Table of Contents

- Military Cloud Computing Market Size

- Market Key Insights

- Regional Analysis

- Demand Analysis

- Increasing Adoption Technologies

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Market Narrative

- Key Market Segments

- Report Scope

Military Cloud Computing Market Size

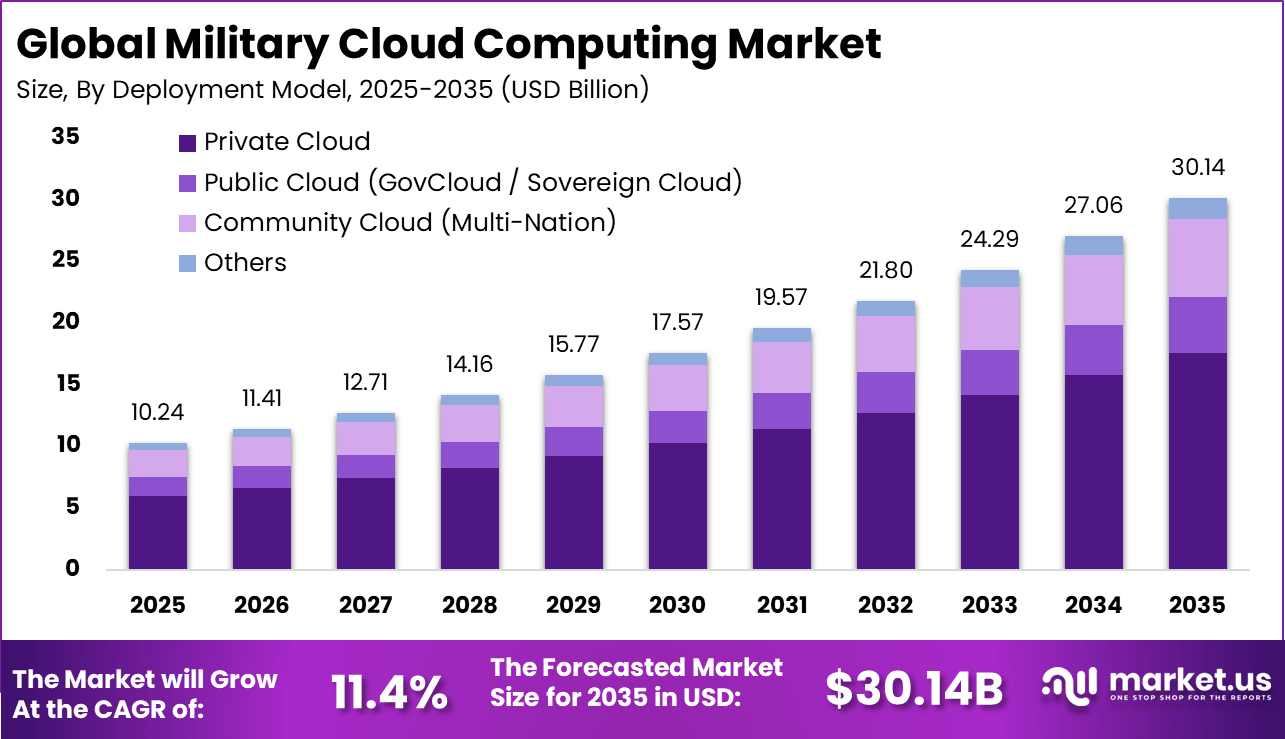

The global Military Cloud Computing market was valued at USD 10.24 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 30.14 billion by 2035, expanding at a CAGR of 11.4% from 2025 to 2035. This growth is driven by increasing demand for secure data storage, real time intelligence processing, and advanced defense communication systems. Adoption of cloud platforms is improving operational agility and mission readiness across military operations.

The military cloud computing market refers to the use of cloud-based computing infrastructure and services to support defense operations, command systems, intelligence processing, and mission-critical applications. These cloud environments enable secure storage, processing, and sharing of defense data across military units and locations. Military cloud systems are designed to meet strict requirements related to security, reliability, and availability. Adoption is driven by defense organizations, armed forces, and government agencies.

