Table of Contents

- Data Discovery Market Size

- Data Discovery Market Key Takeaways

- Key Insights Summary

- Regional Analysis

- Top Driving Factors

- Demand Analysis

- Increasing Adoption Technologies

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Report Scope

Data Discovery Market Size

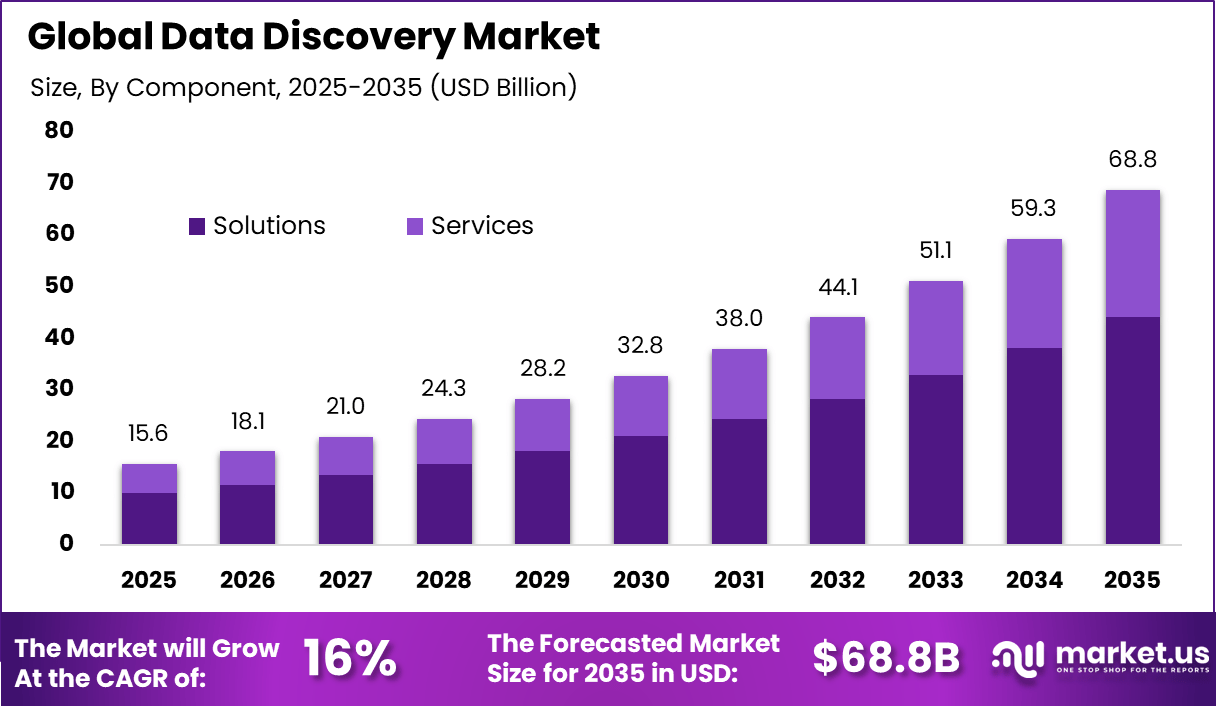

The global Data Discovery market was valued at USD 15.6 billion in 2025 and is expected to expand steadily over the forecast period. The market is projected to reach approximately USD 68.8 billion by 2035, growing at a CAGR of 16% from 2026 to 2035. This growth is driven by rising volumes of enterprise data and increasing demand for self service analytics and data visualization tools. Organizations are adopting data discovery platforms to improve insight generation and data driven decision making.

The data discovery market refers to tools and platforms that help organizations identify, explore, and understand data across multiple sources. These solutions enable users to locate relevant datasets, visualize information, and uncover patterns without deep technical expertise. Data discovery tools support structured and unstructured data from databases, cloud systems, and enterprise applications. Adoption is common across enterprises, research institutions, and public sector organizations. These tools improve data accessibility and decision support.

Data Discovery Market Key Takeaways

- Solutions led the market with a 64.3% share, showing strong enterprise preference for unified data discovery platforms that combine data preparation, analysis, and insight generation in a single environment.

- Cloud based deployment dominated with a 72.6% share, driven by the need for scalable access, reduced infrastructure burden, and seamless collaboration across distributed teams.

- Large enterprises accounted for 68.2% of adoption, supported by complex data environments, high data volumes, and enterprise wide governance requirements.

- Visual data discovery emerged as the leading functionality with a 35.4% share, highlighting the importance of intuitive dashboards and interactive analytics for faster and clearer decision making.

- Sales and marketing management represented the top application area at 31.7%, reflecting increased reliance on customer analytics, campaign performance tracking, and revenue optimization.

- The BFSI sector held a 23.9% share, as financial institutions used data discovery tools for risk assessment, regulatory reporting, and customer intelligence.

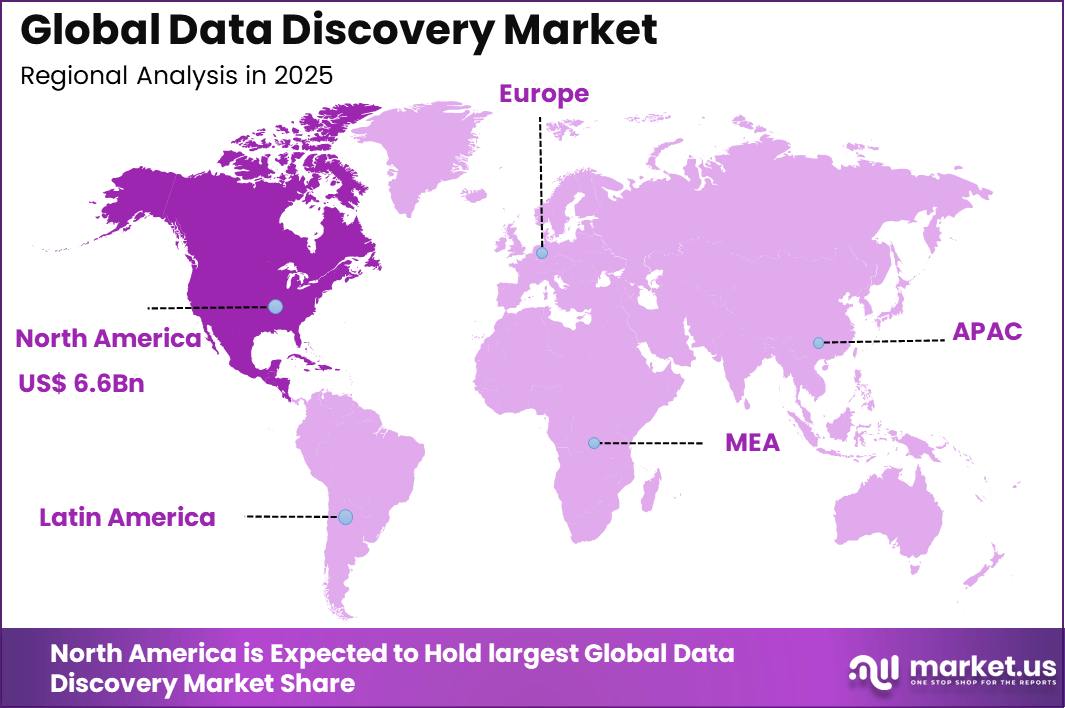

- North America maintained leadership with a 38.9% share, supported by advanced analytics adoption, mature cloud ecosystems, and strong enterprise investment in data platforms.

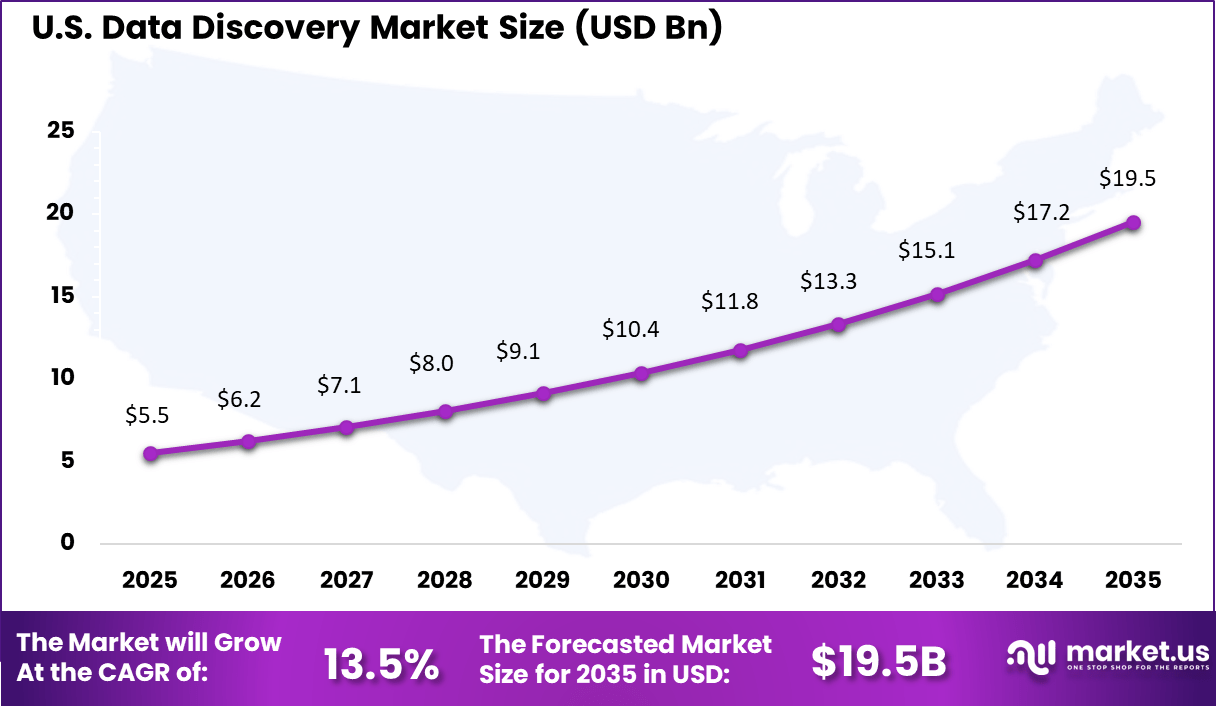

- The United States remained a major contributor with market activity valued at USD 5.56 billion, reflecting a high concentration of analytics driven enterprises.

Key Insights Summary

Market Adoption and Usage Trends

- Adoption of data discovery tools rose sharply from 18% in 2012 to 58% by 2016, and by 2026, nearly 80% of organizations were expected to depend on business intelligence platforms for discovery tasks.

- Data driven decision making became central to operations, with around 77% of organizations embedding analytics into strategic and day to day processes.

- Self service analytics expanded rapidly, as modern discovery platforms increased adoption among non technical users by nearly 70% within one year, reducing reliance on centralized data teams.

Data Landscape Insights

- Global data volumes continued to expand, with total data projected to reach 175 zettabytes by 2025 and about 463 exabytes generated daily, intensifying demand for scalable discovery solutions.

- Unstructured data accounted for roughly 80% of global information assets, requiring advanced discovery approaches beyond traditional databases.

- Up to 80% of enterprise data remained unused and classified as dark data, limiting the return on existing data investments.

- Data silos persisted as a major challenge, with 81% of business leaders reporting difficulty accessing information locked across disconnected systems.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 38.9% of total revenue. The region generated around USD 6.6 billion, supported by strong adoption of advanced analytics and business intelligence solutions. High concentration of data intensive enterprises and early use of cloud based analytics strengthened regional leadership. As a result, North America continues to shape growth and innovation in the data discovery market.

The United States reached USD 5.56 Billion with a CAGR of 13.5%, reflecting steady market growth. Expansion is driven by enterprise analytics demand. Businesses prioritize data visibility and insights. Investment in cloud analytics continues. Market momentum remains positive.

Top Driving Factors

One major driving factor of the data discovery market is the need for faster insights. Business leaders require timely access to information to respond to market changes. Data discovery tools reduce dependence on manual reporting processes. Users can explore data directly and identify trends quickly. This speed supports better operational and strategic decisions.

Another key driver is the growing adoption of self-service analytics. Organizations aim to empower non-technical users to work with data independently. Data discovery platforms offer intuitive interfaces and visual exploration features. This reduces pressure on IT and data teams. Broader access to data supports organizational agility.

Demand Analysis

Demand for data discovery solutions is influenced by enterprise digital transformation initiatives. As systems move to cloud and hybrid environments, data becomes distributed across platforms. Organizations require tools that unify data visibility. Data discovery solutions help navigate complex data landscapes. This demand continues to grow.

Demand is also shaped by regulatory and governance requirements. Organizations must understand what data they hold and where it resides. Data discovery supports compliance, audit readiness, and risk management. Clear data visibility improves control and accountability. Compliance needs reinforce demand.

Increasing Adoption Technologies

Cloud computing technologies play a major role in data discovery adoption. Cloud-based platforms support scalable data access and collaboration. Users can explore data from multiple locations securely. Cloud deployment reduces infrastructure barriers. This flexibility encourages adoption.

Advances in data visualization and analytics technologies also support market growth. Interactive dashboards and visual query tools improve usability. Users can identify patterns and relationships more easily. Improved visualization enhances insight quality. Better user experience drives adoption.

One key reason organizations adopt data discovery tools is improved decision confidence. Access to accurate and timely data reduces uncertainty. Decision makers can validate assumptions through direct exploration. This leads to better planning and execution. Confidence supports consistent performance. Another reason is improved data literacy across teams. Data discovery platforms encourage users to engage with data regularly. Increased familiarity improves analytical skills. Better data literacy supports informed collaboration. This cultural shift strengthens data-driven practices.

Investment Opportunities

Investment opportunities in the data discovery market exist in platforms that integrate governance and analytics. Solutions that combine discovery with access control and data lineage gain attention. These features support enterprise requirements. Integrated platforms reduce complexity. This alignment attracts investment interest.

Another opportunity lies in industry-focused data discovery solutions. Healthcare, finance, and manufacturing require domain-specific data handling. Tailored discovery tools address these needs more effectively. Specialized platforms improve adoption rates. Industry focus supports market differentiation.

Business Benefits

Data discovery solutions improve productivity by reducing time spent searching for information. Automated data cataloging and search features streamline workflows. Teams access relevant data faster. Improved efficiency lowers operational friction. Productivity gains support organizational goals. These tools also enhance collaboration and transparency. Shared data views support consistent understanding across teams. Fewer data silos improve alignment. Better collaboration supports stronger outcomes. Transparency strengthens trust in data usage.

Regulatory Environment

The regulatory environment for the data discovery market includes data privacy and governance requirements. Organizations must manage sensitive and personal data responsibly. Discovery tools must support access controls and audit trails. Compliance with privacy laws is essential. Secure data handling reduces risk.

Regulations related to data retention and classification also influence adoption. Organizations must know what data they store and for how long. Data discovery platforms support classification and policy enforcement. Regulatory alignment improves compliance readiness. Responsible data management supports long-term adoption.

Driver Analysis

The data discovery market is being driven by the growing need for organizations to extract actionable insights from rapidly expanding volumes of structured and unstructured data. Enterprises are increasingly handling data from multiple sources such as cloud platforms, enterprise applications, IoT systems, and digital channels, which makes manual analysis inefficient.

Data discovery tools enable users to explore, visualize, and understand data patterns through automated analytics and intuitive interfaces. This capability supports faster decision making, improves business agility, and empowers non technical users to participate in data driven processes without heavy dependence on IT teams.

Restraint Analysis

A key restraint affecting the data discovery market relates to data quality, governance, and integration complexity. Many organizations operate with fragmented data environments where inconsistent formats, poor data hygiene, and siloed systems limit the effectiveness of discovery tools. Without strong data governance frameworks, users may encounter inaccurate insights or misinterpretation of results, reducing trust in analytics outputs. Additionally, integrating data discovery platforms with legacy systems can require significant customization and technical effort, which may slow adoption in organizations with limited analytics maturity.

Opportunity Analysis

Strong opportunities are emerging as data discovery tools evolve toward augmented analytics and self service intelligence. The integration of artificial intelligence and machine learning allows platforms to automatically identify trends, anomalies, and correlations that may not be immediately visible through manual analysis.

This creates value across functions such as finance, marketing, operations, and risk management by enabling proactive insights rather than reactive reporting. As organizations prioritize democratization of data access, data discovery solutions are well positioned to become central to enterprise analytics strategies.

Challenge Analysis

A major challenge in the data discovery market is balancing ease of use with analytical depth and accuracy. While simplified interfaces attract business users, there is a risk of oversimplification that can lead to misinterpretation of complex datasets. Ensuring that users understand context, assumptions, and limitations behind visual insights is critical for reliable decision making. Additionally, as data volumes grow, maintaining performance, security, and real time responsiveness across distributed environments remains a technical challenge that requires continuous platform optimization.

Emerging Trends

Emerging trends in the data discovery market include the adoption of augmented analytics, natural language query capabilities, and automated insight generation. Platforms are increasingly designed to allow users to ask questions in plain language and receive visual answers without advanced analytical skills. There is also a growing emphasis on embedded analytics, where data discovery features are integrated directly into business applications and workflows. These trends reflect a shift toward more intuitive, context aware, and action oriented data exploration experiences.

Growth Factors

Growth in the data discovery market is supported by the accelerating pace of digital transformation and the widespread adoption of cloud based data architectures. Organizations are investing in analytics solutions that can scale with data growth while supporting remote and distributed teams. The rising demand for real time insights, improved transparency, and faster response to market changes further strengthens adoption. Continuous advancements in AI, data visualization, and automation continue to enhance the value proposition of data discovery tools across industries.

Key Market Segments

By Component

- Solutions

- Services

- Professional Services

- Managed Services

By Deployment Mode

- On-Premises

- Cloud-based

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Functionality

- Visual Data Discovery

- Augmented Data Discovery

- Search-based Data Discovery

- Self-Service Data Discovery

By Application

- Security & Risk Management

- Sales & Marketing Management

- Asset Management

- Supply Chain Management

- Others

By Vertical

- BFSI

- Government

- Healthcare & Life Sciences

- Retail

- Manufacturing

- Media & Entertainment

- IT & Telecom

- Others

Top Key Players in the Market

- Microsoft Corp.

- Tableau Software LLC (Salesforce)

- SAP SE

- QlikTech International AB

- IBM Corp.

- Oracle Corp.

- Amazon Web Services Inc.

- Google LLC (Looker)

- Altair Engineering Inc.

- SAS Institute Inc.

- MicroStrategy Inc.

- Alteryx Inc.

- Datameer Inc.

- Cloudera Inc.

- Talend SA

- Informatica Inc.

- Collibra NV

- Alation Inc.

- Snowflake Inc.

- Tibco Software Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 15.6 Bn |

| Forecast Revenue (2035) | USD 68.8 Bn |

| CAGR(2026-2035) | 16.0% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |