Table of Contents

Report Overview

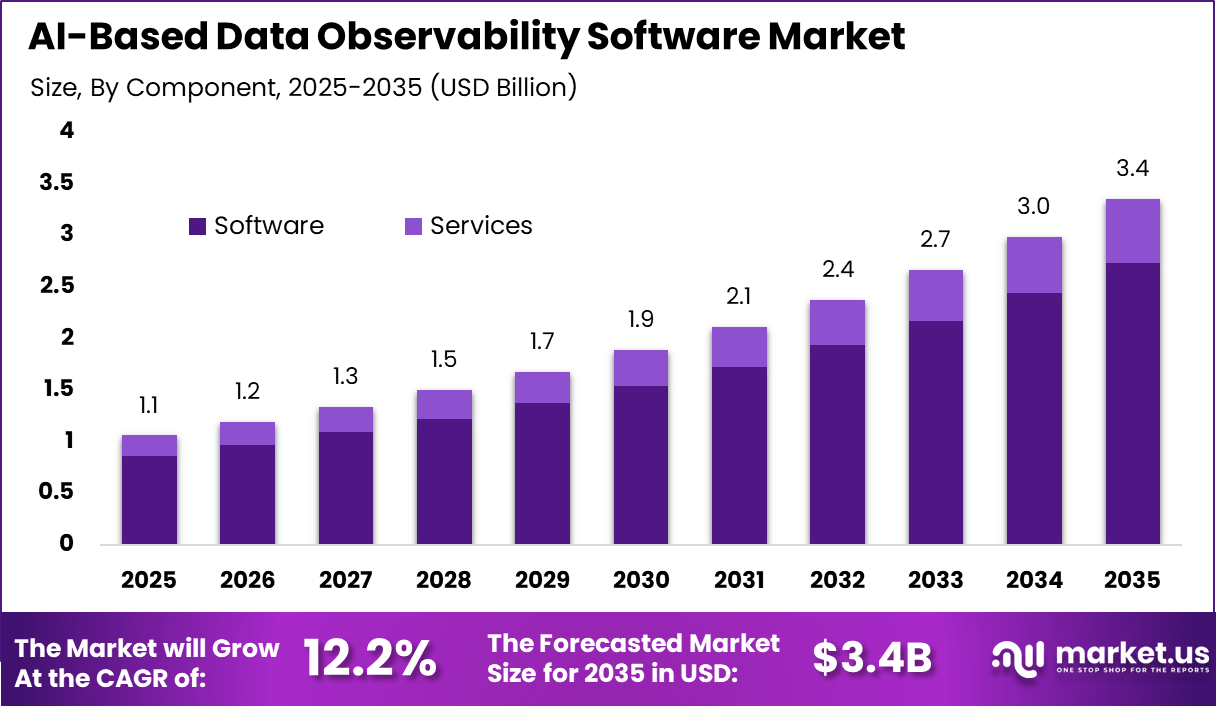

The global AI Based Data Observability Software market was valued at USD 1.1 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 3.4 billion by 2035, expanding at a CAGR of 12.2% from 2026 to 2035. This growth is driven by rising complexity of data pipelines and increasing reliance on AI driven monitoring to ensure data accuracy and reliability. Organizations are adopting these platforms to detect anomalies, improve data trust, and support advanced analytics initiatives.

The AI based data observability software market refers to platforms that monitor, analyze, and ensure the reliability of data across complex data systems. These tools track data quality, freshness, volume, and distribution across pipelines and analytics environments. AI based observability software helps organizations detect data issues before they affect reporting or operations. Adoption spans enterprises that rely on data-driven applications and analytics. These platforms support confidence in data usage.

Market development has been shaped by growing reliance on real-time and automated data pipelines. Modern organizations process data across cloud platforms, applications, and third-party sources. Traditional monitoring tools often fail to detect subtle data issues. AI-based observability solutions address this gap through automated detection and analysis. As data complexity increases, observability becomes essential.

One major driving factor of the AI based data observability software market is the increasing cost of data failures. Incorrect or delayed data can lead to poor decisions and operational disruptions. Organizations seek tools that detect issues early. AI-based systems identify anomalies faster than manual monitoring. This need supports steady market growth.

Another key driver is the expansion of cloud-native data architectures. Distributed data pipelines increase the risk of data quality issues. Observability tools provide end-to-end visibility across these environments. AI enhances detection accuracy and reduces false alerts. Cloud adoption strengthens demand for advanced monitoring.

Market Key Takeaways

- Software platforms dominated with an 81.6% share, indicating that organizations prioritized advanced observability solutions capable of automated anomaly detection, data quality monitoring, and end to end pipeline reliability.

- Cloud based deployment accounted for 78.4%, reflecting strong preference for scalable, centrally managed observability systems that support distributed, real time data environments.

- Large enterprises represented 73.9% of adoption, driven by complex data architectures, high data volumes, and the need for continuous visibility across multiple data sources.

- Data warehouses and data lakes emerged as the primary data environment with a 48.3% share, as enterprises focused on ensuring data accuracy, freshness, and trust for analytics and AI driven workloads.

- The IT and telecommunications sector led end user adoption with a 42.7% share, supported by constant data flows, strict service reliability requirements, and large scale analytics operations.

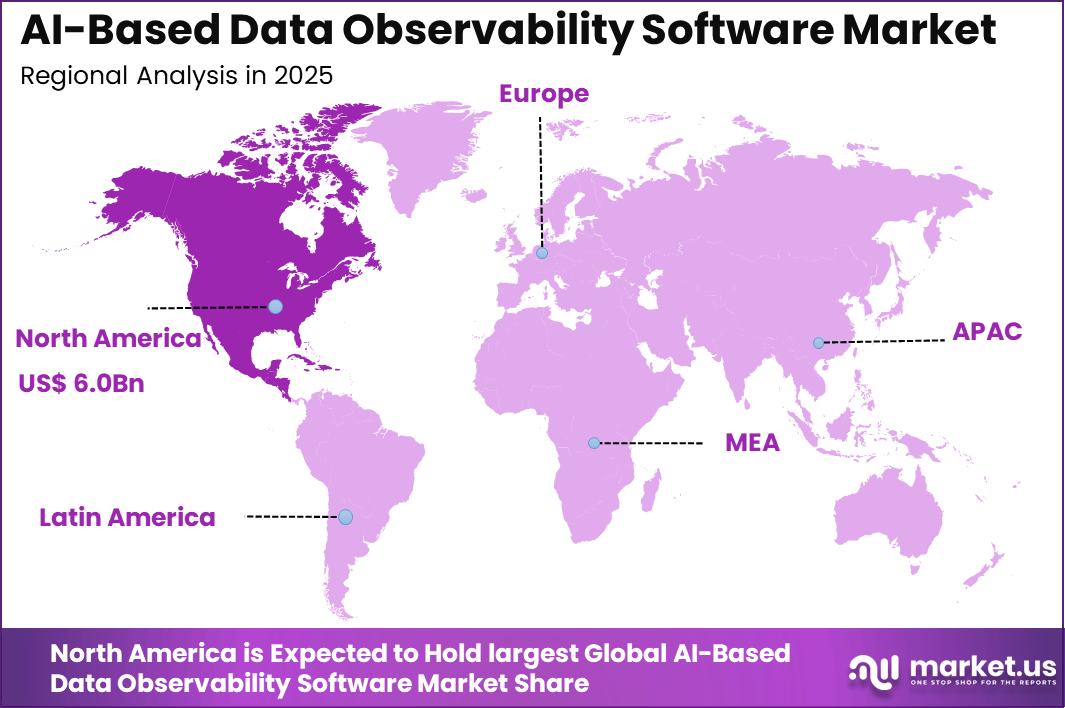

- North America held a leading 42.6% share, backed by early cloud adoption, strong data engineering maturity, and widespread use of AI driven monitoring tools.

- The United States remained a key contributor, with market activity valued at USD 0.41 billion, reflecting high concentration of enterprise data platforms and observability focused investments.

Quick Market Facts

Adoption and Strategic Importance

- Observability maturity gaps were evident, as 90% of IT professionals viewed observability as critical to business performance, yet only 26% rated their practices as mature.

- Budget prioritization strengthened in 2025, with 70% of organizations increasing observability spending. Forward planning remained positive, as 75% planned further budget increases in 2026.

- Lifecycle integration expanded, with 91% of IT leaders agreeing that observability is essential across planning, development, and operational phases.

- AI driven capabilities became the top platform selection factor at 29%, marking a shift from reactive monitoring toward predictive and intelligent observability.

Operational Impact and Return on Investment

- Downtime cost reduction reached up to 90% with advanced observability deployments. In practical terms, losses were reduced from around USD 23.8 million to approximately USD 2.5 million, demonstrating strong cost avoidance.

- Innovation output increased significantly, as organizations with mature observability practices released about 60% more products or revenue streams than less advanced peers.

- Project success rates improved, with teams using MLOps and observability shelving 30% fewer models. At the same time, the overall value generated from AI initiatives increased by up to 60%.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 42.6% of total share. The region generated around USD 6.06 billion in revenue, supported by strong adoption of cloud data platforms and AI based analytics tools. High concentration of data intensive enterprises and early implementation of observability practices strengthened regional leadership. As a result, North America continues to influence adoption and innovation trends in the AI based data observability software market.

Driver Analysis

The AI-based data observability software market is being driven by the intensifying need to ensure data reliability, quality, and operational continuity in complex data ecosystems. As businesses expand data pipelines across cloud, hybrid, and multicloud environments, maintaining end-to-end visibility into data flows and dependencies has become a strategic imperative.

AI-based observability tools automate monitoring, anomaly detection, and root-cause analysis by ingesting telemetry and metadata from diverse sources, enabling data teams to identify issues before they impact downstream analytics or business processes. This proactive approach enhances trust in enterprise data, accelerates troubleshooting, and reduces the operational burden on engineering teams, strengthening overall data governance frameworks.

Restraint Analysis

A key restraint in the AI-based data observability software market relates to the complexity of integrating advanced observability capabilities with existing data infrastructure and governance practices. Organisations often operate with fragmented systems and a mixture of legacy and modern pipelines, which can impede seamless deployment of observability solutions.

Ensuring consistent telemetry collection across diverse platforms requires significant technical planning, specialised expertise, and careful alignment with existing data governance policies to avoid gaps in visibility or duplicated monitoring efforts. These integration challenges may slow adoption, particularly among organisations with limited analytics maturity or constrained technical resources.

Opportunity Analysis

Emerging opportunities in the AI-based data observability software market are linked to increased demand for automated data reliability assurance and self-healing data delivery environments. As enterprises modernise analytics and operational pipelines, observability tools that leverage artificial intelligence can support real-time anomaly detection, predictive alerts, and contextual insights that go beyond simple error logging.

Organisations seeking to accelerate data-driven decision-making can benefit from solutions that proactively identify and resolve data quality issues, reduce incident resolution time, and provide unified dashboards for cross-platform visibility. This positions AI-based observability as a foundational capability in enterprise data platforms and enables improved alignment between data engineering, analytics, and business stakeholders.

Challenge Analysis

A central challenge facing the AI-based data observability software market is balancing automation with interpretation and human oversight. While AI models can detect anomalies and patterns at scale, stakeholders often require transparent reasoning and contextual explanation to trust automated insights and take corrective action.

Addressing alert fatigue, ensuring explainability of model outputs, and integrating observability signals into existing incident management workflows demand thoughtful design and collaboration between development and data teams. Maintaining performance and scalability as data volume and pipeline complexity rise also remains a technical challenge, requiring continuous refinement of observability algorithms and infrastructure.

Emerging Trends

Emerging trends within the AI-based data observability software landscape include the integration of natural language interfaces, predictive analytics, and metadata-centric monitoring to improve accessibility and contextual understanding. Platforms are evolving to support anomaly explanations in human-readable terms, enabling a broader range of users, including data stewards and business analysts, to understand and act on observability insights.

There is also growing adoption of metadata-driven observability, where systems leverage rich lineage and dependency graphs to pinpoint impact and streamline root-cause analysis. Additionally, observability tools increasingly incorporate predictive insights that anticipate data quality degradation before it affects analytics or applications.

Growth Factors

Growth in the AI-based data observability software market is underpinned by the accelerating complexity of data pipelines and the rising importance of data as a strategic enterprise asset. Organisations increasingly prioritise reliability, compliance, and real-time insight generation, which drives investment in tools that can assure data quality and operational health at scale.

The expansion of cloud and hybrid data architectures further amplifies demand for observability capabilities that can operate across distributed environments and respond to dynamic workload patterns. Advances in artificial intelligence and machine learning continue to enhance observability accuracy and automation, supporting broader adoption among data-centric enterprises.

Key Market Segments

By Component

- Software

- Automated Monitoring & Alerting

- Data Quality & Anomaly Detection

- Data Lineage & Mapping

- Performance & Cost Optimization

- Others

- Services

- Professional Services

- Managed Services

- Others

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Data Environment

- Data Warehouses & Data Lakes

- Real-time Data Pipelines & Streams

- Cloud Databases

- Hybrid & Multi-cloud Environments

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Others

Top Key Players in the Market

- Monte Carlo Data, Inc.

- Acceldata, Inc.

- Databricks Inc.

- Datadog, Inc.

- Splunk Inc.

- IBM Corporation

- Oracle Corporation

- Informatica Inc.

- Talend S.A.

- Alation, Inc.

- Collibra, Inc.

- Anomalo, Inc.

- Bigeye Data, Inc.

- Soda Data, Inc.

- Metaplane, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 1.1 Bn |

| Forecast Revenue (2035) | USD 3.4 Bn |

| CAGR(2026-2035) | 12.2% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Data Environment (Data Warehouses & Data Lakes, Real-time Data Pipelines & Streams, Cloud Databases, Hybrid & Multi-cloud Environments, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing, Others) |