One major driving factor of the military cloud computing market is the need for secure and rapid information sharing. Modern military missions rely on real-time intelligence, surveillance, and communication across multiple units. Cloud platforms support controlled data access and faster decision-making. This capability improves operational coordination and mission effectiveness.

Another key driver is the modernization of legacy defense IT infrastructure. Many military systems were built on outdated architectures that limit flexibility and interoperability. Cloud computing supports system modernization without complete hardware replacement. This approach reduces long-term costs and improves system adaptability.

Market Key Insights

- Private cloud deployment led adoption with a 58.3% share, reflecting strict requirements for data sovereignty, mission assurance, and secure network isolation across defense environments.

- Infrastructure as a Service emerged as the primary service model with a 52.7% share, highlighting demand for flexible and rapidly scalable computing capacity to support missions, training simulations, and intelligence workloads.

- C4ISR applications held a leading 41.8% share, as cloud platforms were increasingly used for real time intelligence analysis, secure communications, and coordinated command decision making.

- The Army represented the largest end user group with a 34.6% share, driven by extensive ground operations, complex logistics networks, and ongoing modernization programs.

- Classified workloads accounted for 48.9% of deployments, indicating growing trust in secure cloud architectures for handling sensitive and high security defense data.

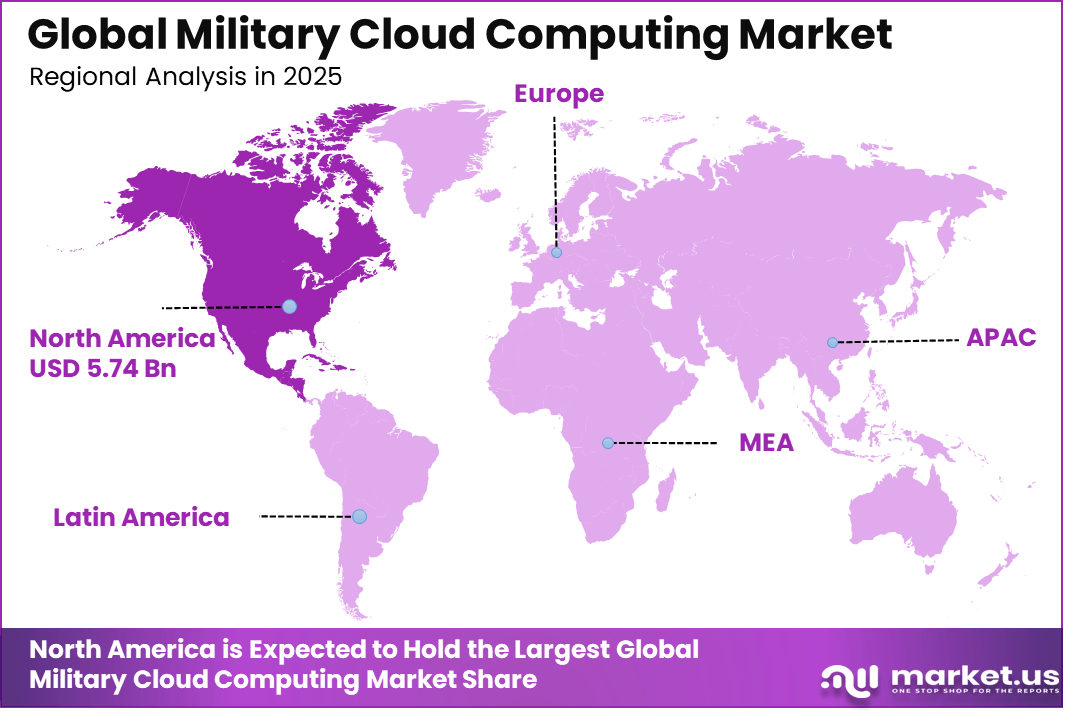

- North America maintained regional leadership with a 56.15% share, supported by advanced defense digitization initiatives, early adoption of secure cloud models, and deep integration of protected computing infrastructure within military operations.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 56.15% of total revenue. The region generated around USD 5.74 billion, supported by high defense spending and early adoption of secure cloud technologies. Strong focus on modernization of defense IT infrastructure strengthened regional leadership. As a result, North America continues to shape development and deployment trends in the military cloud computing market.

Demand Analysis

Demand for military cloud computing solutions is influenced by the growing use of data-driven warfare and digital command systems. Defense forces generate large volumes of data from sensors, satellites, and communication networks. Cloud environments enable efficient data processing and analysis. This demand supports continued investment in military-grade cloud platforms.

Demand is also shaped by joint and coalition operations. Military organizations increasingly operate alongside allied forces that require secure data sharing and interoperability. Cloud platforms support standardized data exchange across defense partners. This operational requirement increases adoption.

Increasing Adoption Technologies

Advances in secure cloud architectures and encryption technologies support market adoption. Military cloud systems use strong access controls, identity management, and data encryption to protect sensitive information. These technologies ensure data integrity and confidentiality. Secure architectures are essential for defense applications.

Edge computing technologies also play an important role in adoption. Military operations often occur in remote or disconnected environments. Edge systems process data locally and synchronize with cloud platforms when connectivity is available. This approach improves responsiveness and operational continuity.

One key reason defense organizations adopt cloud computing is improved operational agility. Cloud platforms allow rapid deployment of applications and mission systems. Military units can adapt faster to changing operational requirements. This flexibility enhances readiness and responsiveness. Another reason is improved data integration and situational awareness. Cloud environments consolidate data from multiple sources into unified platforms. This integration supports better analysis and command decisions. Improved situational awareness strengthens mission outcomes.

Investment Opportunities

Investment opportunities in the military cloud computing market exist in secure hybrid cloud solutions. Defense organizations require systems that combine private, on-premise, and tactical cloud environments. Solutions that support seamless integration across environments attract strong interest. These platforms support flexibility and security.

Another opportunity lies in cloud-based intelligence and analytics platforms. Systems that support advanced data processing for intelligence, logistics, and mission planning are in demand. These solutions improve operational efficiency and resource allocation. Investors focus on compliance-ready and scalable technologies.

Business Benefits

Military cloud computing improves efficiency by reducing infrastructure duplication and maintenance costs. Centralized systems allow better resource utilization and faster updates. Automated management reduces operational overhead. These efficiencies support long-term cost control. Cloud solutions also improve mission reliability and system resilience. Built-in redundancy and backup capabilities reduce the risk of system failure. Reliable access to critical data supports continuous operations. This resilience is vital for defense readiness.

Regulatory Environment

The regulatory environment for the military cloud computing market includes defense security standards and government compliance requirements. Systems must meet strict criteria for data classification, access control, and auditability. Compliance with national defense policies is mandatory. These requirements shape system design and deployment.

Export control laws and cybersecurity regulations also influence market operations. Certain technologies are subject to restrictions related to national security. Defense cloud providers must ensure compliance with all applicable laws. Regulatory alignment ensures lawful and secure military cloud adoption.

Driver Analysis

The military cloud computing market is being driven by the increasing need for efficient data sharing and interoperability across defense networks and allied forces. Modern military operations generate vast volumes of operational data from intelligence, surveillance, and battlefield systems. Cloud computing provides a unified framework that supports secure access to this information, enabling coordinated planning and decision-making across geographically dispersed units.

The integration of cloud technologies also supports scalability and flexibility, which are essential to managing dynamic mission requirements and enhancing situational awareness in real time. This demand for real-time data exchange and operational agility continues to stimulate adoption of cloud solutions tailored to military environments.

Restraint Analysis

A principal restraint in the military cloud computing market stems from concerns over robust cybersecurity and data sovereignty. Military cloud environments house highly sensitive information that must be safeguarded against persistent and advanced cyber threats. Ensuring comprehensive security for these cloud systems requires continuous investment in encryption, access control mechanisms, and monitoring capabilities designed to withstand targeted attacks.

Additionally, regulatory and policy requirements regarding the classification, storage, and handling of sensitive military data can complicate cloud deployment, particularly when data is distributed across different geographic jurisdictions. These constraints slow adoption and necessitate careful planning to maintain compliance and protect critical military information.

Opportunity Analysis

An emerging opportunity in the military cloud computing market lies in the development of secure cloud environments specifically engineered for mission-critical defense workloads. Tailored cloud architectures that incorporate advanced encryption and resilient access controls can bolster confidence in cloud adoption among defense agencies.

Another area of opportunity exists in leveraging cloud platforms for training, simulation, and readiness exercises. Cloud-based simulation environments allow military units to conduct large-scale virtual training without the logistical and financial burden associated with physical training infrastructures. These environments can enhance preparedness and facilitate joint exercises with allied forces in secure virtual spaces.

Challenge Analysis

A central challenge confronting the military cloud computing market is defending cloud infrastructures against evolving cyber threats while maintaining rapid access to information for operational personnel. Military cloud systems are constantly targeted by highly skilled adversaries seeking unauthorized access to sensitive data.

Balancing stringent security protocols with the need for quick and secure access during missions presents a complex technical and operational challenge. Moreover, integrating modern cloud platforms with legacy defense systems and ensuring seamless interoperability across heterogeneous environments remain persistent issues. Addressing these challenges requires continuous investment in cybersecurity talent, rigorous testing, and advanced architectural design to maintain resilient and reliable cloud operations.

Market Narrative

The military cloud computing landscape has evolved to become a strategic component of defense technology infrastructure. Adoption of cloud technologies within defense organizations is driven by the imperative to improve operational efficiency, enable secure data sharing, and support real-time analytics across mission domains.

As military operations become increasingly data-centric, cloud computing provides the foundational architecture needed to handle large volumes of information and support collaborative decision-making among distributed units. This shift reflects a broader trend toward digital transformation within defense sectors globally, where secure and scalable cloud environments are seen as essential tools for maintaining operational readiness and technological superiority.

Continued innovation in cloud security, deployment models, and mission-centric applications is expected to shape how defense agencies approach cloud adoption. The emphasis on hybrid and private cloud solutions reflects the need to balance security requirements with operational flexibility. As cloud technologies mature, tailored offerings that support encrypted communication and resilient access controls will become increasingly important for meeting the complex demands of military cloud computing use cases.

Key Market Segments

By Deployment Model

- Private Cloud

- On-Premises Private Cloud

- Hosted Private Cloud

- Public Cloud (GovCloud / Sovereign Cloud)

- Hybrid Cloud

- Community Cloud (Multi-Nation)

By Service Model

- Infrastructure as a Service

- Secure Compute & Storage

- Networking & Cybersecurity

- Platform as a Service

- Development & Analytics Platforms

- Software as a Service

- Command & Control Applications

- Logistics & Maintenance Systems

- Intelligence, Surveillance, and Reconnaissance

- Training & Simulation

- Others

By Application

- Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance

- Cybersecurity & Cyber Warfare

- Logistics & Supply Chain Management

- Health IT & Personnel Management

- Training & Simulation

- Others

By End-User

- Army

- Navy

- Air Force

- Space Force

- Defense Agencies & Joint Commands

- Others

By Security Classification

- Unclassified / Official Use Only

- Sensitive but Unclassified

- Classified (Secret, Top Secret)

- Multi-Level Security

Top Key Players in the Market

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- Dell Technologies, Inc.

- Hewlett Packard Enterprise Company

- Cisco Systems, Inc.

- Leidos Holdings, Inc.

- Booz Allen Hamilton Holding Corporation

- General Dynamics Information Technology, Inc.

- Science Applications International Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 10.2 Bn |

| Forecast Revenue (2035) | USD 30.1 Bn |

| CAGR(2026-2035) | 11.4% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |