Table of Contents

Introduction

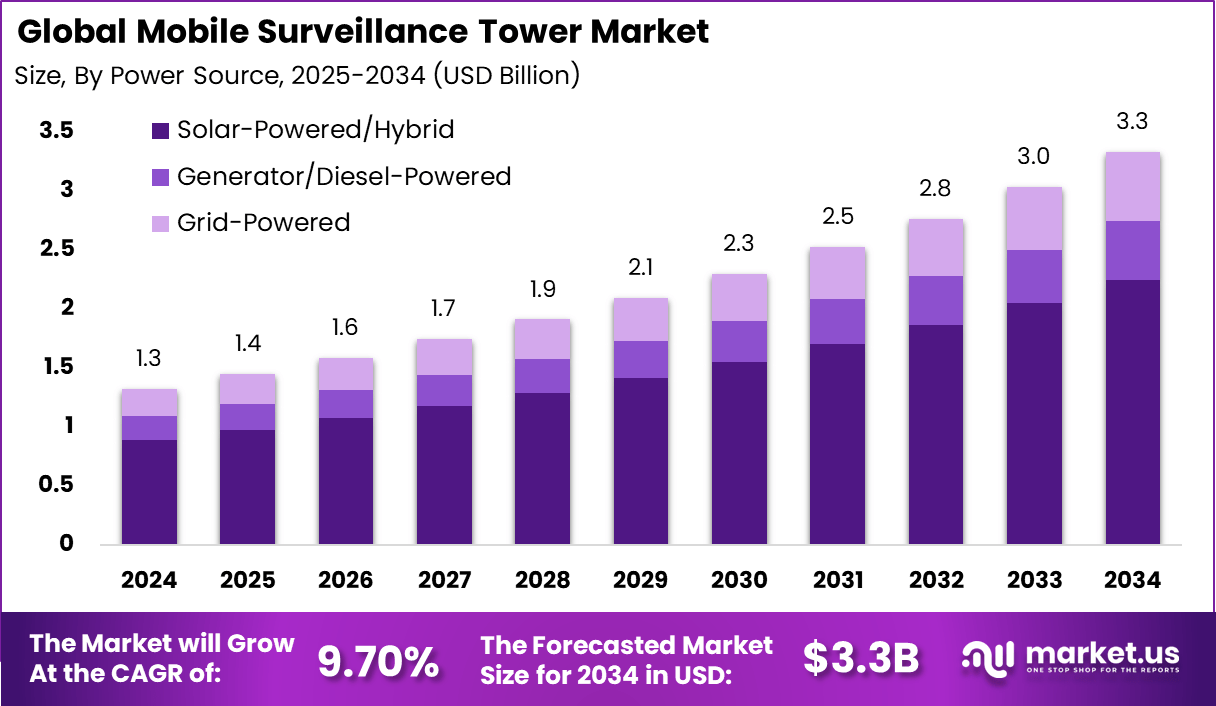

The global Mobile Surveillance Tower market generated USD 1.3 billion in 2024 and is expected to grow steadily over the forecast period. Market revenue is projected to increase from USD 1.4 billion in 2025 to approximately USD 3.3 billion by 2034, registering a CAGR of 9.70% throughout the forecast span. This growth is supported by rising demand for temporary security infrastructure across construction sites, public events, and remote locations. Increased focus on rapid deployment and real time monitoring is further contributing to market expansion.

The mobile surveillance tower market refers to portable security systems that integrate cameras, sensors, power supply, and communication equipment into a movable tower structure. These towers are designed for temporary or remote monitoring where fixed infrastructure is limited. They are widely used at construction sites, public events, transportation hubs, borders, and emergency locations. Mobile surveillance towers provide rapid deployment and flexible coverage. Adoption supports situational awareness and security monitoring in dynamic environments.

Market development has been influenced by the need for temporary and adaptable security solutions. Many sites require monitoring only for short durations or during specific activities. Installing permanent surveillance systems can be costly and impractical. Mobile towers offer a cost-effective and scalable alternative. As temporary infrastructure projects increase, demand for mobile surveillance grows.

Top Market Takeaways

- Hardware dominates with a 54.2% share, supported by widespread use of cameras, sensors, communication modules, and power systems in mobile surveillance towers.

- Solar-powered and hybrid power solutions lead with 67.5%, driven by off-grid deployment needs, sustainability goals, and regulatory pressure.

- Perimeter security and intrusion detection account for 45.8%, reflecting strong use in border control, critical infrastructure, construction sites, and large public events.

- Government entities represent 40.6% of end-user demand, backed by public safety programs, homeland security initiatives, and long-term procurement contracts.

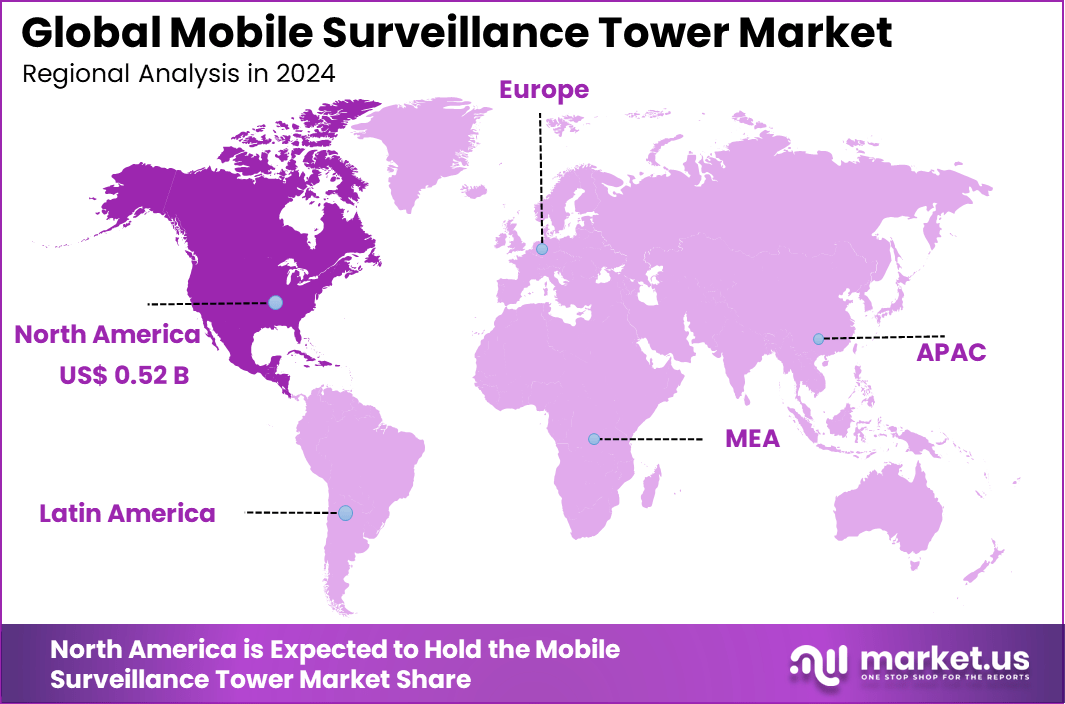

- North America holds around 39.4% of the global market, supported by high security spending and advanced surveillance infrastructure.

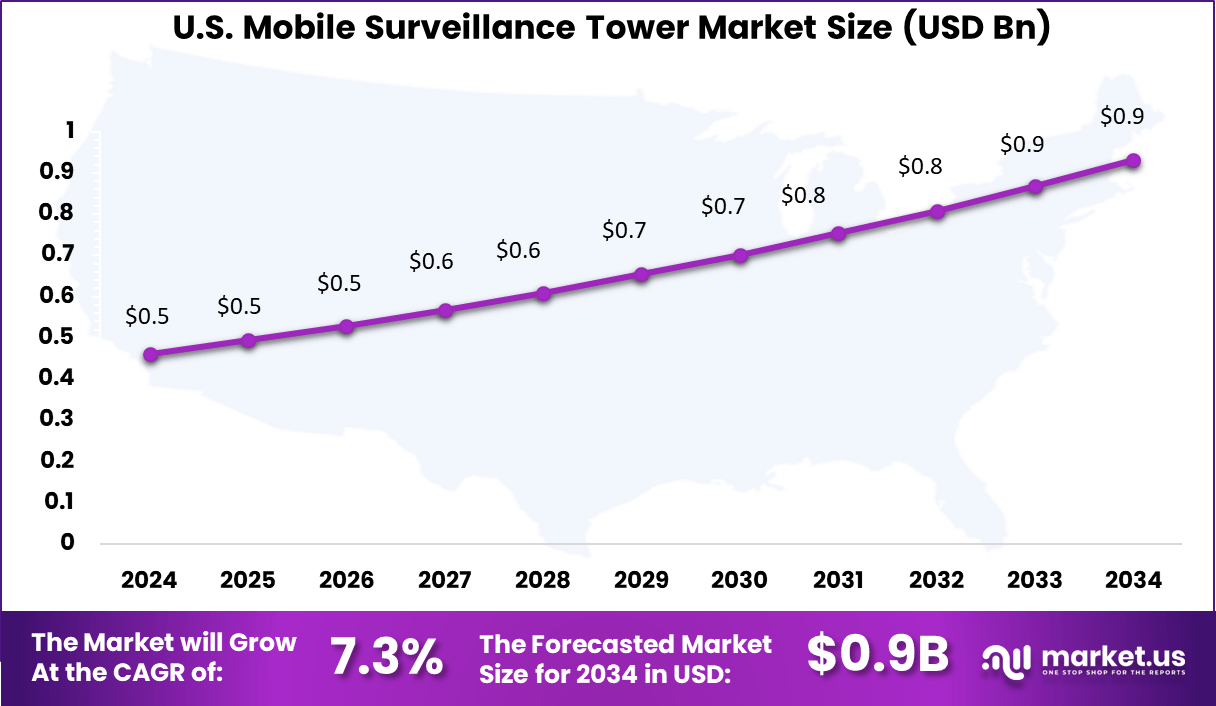

- The U.S. market is valued at approximately USD 0.46 billion in 2025, reflecting steady federal, state, and municipal adoption.

- The market is expanding at a 7.3% CAGR, driven by AI-enabled surveillance, IoT integration, and rising security requirements across public and private sectors.

Top Driving Factors

One major driving factor of the mobile surveillance tower market is the rising need for temporary site security. Construction projects, infrastructure repairs, and outdoor events face risks such as theft and unauthorized access. Mobile towers provide immediate monitoring without permanent installation. Rapid deployment improves security readiness. This flexibility drives adoption.

Another key driver is increased focus on public safety and asset protection. Authorities and organizations require surveillance in remote or high-risk locations. Mobile towers extend monitoring coverage where power and network access may be limited. Integrated power sources support continuous operation. Public safety concerns support market growth.

Demand Analysis

Demand for mobile surveillance towers is influenced by growth in construction and infrastructure activities. Large projects require monitoring over extended but finite periods. Mobile solutions reduce setup and removal costs. Consistent monitoring improves project security. These needs strengthen demand.

Demand is also shaped by emergency response and disaster management requirements. Temporary surveillance supports crowd control, traffic management, and damage assessment. Mobile towers can be deployed quickly in crisis situations. Rapid response capability is critical. Emergency preparedness increases adoption.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 39.4% of total revenue. The region generated around USD 0.52 billion, supported by strong adoption of mobile surveillance solutions in infrastructure projects and public safety operations. Advanced security requirements and higher spending on surveillance technologies strengthened regional leadership. As a result, North America continues to influence adoption trends in the mobile surveillance tower market.

The U.S. leads within North America, valued at approximately USD 0.46 billion in 2024 and growing at a CAGR of 7.3%.

Increasing Adoption Technologies

Advances in camera and imaging technologies support market adoption. High-resolution cameras improve visibility and identification accuracy. Night vision and thermal imaging extend monitoring capability. Enhanced imaging improves reliability. Technology upgrades increase effectiveness. Wireless communication technologies also support adoption. Mobile towers use cellular and wireless networks for data transmission. Remote access enables centralized monitoring. Reliable connectivity improves operational efficiency. Connectivity advancements expand deployment options.

One key reason organizations adopt mobile surveillance towers is deployment flexibility. Towers can be relocated as security needs change. This adaptability reduces long-term infrastructure investment. Flexible use supports multiple applications. Cost efficiency improves decision making. Another reason is improved coverage in challenging environments. Mobile towers operate in areas without fixed power or network infrastructure. Integrated power systems support continuous monitoring. Expanded coverage improves security outcomes. Reliability drives adoption.

Opportunities and Business Benefits

Investment opportunities in the mobile surveillance tower market exist in advanced analytics integration. Combining towers with intelligent video analytics increases value. Automated alerts improve response speed. Enhanced capabilities attract buyers. Technology-driven solutions support growth. Another opportunity lies in rental and service-based business models. Many users prefer temporary access rather than ownership. Managed services reduce operational burden. Recurring revenue models appeal to investors. Service expansion supports scalability.

Mobile surveillance towers improve security effectiveness by enabling rapid monitoring deployment. Reduced setup time improves readiness. Continuous surveillance deters theft and vandalism. Improved protection reduces losses. Security outcomes improve overall operations. These solutions also reduce operational costs compared to permanent installations. Shared use across projects improves asset utilization. Lower infrastructure investment improves financial efficiency. Cost control supports profitability. Businesses benefit from flexible security spending.

Driver Analysis

The mobile surveillance tower market is being driven by the increasing need for rapid-deployment security solutions across public safety, construction sites, events, and critical infrastructure. Mobile surveillance towers provide elevated visibility and flexible positioning of cameras, sensors, and communication equipment without the need for permanent installation.

Organisations that manage large outdoor environments increasingly rely on these solutions to deter crime, monitor crowd behaviour, and enhance situational awareness in real time. The growing emphasis on proactive security and risk management in both public and private sectors has made mobile surveillance towers a practical alternative to fixed systems, especially in temporary or changing environments where traditional infrastructure is impractical.

Restraint Analysis

A key restraint in the mobile surveillance tower market arises from concerns about operational costs and logistical complexity. Deploying and maintaining mobile surveillance units can incur significant expenses related to power supply, transport, setup, and ongoing monitoring. Smaller organisations or those with limited security budgets may find these costs prohibitive, particularly when long-term deployment is required.

Additionally, logistical challenges such as site accessibility, environmental conditions, and secure anchoring can complicate installation and reduce the operational readiness of mobile towers in certain terrains. These practical barriers can slow adoption among entities without dedicated security operations.

Opportunity Analysis

Emerging opportunities in the mobile surveillance tower market are linked to the integration of advanced sensor technologies, artificial intelligence analytics, and remote connectivity. By incorporating AI-enabled video analytics, thermal imaging, and automated alerting, mobile towers can deliver richer, actionable insights that extend beyond basic visual monitoring.

Cloud-connected platforms and wireless communication modules make it possible to manage multiple units from centralised dashboards, enhancing operational coordination across distributed sites. These advancements enable mobile surveillance towers to support modern security strategies that prioritise real-time detection, automated threat assessment, and rapid response, expanding their appeal to sectors such as critical infrastructure protection, border security, and large-scale public events.

Challenge Analysis

A central challenge confronting this market relates to ensuring reliable performance and data security in diverse deployment contexts. Mobile surveillance towers often operate in environments with variable connectivity, power availability, and environmental stressors such as extreme weather conditions.

Maintaining consistent surveillance quality and secure data transmission poses technical demands that require robust hardware design and resilient communication networks. Moreover, integrating surveillance data with broader security infrastructures without creating vulnerabilities or compliance gaps requires careful planning and adherence to data protection standards.

Emerging Trends

Emerging trends in the mobile surveillance tower landscape include the adoption of autonomous power systems such as solar panels and energy-efficient batteries that reduce reliance on external power sources. There is also growing use of modular sensor arrays that combine high-resolution cameras, thermal imaging, radar, and acoustic sensors to deliver multi-modal situational awareness.

Another trend involves the integration of artificial intelligence and edge computing to enable on-site analytics that filters events, reduces false alarms, and prioritises alerts for human operators. Remote management platforms and IoT connectivity are enabling fleet-wide coordination of mobile towers from centralised command centres.

Growth Factors

Growth in the mobile surveillance tower market is supported by heightened security awareness, increasing incidence of outdoor events, and expanding infrastructure projects that require temporary or flexible monitoring solutions. Organisations are seeking mobile systems that can be rapidly deployed to address emerging security concerns, manage large crowds, and support public safety operations.

Technological advancements in wireless communication, sensor capabilities, and autonomous power systems continue to enhance the effectiveness and cost-efficiency of mobile surveillance towers. As stakeholders prioritise proactive threat detection and operational visibility in dynamic environments, demand for flexible, intelligent surveillance solutions remains robust.

Key Market Segments

By Component

- Hardware

- Sensors & Cameras

- Power System

- Communication Module

- Others

- Software

- Video Management Software

- Command & Control (C2) Software

- Others

- Services

- Rental/Leasing Services

- Installation & Deployment Services

- Managed Services (VSaaS)

- Maintenance & Support Services

By Power Source

- Solar-Powered/Hybrid

- Generator/Diesel-Powered

- Grid-Powered

By Application

- Perimeter Security & Intrusion Detection

- Traffic Monitoring & Incident Detection

- Crowd & Event Management

- Temporary Critical Infrastructure Monitoring

- Public Safety & Emergency Response

- Others

By End-User

- Government

- Commercial

- Industrial

- Others

Top Key Players in the Market

- Dahua Technology

- Hikvision

- Axis Communications

- Bosch Security Systems

- FLIR Systems

- MSS (Mobile Surveillance Systems)

- WCCTV (Wireless CCTV Ltd)

- Vanguard Wireless

- 3xLOGIC

- Senstar Corporation

- Honeywell International

- Avigilon (Motorola Solutions)

- MOBOTIX AG

- Pro-Vigil

- LiveView Technologies

- Solar Surveillance

- Total Security Solutions

- Mobile Pro Systems

- SentryPODS

- Rapid Deployment CCTV

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Bn |

| Forecast Revenue (2034) | USD 3.3 Bn |

| CAGR(2025-2034) | 9.7% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |