Table of Contents

Market Overview

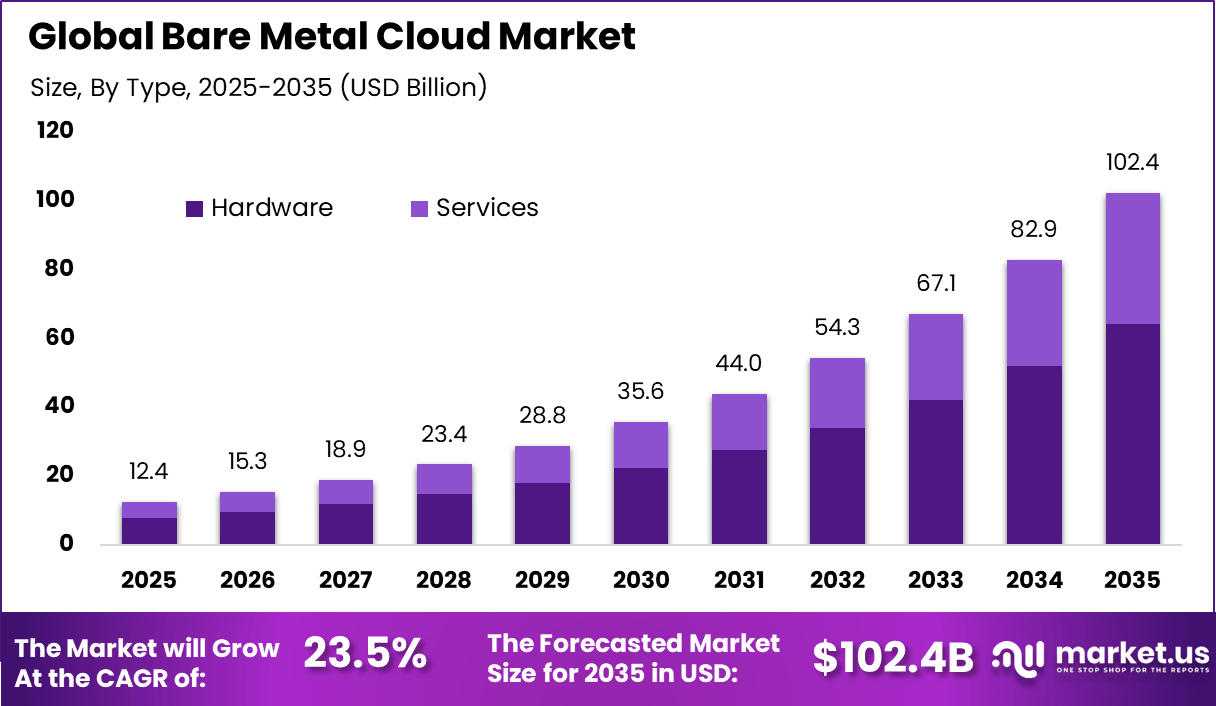

The global Bare Metal Cloud market was valued at USD 12.4 billion in 2025 and is expected to expand rapidly over the forecast period. The market is projected to reach approximately USD 102.4 billion by 2035, growing at a strong CAGR of 23.5% from 2026 to 2035. This growth is driven by rising demand for high performance computing, low latency workloads, and greater control over cloud infrastructure. Enterprises are increasingly adopting bare metal cloud solutions to support data intensive and mission critical applications.

The bare metal cloud market refers to cloud services that provide dedicated physical servers to customers without virtualization layers. These servers offer full hardware control, predictable performance, and high security compared to shared cloud environments. Bare metal cloud combines the flexibility of cloud provisioning with the performance of on-premise infrastructure. It is widely used in workloads that require low latency and consistent compute power. Adoption spans enterprises, service providers, and technology-intensive industries.

One major driving factor of the bare metal cloud market is demand for high and predictable performance. Applications such as databases, analytics, and real-time processing require consistent compute resources. Shared cloud environments may introduce variability in performance. Bare metal cloud eliminates this concern through dedicated hardware. This reliability drives adoption. Another key driver is increasing focus on data security and isolation. Organizations handling sensitive data prefer environments without shared infrastructure.

Key Takeaways

- Hardware based offerings dominated the market with a 62.7% share, indicating strong preference for dedicated physical servers that deliver consistent performance, low latency, and higher security without virtualization overhead.

- Large enterprises accounted for 75.4% of adoption, reflecting their reliance on customized infrastructure for mission critical, compliance driven, and data intensive workloads.

- The BFSI sector led end user adoption with a 38.9% share, supported by requirements for low latency transaction processing, data sovereignty, and high performance computing.

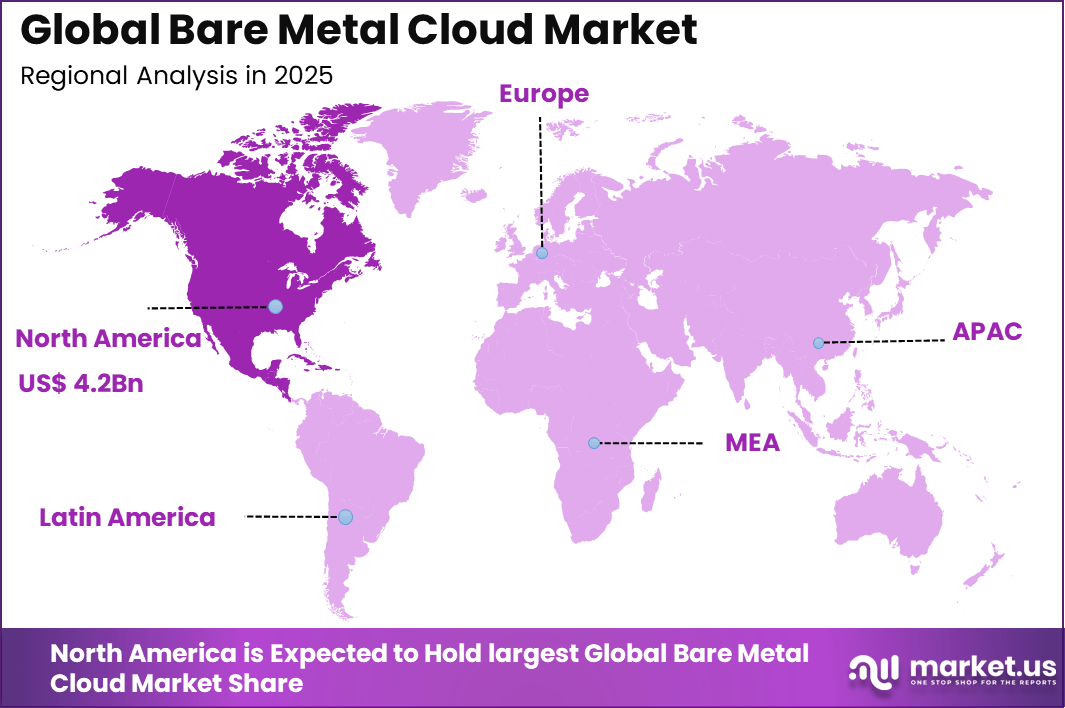

- North America held a 34.2% share, supported by mature cloud infrastructure, strong enterprise IT spending, and early adoption of bare metal and hybrid cloud architectures.

- The U.S. market was valued at USD 3.62 billion, expanding at a 21.6% growth rate, driven by rising demand from financial services, SaaS providers, and performance sensitive digital platforms.

Usage and Performance Insights

- Bare metal environments provide full access to physical hardware, eliminating hypervisor related performance losses of up to 15% commonly seen in virtualized systems.

- Virtualization improves server utilization for general workloads, but bare metal remains preferred for predictable and stable workloads requiring consistent CPU and memory performance.

- Real time analytics represented 32.61% of workload revenue in 2025, followed by AI and machine learning, high performance gaming, and large scale database hosting.

- By 2025, nearly 75% of organizations had shifted cloud strategies toward containerization and bare metal deployments, reflecting increasing focus on performance control and infrastructure efficiency.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 34.2% of total revenue. The region generated around USD 4.2 billion, supported by advanced cloud infrastructure and high adoption among large enterprises and technology providers. Strong investment in hybrid cloud and edge computing strategies strengthened regional leadership. As a result, North America continues to shape adoption and innovation trends in the bare metal cloud market.

Driver Analysis

The bare metal cloud market is being driven by the increasing need for high-performance, dedicated infrastructure that supports compute-intensive workloads with minimal virtualization overhead. Bare metal cloud platforms deliver direct access to physical servers, enabling organisations to achieve predictable performance, enhanced security, and full control over hardware configurations.

This capability is particularly valuable for applications such as high-performance computing, big data analytics, and latency-sensitive services where traditional shared cloud environments can introduce performance variability. In addition, the growing adoption of hybrid and multi-cloud strategies encourages enterprises to integrate bare metal options to optimise workload placement and meet specific performance or compliance requirements.

Restraint Analysis

A key restraint inhibiting broader adoption of bare metal cloud solutions is the complexity and cost associated with deployment, management, and specialised support requirements. Bare metal environments often demand advanced infrastructure skills and operational processes that differ from those used for virtualised cloud platforms. Organisations with limited technical expertise or constrained IT resources may find it challenging to manage physical server configurations, maintenance, and scaling operations effectively without significant support. This can slow uptake, particularly among small and mid-market enterprises that may prioritise simplicity and lower-cost shared cloud solutions.

Opportunity Analysis

Significant opportunities in the bare metal cloud market are emerging from demand for tailored infrastructure in domains requiring high throughput and low latency performance. Use cases such as edge computing, artificial intelligence model training and inference, and real-time data analytics benefit from the direct hardware access and resource isolation that bare metal provides.

Service providers that can offer flexible, scalable bare metal options alongside orchestration tools and automation stand to attract organisations seeking enterprise-grade performance without sacrificing the operational convenience of cloud delivery models. Additionally, integration with containerisation platforms and support for hybrid workloads expands the appeal of bare metal solutions across varied enterprise scenarios.

Challenge Analysis

A central challenge confronting the bare metal cloud market relates to achieving seamless orchestration and integration with existing cloud ecosystems and developer workflows. While the performance advantages of bare metal are clear, ensuring that these environments can be managed with the same agility and flexibility as virtualised services requires sophisticated automation frameworks and tooling.

Compatibility with DevOps practices, continuous integration pipelines, and advanced monitoring systems must be addressed to avoid operational friction. Balancing the demands of performance optimisation with automated governance, security, and resource provisioning further adds to the operational complexity that organisations must manage.

Emerging Trends

Emerging trends in the bare metal cloud landscape include tighter integration with hybrid cloud architectures and support for on-demand bare metal provisioning that mirrors the elasticity of virtualised environments. Providers are increasingly offering orchestration APIs, container-ready bare metal instances, and tools that simplify workload migration between public, private, and bare metal cloud layers.

Another trend involves enhanced support for GPU-accelerated and high-memory configurations tailored to artificial intelligence and machine learning workloads that demand substantial compute resources. There is also a movement toward edge-aware bare metal deployments that bring high-performance infrastructure closer to data sources and latency-sensitive applications.

Growth Factors

Growth in the bare metal cloud market is anchored in the expanding need for performance-centric infrastructure that supports complex workloads with strict performance and security requirements. Organisations prioritising predictable performance, resource isolation, and dedicated hardware control find bare metal deployments well suited to their technical objectives.

Wider adoption of containerisation and orchestration frameworks that can operate across bare metal and virtualised environments enhances flexibility for enterprise applications. The continued evolution of hybrid cloud strategies, combined with demand for robust infrastructure capable of supporting artificial intelligence, analytics, and edge computing use cases, reinforces investment in bare metal options as part of broader cloud portfolios.

Top Key Players in the Market

- DataBank Holdings, Ltd.

- IBM Corporation

- BIGSTEP

- Equinix, Inc.

- Hivelocity, Inc

- Hetzner Online GmbH

- HorizonlQ

- Linode, LLC

- Lumen Technologies

- OVH SAS

- Oracle

- phoenixNAP

- Scaleway SAS

- Vapor IO, Inc.

- Zenlayer

- Others

Key Market Segments

By Type

- Hardware

- Bare Metal Compute

- Bare Metal Network

- Bare Metal Storage

- Others

- Services

- Integration & Migration

- Consulting & Assessment

- Maintained Services

By Enterprise Size

- Large Size Enterprise

- Small and Medium Sized Enterprise (SMEs)

By End Use

- Advertising

- BFSI

- Government

- Healthcare

- Manufacturing

- Telecom & IT

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 12.4 Bn |

| Forecast Revenue (2035) | USD 102.4 Bn |

| CAGR(2026-2035) | 23.5% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |