate capital toward financial instruments aligned with environmental, social, and governance (ESG) criteria, ethical values, and sustainability goals. These platforms offer access to ethically screened stocks, bonds, mutual funds, exchange-traded funds (ETFs), and impact-oriented portfolios that exclude industries such as fossil fuels, tobacco, or weapons.

Ethical investment platforms also support transparent reporting on social and environmental impacts, investor education, and tools to measure portfolio alignment with ethical standards. Adoption spans individual retail investors, financial advisors, and institutional investors seeking to match financial returns with responsible practices.

Market Key Takeaways

- In 2025, platform and software solutions dominated with an 84.7% share, reflecting strong demand for digital tools that support portfolio screening, ESG reporting, and compliance with responsible investing frameworks.

- ESG strategy integration led adoption with a 58.9% share, as investors increasingly embedded environmental, social, and governance factors directly into core investment decision processes rather than treating them as overlays.

- Equities, including stocks and ETFs, accounted for 72.4%, highlighting investor preference for transparent, liquid instruments that align ethical goals with portfolio flexibility.

- Retail investors represented 68.3% of total adoption, driven by higher awareness of responsible investing and simplified access through digital first investment platforms.

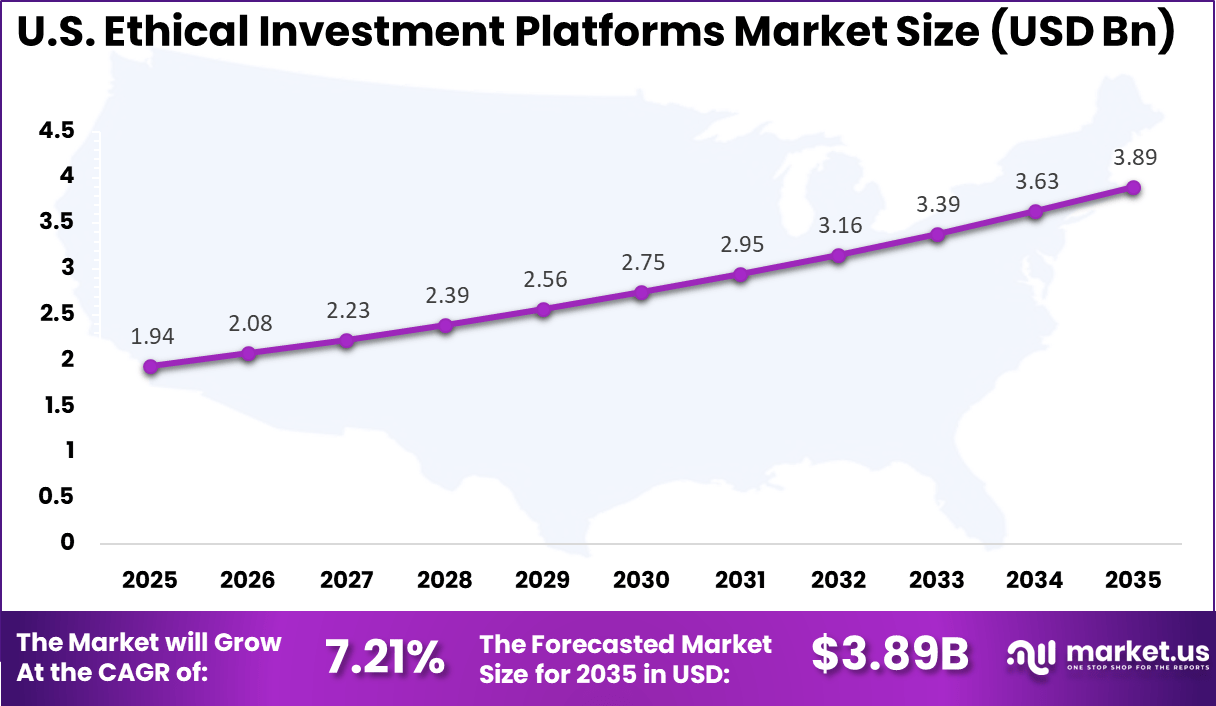

- The U.S. market reached USD 1.94 billion in 2025, expanding at a steady 7.21% growth rate, supported by rising ESG focused portfolios and fintech enabled investing tools.

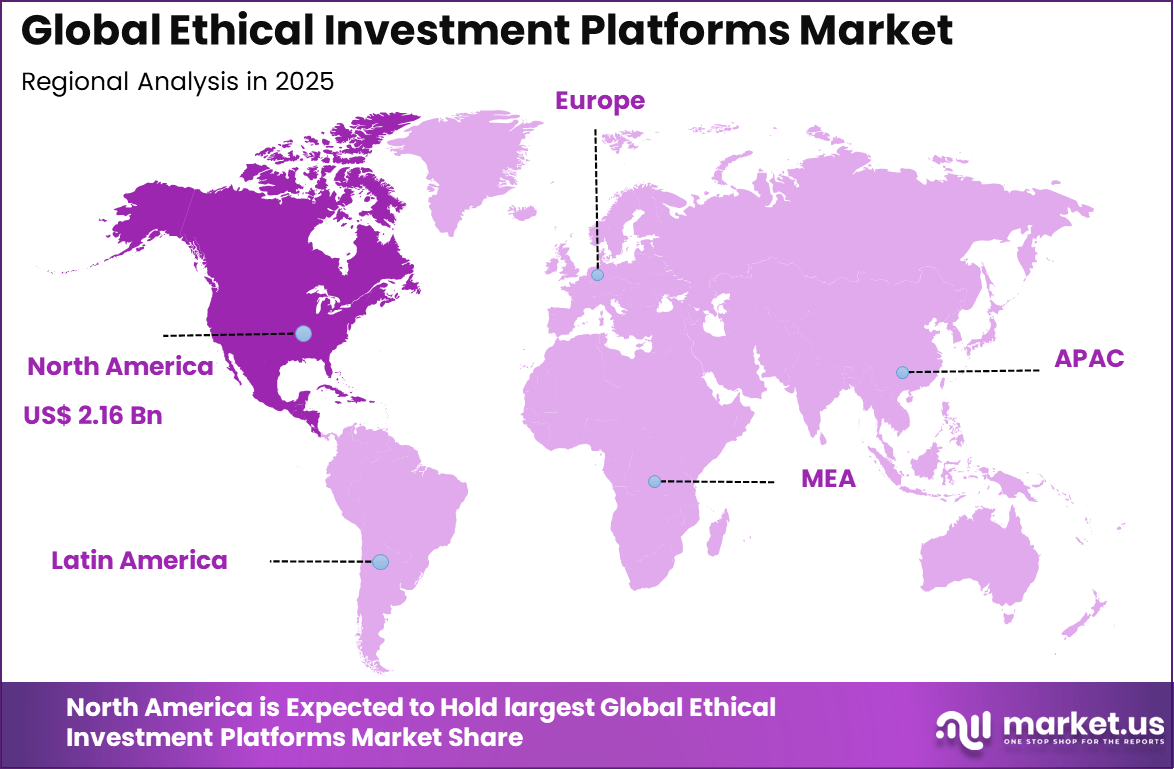

- North America held more than 38.5% of the global market, backed by mature capital markets, strong ESG disclosure standards, and high penetration of digital investment platforms.

Top Driving Factors

One primary driver of the ethical investment platforms market is increasing investor demand for sustainable and values-based investment options. Investors, particularly younger demographics such as millennials and generation Z, express a preference for investment products that reflect personal or societal values. Ethical platforms respond by curating portfolios that emphasise sustainability, social responsibility, and ethical governance. This alignment between values and investment strategy drives broader market adoption.

Another key driver is the integration of ESG criteria into mainstream investment decision making. Asset managers, pension funds, and institutional investors increasingly incorporate ESG metrics to assess long-term risk and resilience. Ethical investment platforms provide the infrastructure to screen, score, and report ESG performance, which supports compliance and strategic allocation. As ESG considerations become material to financial analysis, demand for ethical platforms grows.

Demand Analysis

Demand for ethical investment platforms is shaped by heightened public awareness of social and environmental challenges such as climate change, inequality, and corporate governance failures. ESG research, impact reporting, and sustainability rankings inform investor choice and increase expectations for accountability. Ethical platforms amplify this demand by providing accessible, transparent options for aligning capital with impact objectives.

Demand is also influenced by regulatory evolution and policy frameworks that encourage or mandate ESG disclosures. Governments and financial regulators in multiple jurisdictions are introducing standards for sustainable finance, forcing greater transparency and comparability of ethical investment products. This regulatory environment increases confidence in ethical platforms and supports institutional participation. As standards mature, demand is expected to further accelerate.

Driver Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| ESG Awareness Growth | Rising awareness among retail and institutional investors about environmental, social, and governance aligned investing. | ~2.4% | North America, Europe | Short to Mid Term |

| Regulatory Support | Government policies promoting transparency, sustainability disclosures, and ethical fund classification. | ~1.8% | Europe, North America | Mid Term |

| Digital Investment Adoption | Growing use of mobile and web based investment platforms improving access to ethical portfolios. | ~1.5% | North America, Asia Pacific | Short Term |

| Millennial and Gen Z Participation | Strong preference among younger investors for values driven and impact focused investment options. | ~1.3% | North America, Europe | Long Term |

| Corporate Sustainability Focus | Improved corporate ESG reporting and alignment increases the quality of ethical investment opportunities. | ~1.1% | Global | Mid to Long Term |

| Institutional Capital Allocation | Rising participation of pension funds and asset managers allocating capital to ethical strategies. | ~0.9% | Europe, North America | Long Term |

Regional Analysis

North America held a dominant position in the global market, accounting for more than 38.5% of total revenue. The region generated around USD 2.16 billion, supported by strong adoption of sustainable finance practices and mature digital investment infrastructure. High participation from retail and institutional investors strengthened regional leadership. As a result, North America continued to influence platform innovation and market expansion.

U.S. Market Size

The United States reached USD 1.94 Billion with a CAGR of 7.21%, indicating steady market expansion. Growth is driven by rising retail participation in ethical investing.

Increasing Adoption Technologies

Advances in data analytics and artificial intelligence are accelerating ethical investment platform adoption. These technologies enable sophisticated ESG scoring, risk modelling, and portfolio optimisation based on large, diverse datasets. AI-driven tools can assess corporate disclosures, news sentiment, and supply chain impacts with greater depth and speed. Ethical platforms that integrate predictive analytics help investors make informed decisions aligned with sustainability goals.

Cloud computing and digital onboarding technologies also support broader adoption by reducing friction in platform access and user experience. Cloud-native platforms offer scalable performance, secure data storage, and integration with mobile applications that meet modern investor expectations. Real-time reporting and dashboard visualisation provide clarity about portfolio alignment with ethical criteria. These technological capabilities improve convenience and transparency.

Key Reasons for Adopting These Solutions

One key reason investors adopt ethical investment platforms is the desire to generate positive social and environmental impact alongside financial returns. Ethical platforms allow capital to be directed toward companies and projects that advance sustainability, renewable energy, social justice, and responsible governance. This dual objective resonates with investors seeking purpose-aligned investments.

Another reason is improved transparency and reporting. Ethical investment platforms frequently provide clear metrics on ESG performance, impact outcomes, and portfolio alignment with sustainability goals. This insight supports accountability and enables investors to track progress over time. Enhanced transparency strengthens trust and confidence in ethical investment products.

Investment Opportunities

Investment opportunities in the ethical investment platforms market exist in tools that enhance ESG data integration and impact measurement. Platforms that offer robust, standardised ESG metrics and predictive analytics appeal to both retail and institutional participants. Investors may focus on solutions that unify financial and sustainability data to support holistic decision making. Enhanced measurement capabilities help differentiate offerings in a crowded market.

Another opportunity lies in specialised ethical investment offerings tailored to specific themes such as climate action, gender equity, community development, or sustainable infrastructure. Niche products that resonate with targeted investor priorities can unlock new segments. Investors can also explore partnerships with research providers, impact verification services, and financial advisors to strengthen platform value.

Business Benefits

Adoption of ethical investment platforms enables organisations to attract socially conscious capital and build brand reputation. Platforms that demonstrate commitment to sustainability and transparency can differentiate themselves and foster long-term investor loyalty. This reputational advantage supports customer retention and attracts new investor segments.

Ethical investment platforms also support diversification and risk management. Incorporating ESG criteria can uncover risks not apparent through traditional financial analysis alone, such as regulatory exposure, environmental liabilities, or governance concerns. Portfolios built with ethical screens may perform more resiliently over long time horizons. These risk management benefits strengthen investor confidence and contribute to strategic asset allocation.

Regulatory Environment

The regulatory environment for the ethical investment platforms market is shaped by evolving ESG disclosure standards, sustainable finance frameworks, and investor protection requirements. Financial regulators in various jurisdictions are introducing mandatory ESG reporting, taxonomy systems, and sustainability risk integration principles. These regulations require investment platforms to provide accurate, comparable disclosures about ESG performance and product characteristics. Compliance supports market credibility and protects investors.

Data privacy and cybersecurity regulations also influence platform operations. Ethical investment platforms must handle sensitive user data securely and adhere to regional privacy standards. This includes transparent consent management, secure storage, and risk mitigation practices. Alignment with regulatory expectations builds trust and supports sustainable growth of ethical investment services.

Key Market Segments

By Component

- Software

- Services

By Investment Strategy

- ESG Integration

- Socially Responsible Investing (SRI)

- Impact Investing

- Faith-based Investing

- Others

By Asset Class

- Equities

- Fixed Income (Green Bonds)

- Alternatives & Private Equity

- Others

By Investor Type

- Retail Investors

- High-Net-Worth Individuals (HNWIs)

- Institutional Investors

Top Key Players in the Market

- Betterment Holdings, Inc.

- Wealthsimple, Inc.

- Nutmeg Saving and Investment, Ltd.

- Moneyfarm, Ltd.

- Ethic, Inc.

- OpenInvest, Inc.

- Aspiration Partners, Inc.

- Earthfolio, LLC

- Sustainalytics

- MSCI, Inc.

- Calvert Research and Management

- Impax Asset Management Group plc

- Trillium Asset Management, LLC

- Arabesque Partners

- Folio Investing

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 5.6 Bn |

| Forecast Revenue (2035) | USD 13.3 Bn |

| CAGR(2025-2035) | 9.0% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |