Table of Contents

Cloud Manufacturing Market Size

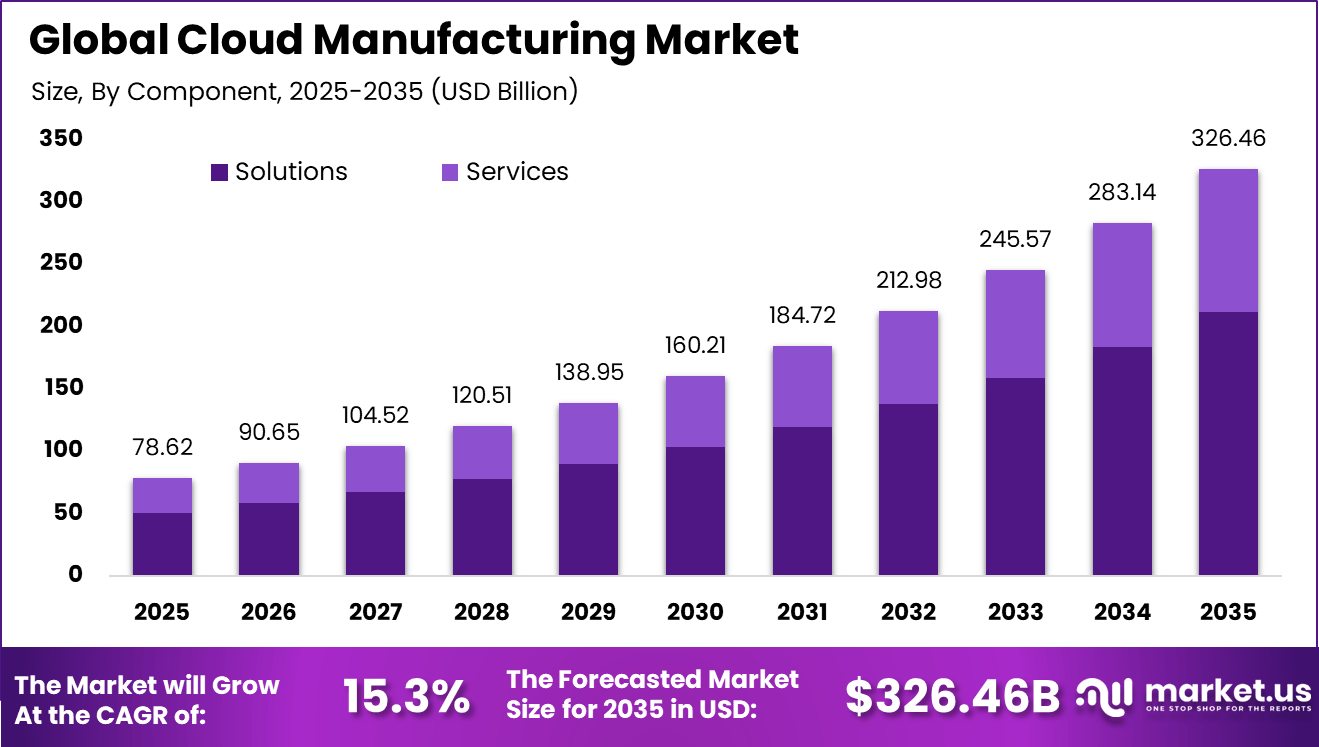

The global Cloud Manufacturing market was valued at USD 78.62 billion in 2025 and is expected to expand strongly over the forecast period. The market is projected to reach approximately USD 326.46 billion by 2035, growing at a CAGR of 15.3% from 2025 to 2035. This growth is driven by increasing adoption of cloud based production systems and rising demand for flexible, scalable manufacturing operations. Integration of IoT, AI, and advanced analytics is further accelerating market expansion.

The cloud manufacturing market refers to the use of cloud computing technologies to deliver shared manufacturing resources, services, and capabilities over the internet. Cloud manufacturing platforms integrate computing power, production equipment, software tools, and data analytics to enable flexible, on-demand manufacturing operations.

These services support design processing, production scheduling, quality monitoring, supply chain coordination, and real-time collaboration among distributed stakeholders. Adoption spans discrete manufacturing sectors such as automotive, aerospace, electronics, machinery, and industrial equipment aiming to improve agility, resource utilisation, and responsiveness to market demand.

Top Driving Factors

One major driver of the cloud manufacturing market is the demand for increased operational flexibility and scalability. Manufacturers face fluctuating demand patterns and supply chain disruptions that require rapid adjustment of production capacity and resource allocation. Cloud platforms allow facilities and partners to access shared computing tools, automation interfaces, and production workflows without heavy local infrastructure investments. This flexibility supports faster responses to market changes and improves capacity utilisation.

Another key driver is the need for improved collaboration across distributed engineering and production teams. Global manufacturing networks involve suppliers, design partners, contract manufacturers, and service providers that must coordinate complex tasks. Cloud manufacturing systems provide real-time visibility into production status, design revisions, and quality data, enabling seamless integration and decision coordination. Enhanced collaboration reduces errors, shortens lead times, and accelerates product innovation.

Key Insights

- Solutions remained the leading component with a 64.8% share, as manufacturers favored unified platforms that support production planning, real time monitoring, analytics, and end to end process optimization.

- Public cloud deployment accounted for 52.7%, indicating strong preference for scalable infrastructure, faster implementation, and reduced capital expenditure across multi location manufacturing environments.

- Large enterprises dominated adoption with a 71.5% share, reflecting their need to manage complex operations, coordinate multiple plants, and process large volumes of data generated by smart factory systems.

- Predictive maintenance emerged as a key application with 32.4%, driven by increased use of cloud analytics and IoT data to lower unplanned downtime and improve asset reliability.

- The automotive sector held a 28.9% share, supported by growing use of cloud manufacturing for automation, digital twin modeling, and connected production lines.

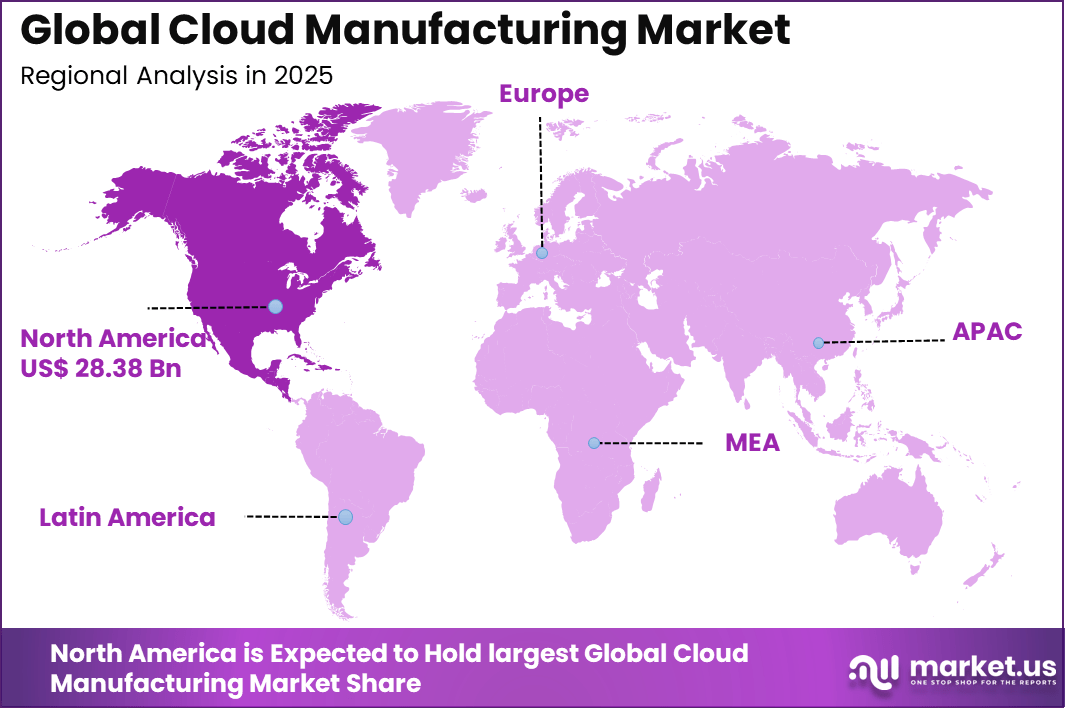

- North America captured 36.1% of global adoption, backed by early Industry 4.0 implementation, strong cloud infrastructure, and a mature advanced manufacturing ecosystem.

- The U.S. market reached USD 25.54 billion, expanding at a 13.94% growth rate, supported by sustained investment in smart manufacturing, AI driven analytics, and cloud native production platforms.

- Cost efficiency improved significantly, as manufacturers commonly reported 20% to 30% cost reductions after adopting cloud manufacturing solutions. These gains were mainly achieved through optimized resource utilization and lower infrastructure overhead.

- Performance improvements were notable, with certain engineering workloads achieving up to 50% higher performance following cloud migration. At the same time, IT infrastructure expenses declined by nearly 40%, strengthening overall operational efficiency.

- Adoption maturity continued to progress, as around 87% of manufacturers had integrated cloud solutions into their core digital and operational strategies by 2025, indicating strong long term commitment to cloud based manufacturing models.

Demand Analysis

Demand for cloud manufacturing solutions is influenced by broader enterprise digitalisation strategies that prioritise data consolidation, predictive analytics, and smart automation. Manufacturers increasingly adopt cloud platforms to centralise production data from machines, sensors, and enterprise systems such as ERP, MES, and PLM. This unified data environment supports advanced analytics that drive optimisation, predictive maintenance, and performance forecasting. As data driven manufacturing becomes standard, demand for cloud based platforms grows.

Demand is also shaped by small and medium enterprise (SME) participation in global value chains. SMEs often lack the capital to deploy extensive on premises IT and automation infrastructure. Cloud manufacturing platforms lower entry barriers by offering subscription models, shared services, and pay-as-you-go consumption that align with lean investment strategies. This accessibility expands market reach beyond large enterprises.

Increasing Adoption Technologies

Cloud computing infrastructure underpins the market by enabling elastic computing resources, scalable storage, and remote access to manufacturing applications. Cloud environments support distributed production tasks, global data aggregation, and collaborative engineering without the constraints of local hardware. The ability to scale compute resources on demand facilitates complex simulations, design processing, and production planning at reduced cost. Cloud architectures improve interoperability and upgrade management.

The integration of the Internet of Things (IoT) also accelerates adoption by enabling comprehensive connectivity between physical equipment and cloud platforms. IoT sensors and edge devices capture real-time machine, process, and environmental data, which is transmitted securely to the cloud for analysis and control. Edge computing complements cloud capabilities by pre-processing data close to production nodes, improving latency and reliability. These combined technologies enable closed-loop manufacturing optimisation.

One key reason organisations adopt cloud manufacturing solutions is improved resource utilisation and cost efficiency. Centralised access to design tools, machines, and process analytics reduces duplication of infrastructure and enables shared use of expensive assets. Cloud platforms support efficient scaling of production capacity based on demand without heavy upfront capital expenditure. This cost advantage enhances manufacturing competitiveness and operational resilience.

Another reason is enhanced quality control and compliance management. Cloud platforms provide unified tracking of process parameters, quality metrics, and audit trails across facilities and vendors. Standardised data collection improves traceability and enables consistent quality checks across distributed production environments. Improved insight into quality performance supports process standardisation and regulatory compliance.

Investment Opportunities

Investment opportunities in the cloud manufacturing market exist in platforms that provide integrated digital twins and advanced simulation capabilities. Digital twin frameworks replicate physical assets and processes in the cloud, enabling scenario analysis, optimisation, and predictive performance modelling. Solutions that combine twin models with real-time production data can unlock new levels of operational insight and efficiency.

Another opportunity lies in AI and machine learning enabled optimisation services that analyse aggregated manufacturing data for predictive maintenance, quality prediction, and workflow optimisation. Investors may focus on analytics modules that extract strategic value from large data sets and support autonomous decision making. These predictive and prescriptive tools enhance process efficiency and support continuous improvement.

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Large manufacturing enterprises | Very High | ~38% | Scalability and cost efficiency | Long term platform contracts |

| Industrial SMEs | High | ~27% | Flexible access to manufacturing resources | Phased cloud adoption |

| Technology providers | Moderate to High | ~18% | Platform and service expansion | R and D driven investment |

| System integrators | Moderate | ~11% | Digital transformation services | Project based deployment |

| Research institutions | Low to Moderate | ~6% | Advanced manufacturing innovation | Pilot programs |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| Cloud computing platforms | Core infrastructure for manufacturing services | ~4.6% | Mature |

| Industrial IoT | Real time machine data integration | ~3.4% | Growing |

| Digital twin technology | Virtual production modeling | ~2.6% | Growing |

| AI driven analytics | Predictive maintenance and optimization | ~2.1% | Developing |

| Edge computing | Low latency processing | ~1.3% | Developing |

Emerging Trends

Business Benefits

Adoption of cloud manufacturing solutions improves operational agility and responsiveness. Manufacturers can deploy new production lines, coordinate cross-site activities, and integrate partner facilities faster than with traditional systems. Enhanced flexibility supports rapid product transitions and shorter development cycles. This adaptability strengthens competitiveness in dynamic markets.

Cloud based platforms also support better data visibility and decision making. Centralised data environments provide executives and production managers with real-time dashboards, performance indicators, and exception alerts. Organisations can identify bottlenecks, optimise schedules, and address issues swiftly. Improved visibility fosters strategic planning and informed operational control.

Regulatory Environment

The regulatory environment for the cloud manufacturing market includes data protection and cybersecurity standards that govern how production data and intellectual property are stored, accessed, and transmitted. Manufacturers must comply with regional and sector specific data privacy frameworks and ensure secure cloud configurations. Secure access controls, encryption, and audit logs are essential to meeting regulatory requirements and protecting sensitive information.

Industry and safety compliance standards also influence cloud manufacturing deployments, especially in sectors such as aerospace, healthcare, and automotive where quality and traceability are regulated. Cloud platforms must support documentation, process validation, and controlled change management to align with regulatory expectations. Adherence to safety and quality mandates reinforces trust and supports long-term adoption of cloud manufacturing solutions.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 36.1% of total revenue. The region generated around USD 28.38 billion, supported by advanced manufacturing infrastructure and early adoption of digital transformation technologies. Strong investment in smart factories and Industry 4.0 initiatives strengthened regional leadership. As a result, North America continues to shape the evolution of cloud manufacturing solutions.

Key Market Segments

By Component

- Solutions

- Enterprise Resource Planning

- Customer Relationship Management

- Manufacturing Execution Systems

- Product Lifecycle Management

- Supply Chain Management

- Asset Performance Management

- Others

- Services

- Professional Services

- Managed Services

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Predictive Maintenance

- Business Analytics

- Asset Management

- Supply Chain & Logistics

- Others

By End-User Industry

- Automotive

- Aerospace & Defense

- Industrial Machinery & Heavy Equipment

- Electronics & Semiconductor

- Food & Beverage

- Pharmaceuticals & Healthcare

- Energy & Utilities

- Others

Top Key Players in the Market

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- International Business Machines Corporation

- PTC Inc.

- Siemens AG

- Amazon Web Services, Inc.

- Google LLC

- Cisco Systems, Inc.

- Rockwell Automation, Inc.

- Hewlett Packard Enterprise Company

- Dassault Systèmes SE

- Honeywell International Inc.

- Johnson Controls International plc

- Schneider Electric SE

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 78.6 Bn |

| Forecast Revenue (2035) | USD 326.4 Bn |

| CAGR(2026-2035) | 15.3% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Component (Solutions, Services), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Predictive Maintenance, Business Analytics, Asset Management, Supply Chain & Logistics, Others), By End-User Industry (Automotive, Aerospace & Defense, Industrial Machinery & Heavy Equipment, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals & Healthcare, Energy & Utilities, Others) |