Table of Contents

- Location of Things Market Size

- Market Key Takeaways

- Adoption Rates and Market Momentum

- Usage Patterns by Industry and Application

- Regional Analysis

- Top Driving Factors

- Demand Analysis

- Increasing Adoption Technologies

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Key Market Segments

- Report Scope

Location of Things Market Size

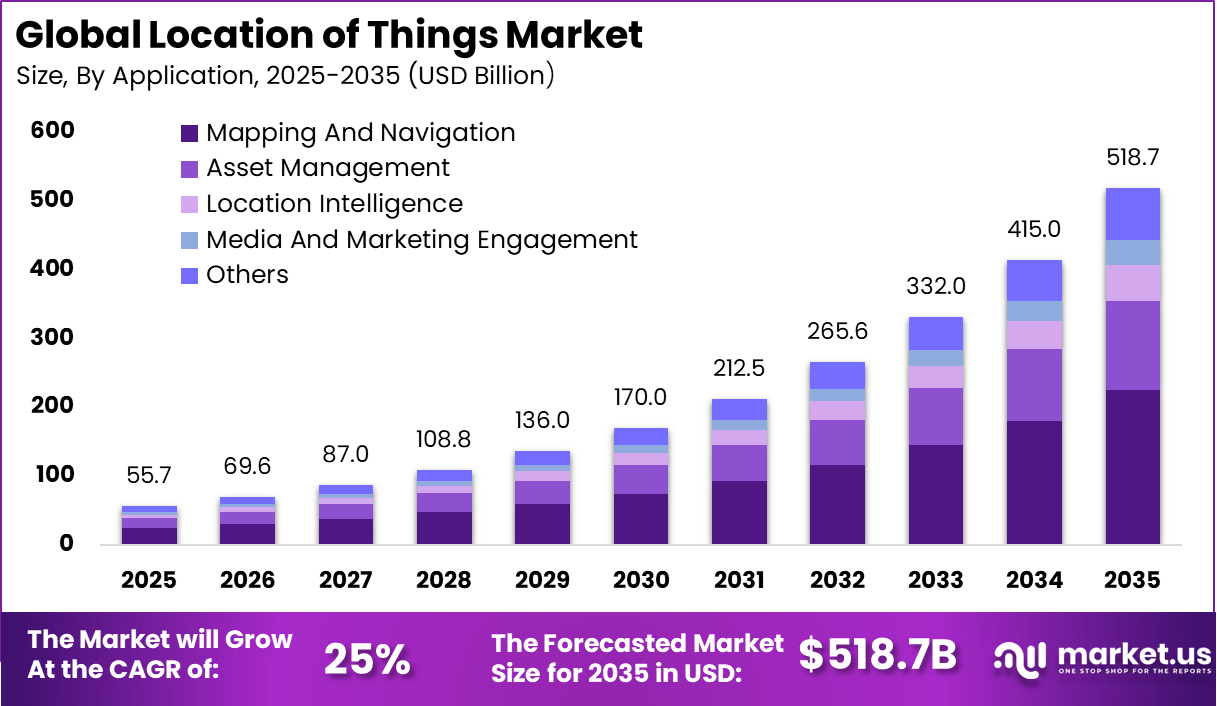

The global Location of Things market was valued at USD 55.7 billion in 2025 and is expected to expand rapidly over the forecast period. The market is projected to reach approximately USD 518.7 billion by 2035, growing at a strong CAGR of 25% from 2026 to 2035. This growth is driven by increasing adoption of IoT enabled tracking, real time asset monitoring, and location based analytics across industries. Rising demand for supply chain visibility and smart infrastructure is further supporting market expansion.

The Location of Things (LoT) market refers to technologies and solutions that determine, transmit, and utilize precise geographic and spatial information from connected devices and objects. LoT systems integrate positioning technologies such as GPS, Bluetooth Low Energy (BLE), Wi-Fi, ultra-wideband (UWB), and sensor fusion to track the location of assets, people, vehicles, machinery, or goods in real time. These capabilities are embedded in Internet of Things (IoT) networks, enabling contextual awareness that supports navigation, asset monitoring, safety, and operational optimisation. Adoption spans logistics, smart cities, manufacturing, healthcare, retail, and transportation sectors seeking enhanced visibility and control over mobile and stationary assets.

Market Key Takeaways

- Mapping and navigation led application adoption with a 43.5% share, driven by growing reliance on real time location data across mobility services, logistics optimization, and urban planning initiatives.

- Government, defence, and public utilities dominated vertical adoption at 37.7%, reflecting strong demand for location intelligence in surveillance, critical asset tracking, emergency response, and infrastructure management.

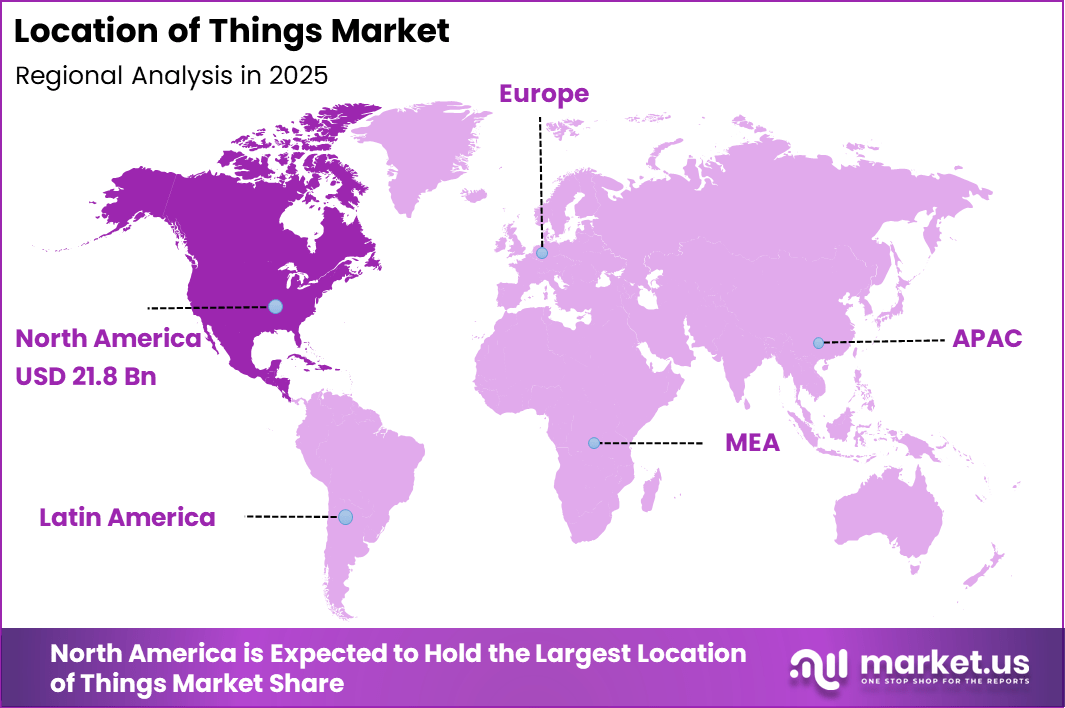

- North America held a 39.3% market share, supported by advanced IoT infrastructure, high GPS penetration, and sustained investment in smart city and connected mobility programs.

- The U.S. market reached USD 19.07 billion, expanding at a robust 21.5% growth rate. This expansion was driven by large scale deployment of geospatial analytics, connected devices, and location based services across both public and commercial sectors.

Adoption Rates and Market Momentum

- Global interconnected IoT devices are projected to exceed 40.6 billion by 2034, nearly doubling the installed base seen in 2025. This reflects strong long term adoption momentum for location enabled technologies.

- Around 60% to 70% of large manufacturing, transportation, and energy enterprises have already implemented IoT solutions, with location based use cases among the most widely deployed.

- Adoption has been reinforced by measurable outcomes, as 92% of enterprises reported achieving a positive return on investment from IoT and location intelligence implementations.

Usage Patterns by Industry and Application

- Fleet management and supply chain tracking recorded an adoption rate of 54%, supporting route optimization, asset visibility, and delivery efficiency.

- In manufacturing, 46% of organizations used industrial IoT within production environments, while 42% deployed real time location systems. These deployments contributed to an average 7% improvement in labor efficiency and 52% gains in productivity.

- Retailers increasingly applied geolocation data for inventory tracking, store analytics, and personalized promotions, making location intelligence a core operational capability.

- Medical facilities are expected to deploy around 7.4 million IoT devices by 2026, with nearly 47% dedicated to location based services such as patient flow management and equipment tracking.

- Early adoption continued in disaster response, public safety, and connected transportation, supported by sustained public sector investment.

- About 81% of stakeholders identified IoT and location intelligence as critical enablers for smart city initiatives, particularly in traffic management, waste optimization, and urban infrastructure planning.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 39.3% of total revenue. The region generated around USD 21.8 billion, supported by advanced digital infrastructure and early adoption of IoT technologies. Strong investment in smart logistics, transportation, and industrial automation strengthened regional leadership. As a result, North America continues to influence market growth and technology deployment trends.

Top Driving Factors

One primary driver of the Location of Things market is the expansion of asset-intensive industries requiring high-precision tracking. Logistics and supply chain organisations deploy LoT solutions to monitor goods movement, reduce shrinkage, optimise routing, and ensure on-time delivery. Real-time location visibility enhances transparency across distributed operations, improves resource allocation, and supports business resilience.

Another key driver is the acceleration of smart city initiatives that rely on spatial data to improve urban mobility, public safety, and infrastructure management. Urban planners and authorities use LoT systems to manage fleets, monitor environmental sensors, optimise transit schedules, and support emergency response. The ability to locate assets, people, and events in real time enhances service delivery and citizen experience.

Demand Analysis

Demand for Location of Things solutions is influenced by the integration of IoT ecosystems across industries. As enterprises deploy sensors, connected machinery, and edge computing across facilities and field operations, the need for spatial context becomes central to interpreting real-time data. LoT systems enrich IoT data with precise location tags, enabling deeper insights into operational patterns and efficiency metrics. Organisations increasingly prioritise location intelligence as a core input for digital transformation and performance optimisation.

Demand is also shaped by workforce safety and compliance imperatives. In industrial and construction environments, LoT solutions support worker safety monitoring, geofencing alerts, and incident tracking. Regulations and internal safety protocols require accurate location records to protect personnel and meet compliance standards. These safety and risk management needs reinforce demand for robust location awareness technologies.

Increasing Adoption Technologies

Global Navigation Satellite Systems (GNSS) such as GPS, GLONASS, Galileo, and BeiDou provide foundational coverage for outdoor positioning, and continue to support adoption of LoT applications. Combined with differential correction and augmentation systems, GNSS improves accuracy for logistics, fleet tracking, and outdoor asset monitoring. Enhanced satellite positioning remains critical for broad geographic coverage.

Indoor and localized positioning technologies such as Bluetooth Low Energy (BLE), ultra-wideband (UWB), and Wi-Fi are accelerating adoption by enabling precise tracking within buildings, warehouses, and other enclosed spaces. UWB in particular offers high-precision location data suitable for equipment tracking, robotics navigation, and real-time workflow coordination. Sensor fusion techniques that combine multiple positioning methods improve consistency, reduce error, and support seamless indoor-to-outdoor transitions. These technological advances expand LoT applicability across environments.

One key reason organisations adopt Location of Things solutions is to improve operational efficiency and resource utilisation. Precise location data enables better planning, reduced idle time, and streamlined workflows. For example, asset tracking reduces time spent locating equipment, enhances utilisation rates, and decreases unnecessary inventory purchases. These efficiencies support performance and cost optimisation.

Another reason is enhanced decision support through contextual insights. LoT systems provide spatial analytics that help organisations understand patterns such as movement flows, dwell times, and route effectiveness. Insights derived from location context improve operational strategies, planning accuracy, and strategic forecasting. Decision makers benefit from actionable intelligence grounded in real-world spatial dynamics.

Investment Opportunities

Investment opportunities in the Location of Things market exist in platforms that unify multi-technology location data into coherent, standardised intelligence layers. Solutions that integrate GNSS, BLE, UWB, and sensor fusion into scalable platforms provide versatility across diverse applications. Investors may prioritise providers that offer interoperable APIs, analytics dashboards, and machine-learning-enhanced insights, as these capabilities increase platform value and enterprise adoption.

Another opportunity lies in sector-specific LoT applications tailored to specialised industry needs. Healthcare asset and patient tracking, industrial safety monitoring, retail footfall analysis, and autonomous vehicle navigation each require bespoke location models and workflows. Platforms that deliver domain-focused solutions with compliance and performance guarantees can achieve higher adoption rates and premium positioning. Tailored LoT offerings address unmet demand and deepen market penetration.

Business Benefits

Adoption of Location of Things solutions improves transparency and control across distributed operations. Organisations gain real-time visibility into assets, vehicles, and personnel that enhances coordination and reduces uncertainty. This real-time awareness strengthens responsiveness to events, reduces downtime, and improves service delivery outcomes. The ability to monitor in-motion and stationary assets supports dynamic operational adjustments.

LoT systems also support risk reduction and safety outcomes. Geofencing, real-time alerts, and incident location tracking improve worker safety and compliance. For example, alerts triggered when personnel enter restricted zones or hazardous areas reduce the likelihood of accidents. These capabilities contribute to safer work environments, lower liability exposure, and stronger regulatory alignment.

Regulatory Environment

The regulatory environment for the Location of Things market includes data privacy and protection frameworks that govern how location information is collected, stored, and shared. Many jurisdictions require transparent user consent, secure data management, and restricted access to personally identifiable location data. Compliance with privacy laws such as GDPR and regional equivalents is essential for lawful deployment of LoT solutions involving people tracking.

Sector-specific safety and operational regulations also influence LoT implementation. Industries such as transportation, healthcare, and construction must adhere to standards that govern equipment tracking, incident reporting, and worker location monitoring. LoT solutions must support audit trails, secure access controls, and record retention policies that align with these regulations. Regulatory alignment builds trust, reduces legal risk, and supports sustainable market integration of location intelligence technologies.

Key Market Segments

By Application

- Mapping And Navigation

- Asset Management

- Location Intelligence

- Media And Marketing Engagement

- Others

By Vertical

- Government, Defence And Public Utilities

- Transportation And Logistics

- Retail And Consumer Goods

- Manufacturing And Industrial

- Healthcare

- Others

Top Key Players in the Market

- VIRDI

- GitHub

- Bosch

- LockSmithLedger

- FocalTech

- Anviz

- SPEX Forensics

- ievo Ltd

- Goodix

- Precise Biometric

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 55.7 Bn |

| Forecast Revenue (2035) | USD 518.7 Bn |

| CAGR(2026-2035) | 25% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |